Gold is a currency

Just because it is quoted in US dollars does not make it a US dollar exposure.

Gold has been viewed as a currency since ancient times. It has held a store of value to exchange for goods or services and can be easily divided and cast into smaller pieces. The Romans under Constantine used to mint gold coins called the solidus and used them as currency of their empire. Right through to the modern era many currencies were backed by the gold standard, whereby the country guaranteed gold against its issued currency.

Under our current monetary system gold should be viewed as a currency like the US dollar or euro.

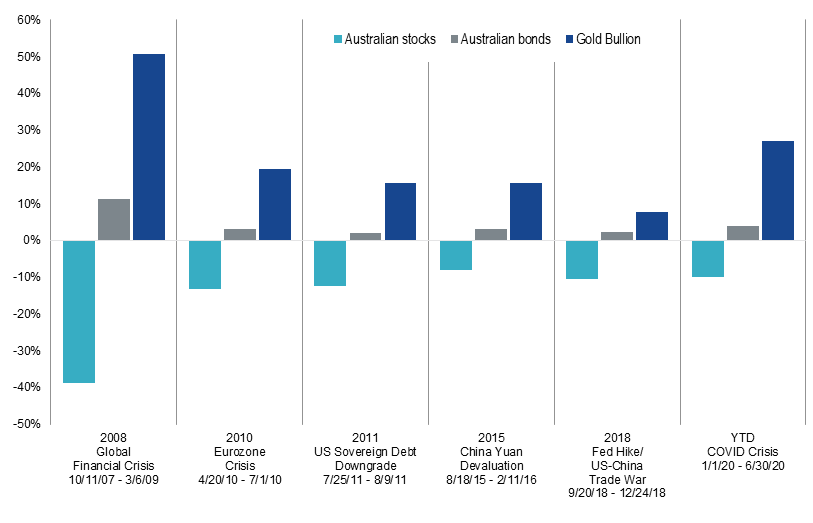

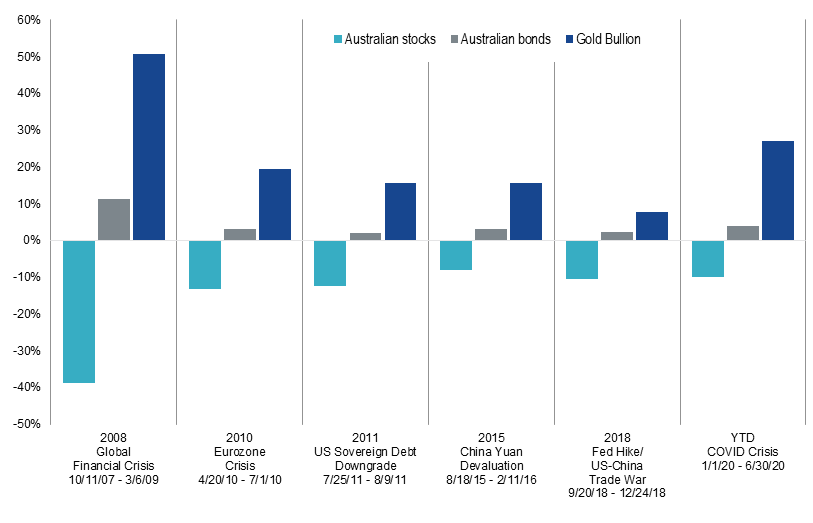

During times of financial crisis or uncertainty the value of gold has increased as investors buy more gold to alleviate some of the financial turmoil in other assets.

Gold has Shined in Recent Crises

Source: Morningstar. Data as of 6/30/2020. Australian stocks represented by S&P/ASX 200; Gold Bullion represented by LBMA PM Gold Price; Australian Bonds represented by the Bloomberg AusBond Composite Index 0+ Years. Past performance is not indicative of future results. Indices are not securities in which investments can be made. An index’s performance is not illustrative of a fund’s performance.

By buying gold you could find shelter during the pandemic and the economic issues that entails. But economic trends can reverse and the same is true for gold. Gold is therefore a way to express the future and expectations on various economic events in your portfolio. It’s a store of value and can diminish against all other currencies just like the movement of all freely traded goods.

Gold is often quoted in US dollars per ounce and has past US$2,000 per ounce. While gold is often quoted in US dollars its value is still in the physical gold itself. If the US dollar were to fall sharply the price of gold is not necessarily going to plummet as well. We’ve seen this during the COVID recovery. As US debt has ballooned during the crisis, the value of the greenback has fallen which has resulted in a rise to the gold price.

