Gold holds with risks abound

Geopolitical risk, inflation fuel gold’s March moves

March was a month marked by daily, and tragic, developments affecting the world order and increasing the level of risk in the global economy and the global financial system. Russia’s attack on Ukraine pushed gold to an intraday price of US$2,070 per ounce on March 8, just shy of its August 2020 all-time high of US$2,075. The war in Ukraine and associated sanctions against Russia increased gold’s appeal as both a safe haven and an inflation hedge.

Global geopolitical risk is escalating hand-in-hand with intensifying concerns about inflation, most notably due to the impact on energy markets resulting from a reduction of Russian oil and gas exports. In addition, Russia also accounts for a significant share of the global production of many commodities including palladium, gold, metallurgical coal, nickel and aluminum and iron ore. Russia and Ukraine together account for approximately a quarter of global wheat and corn trade, putting further inflationary pressure on what were, prior to the war, already increasing food prices.

The headline US Consumer Price Index (CPI) reached 7.9% in February, a 40-year high, up from 7.5% in January, and is likely to spike higher in March given recent price pressures. Average West Texas Intermediate (WTI) and Brent crude prices in March were over 18% higher than in February. University of Michigan’s Index of Consumer Sentiment dropped to a decade low, while the survey’s year-ahead inflation expectations, as measured by University of Michigan’s Inflation Expectations, climbed to the highest since 1981.

Market uncertainty, Fed policy also having an impact

Fueling uncertainty and volatility in the markets and coinciding with gold’s 19-month high, on March 8 the London Metal Exchange (LME) was forced to halt trading in nickel after a short squeeze drove the nickel price up over 100% in one trading session. Gold hovered around the US$2,000 level for a couple of days, before declining during the week ahead of the anticipated initial rate hike by the US Federal Reserve Bank (Fed).

On March 16, as widely expected, the Federal Open Market Committee (FOMC) raised the federal funds target rate by 25 basis points. Gold bounced back following the announcement, and showed resilience in the second half of March, despite a steady US dollar and significantly higher US treasury rates. Optimistic reports of Russia-Ukraine peace talks put pressure on gold at month-end, though the metal still managed to close at US$1,937.44, up US$28.45 per ounce or 1.5% during March.

Gold equities follow suit

Most gold equities performed well during the month. The NYSE Arca Gold Miners Index gained 7.8%. Though gold’s positive price trend resulted in outperformance by its miners, many gold companies’ valuations remain historically low.

Some gold equities have been more directly impacted by the Russia-Ukraine crisis than others. For example, Kinross Gold has underperformed recently due to its exposure to Russia, where about 12% of the company’s gold reserves are located. On March 2, the company announced its plans to suspend operations at its Kupol mine and suspend all activities at its Udinsk development project. Further, on March 29, Kinross announced that it is in negotiations regarding the potential sale of 100% of its assets in Russia. We view the announcement as positive given that most of the Russian value was likely wiped out of Kinross’ stock price this past month, so removal of this overhang should allow the company to trade on its other strong fundamentals.

Shifting demand from central banks may spark moves

The effect of sanctions on Russia extends to its central bank (Bank of Russia), which has lost access to a large portion of its foreign exchange reserves as Western governments froze assets in order to undermine Russia’s violent attacks on Ukraine. Effectively, Bank of Russia’s foreign currency reserves were rendered useless, and at a critical time. This shifted the spotlight to gold, which Bank of Russia holds in its own boarders and, thanks to strong purchases in recent years, is estimated to represent over 20% of its total reserves (about 2,300 tonnes or US$140 billion dollars’ worth). Other central banks around the world were certainly watching as gold, a presumed financial lifeline, emerged uncontested as a safe store of value.

Later in March, the US issued a notice prohibiting gold transactions with Russia. While this certainly complicates any sales, we doubt it would stop Russia from monetising its gold if it so desired as Bank of Russia later announced it will buy gold from Russian credit institutions.

Amid these developments, we think it is reasonable to assume that the move to freeze Russia’s foreign currency reserves brings attention to the need to diversify into gold, and could have a positive impact on gold demand from central banks and from other institutions and investors globally. According to BGM Group, gold represents less than 1% of global financial assets, and a relatively small percentage of the total reserves of several large economies, including China (3.3%), Japan (3.5%), Switzerland (5.4%), and India (6.9%). A relatively small increase in the percentage of global financial assets allocated to gold, from, say, just under 1% to 2%, could see demand double—and with it, the price of gold. Though speculative, under these scenarios, it is not that difficult to see gold prices moving higher from current levels.

