A tale of two markets

With the US announcing its ban on Chinese mobile apps – Tik Tok and Wechat, as well as the rhetoric emanating from the US election campaign, the two largest economies in the world are at odds. It seems too they are exhibiting divergence in both growth and policy perspectives.

There are potential diversification benefits from having exposure to China assets resulting from the economic decoupling. Here are some interesting observations for China coming into 2H20.

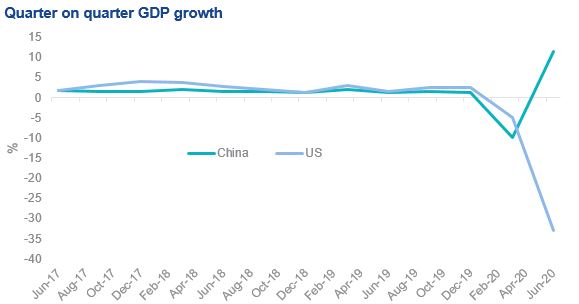

First in, first out

Economic activity in China seems to have come back full swing to the pre-COVID level; the strict lockdown measures from February across major cities have proven to be effective to contain the spread of the virus. In the US, on the other hand, quarter on quarter GDP growth is still deep in the negative territory shown in the chart below. There is some economic data showing early signs of recovery – July US Housing Starts rose more than forecast by 22.6%, fuelled by record-low interest rates; though jobless claims rose by 135,000 over the past week due to lockdown in many states.

Source: Bloomberg

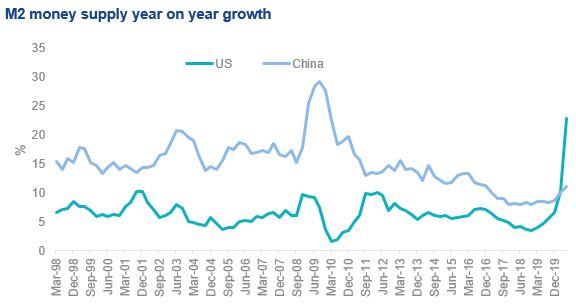

Monetary policy divergence

M2 is a measure of the money supply that includes cash, checking deposits, and easily convertible near money in an economy. If we look at the M2 year on year growth rates of the two countries, China has generally followed the US in the past two decades in reserve expansion. However the trend started to diverge markedly since the end of 2019 – China has retained a moderate monetary policy (10.7% as of July 2020), whereas the Fed balance sheet has surged (23.31%) via asset purchases (source: Bloomberg). The cautious use of monetary stimulus in China provides flexibility if further support is required at a later stage.

Source: Bloomberg

Australian investors may have exposure to US-listed shares in their portfolio, but they may not have China-listed shares. Diversification is important for portfolios and Australian investors can access China A-shares by investing in ETFs that include A-shares.

Read more

>

Published: 31 August 2020

IMPORTANT NOTICE: Issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as the responsible entity and issuer of units in the VanEck Vectors ETFs traded on ASX. This is general information only about financial products and not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision, you should read the relevant PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. PDSs are available at www.vaneck.com.au or by calling 1300 68 38 37.

An investment in Chinese securities has heightened risks compared to investing in the Australian market including currency/foreign exchange fluctuations, ASX trading time differences and foreign political, regulatory and tax issues. The PDSs detail the key risks. No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from a fund.