The year of quality small caps?

To curb inflation the US Federal Reserve and other central banks delivered large and rapid increases in policy rates and markets repriced, but inflation is still not at target levels, and now market participants are trying to determine the timing of the ‘pivots’.

The problem for equity markets though, is that these pivots, usually in response to economic weakness, are not bullish for equities and historically most of the declines in a US bear market occurred after Fed pivots. This is where being small and nimble has its advantages.Small companies tend to be domestic rather than internationally focused and they also tend to be more sensitive to the macro environment. Savvy investors are reassessing portfolios and preparing for the next cycle, which could lead to low growth and a period of recovery. In the past and during this type of cycle, small caps have offered more upside than large caps, however, being selective is important.

A strong first quarter

If 2023 was the year of the magnificent seven, 2024 has started as the year of quality small caps. The VanEck MSCI International Small Companies Quality ETF (QSML) returned 17.28%, outperforming global equity benchmarks, the small cap, MSCI World ex Australia Small Cap Index as well as the large cap dominated, MSCI World ex Australia Index.

While the past quarter was only 91 days, and we always say past performance should not be relied upon for future performance, it may provide an insight as to how a potential growth/recovery potentially looks over the long term. As the recent US jobs numbers illustrated, for markets, labour supply is tight, and pressure on inflation remains. While a soft or ‘no-landing’ appears to be the likely outcome of the last rate hiking cycle, central banks will eventually have to start easing to stimulate growth.

One of the beneficiaries of any potential, recovery could be quality international small companies.

It pays to be selective in small caps

As you know, with small companies investing, it pays to be prudent. The international benchmark, as is the case in the S&P/ASX Small Ordinaries, includes companies that are not attractive from an investment point of view. The MSCI World ex Australia Small Cap Index includes over 4,000 companies.

Like the local bourse, many international small companies are non-profitable, highly leveraged and have weak balance sheets. Quality is a factor approach that considers balance sheet strength, so investors may benefit from being selective in global small companies by taking a ‘quality’ approach.

In the first quarter of 2024, quality small companies shone, outperforming the MSCI World ex Australia Small Cap Index. Noting this is not indicative of future performance.

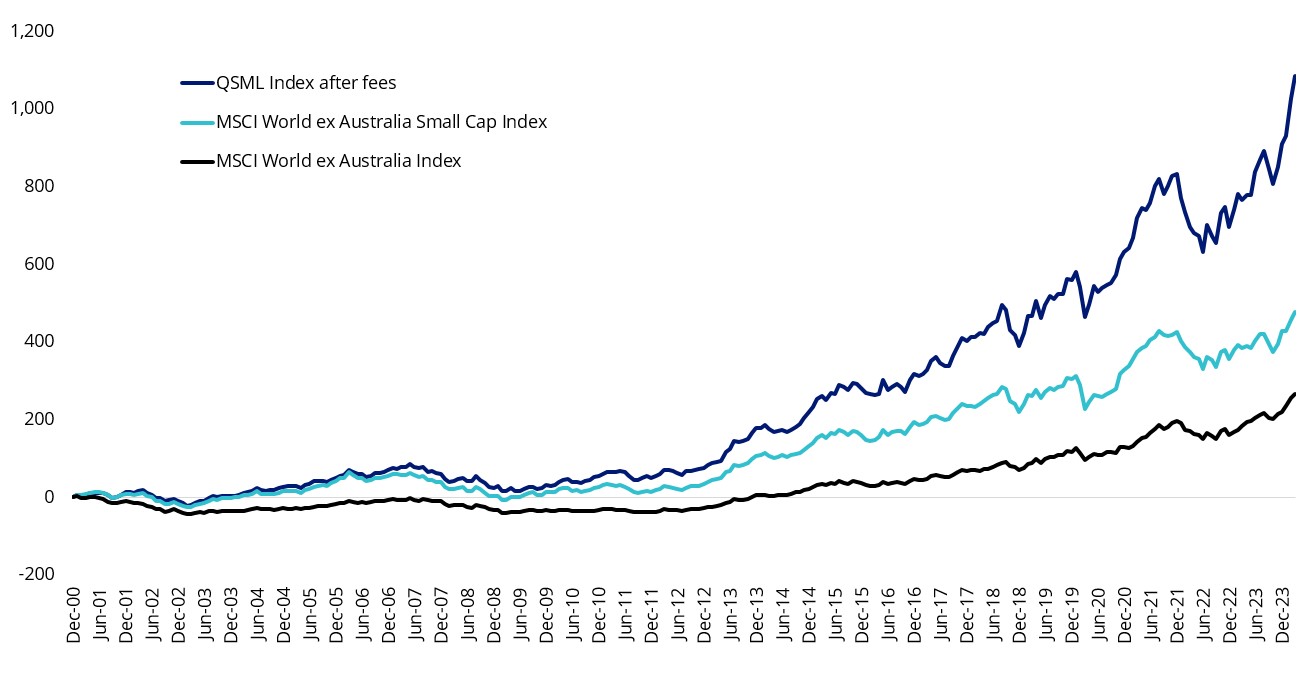

Over the longer term, based on back-testing after fees, QSML’s Index (net of QSML’s 0.59% p.a. management fee) displayed long-term outperformance against the MSCI World ex Australia Small Cap Index, both of which outperformed the large capitalisation equivalent, as highlighted by the chart below.

