CNEW provides investors with access to a portfolio of fundamentally sound companies domiciled and listed in China with growth prospects from the following sectors:

- Technology

- Healthcare

- Consumer Staples

- Consumer Discretionary

It is these sectors which are the New Economy.

What is the New Economy?

Traditionally emerging markets like China have been dependent on financials, energy and materials. As GDP per capita has increased, domestic policy and reform has been focused on transitioning the economy to be consumption led.

There are four forces behind this transition in which consumer-oriented sectors are gradually replacing heavy industry and low cost manufacturing as the country’s economic engines:

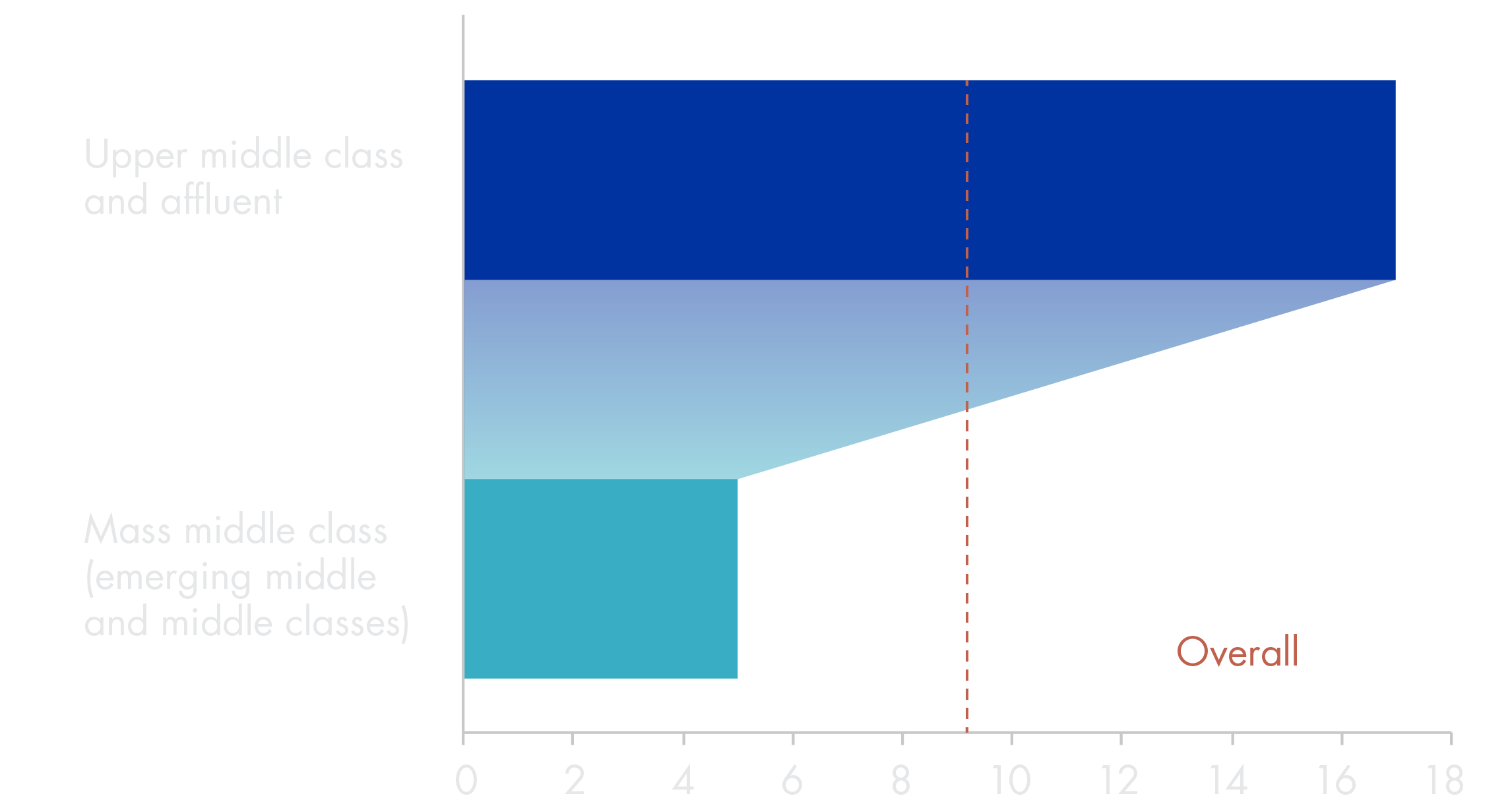

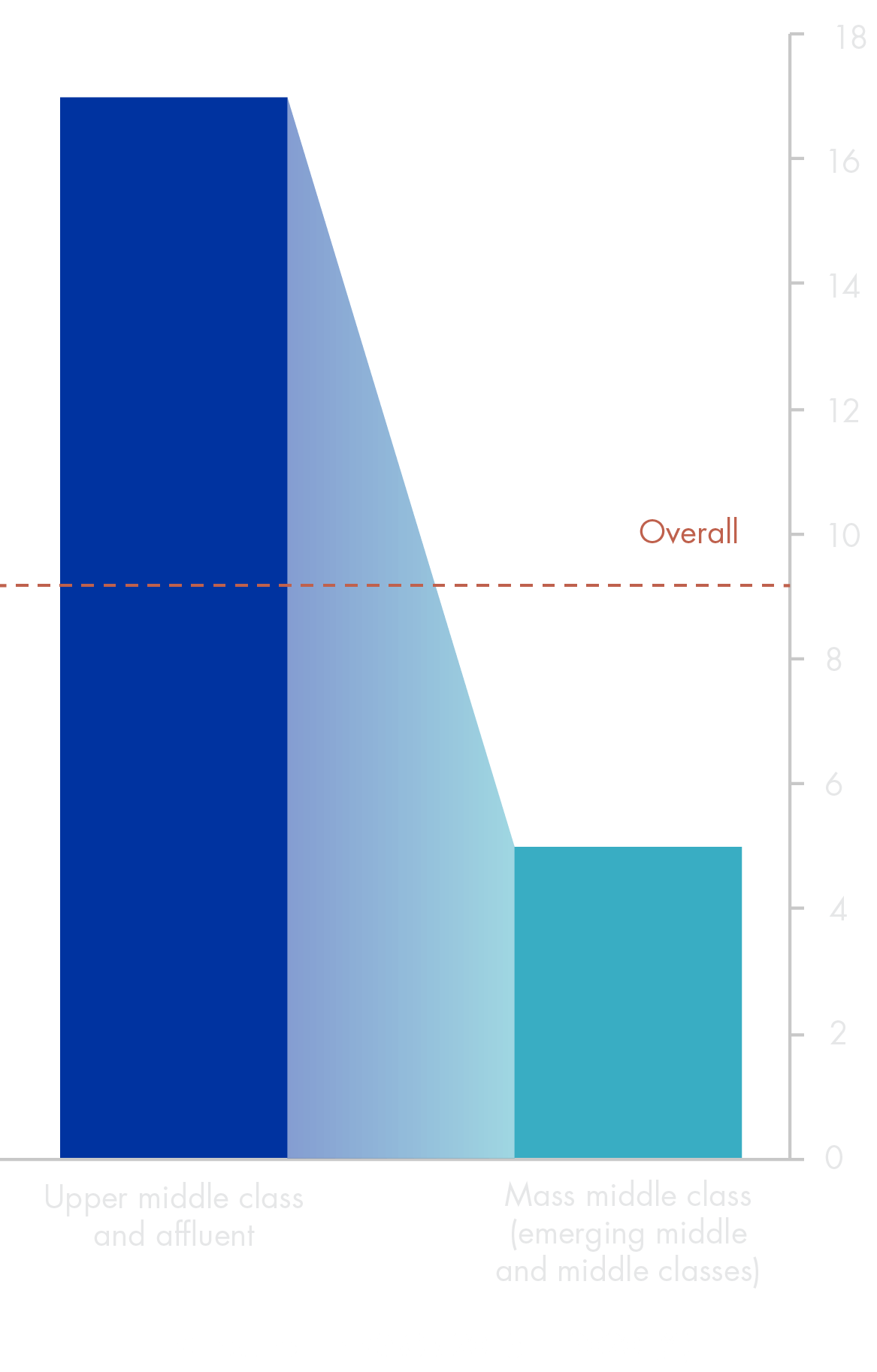

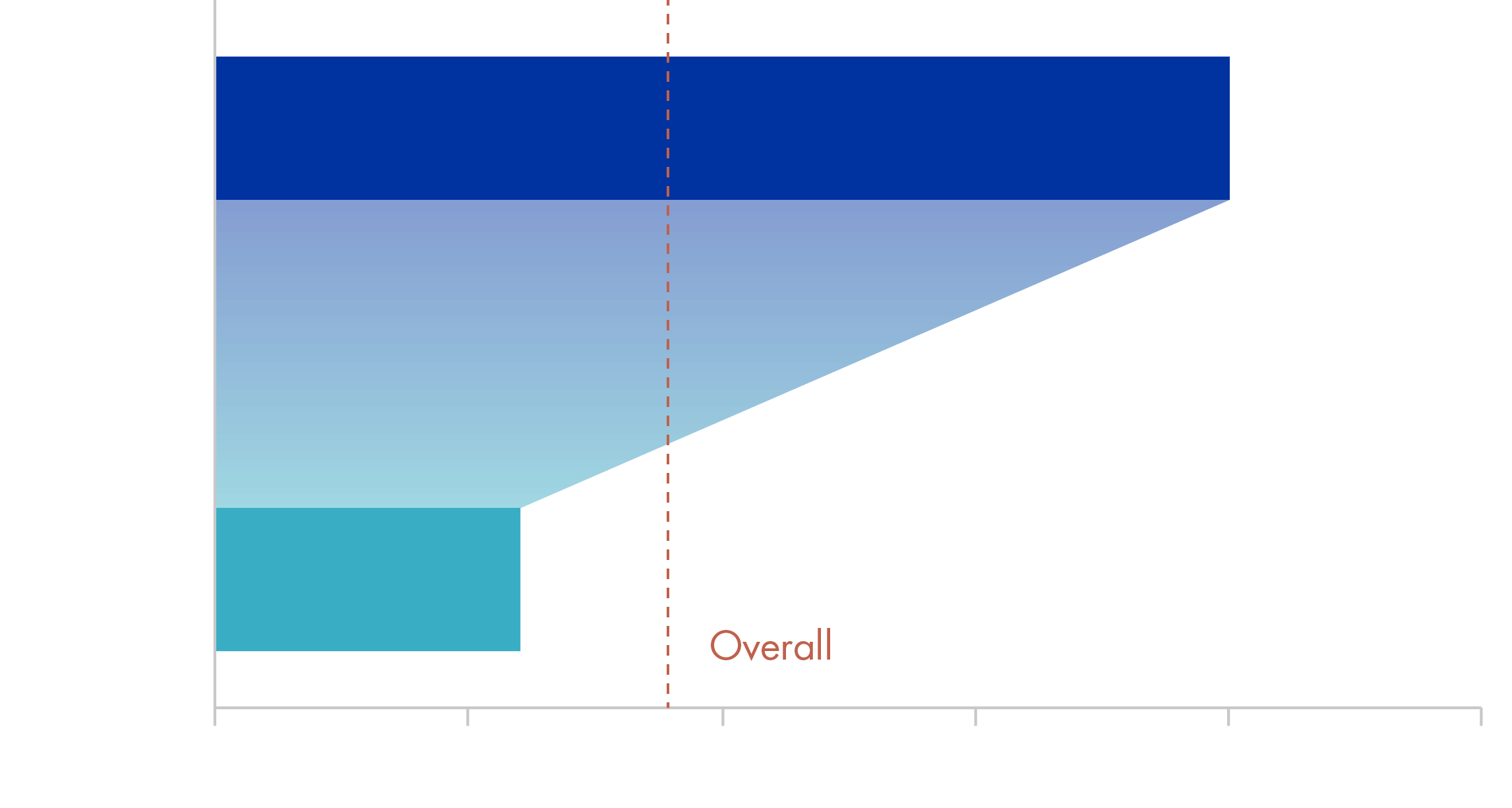

