Under the hood of ESPO

Our new Video Gaming and eSports ETF (ASX code: ESPO) has garnered a lot of attention from investors, advisers and brokers, and the gaming sector. What type of stocks are included in ESPO?

The VanEck Vectors Video Gaming and eSports ETF (ASX code: ESPO) launched in mid-September and has attracted more than AU$16m in net flows as at 28 September 2020.

ESPO tracks the MVIS Global Video Gaming and eSports Index, which invests in the largest 25 stocks by market capitalisation where at least 50% of revenue is from video gaming and/or eSports.

Video Games and eSports ecosystem

ESPO invests in a range of companies that contribute to various components of the video gaming and eSports ecosystem.

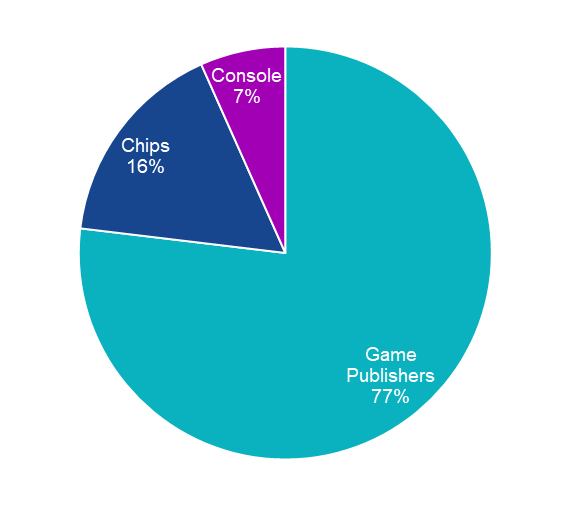

Figure 1. ESPO exposure by company speciality

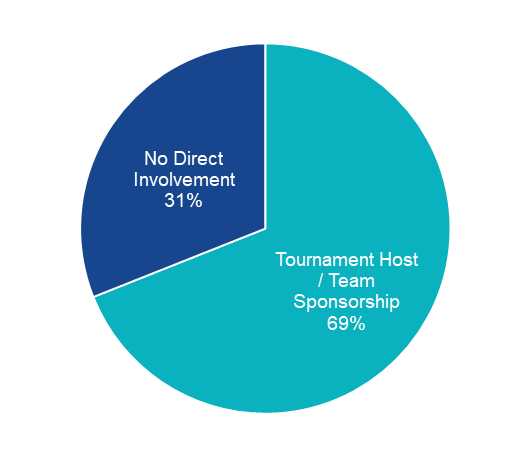

Figure 2. ESPO exposure by eSports involvement

Source for Figures 1 and 2: VanEck, as at 28 September 2020.

A number of game publishers manage and own the rights to professional eSports tournaments including broadcasting. Goldman Sachs predict media rights revenue to grow from representing around 20% of all eSports revenues to 40% by 2022. This means that, after factoring in other revenue sources like sponsorship and game publisher fees, video game publishers may be in a position to own the majority of revenues coming from eSports. 10% of revenue (US$848m) for Activision Blizzard in 2019 came from eSports.

Figure 3. eSport tournaments hosted by game publishers

|

Activision Blizzard

|

Riot Games

(Owned by Tencent) |

|

Epic Games

(Owned by Tencent) |

Take Two Interactive

(League 50% owned by NBA) |

ESPO holdings

We explore three types of companies available via ESPO:

|

Company |

Category |

Summary

|

|

|

Game publisher |

Created some of the most iconic and memorable game experiences of all time - Call Of Duty, World of Warcraft, Destiny, Guitar Hero, Candy Crush Saga, Pitfall!, and the Skylanders series. Call of Duty is one of the best-selling video game franchises in history and regularly tops the charts for console game sales each year. Host of eSports tournaments featuring Overwatch, Call of Duty & Major League Gaming. |

|

|

Chips |

Designs, develops and markets graphic processors and related software for PCs, mobiles and self-drive vehicles. Nvidia recently announced its acquiring Arm holdings (further details here) that creates semiconductor designs at the heart of more than one billion smart phones sold annually. Over the past five years, Nvidia sales have increased 118% and profit is up 355%. Major sponsors of multiple eSports teams. |

|

|

Console |

Veteran of video game industry producing consoles over more than 30 years. As of June 2020, the Nintendo Switch and Nintendo Switch Lite have sold more than 61 million units worldwide. 2019 sales revenue was AUD $17.5bn. |

Market Outlook

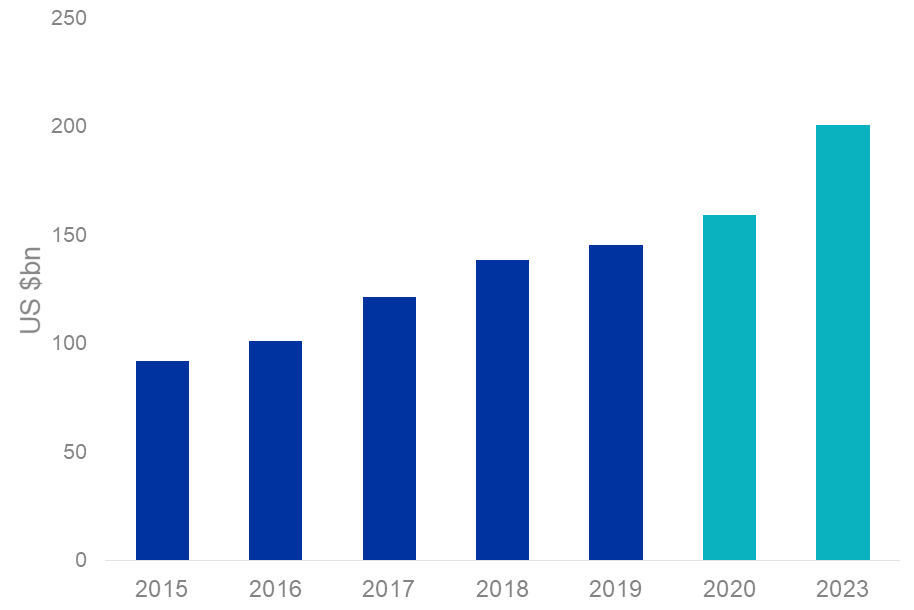

In 2020, Asia-Pacific is predicted to generate game revenues of US$78.4 billion, accounting for 49% of the global games market. North America will be the second-largest region by game revenues, making up a quarter of 2020’s revenues (US$40.0 billion). Global gaming revenue has grown 12% p.a since 2015.

Figure 2. Global Games Revenue

Source: 2020 Global Games Market Report, Newzoo. *Projected

Want to know more about ESPO or the video gaming and eSports industry? Find out here.

Published: 01 October 2020

An investment in ESPO carries risks associated with: financial markets generally, individual company management, industry sectors, ASX trading time differences, foreign currency, country or s

ector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the PDS for details.

MVIS Global Video Gaming and eSports Index (AUD) (‘MVIS Index’) is the exclusive property of MV Index Solutions GmbH based in Frankfurt, Germany (‘MVIS’). MVIS is a related entity of VanEck. MVIS makes no representation regarding the advisability of investing in the Fund. MVIS has contracted with Solactive AG to maintain and calculate the MVIS Index. Solactive uses its best efforts to ensure that the MVIS Index is calculated correctly. Irrespective of its obligations towards MVIS, Solactive has no obligation to point out errors in the MVIS Index to third parties.