Invest in companies at the forefront of emerging markets ‘goldilocks’ moment

Emerging Markets (EM) are having their ‘goldilocks’ moment. Growth is accelerating without economies overheating and capital inflows are rising. After five years of lacklustre performance, 2017 was a year of strong returns for EM and all signs indicate this will likely continue through 2018 as EM securities are attractively priced compared to developed markets. The long-term investment rationale for EM is also compelling as they represent a growing portion of global GDP yet only represent a small fraction of the world’s equities. Earlier this month, the first smart beta EM ETF listed on ASX giving Australian investors the opportunity to access a diversified portfolio of quality EM stocks via a single trade: VanEck Vectors MSCI Multifactor Emerging Markets Equity ETF (ASX: EMKT)

Emerging

markets: still cheap

Emerging Markets (EM) are currently one of the most attractive asset

classes. EM

stocks are trading at a significant discount to developed markets, with the

MSCI Emerging Markets Index estimated price-earnings (P/E) ratio below 15

compared to over 25 for developed markets.

With increasing investor activity in EM this differential has narrowed

recently, however it is still above long term averages, as the graphs below

indicate.

Growing influence

EM nations account for almost 60 per cent of the world’s population and account for an increasing proportion of global GDP, yet EM securities account for less than 10% of all equity funds’ holdings. Fund managers around the world are recognising the investment opportunity that EM securities represent given their attractive prices and the EM growth prospects. Notorious bear investor and GMO co-founder Jeremy Grantham recently said, “What I would own is as much emerging-market equity as your career or business risk can tolerate”.

VanEck Vectors MSCI Multifactor Emerging Markets Equity ETF (ASX: EMKT)

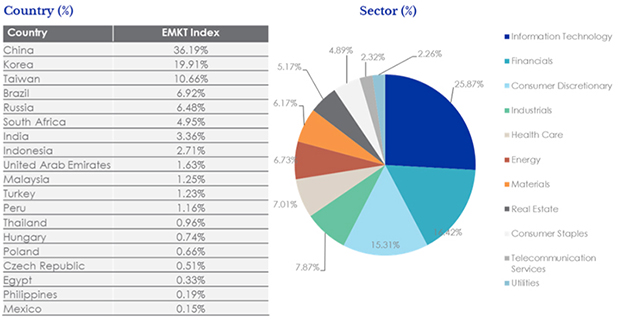

On 12 April 2018, the first smart beta EM ETF listed on ASX giving Australian investors the opportunity to access a diversified portfolio of quality EM stocks via a single trade. EMKT is designed to provide investors with access to a diversified portfolio of EM companies, including large and mid-caps.

The MSCI Emerging Markets Diversified Multiple-Factor Index (EMKT Index) is based on MSCI Emerging Markets Index, its parent index, which includes large and mid-cap stocks across EM countries. EMKT Index aims to maximise exposure to four factors – Value, Momentum, Low Size and Quality – while maintaining a risk profile similar to that of the parent index.

Since inception the EMKT Index has significantly outperformed the MSCI Emerging Markets Index. To the end of February 2018, the Index has outperformed over 1, 3, 5, 10, 15 year and since inception time periods

Why it’s important to fill the ‘EM gap’

While investors know about technology companies such as Apple and Google, EM companies include the likes of Alibaba and Tencent, which have more impressive growth profiles than their developed market counterparts.

China’s Tencent has an astonishing growth rate of 750% in five years, or 53% annualised, and its global presence in social media and advertising is quickly expanding beyond China. Korea's Samsung is a global brand, accounting for electrical products in many Australian homes, yet is rarely represented in Australian portfolios. EMKT features both stocks in its Top 10 holdings.

VanEck manages US$11.3 billion (A$14.65 billion) in EM assets across a variety of active and passive investment solutions. With a dedicated team of 17 portfolio managers and analysts, VanEck has significant expertise in EM.

With a single trade on ASX, EMKT gives investors instant access to a diversified portfolio of EM equities.

IMPORTANT NOTICE

This information is prepared in good faith by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as the responsible entity and issuer of VanEck Vectors MSCI Multifactor Emerging Markets Equity ETF ARSN 623 953 631 (“the Fund”).

This information is general in nature and not financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision investors should read the product disclosure statement and with the assistance of a financial adviser consider if it is appropriate for their circumstances. A copy of the PDS is available at https://www.vaneck.com.au/funds/emkt/Documents/.

The Fund will be exposed to the risks associated with overseas investment. These include changes in foreign exchange control regulations, application of foreign tax legislation including confiscatory taxation and withholding taxes, changes in government administration and economic monetary policy, appropriation, changed circumstances in dealings between nations, lack of uniform accounting and auditing standards, potential difficulties in enforcing contractual obligations and extended settlement periods.

The Fund is also subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from the Fund.

EMKT is indexed to a MSCI index. EMKT is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to EMKT or the MSCI Index. The PDS contains a more detailed description of the limited relationship MSCI has with VanEck and EMKT.

Published: 09 August 2018