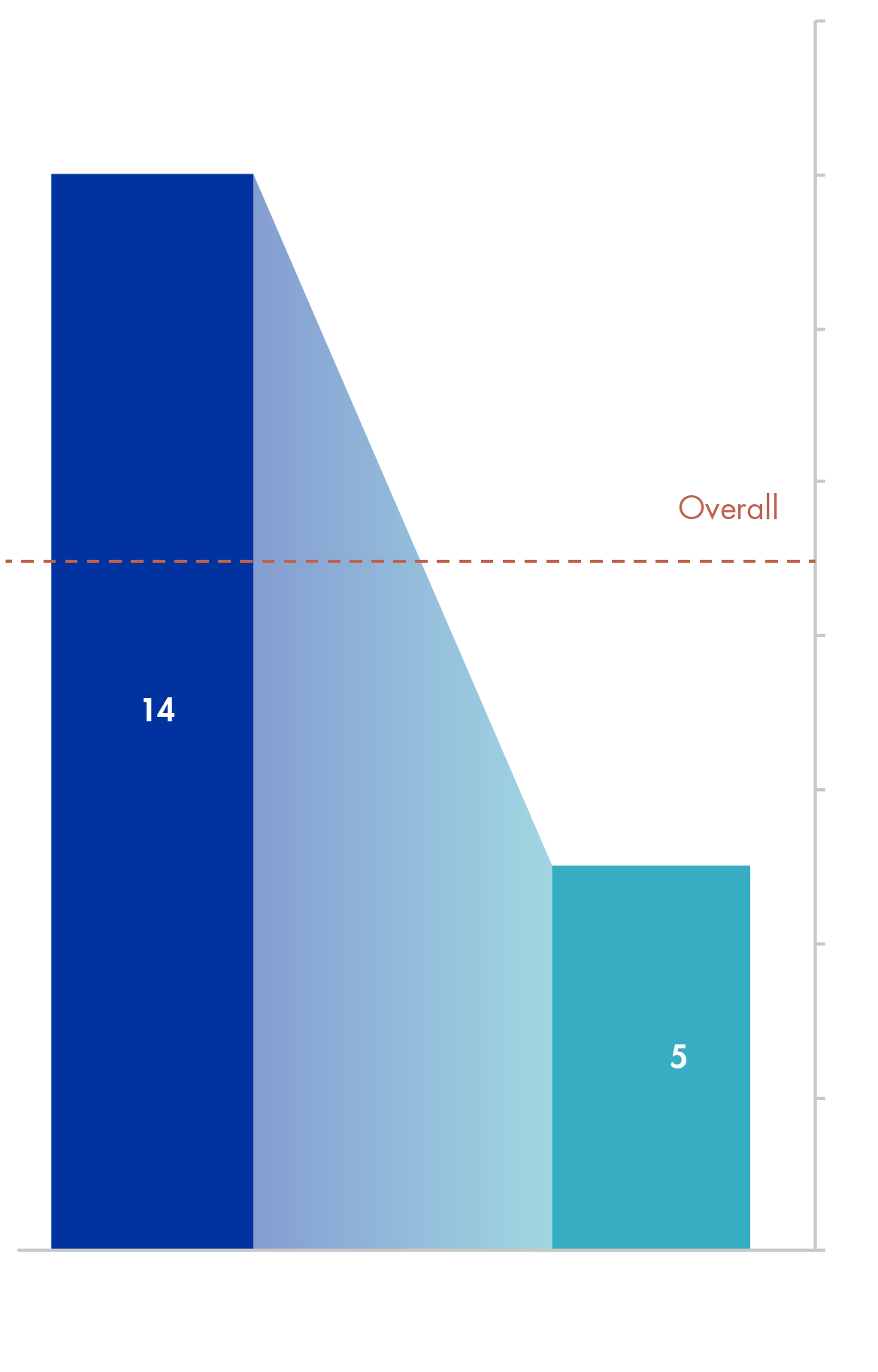

1. Affluence and a growing middle class

Upward mobility

Source: BCG Analysis CAGR = compound annual growth rate

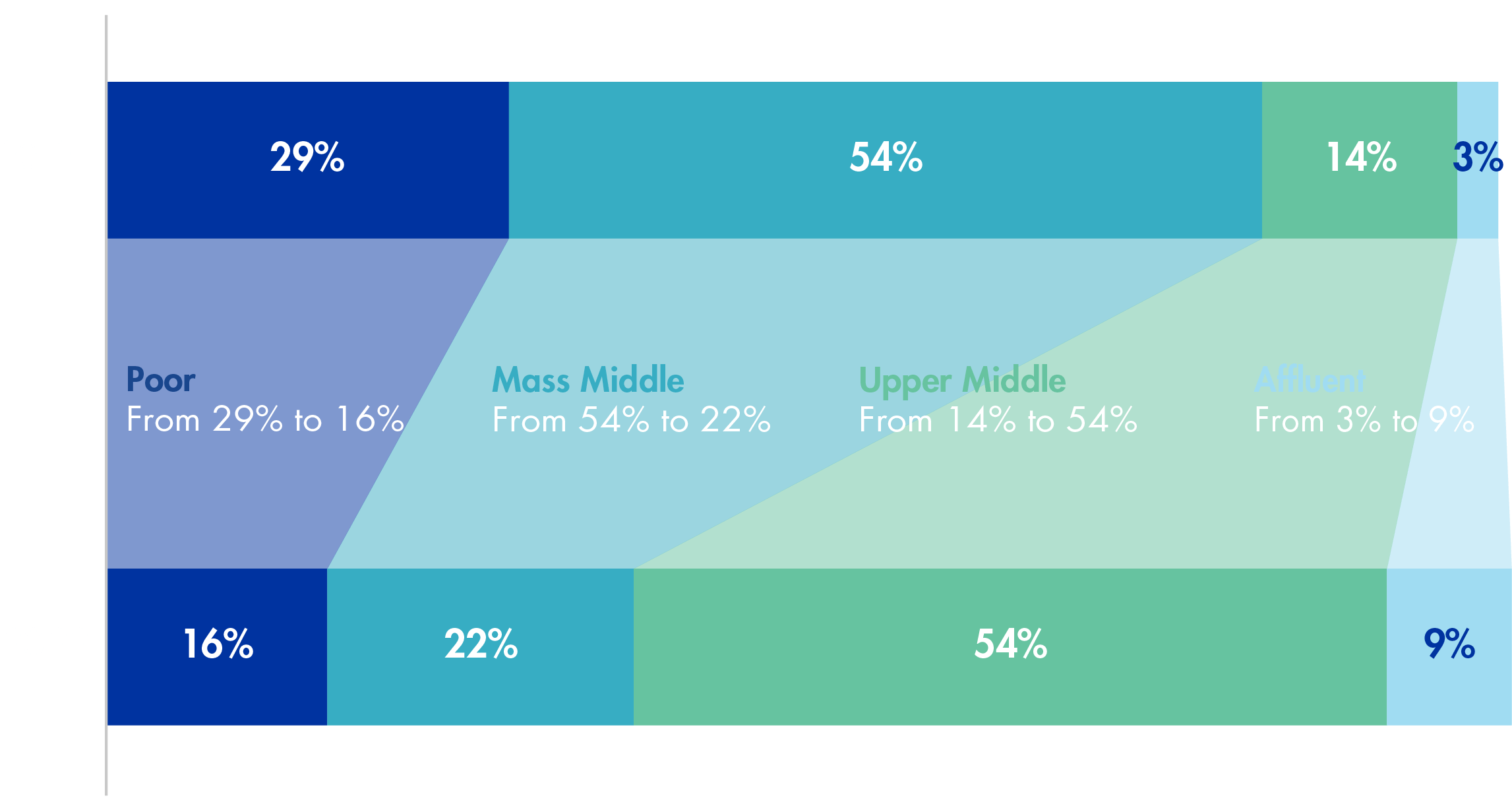

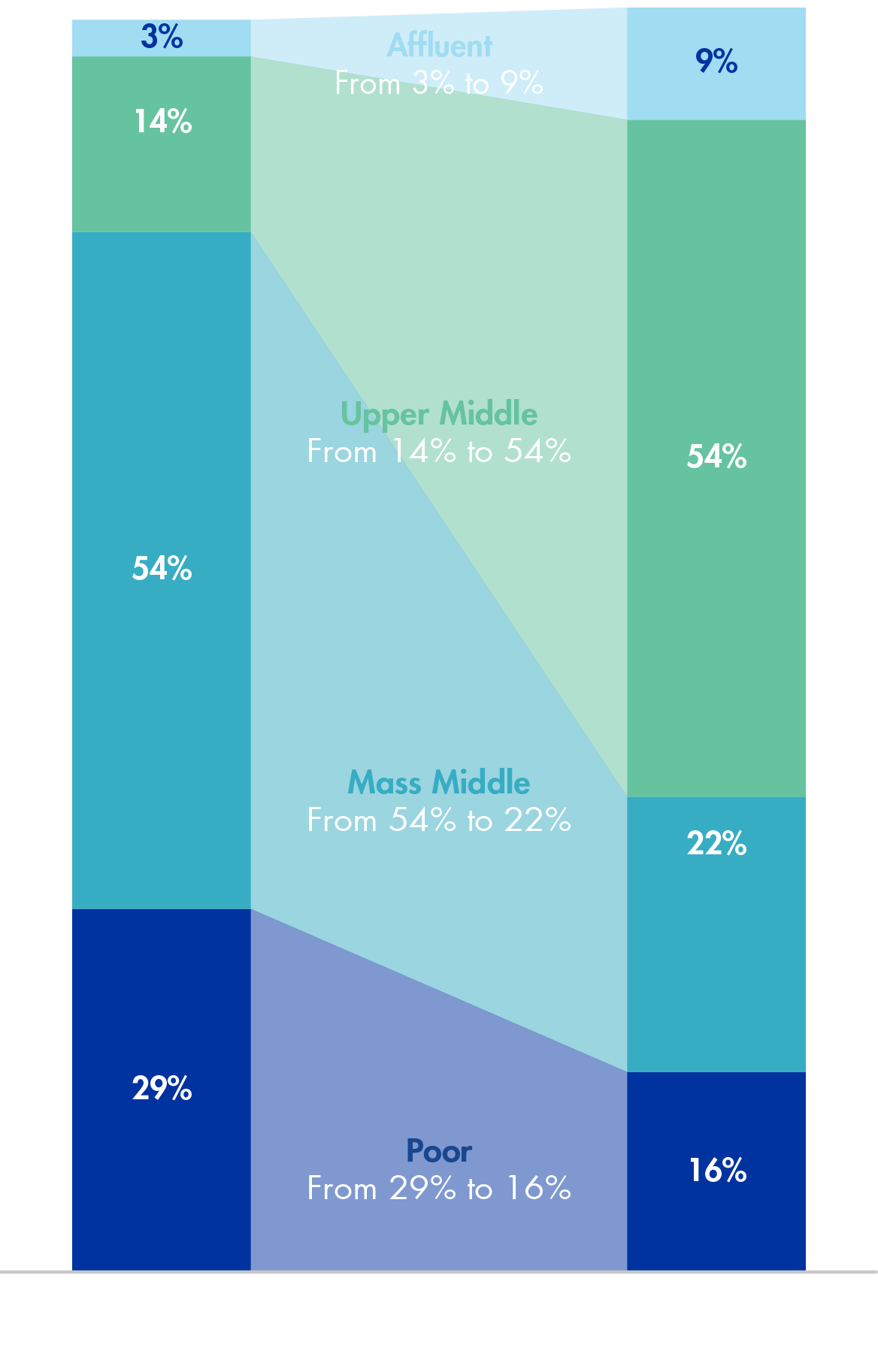

China’s growing middle class

Emerging middle and middle classes include consumers whose annual household incomes range from $10,001 to $24,000; upper middle classes and affluent include consumers