Bonds strike back!

The comeback in emerging markets (EM) bonds has been stellar and points to a reversal of liquidity-panic selling, as well as country-specific positive developments – an asset class where active management demonstrates its advantage.

Like the GFC and subsequent debt crisis when EM bonds shined, they currently have the same basic fundamentals that made them perform and attract inflows back then:

- Emerging markets have lower leverage and higher real interest rates relative to developed markets; and

- Developed market authorities are being forced into more fiscal and monetary experimentation and supply - creating greater risks.

Market stimulus from developed markets for this current crisis is specifically aimed at stabilising emerging markets.

Rebounding growth data out of China and the stronger than anticipated employment data in the US, point to a sharper economic recovery than the market had been pricing and is supportive of a bullish EM bond market.

EM bonds on the rebound

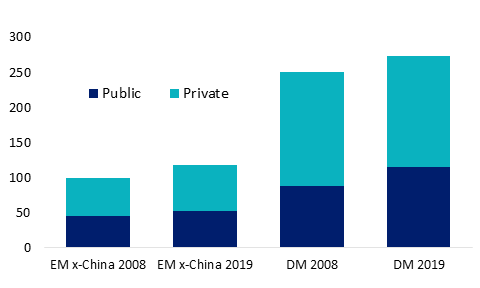

Emerging market economies are in a better fiscal shape than their developed markets peers, just like they were after the GFC.

Debt/GDP Ratios in emerging markets and developed markets - GFC vs COVID-19

Source: VanEck, Bloomberg 31 May 2020

As the world emerged from the GFC, and the subsequent debt crises, emerging market bonds outperformed their developed market counterparts. We think the current fundamentals support an allocation to emerging markets now.

The case to be bullish

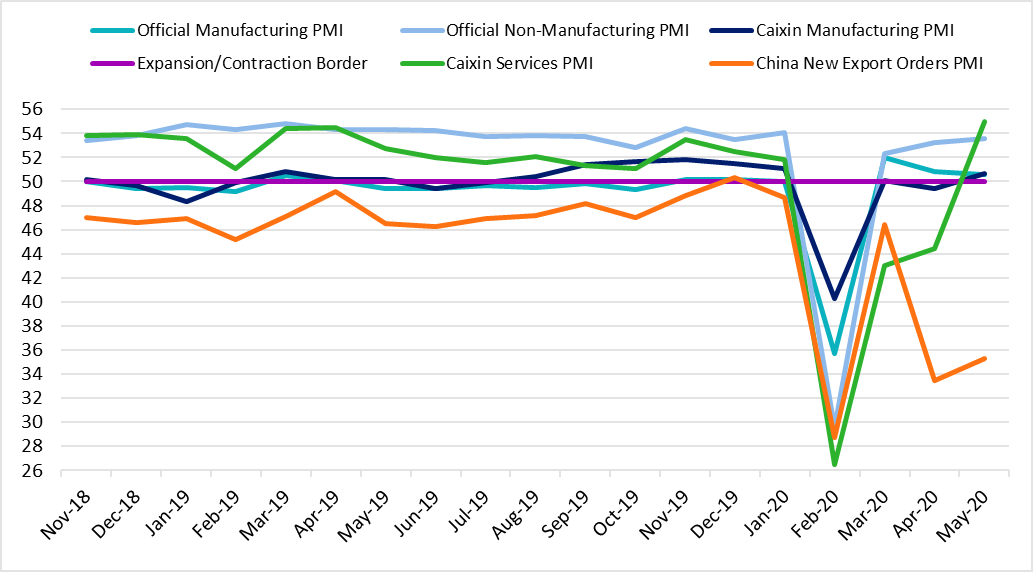

China’s rebounding growth data and better US employment figures point to a sharper economic recovery than the market has been pricing. These factors, combined with recent EM bond market performance, strengthen a bullish thesis for emerging markets bonds. As the first to suffer from COVID-19, China’s policy response is key to watch. During the National People’s Conference, the government dropped its official growth target, although a binding employment target was created (9 million new urban jobs). Fiscal stimulus was promised, but at roughly 3.5% (currently) it looks prudent. Total social financing is set to grow “significantly”, giving a green light for more rate cuts. Through this, China’s latest activity gauges (Purchasing Managers Indices, or PMIs) point to an uneven recovery that faces strong global headwinds. The official manufacturing PMI remained expansionary (50.6), but undershot consensus, while new export orders PMI was outright contractionary (35.3). At the same time, the services PMI continued to improve (55.0), and the Caixin manufacturing PMI – which has a larger share of small privately-owned companies – returned to expansion territory (50.7). So green shoots are clearly there, but they will require policy support for quite some time – especially as the trade deal with the US is once again under threat.

China Purchasing Managers Indices (PMI)

Source: VanEck, Bloomberg 31 May 2020

Active management capitalises on rebound

During the COVID-19 crisis it seemed babies were thrown out with the bathwater and a number of EM bonds were sold at prices reflecting a liquidity crisis. For example, Argentina and Angola were sold down in a range with Lebanon and Ecuador (which we don’t own) even though only the latter two defaulted.

This highlights why active management is important.

An unconstrained approach offers a number of benefits including greater diversification than approaches limited to only hard or local currency. We believe an optimal portfolio of emerging market bonds is unconstrained by indices, and invests in bonds that offer the best value relative to their fundamentals while managing risk.

Find out how you can invest in EM bonds and access a target yield of 5% p.a.*

* In determining each month’s dividend VanEck will target an annual dividend yield of 5% p.a. of the capital invested at the beginning of the period. From time to time we may amend this target.

No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from EBND.

Published: 14 June 2020