Near-term, gold outlook likely more war- and fed-driven

Shorter term, and in our view, the gold price will likely continue to be driven by the effects and risks brought about by the ongoing war, its potential for expansion beyond Ukraine and residual, negative impacts on the world economy. In addition, gold markets will be watching the Fed in its fight against inflation. The Fed has reiterated that it has the necessary tools to combat inflation and make sure it does not become entrenched. It intends to restore price stability while supporting a strong job market, believing that both the labor market and the economy are strong enough to withstand its tightening policy. Fed Chair Jerome Powell now expects inflation to peak in the first half of 2022, and while remaining elevated, he anticipates declining inflation through the second half of the year. The market expects the Fed to hike at least by 25 basis points at each of its six remaining FOMC meetings in 2022, and recent commentary by Fed members suggests 50 basis points hikes are definitely on the table. We estimate these projections have already been priced-in by gold markets.

Against this backdrop, gold’s price action should be tightly linked to the shifting expectations around the Fed’s pace of rate increases and its perceived effect on the economy and inflation. In other words, while higher interest rates are generally negative for gold, it is real rates (nominal interest rates less inflation) that are more strongly (negatively) correlated with gold. With US CPI around 8%, there is a lot of room to allow real rates to remain negative, even as the Fed hikes, which is generally supportive of gold. The Fed has to navigate in choppy waters, made even rougher by the ongoing war. It needs to be aggressive enough to have a real chance to combat inflation, but careful not to launch the economy into a recession. Both persistent inflation and/or a recession would be positive for gold.

How has gold faired in past rate hiking cycles?

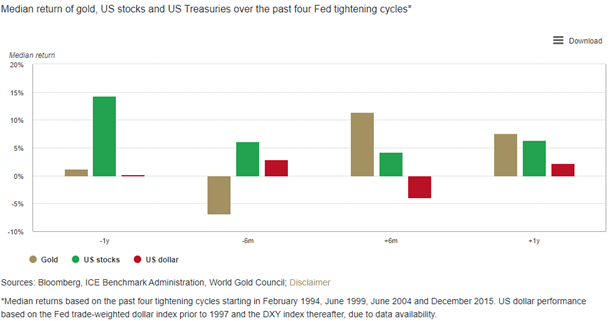

It is worth noting gold’s price performance during the last several Fed tightening cycles. Based on the median returns, as shown in the chart below, gold outperformed US equities (as represented by the S&P 500 Index) and the US dollar (as represented by the DXY Dollar Index) in the six months and the twelve months after the first hike of the cycle, even though it underperformed in the months ahead of it.

Gold has typically outperformed follow the first rate hike of a Fed tightening cycle

Market sentiment towards gold continued to improve in March. According to the World Gold Council, after persistent outflows throughout 2021, gold bullion exchange traded products have recorded strong inflows, with holdings up over 5% in the month of March, and 8% thus far in 2022.

Stable, higher prices should continue to benefit the miners

Gold has established a new, positive trend, and is now consolidating its gains above the US$1,900 per ounce level. This environment of higher and potentially rising gold prices should continue to benefit the gold equities. Gold equities carry strong operating leverage to the gold price, as demonstrated in March. In addition, they carry resource leverage to the gold price. As the gold price increases, resources and reserves tend to grow and, therefore, so do companies’ valuations.

This comes from several sources:

- Ounces that were not economic to mine at a given price, may become economic at higher gold prices

- Companies increased cash flow can be used to carry out “definition drilling” (drilling projects designed to assess the magnitude and style of mineralisation of a company’s mine) to convert resources to reserves

- Exploration activity tends to increase which can also lead to further resource discoveries

These were topics of our conversations during our recent meetings with the gold companies at an industry conference. The conversation has now definitely shifted to investing in growth to building, expanding, exploring and consolidating. While inflationary pressures have pushed industry costs higher in 2022 (roughly +5% on average according to Scotiabank), margins remain very healthy. Gold producers enjoy the benefits of a natural hedge against industry cost increases, in that, as inflation pushes costs higher it also tends to support higher gold prices. Ultimately, we do expect growing margins, so we are encouraged to see companies also discussing their continued focus on reducing costs and optimising their operations and portfolios.

Published: 11 April 2022