Why you shouldn't currency hedge gold

As the gold price surges, there has been some conjecture about how an Australian investor should best access gold and its global miners. Our view is that an unhedged exposure is the best access.

The recent rally in gold and global gold mining companies has generated interest in these asset classes. It has also generated questions from Australian investors about how they should access gold and gold miners. Our view is an unhedged exposure is the best way to get access. Here is why.

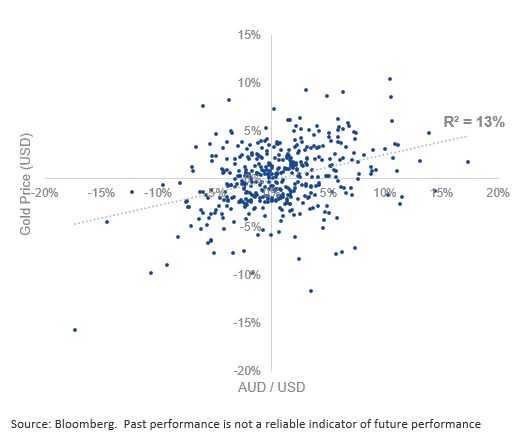

Let’s take a look at the correlation of the gold price in US dollar terms and AUD/USD currency movements since the Australian dollar was floated in December 1983. Correlation measures how strong a relationship is between two variables, in this instance, US dollar gold price movements and changes in the value of the Australian dollar compared to the US dollar.

In the scatter graph (Figure 1) below, you can see there is no specific relationship between the movement in the gold price and changes in the AUD/USD rate because the dots fall in all four quadrants of the graph, they are not skewed to any area. There is no pattern.

One way to express correlation is a statistical measure called R2, pronounced “R squared”. The results of an R2 analysis gives you a score between 0 and 100%. An R2 of 100% would indicate that movements in the gold price can be predicted by movements in AUD/USD. However, as shown below, the R2 is only 13%, therefore there is no evidence to suggest the two variables correlate.

Figure 1: Gold price (USD) versus AUD/USD monthly movements since 1984

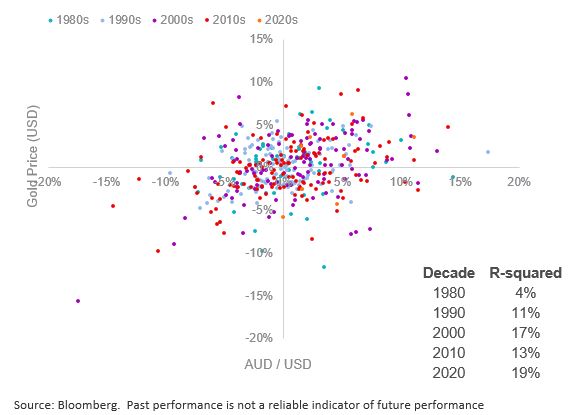

Now, comparing the movements in the two variables over different decades we see each decade produces similar, uncorrelated, results.

Figure 2: Gold price (USD) versus AUD/USD monthly movements since 1984 broken down by decade

Because the two are uncorrelated there is no investment rationale to hedge your gold and gold miners exposure back to Australian dollars.

The decision to hedge your exposures is complex. Always speak to a financial adviser to consider your individual financial circumstances, needs and objectives and read the relevant PDS before making a decision to invest. Currency movements are unpredictable and volatile and are just one of the many risks investors have to navigate in these tricky times.

Published: 14 August 2020

Issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as the responsible entity and issuer of units in the VanEck Vectors ETFs traded on ASX. This is general information only about financial products and not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision, you should read the relevant PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. PDSs are available at www.vaneck.com.au or by calling 1300 68 38 37. All investments carry some level of risk. Investing in international markets has specific risks that are in addition to the typical risks associated with investing in the Australian market. These include currency/foreign exchange fluctuations, ASX trading time differences and changes in foreign regulatory and tax regulations. See the PDS for details.

No member of VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return of any VanEck funds. Past performance is not a reliable indicator of future performance.