whose annual household incomes exceed $24,000. Source: McKinsey 2016 China Consumer Report

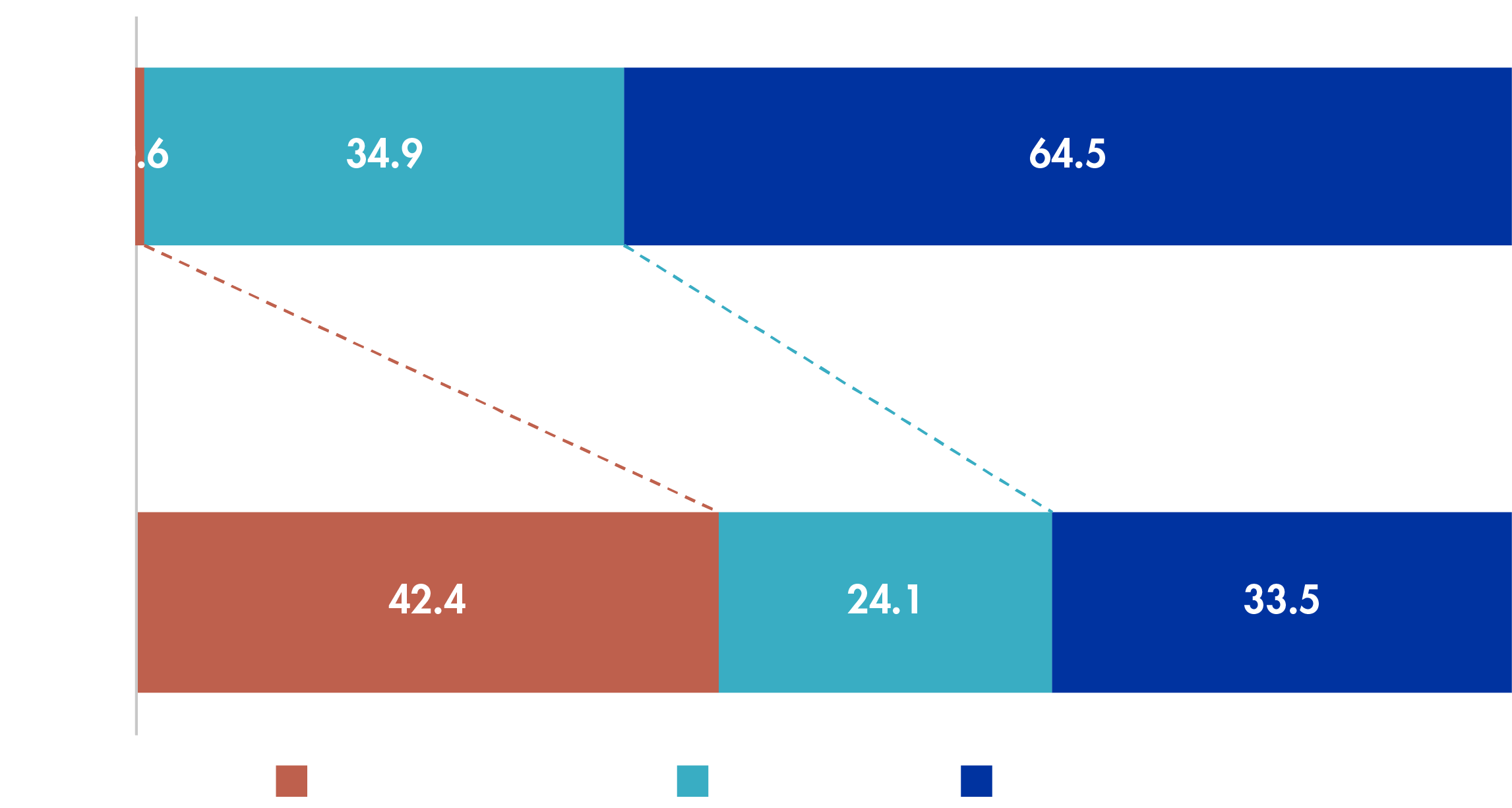

2. World leading digital technology

Growth of e-commerce

Source: BCG Analysis CAGR = compound annual growth rate

% of total retail e-commerce transaction value

Mckinsey Global Institute (Middle) Forrester Research (US) iResearch (China) via Financial Times. McKinsey 2016 China Consumer Report

