Davids to complement Goliaths

Australian investors are often attracted to Australian small companies because of their historical long term outperformance above large companies. A similar history of long-term outperformance also applies for international small-cap stocks.

Australian investors are often attracted to Australian small companies because of their historical long term outperformance above large companies. A similar history of long-term outperformance also applies for international small-cap stocks.

Some benefits of investing in international small-caps

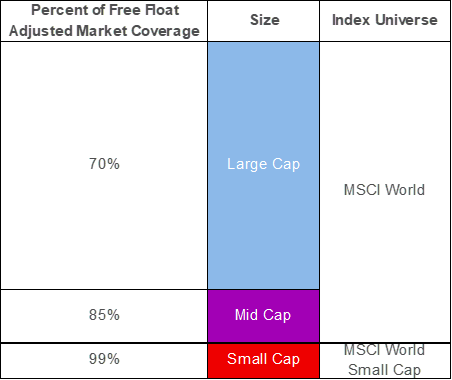

1. Underrepresentation in portfoliosInternational investments in Australian investors’ portfolios are often dominated by large and mid-sized companies from developed markets. This means they are effectively benchmarked to the MSCI World ex Australia Index, which aims to capture the performance of large- and mid-cap companies. This index captures the largest 85% by free float-adjusted market capitalisation coverage of each developed country.

Investors may be missing opportunities in the remaining 15% made up of small-cap companies.

Table 1 – MSCI market coverage reference

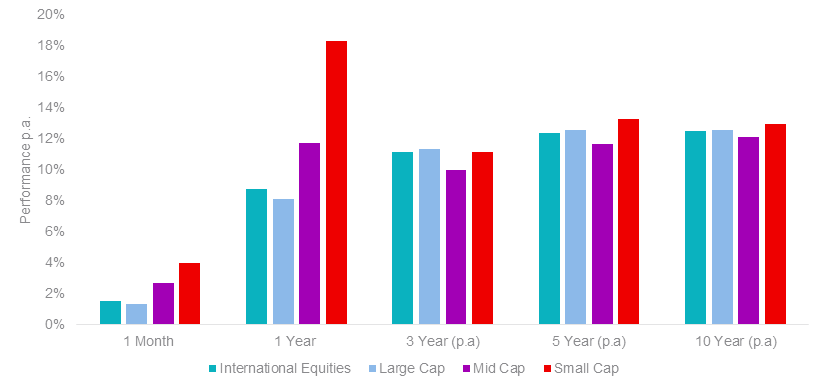

2. Historical outperformance of international small-caps relative to global large- and mid-caps

International small-caps have outperformed international large- and mid-caps, and the broader benchmark MSCI World Index in AUD terms over almost all time periods below.

Chart 1 – Performance comparison of international large-, mid- and small-caps, and international equities as at 28 February 2021

Source: Bloomberg, as at 28 February 2021. International Equities is MSCI World ex Australia Index; Large Cap is MSCI World Large Cap Index; Mid Cap is MSCI World Mid Cap Index; Small Cap is MSCI World Small Cap Index. You cannot invest in an index. Results are calculated to the last business day of the month and assume immediate reinvestment of all dividends and exclude fees and costs associated with investing in QSML. Past performance of the indices is not a reliable indicator of future performance of the indices or QSML.

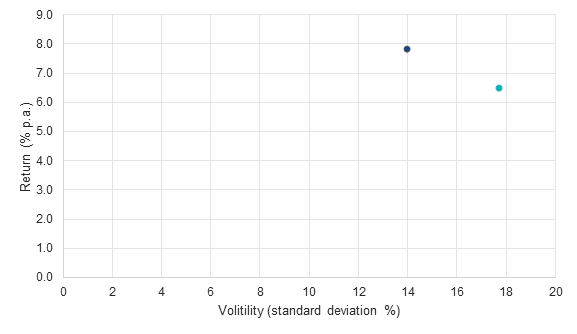

3. International small-caps have better risk return characteristics compared to Australian small-caps

The risk return characteristics for international small-caps are better than Australian small-caps over the long term. As you can see from the chart below, international small-caps have returned almost 8% p.a. on a risk adjusted basis since 2001, which is more than Australian small-caps and with less volatility.

Chart 2: Risk return from 1 January 2001 to 31 January 2021 International Small Caps

International Small Caps  Australian Small Caps

Australian Small Caps

Source: Morningstar Direct; Indices used: International Small Caps is MSCI World ex Australia Small Cap Index; Australian Small Caps is S&P/ASX Small Ordinaries Index. You cannot invest in an index. Results are calculated to the last business day of the month and assume immediate reinvestment of all dividends and exclude fees and costs associated with investing in QSML. Past performance of the indices is not a reliable indicator of future performance of the indices or QSML.

In addition, the risk-adjusted performance of international small-caps is attractive when compared to international mid- and large-caps, as well as Australian small-, mid- and large-caps. The table below shows the Sharpe ratio over different periods for the various market segments. The Sharpe ratio is a measure which takes into account both performance and volatility. The greater the value of the Sharpe ratio, the more attractive the risk-adjusted return.

Table 2: Small companies versus mid- and large- companies

Source: Morningstar Direct; All data to 28 February 2021. Results are calculated monthly and assume immediate reinvestment of all dividends and exclude fees and costs associated with investing in QSML. You cannot invest in an index. Past performance is not a reliable indicator of future performance of the indices or QSML. Indices used: International Small Caps is MSCI World Ex Australia Small Cap Index; Australian Large and Mid Caps is S&P/ASX 100 Index; Australian Small Caps is S&P/ASX Small Ordinaries Index; International Large and Mid Caps is MSCI World Ex Australia Index.

Building your international small-caps portfolio

Historically, investing directly in international small-caps has proved difficult due to accessibility and cost. To date, the only options for Australian investors have been actively managed funds which typically charge much higher fees than passive funds, or ETFs, that follow a market cap approach. A market cap approach is selecting companies simply based on their size. However, when it comes to selecting the small companies that are most likely to deliver growth, there are other factors that should be considered beyond size.

VanEck will soon be offering an international quality small companies ETF (ASX: QSML) that will take a “smarter” approach to selecting holdings. QSML will track the MSCI World ex Australia Small Cap Quality 150 Index which selects 150 of the world's highest quality small companies based on three key fundamentals: high return on equity; earnings stability; and low financial leverage.

QSML will be launching on ASX this week. Learn more about this ETF and register your interest for further information here.

Published: 04 March 2021

This is general advice only, not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Units in QSML are not currently available. The PDS is available here.

An investment in QSML has risks, including possible loss of capital invested. QSML carries risks associated with: financial markets generally, individual company management, industry sectors, ASX trading time differences, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the PDS for details.

Past performance is not a reliable indicator of future performance. No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from the fund.

QSML is indexed to a MSCI index. QSML is not sponsored, endorsed or promoted by MSCI, and MSCI bears no liability with respect to QSML or the MSCI World ex Australia Small Cap Quality 150 Index. The PDS contains a more detailed description of the limited relationship MSCI has with VanEck and QSML.