International Property

Australians have a love affair with property. A glance at the AFR Rich List highlights that property has enabled vast fortunes to be made by developers and investors. Many of them have built their empires primarily on development but also on diversifying in real estate beyond Australian shores.

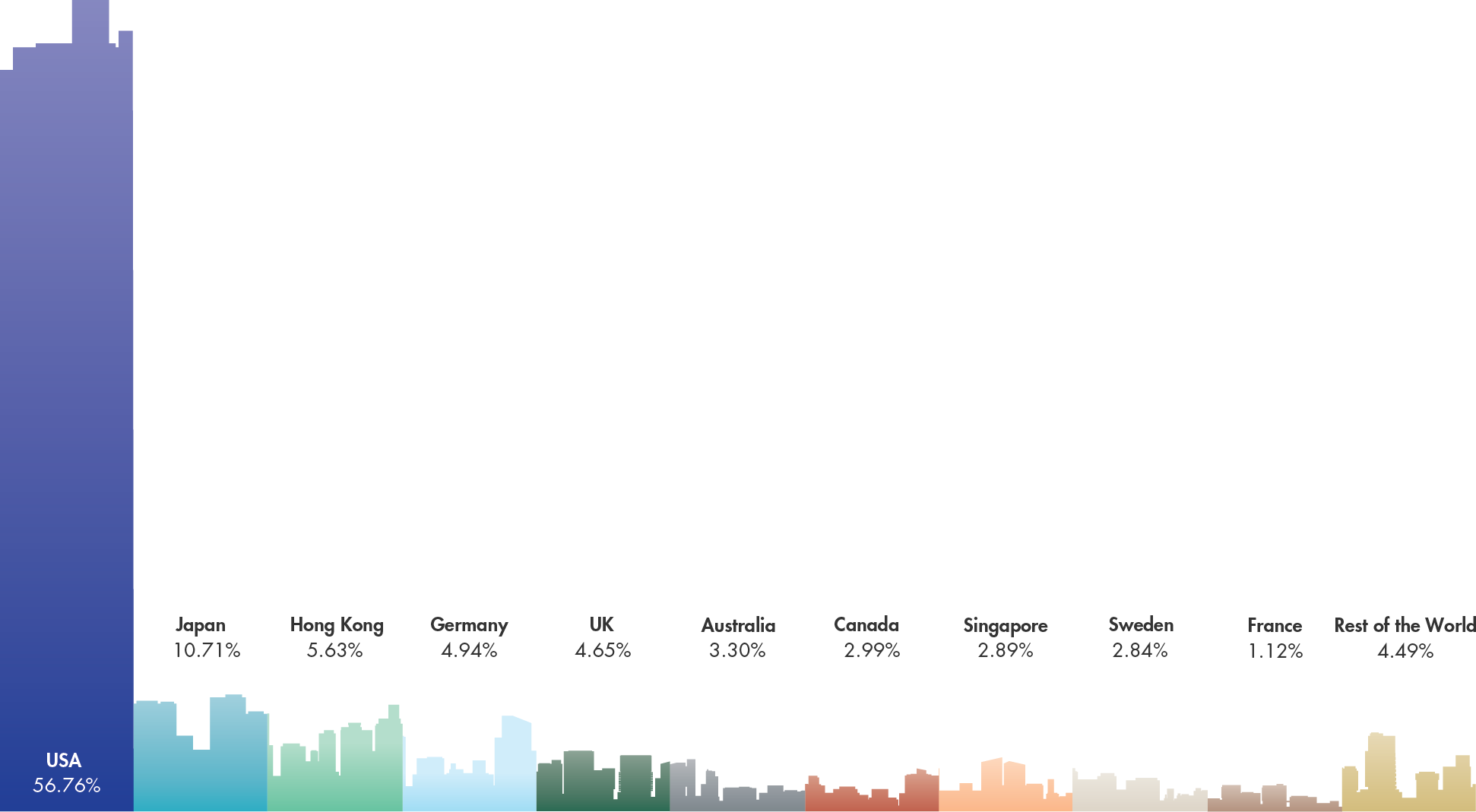

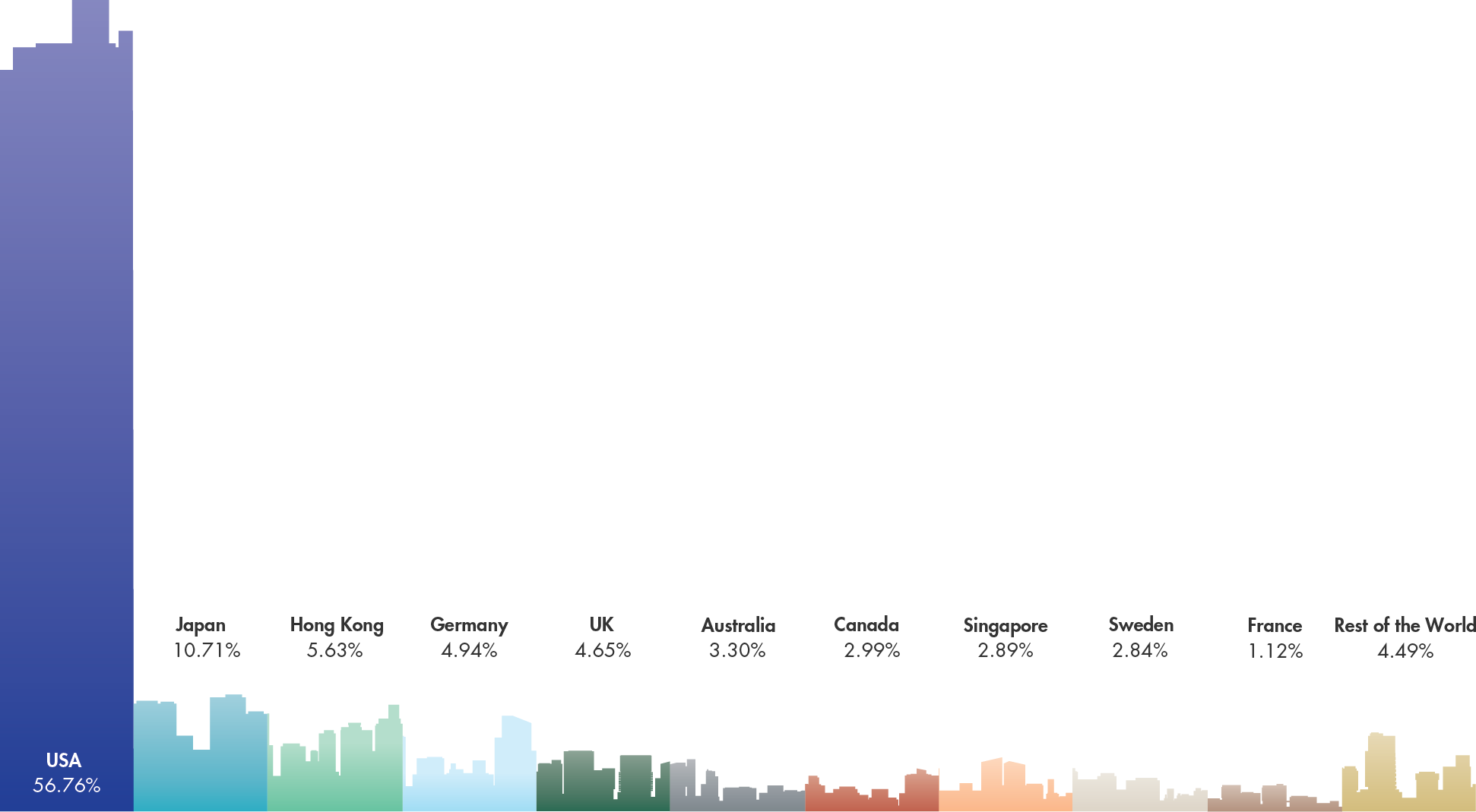

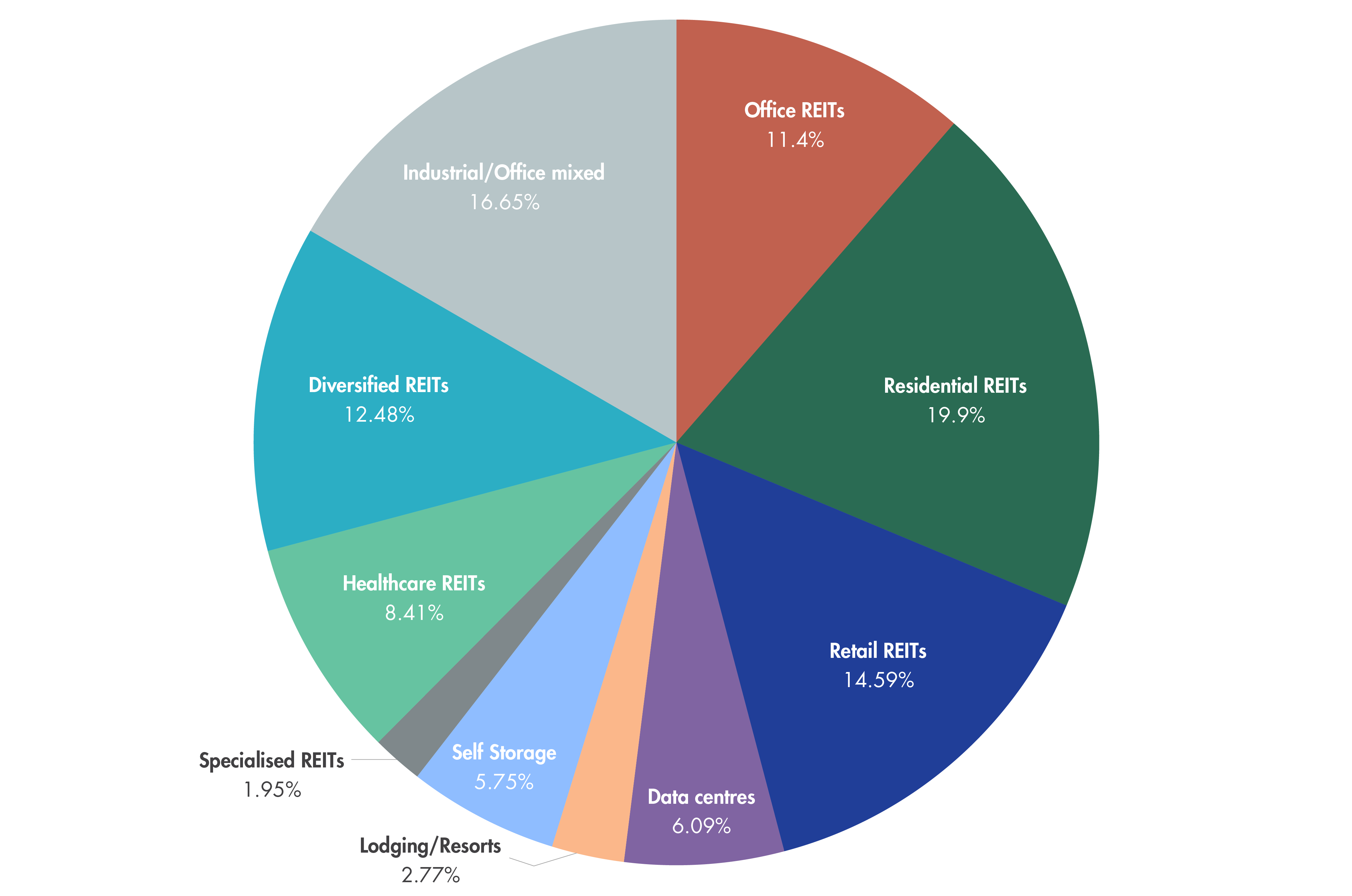

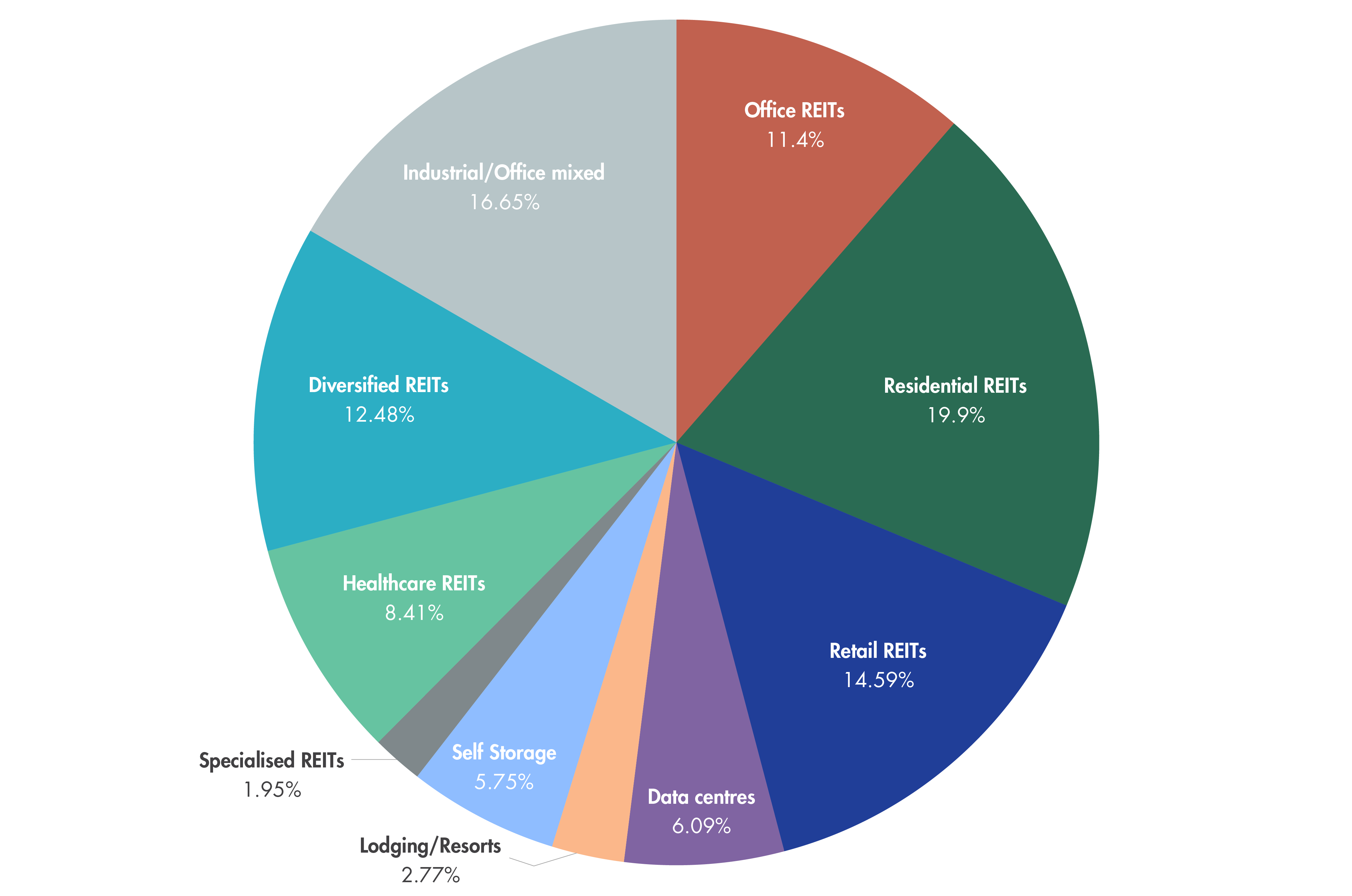

Listed real estate investment trusts (REITs) enable investors to buy into property, without