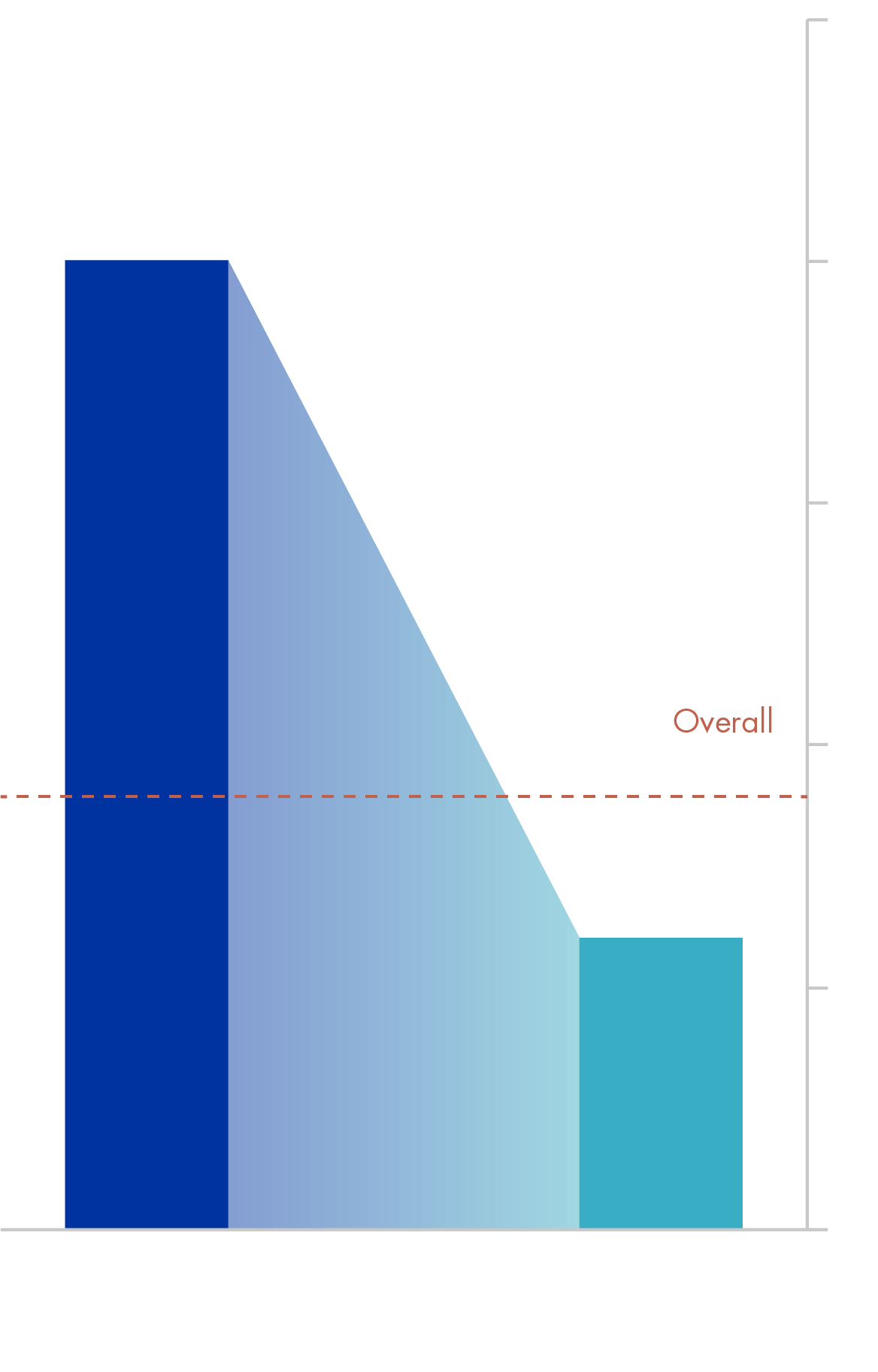

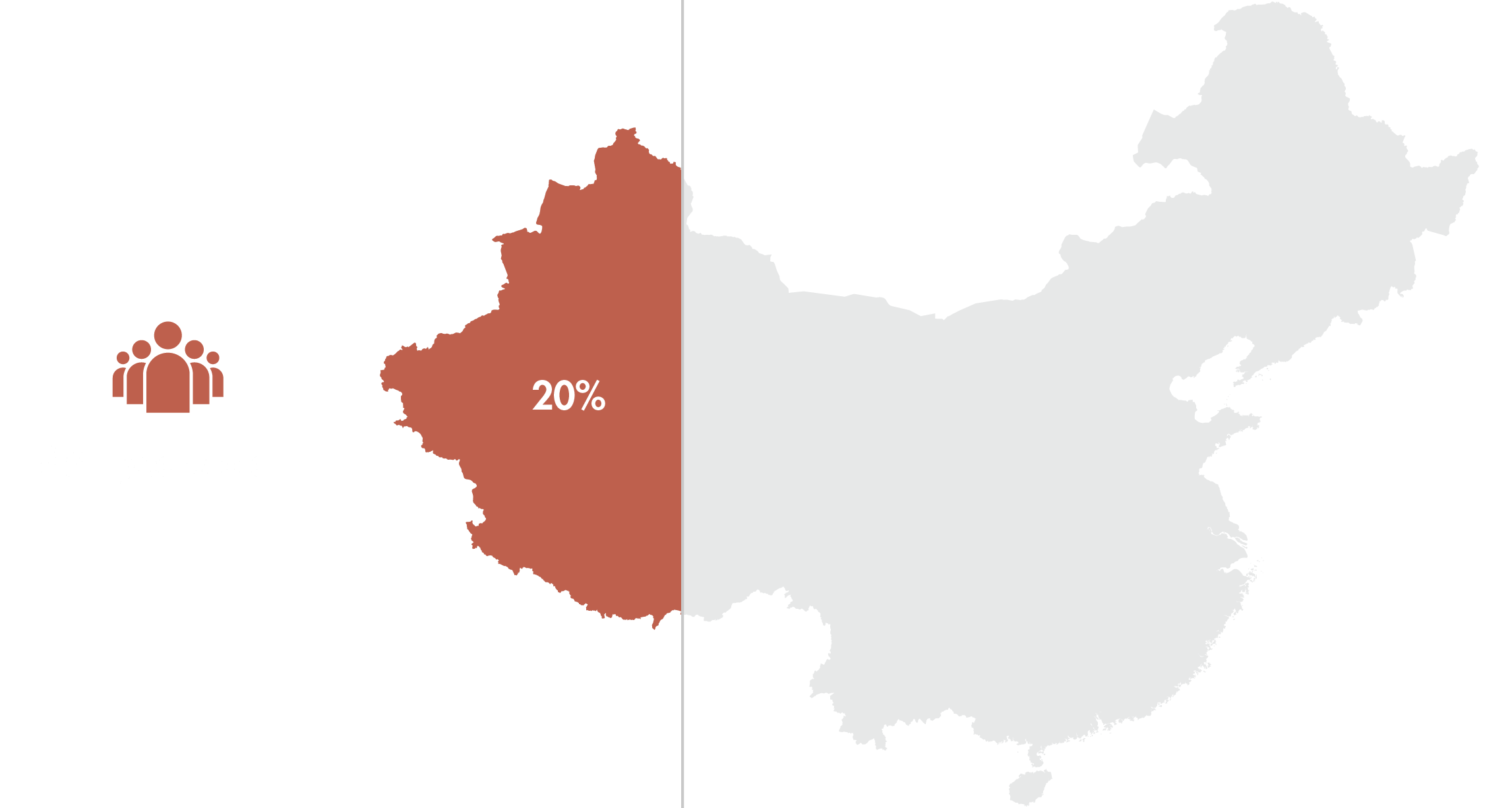

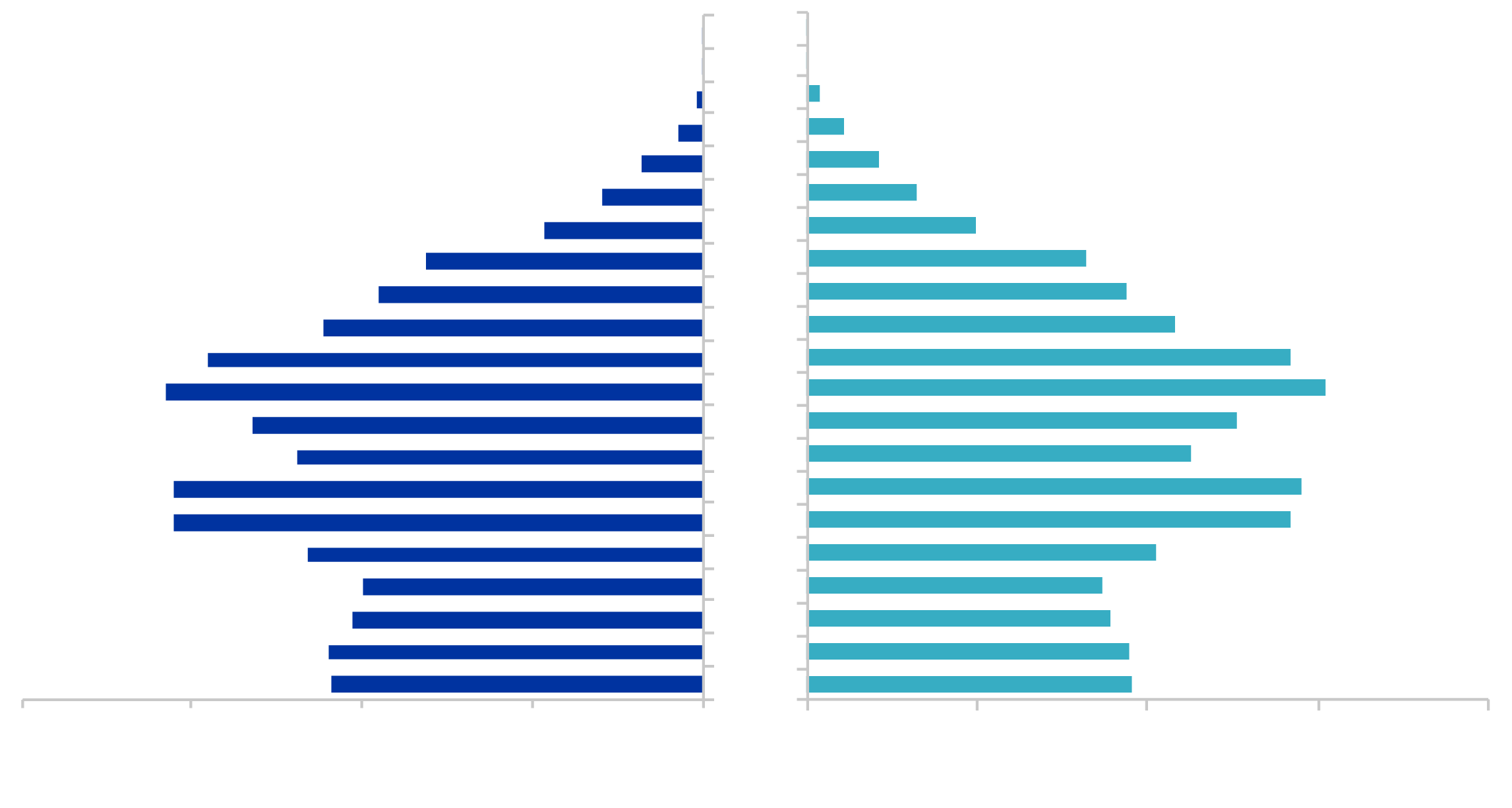

3. Aging population

China by 2035

Sources: Credit Suisse, The United Nations “World Population Prospects: The 2017 Revision”, CSRI “Emerging Consumer