Moats’ Sustainable Competitive Advantages

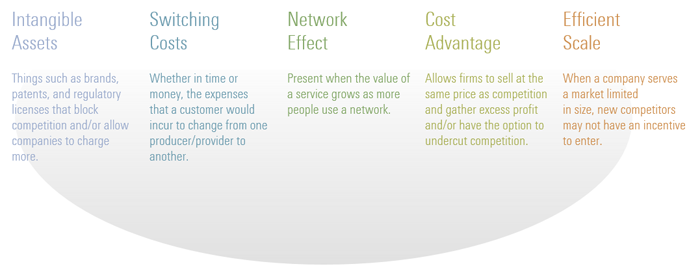

This moat investing education series explores the primary sources of economic moats. The idea of an economic moat refers to how likely a company is to keep competitors at bay for an extended period. According to Morningstar Equity Research, there are five key attributes that can give companies economic moats, and which are viewed as sources of sustainable competitive advantages: 1) Network Effect; 2) Intangible Assets; 3) Cost Advantage; 4) Switching Costs; and 5) Efficient Scale. Here we explore the concept of the "Network Effect."

The Network Effect: A proven way to create a moat

The economic principle of the "Network Effect" has risen to the forefront as our world has grown increasingly digital. It describes the phenomenon of an external effect in the economy, where the value of a product or service increases as the number of its buyers or subscribers expands. When a network effect is in play, each additional customer increases the product's or service's value exponentially. The internet is a good example; it originally had few users outside the military and research science spheres, but its expanding user base exploded its reach and impact over the past two decades. More recently, internet companies like Facebook and Google have been labelled "network effect" paragons.

Morningstar posits that a network effect can help a company to increase its advantages over competitors, and is often an important source of a company's economic moat. Morningstar Research explains it as:

- Network Effect occurs when the value of a company's service increases for both new and existing users as more people use the service. For example, millions of buyers and sellers on eBay give the company an advantage over other online marketplaces. The more sellers there are on eBay, the more likely buyers are to find what they're looking for at a decent price. The more buyers there are, the easier it is to sell things.

The term "critical mass" is often used in connection with the network effect. In game theory, this means that not all game participants need to be convinced for a strategy to succeed, just a very specific portion of them. If this participation threshold is exceeded, the strategy is likely to succeed of its own accord. The network effect works in similar fashion. If the user base for a product or service reaches a critical mass, the network is likely to expand under its own power.

Economic moat

Five Sources of Sustainable Competitive Advantage

Source: The Morningstar® Economic Moat™ Rating System.

The Network Effect in action: Three case studies of moat companies

Within the technology sector, two moat-rated companies standout as beneficiaries of the network effect: Salesforce.com and Microsoft. We also highlight credit card firm Visa from the payments industry and London Stock Exchange Group within the financial exchanges industry.

Salesforce.com (CRM US) currently holds a "wide moat" rating from Morningstar, based on the firm's unique software lineup that offers customer relationship management tools. Salesforce.com is also the largest pure-play software-as-a-service company in the world by many multiples. Writes Morningstar: "We think the combination of the mission-critical applications Salesforce offers, the ubiquity of its products in the enterprise, and increasingly valuable data generated by these applications yields substantial customer switching costs and a network effect that support one of the widest economic moats in software. Between its sales and service cloud offerings, Salesforce has quickly become the dominant vendor in the customer relationship management vertical."

Microsoft (MSFT US) has also earned Morningstar's "wide moat rating." Morningstar believes that Microsoft's massive enterprise footprint creates a network effect around its productivity apps and operating systems. Morningstar also applauds management's cloud-first, mobile-first vision, which is beginning to take hold. As many office workers can attest based on dominant desktop applications: "Microsoft's effective monopolies revolve around its Windows operating system for both client devices and servers and the Office suite of productivity applications. Despite lengthening PC refresh cycles, declining PC shipments, and an influx of new device form factors, Microsoft has maintained upward of 90% PC operating system market share and consistent revenue contributions from both enterprise and consumer Windows desktop deployments."

Visa (V US) is a great example of how the network effect creates powerful competitive advantages for companies in the electronic payments industry. Visa (V US) dominates the global market, controlling a little more than half of all credit card transactions and an even higher portion of debit card activity.1 Morningstar has given Visa a wide moat rating and writes: "As consumer spending around the world grows and digital methods continue to take share from cash, Visa should continue to flourish for years to come as an effective toll booth on global spending. Visa has been coordinating the interaction of banks, consumers, and merchants for decades. Its effective network consists of 16,800 financial institutions, 44 million merchants, and billions of cards issued to customers around the world. This creates a formidable barrier to entry."

VanEck Vectors Morningstar Wide Moat ETF (MOAT) provides access to US moat-rated companies, by seeking to track the Morningstar® Wide Moat Focus IndexSM . The index measures the overall performance of attractively priced companies with sustainable competitive advantages in their respective markets according to Morningstar's equity research team.

MOAT holdings and learn more about moat investing

Important Disclosures

Published: 09 August 2018