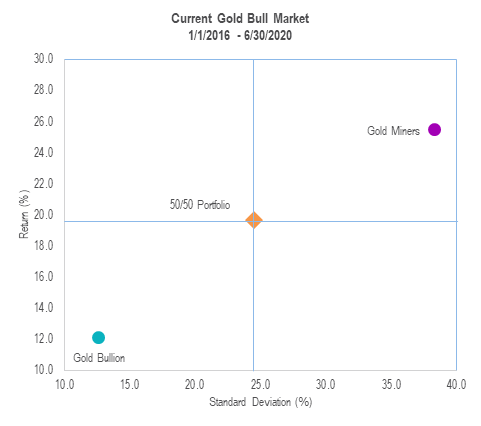

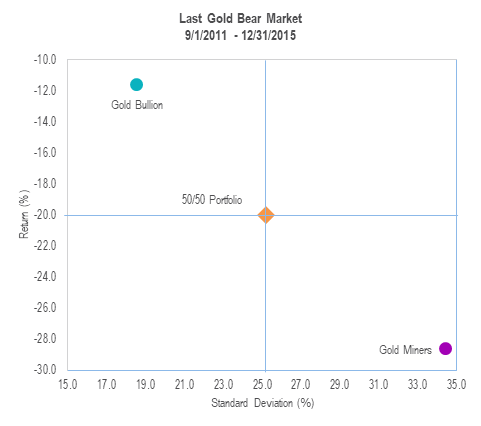

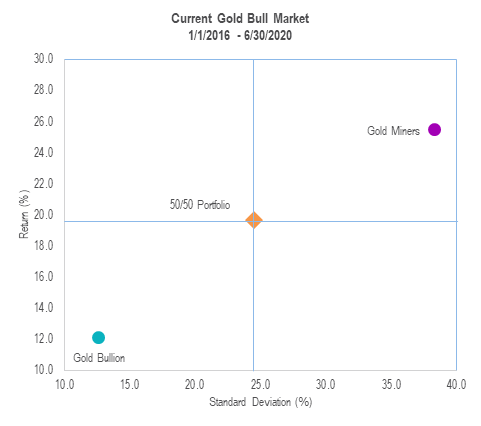

We think a new secular gold bull market began with the US Federal Reserve (Fed) rate hike in December 2015. The market broke out in 2019 with the Fed’s shift to easing in 2019 and the overwhelming risks of pandemic drove gold to US$2,000 per ounce in 2020.

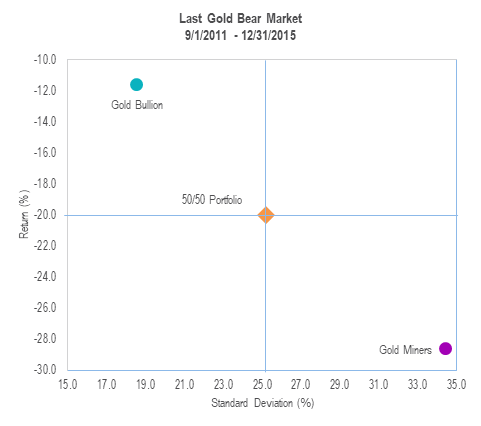

Gold miners have been used by investors to gain leveraged exposure to gold and miners have historically exhibited higher risk and higher reward in gold bull markets. Gold bullion had a lower volatility profile in both bull and bear markets offering return potential and defensive characteristics.

Source: Morningstar; VanEck. Data as of 6/30/2020. Standard Deviation is a historical measure of the variability of returns relative to the average annual return. A higher number indicates higher overall volatility. Past performance is no guarantee of future results. Please see important disclosures at the beginning of this presentation and definitions at end.

Under our current monetary system gold should be viewed as a currency like the US dollar or euro.

During times of financial crisis or uncertainty the value of gold has increased as investors buy more gold to alleviate some of the financial turmoil in other assets.

Gold has Shined in Recent Crises

Source: Morningstar. Data as of 6/30/2020. Australian stocks represented by S&P/ASX 200; Gold Bullion represented by LBMA PM Gold Price; Australian Bonds represented by the Bloomberg AusBond Composite Index 0+ Years. Past performance is not indicative of future results. Indices are not securities in which investments can be made. An index’s performance is not illustrative of a fund’s performance.

By buying gold you could find shelter during the pandemic and the economic issues that entails. But economic trends can reverse and the same is true for gold. Gold is therefore a way to express the future and expectations on various economic events in your portfolio. It’s a store of value and can diminish against all other currencies just like the movement of all freely traded goods.

Gold is often quoted in US dollars per ounce and has past US$2,000 per ounce. While gold is often quoted in US dollars its value is still in the physical gold itself. If the US dollar were to fall sharply the price of gold is not necessarily going to plummet as well. We’ve seen this during the COVID recovery. As US debt has ballooned during the crisis, the value of the greenback has fallen which has resulted in a rise to the gold price.

We think a new secular gold bull market began with the US Federal Reserve (Fed) rate hike in December 2015. The market broke out in 2019 with the Fed’s shift to easing in 2019 and the overwhelming risks of pandemic drove gold to US$2,000 per ounce in 2020.

Gold miners have been used by investors to gain leveraged exposure to gold and miners have historically exhibited higher risk and higher reward in gold bull markets. Gold bullion had a lower volatility profile in both bull and bear markets offering return potential and defensive characteristics.

Source: Morningstar; VanEck. Data as of 6/30/2020. Standard Deviation is a historical measure of the variability of returns relative to the average annual return. A higher number indicates higher overall volatility. Past performance is no guarantee of future results. Please see important disclosures at the beginning of this presentation and definitions at end.

Published: 07 August 2020

IMPORTANT NOTICE: Issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as the responsible entity and issuer of units in the VanEck Vectors ETFs traded on ASX. This is general information only about financial products and not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision, you should read the relevant PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. PDSs are available at www.vaneck.com.au or by calling 1300 68 38 37. All investments carry some level of risk. Investing in international markets has specific risks that are in addition to the typical risks associated with investing in the Australian market. These include currency/foreign exchange fluctuations, ASX trading time differences and changes in foreign regulatory and tax regulations. See the PDS for details.

No member of VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return of any VanEck funds. Past performance is not a reliable indicator of future performance.

Related Insights

1 of 4

1 - 3 of 3

Education

ETFs Explained

About Smart Beta

International Investing

Emerging Markets

Quality Investing

Moat Investing

Investing for Income

Property Investing

Investing in Infrastructure

Gold Investing

Expert Insights

ViewPoint Quarterly

ESG Investing

Investing in Healthcare

Video Gaming & Esports

Investing In Clean Energy