Survey 2017”, IMS, Credit Suisse estimates

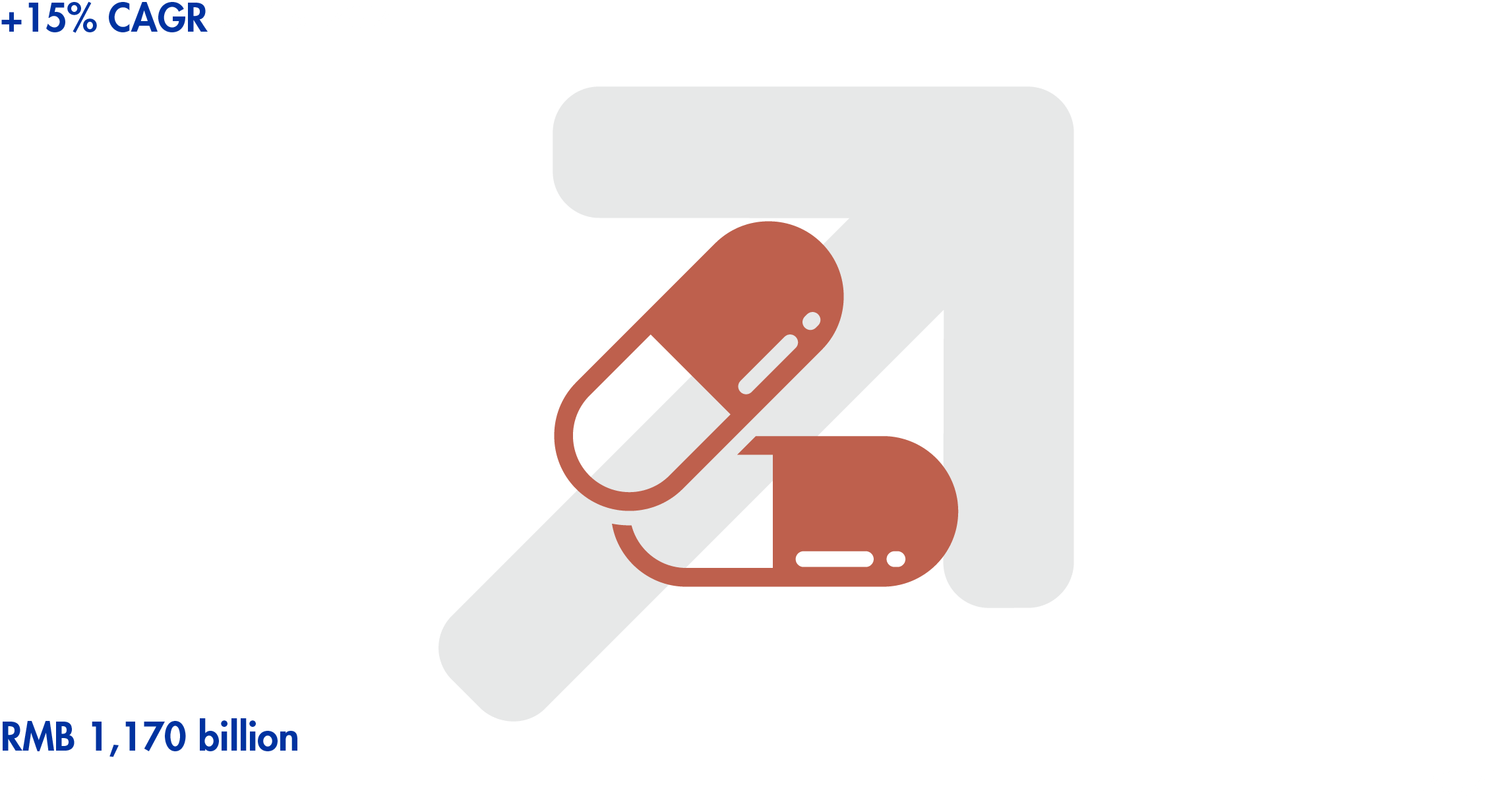

China’s pharmaceutical market

Sources: Credit Suisse, The United Nations “World Population Prospects: The 2017 Revision”, CSRI “Emerging Consumer Survey 2017”, IMS, Credit Suisse estimates