having to invest the huge sums that are involved in buying property directly. REITs primarily hold assets rather than develop them however development does form part of the income. But the opportunities to invest in international REITs in Australia are limited. Australian REITs account for just 3% of the world’s REIT opportunity. The US, Europe and Asia offer investment opportunities not readily available in Australia, including student housing developments and storage including data warehouses.

Source: Bloomberg, FTSE EPRA/NAREIT Developed Index.

Data as of 30 June 2021.

REIT gives investors low cost access to a diversified portfolio of international REITs in a single trade on ASX.

The US, Europe and Asia offer investment opportunities not readily available in Australia, including hotels and resorts, healthcare, self storage and data warehouses.

Source: Bloomberg, FTSE EPRA/NAREIT Developed Rental Index. Data as of 30 June 2021.

The Australian research community has reinforced their conviction in REIT's strategy with favourable ratings including:

■ Lonsec - Recommended Index

■ Zenith - Recommended

Global Infrastructure

There are limited opportunities on the ASX to invest in infrastructure assets. Australian investors should look to diversify globally on assets, geographies and management teams.

The case for global infrastructure:

- Infrastructure assets form the backbone of society - they are the basic and irreplaceable public services essential to an economy such as roads, rail, airports, water, power, schools, hospitals and pipelines.

- Stable income - infrastructure assets are enduring and have steady cash flows often linked to inflation and mandated by government regulation offering reliable income.

