Play on

Positive secular trends such as the increasing number of gamers and time spent in game, and changing global consumer behaviour, are projected to continue driving industry growth over the long term. Importantly, the gaming and esports investment opportunity also presents diversification away from the FAANGM mega cap tech giants, Facebook, Amazon, Apple, Netflix, Google owner, Alphabet and Microsoft.

A thriving industry

According to Newzoo’s Global Esports and Live Streaming Market Report the global esports and video gaming industry will achieve revenue growth of US$1.6 billion and have a global audience of more than 570 million in 2024.

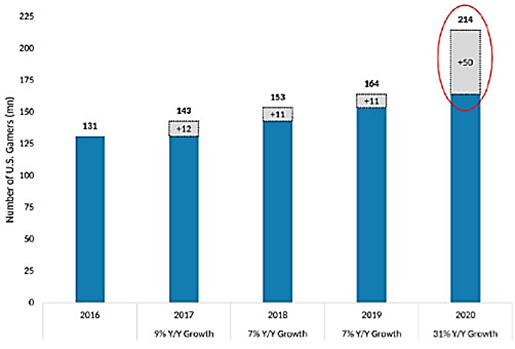

The industry was already enjoying a steady growth trajectory before the pandemic accelerated the trend last year. Restrictions that have kept many at home and shut down other forms of entertainment have resulted in a banner year for the sector. Morgan Stanley’s recent research showed that the US game industry, for example, may have pulled forward four years of video game user growth in 2020 as player bases, time spent and in-game revenue soared (Figure 1).

Figure 1: Accelerated growth

Note: 2018 figure is Morgan Stanley estimate based on 2017 and 2019 ESA figures.

Source: Entertainment Software Association, Morgan Stanley Research. December 2020.

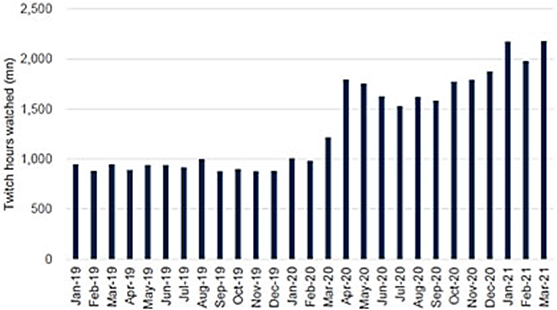

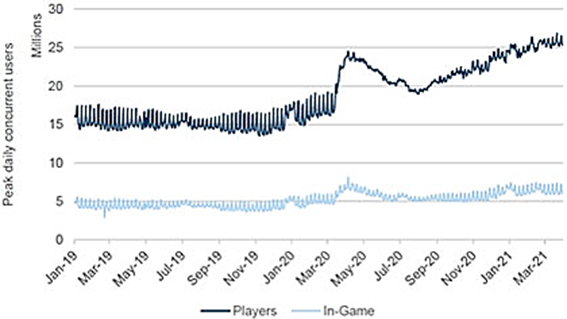

Meanwhile, viewership and in-game player counts on Twitch and Steam, proxies for video game engagement, hit new record levels in the first quarter of 2021, surpassing levels achieved during the fourth quarter of 2020 and the height of the pandemic. Other metrics such as consumer spending on video games also rose, driven by new content and hardware releases.

Figure 2: Record viewership in 1Q21 on Twitch (live game streaming platform)

Source: Company data, Goldman Sachs Global Investment Research

Figure 3: Increased levels of engagement on Steam (online PC games marketplace)

Source: Company data, Goldman Research, March 2021.

Big opportunities ahead

The sector’s long-term structural growth story is supported by other macro trends such as demographic shifts. Contrary to the common perception that video game playing is dominated by young people, the average gamer is between 28 and 32 years of age. They grew up playing video games and continue to do so. They are also well-educated, earn more than the average consumer, and spend their money on video games and related activities. The demographics are replicated across the world, particularly in populous emerging market countries.

Another supportive trend is the change in consumer preferences, with consumers increasingly going for interactive, not just passive, entertainment. Mixing social media and gaming allows them to bring their friends into the interactive online world.

Then there is the widening of monetisation avenues through subscription and free-to-play models. Games are increasingly moving towards a subscription model, much like Netflix. Such a model provides a more reliable path to monetisation for smaller, quality games that may otherwise lack the marketing or monetisation nous to break into the mainstream. Meanwhile, free-to-play games allow developers to monetise without needing to convince consumers to make up-front purchases. Instead, they offer in-game upsell opportunities such as upgrades and expansion packs.

The VanEck Vectors Video Gaming and eSports ETF (ASX: ESPO) is benefiting from the industry’s strong run. It offers exposure to leading video gaming and esport companies including publishers Tencent, Nintendo, Electronic Arts and Activision. The fund has grown to nearly $100 million in just seven months since listing.

1 Mordor Intelligence, GAMING MARKET - GROWTH, TRENDS, FORECASTS (2020 - 2025)

Published: 22 April 2021

An investment in ESPO carries risks associated with: financial markets generally, individual company management, industry sectors, ASX trading time differences, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the PDS for details.

MVIS Global Video Gaming and eSports Index (AUD) (‘MVIS Index’) is the exclusive property of MV Index Solutions GmbH based in Frankfurt, Germany (‘MVIS’). MVIS is a related entity of VanEck. MVIS makes no representation regarding the advisability of investing in the Fund. MVIS has contracted with Solactive AG to maintain and calculate the MVIS Index. Solactive uses its best efforts to ensure that the MVIS Index is calculated correctly. Irrespective of its obligations towards MVIS, Solactive has no obligation to point out errors in the MVIS Index to third parties.