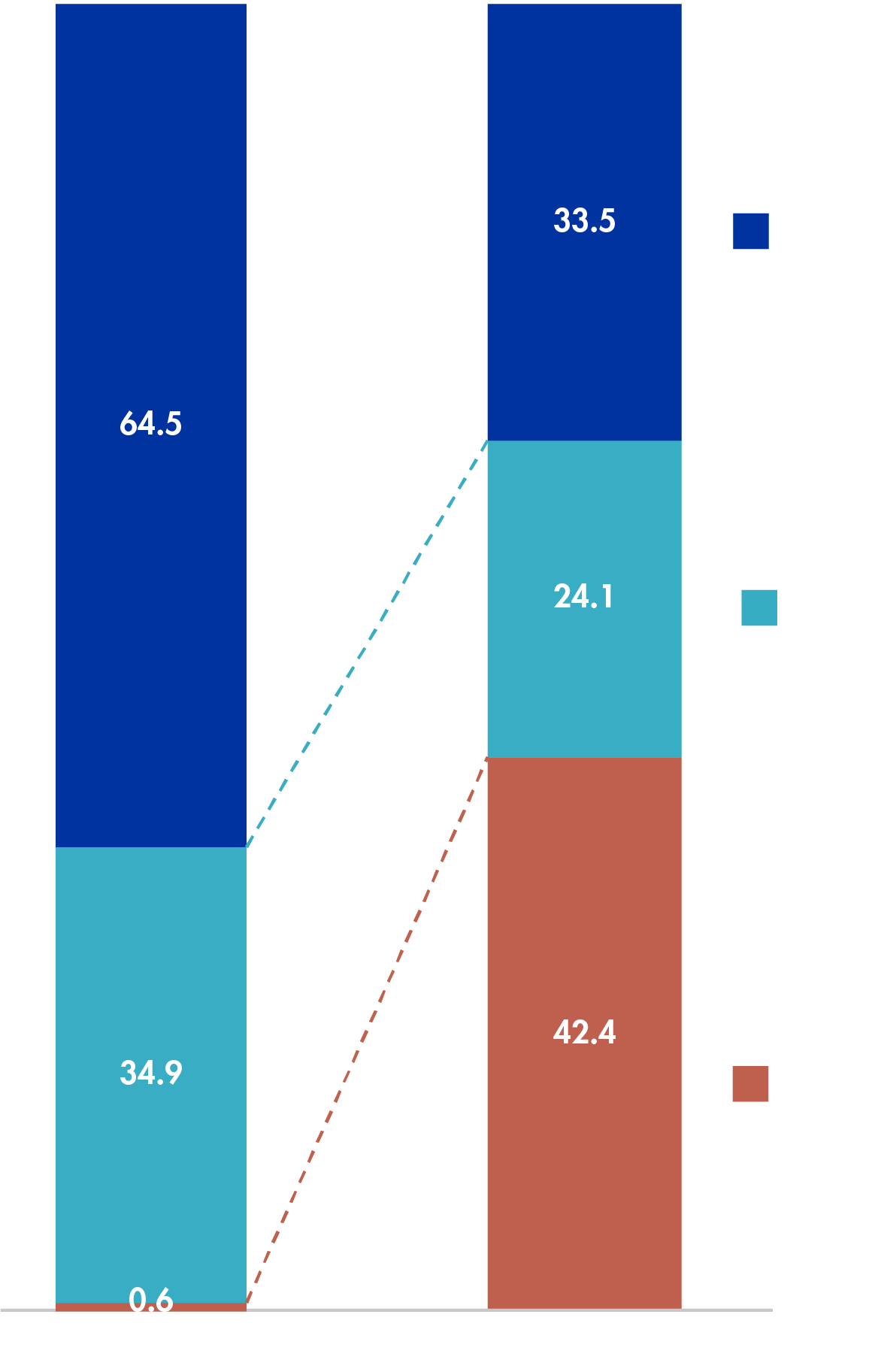

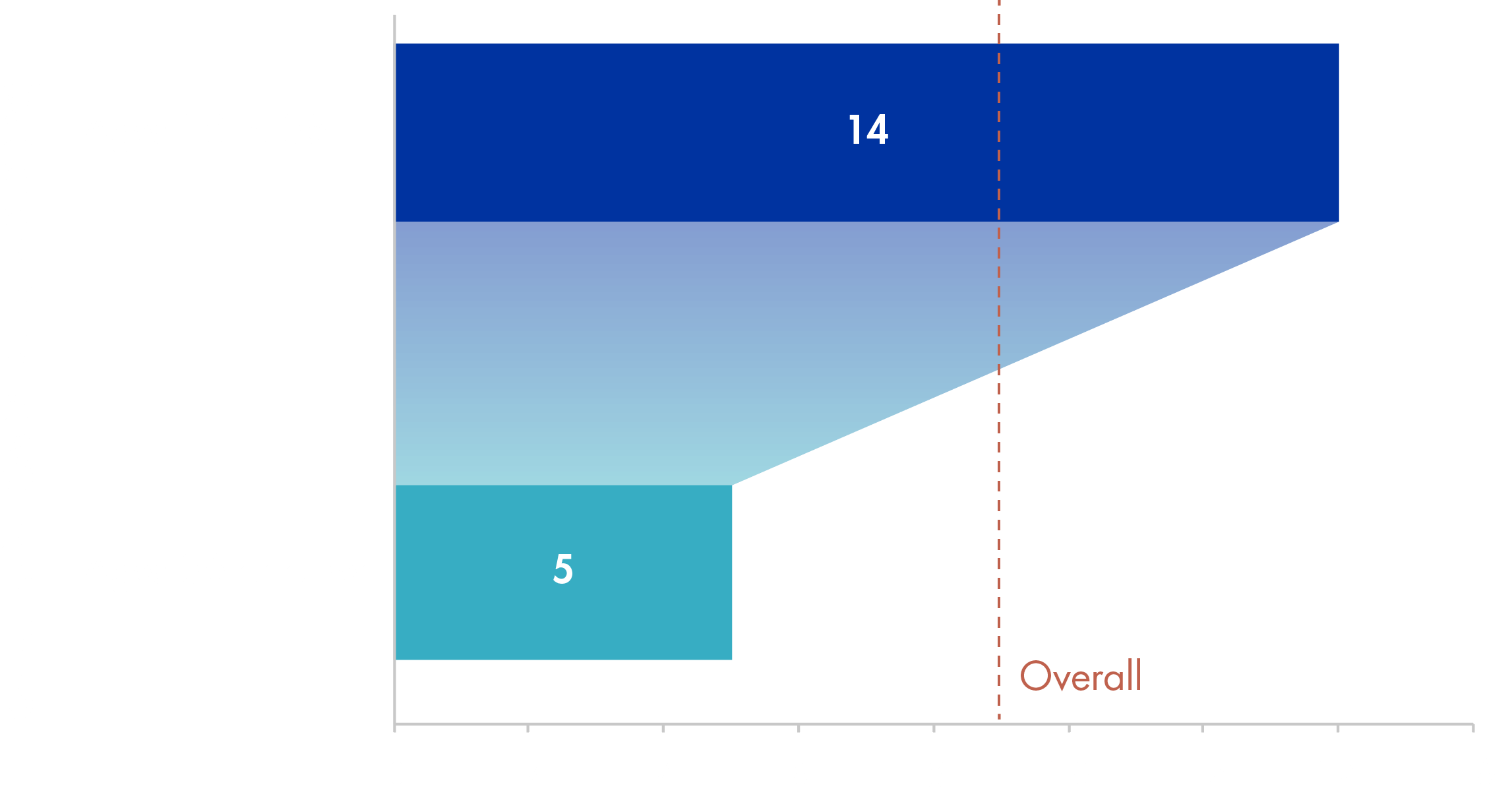

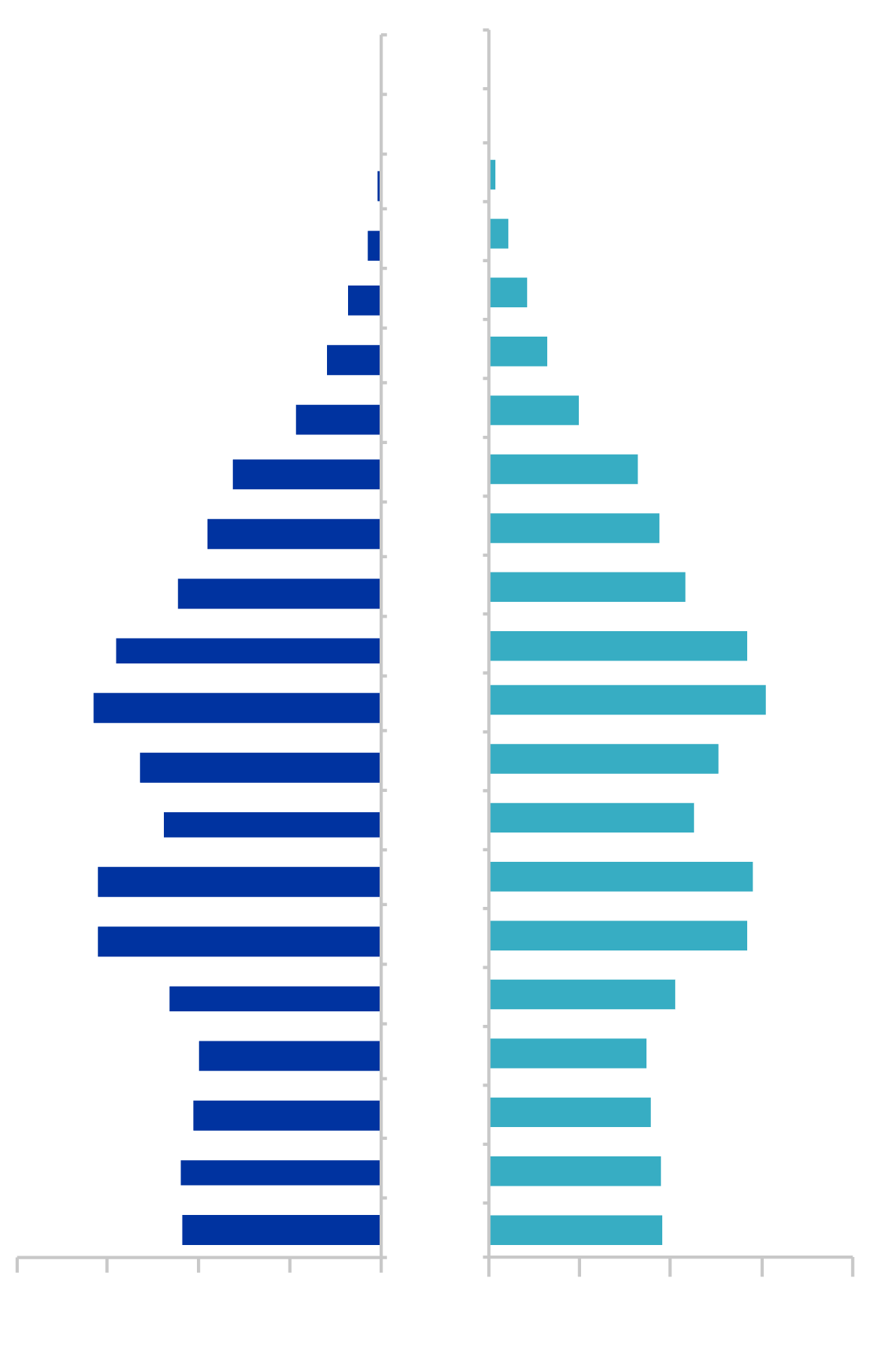

4. But with more millennials than anywhere else in the world

Generational Shift

Source: BCG Analysis CAGR = compound annual growth rate.

Age Group

Sources: CIA World, Facebook

The difficulty for Australian investors wanting to invest in this growth opportunity is gaining access. Many of the Chinese companies in the New Economy aren’t available via other countries’ exchanges and only trade on the mainland Shanghai and Shenzhen stock exchanges.

A RQFII licence holder, VanEck can trade these shares and for the first time we are offering Australian investors a way to step into tomorrow’s prosperity today via an ETF on ASX.

| VanEck Vectors China New Economy ETF | |

| ASX code: CNEW |

|

| Management costs: 0.95% p.a. |

|

| Index: CSI MarketGrader China New Economy Index |

|

| Stock number: 120 |

|

| Bloomberg index ticker: CSIN1086 |

|

| Weighting methodology: Equal |

|

CSI MarketGrader China New Economy Index

The CSI MarketGrader China New Economy Index is a smart beta strategy that seeks to follow fundamentally sound companies domiciled and traded in China that belong to the consumer discretionary, consumer staples, healthcare and technology sectors.

The Index seeks to identify the companies in China with 'growth at a reasonable price' (GARP) attributes which are considered drivers of long-term capital appreciation. Companies are selected on the basis of the strength of 24 fundamental indicators across four categories:

Find out more about CNEW

Investors - 02 8038 3300

Registrar - 1300 68 3837

Email - info@vaneck.com.au

Adviser Services - click here

Institutional Services - click here

Visit our blog

Visit our blog to learn more about the New Economy and the China equity market