- Defensive characteristics - infrastructure assets exhibit low volatility and low correlation compared to traditional asset classes. Infrastructure assets are large and have little or no competition, protected by high barriers to entry. This results in monopolies with inelastic demand ensuring comfortable margins.

- Global trends - trends such as population growth, urbanisation and increasing trade are supportive of infrastructure. More recently long running fiscal deficits are also creating the need for governments to spend on new assets and privatise existing public services.

Do you know why investors choose infrastructure companies

Do you know why investors choose infrastructure companies

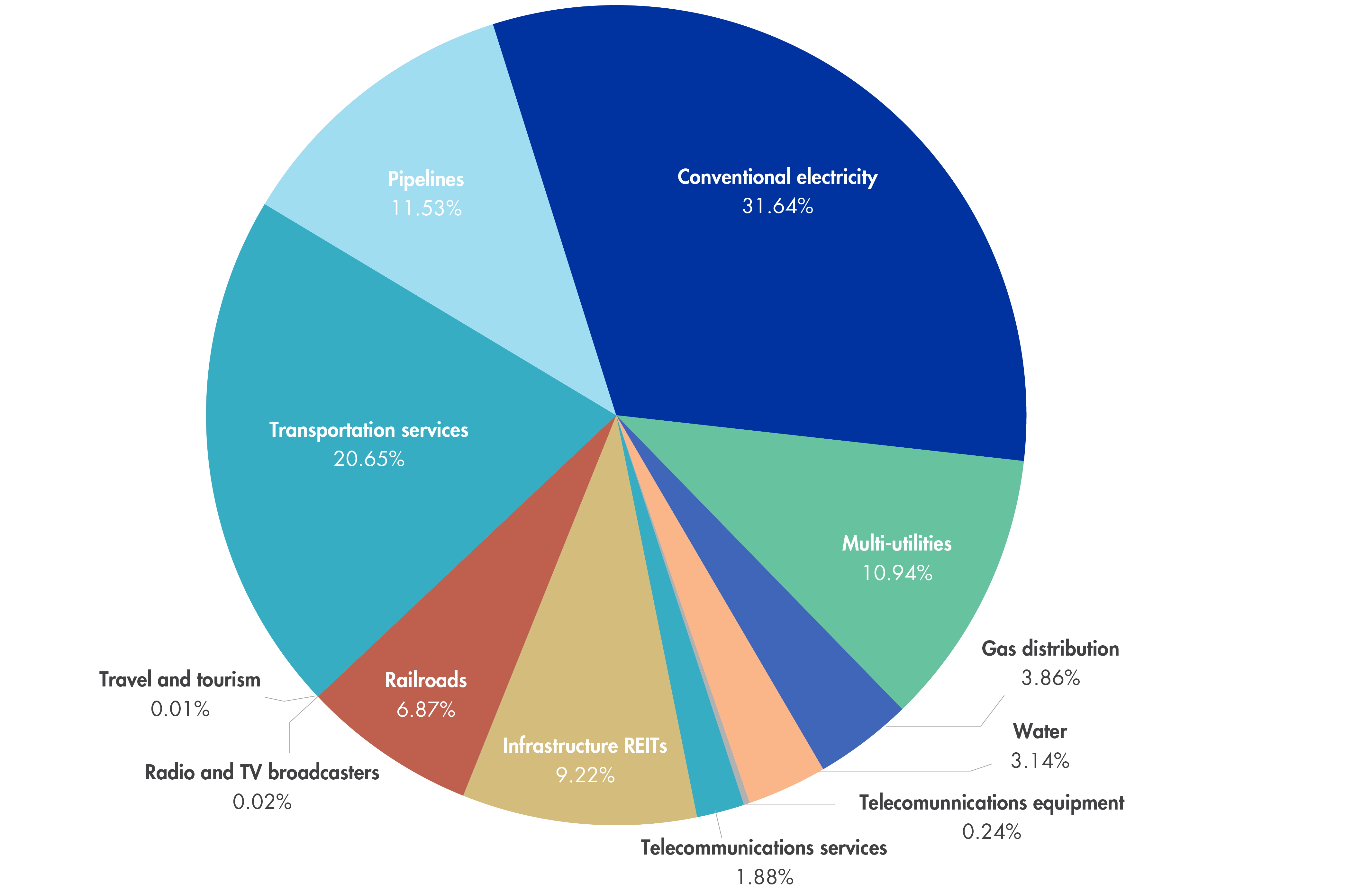

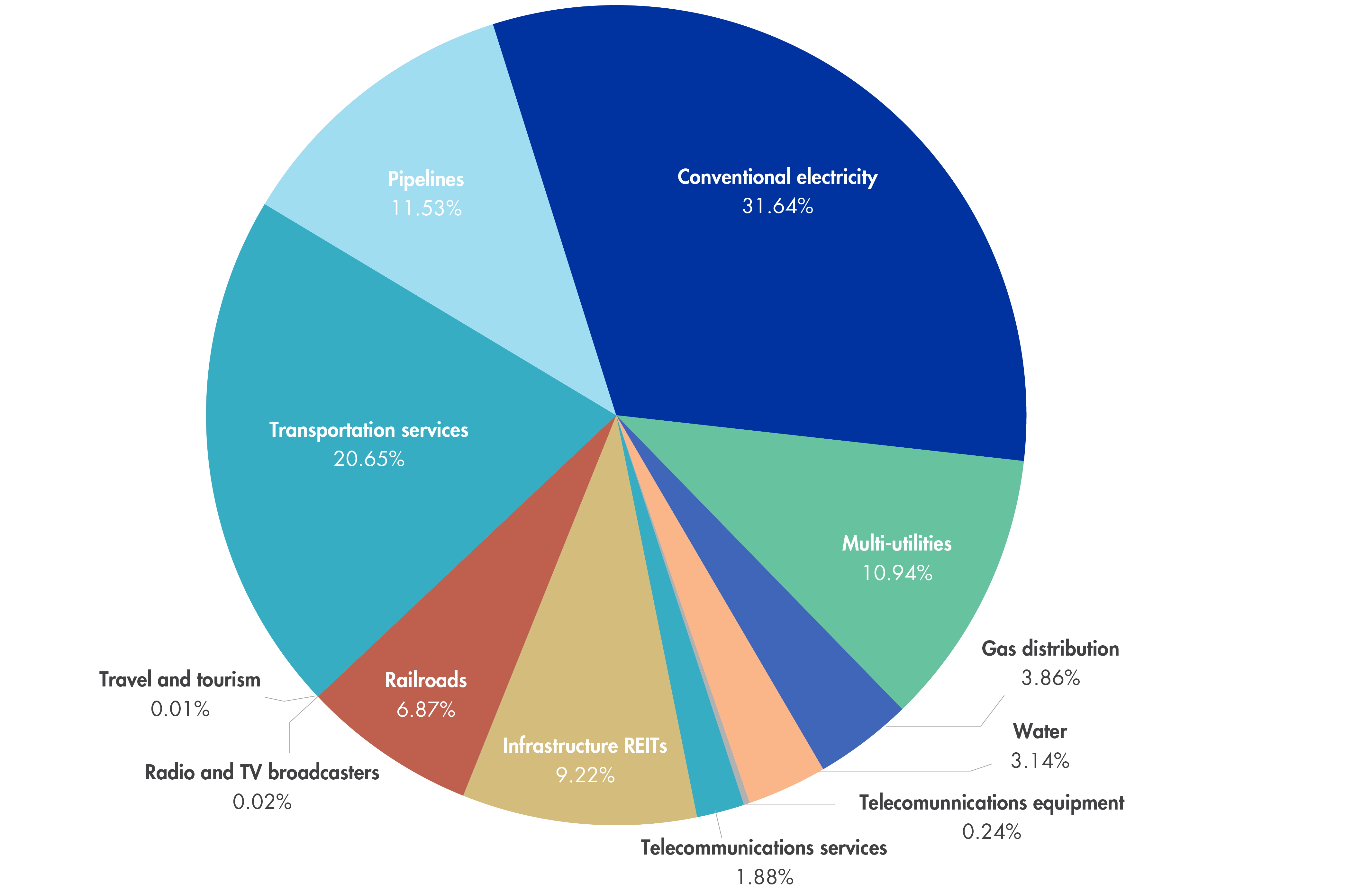

IFRA gives investors low cost access to a diversified portfolio of global infrastructure securities in a single trade on ASX.

Subsector Breakdown

Source: FTSE Developed Core Infrastructure 50/50 Index. Hedged AUD 30 June 2021.

The Australian research community has reinforced their conviction in IFRA's strategy with favourable ratings including:

■ Lonsec - Recommended Index

■ Zenith - Recommended