An unusual link between Scrabble scores and investment strategy

It may seem a tenuous link – but to understand how Scrabble scores can help achieve outperformance, it is first necessary to understand how most passive funds that track market capitalisation indices are constructed.

Market capitalisation

Most indices, such as the S&P/ASX 200 Index, weight their constituents based on their relative market size. This means the biggest companies make up a bigger part of the index. These indices are called market capitalisation indices. In the S&P/ASX 200, for example, companies with the largest market capitalisations, such as Commonwealth Bank (7.82%) and Westpac (6.65%), get larger weights and smaller companies, such as WorleyParsons (0.22%) and Vocus (0.09%) make up a smaller part of the index.

Passive funds which track a market capitalisation index replicate the performance of their index by buying stocks in the same proportion as the index. From a portfolio perspective, this assumes that the biggest companies are the best to invest in and so that is where most of investors’ money goes.

As an index strategy there is mounting evidence that market capitalisation is not the best foundation for a portfolio. Cass Business School (Cass) has previously proven here that over 99% of random indices beat market capitalisation indices over a 40+ year period and that newly emerging smart beta portfolios beat ~90% of the random samples here.

Despite a growing body of reputable academic evidence, market capitalisation based investing dominates passive funds, even in markets such as Australia in which the benchmark market capitalisation index is poorly diversified - in fact among the most highly concentrated in the developed world.

The Scrabble Index

So Cass designed another index weighting methodology to once again illustrate the point. This time they used Scrabble letter scoring. Using the ticker symbol for each stock they calculated a scrabble score. Cass used US stock market data as it has the longest track record, so instead of Apple (AAPL: 5 points) being the largest company, Equinix (EQIX), which scored 20 points was the largest holding.

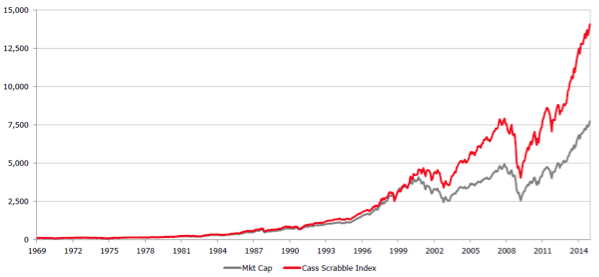

While the concept of a Scrabble Index, from an investment viewpoint seems irrational, the results reinforce Cass’s earlier research. Over the 40+ year period tested, the Scrabble Index outperformed the S&P 500 Index by 1.53% per annum. The risk adjusted returns were also superior.

Cass’s Scrabble Index versus S&P 500 Index

Source: Cass Business School

The conclusion that Cass Research reaches is that beating the market capitalisation index might not be that difficult, yet most actively managed funds persistently underperform it, as illustrated time and time again by S&P’s SPIVA results.

For investors seeking outperformance, there is an alternative: passive investments that track a different weighting methodology, otherwise known as Smart Beta. Cass Business has shown over the long term the eight alternate weighting approaches it considered all outperformed market capitalisation and all eight have a higher Sharpe ratio.

Savvy investors are taking note. Smart Beta usage is on the rise in Australia.

VanEck’s recent third annual Smart Beta Survey found that the majority (68%) of financial professionals are using smart beta strategies to replace actively managed funds, a significant increase over past surveys. This was the first time that over 50% of respondents indicated that they are using smart beta and the satisfaction rates among users were high. Of those currently using smart beta strategies 74% of them are extremely or very satisfied with their smart beta investments, an increase from 68% in 2016.

For the most part, the smart beta offerings in Australia have greater theoretical underpinnings than the Scrabble Index but for your information the largest Scrabble score among Australia’s largest 200 companies is Fairfax Media (FXJ) scoring 20. As at 21 August it has gone up 23% so far this calendar year. That is largely because there is a takeover offer from Nine Entertainment (NEC) which is a measly 5 points. While, to our knowledge, no one has calculated the returns of an Australian Scrabble index, the outcome over the very long term would be both interesting and entertaining.

The complete Cass Research can be found by clicking on the links below, part 2 introduces the Scrabble Index.

Smart Beta Research: Cass Business School

Smart Beta: Part 1: Origins – Cass Business School

Smart Beta: Part 2: What lies beneath – Cass Business School

Smart Beta Part 3: Factors assembled – Cass Business School

Smart Beta: Part 4: Monitoring challenges – Cass Business School

IMPORTANT NOTICE:

This commentary is not intended as a recommendation to buy or sell any of the named securities.

This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck) as the responsible entity and issuer of the VanEck Vectors Australian domiciled exchange traded funds (‘Funds’). Nothing in this content is a solicitation or recommendation to buy or an offer to sell any shares or any investment in any jurisdiction including where the offer or solicitation would be unlawful under the securities laws of such jurisdiction. This is general information only and not financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision in relation to a Fund, you should read the applicable PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. PDSs are available at www.vaneck.com.au or by calling 1300 68 38 37. The Funds are subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from any Fund.

Published: 09 September 2018