This information is prepared in good faith by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as the responsible entity and issuer of VanEck Vectors China New Economy ETF (the Fund). This information is general in nature and not financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision investors should read the product disclosure statement and with the assistance of a financial adviser consider if it is appropriate for their circumstances. A copy of the PDS is available at www.vaneck.com.au or by calling 1300 68 38 37.

An investment in the Fund is subject to various risks that may have the effect of reducing the value of the Fund, resulting in a loss of capital invested and a lack of income from the Fund. Chinese securities have heightened risks compared to investing in the Australian market.

These risks include currency risks from foreign exchange fluctuations, ASX trading time differences, foreign laws and regulations including taxation, potential difficulties in enforcing contractual obligations, changes in government policy, expropriation, economic conditions including international trade barriers, restrictions on foreign ownership, securities trading restrictions, restrictions on repatriation and restrictions on currency conversion. No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from the Fund.

The Fund tracks the CSI MarketGrader China New Economy Index. “MarketGrader” and “CSI MarketGrader China New Economy Index” are trademarks of MarketGrader.com Corporation. MarketGrader does not sponsor, endorse, sell or promote the Fund and makes no representation regarding the advisability of investing in the Fund. The inclusion of a particular security in the Index does not reflect in any way an opinion of MarketGrader or its affiliates with respect to the investment merits of such security.