Chart 1: Cumulative performance: QSML Index after fees1 vs MSCI market capitalisation indices

Table 1: Trailing returns: QSML, QSML Index after fees1 vs MSCI World ex Australia Small Cap Index

Chart 1 and Table 1 Source: VanEck, Morningstar, Bloomberg as at 31 March 2024. Past performance is not a reliable indicator of future performance.

1QSML Index results are net of QSML’s 0.59% p.a. management fees, calculated daily but does not include brokerage costs or buy/sell spreads of investing in QSML. You cannot invest in an index. QSML’s Index base date is 30 November 1998. QSML Index performance prior to its launch in February 2021 is simulated based on the current index methodology.

2 QSML inception date is 8 March 2021 and a copy of the factsheet is here.

3 The MSCI World ex Australia Small Cap Index (Parent Index) is shown for comparison purposes as it is the widely recognised benchmark used to measure the performance of developed market small companies, weighted by market cap. QSML Index measures the performance of 150 companies selected from the Parent Index based on MSCI quality scores. Consequently the QSML Index has fewer companies and different country and industry allocations than the Parent Index. ‘Click here for more details’.

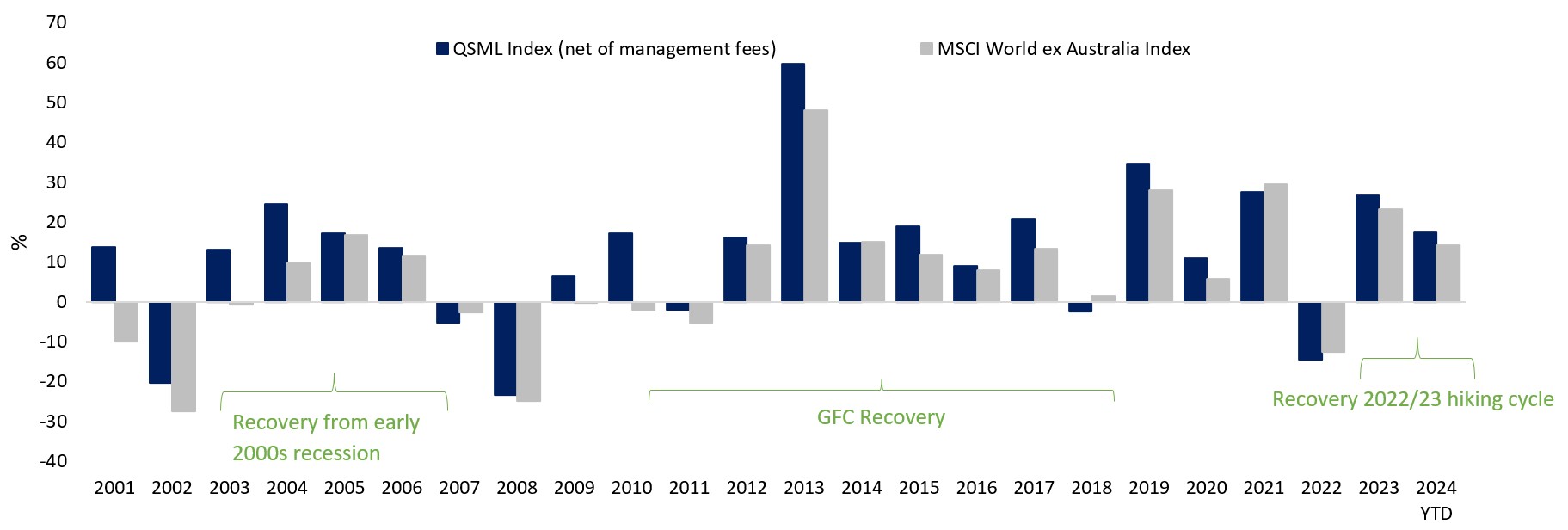

Historically, international quality small-cap companies outperformed larger companies during previous recoveries, namely following: 1) the global slowdown in the early part of the century following the dotcom bubble; and 2) for many of the low-growth years following the GFC. Since the market falls of 2022, QSML’s Index has outperformed.

Chart 2: Calendar year performance: MSCI World ex Australia Small Cap Quality 150 Index and MSCI World ex Australia Index

Source: VanEck, Morningstar Direct, as at 31 March 2023. You cannot invest directly in an index. Past performance of the index is not a reliable indicator of the future performance of QSML. The MSCI World ex Australia Index is shown for comparison purposes as it is the widely recognised international equity benchmark used to measure the performance of developed market large- and mid-cap companies, weighted by market cap. It is used here to represent larger companies. QSML Index measures the performance of 150 companies selected from the MSCI World ex Australia Small Cap Index based on MSCI quality scores. Consequently, the QSML Index includes smaller-sized companies, has fewer companies and has different country and industry allocations than the MSCI World ex Australia.

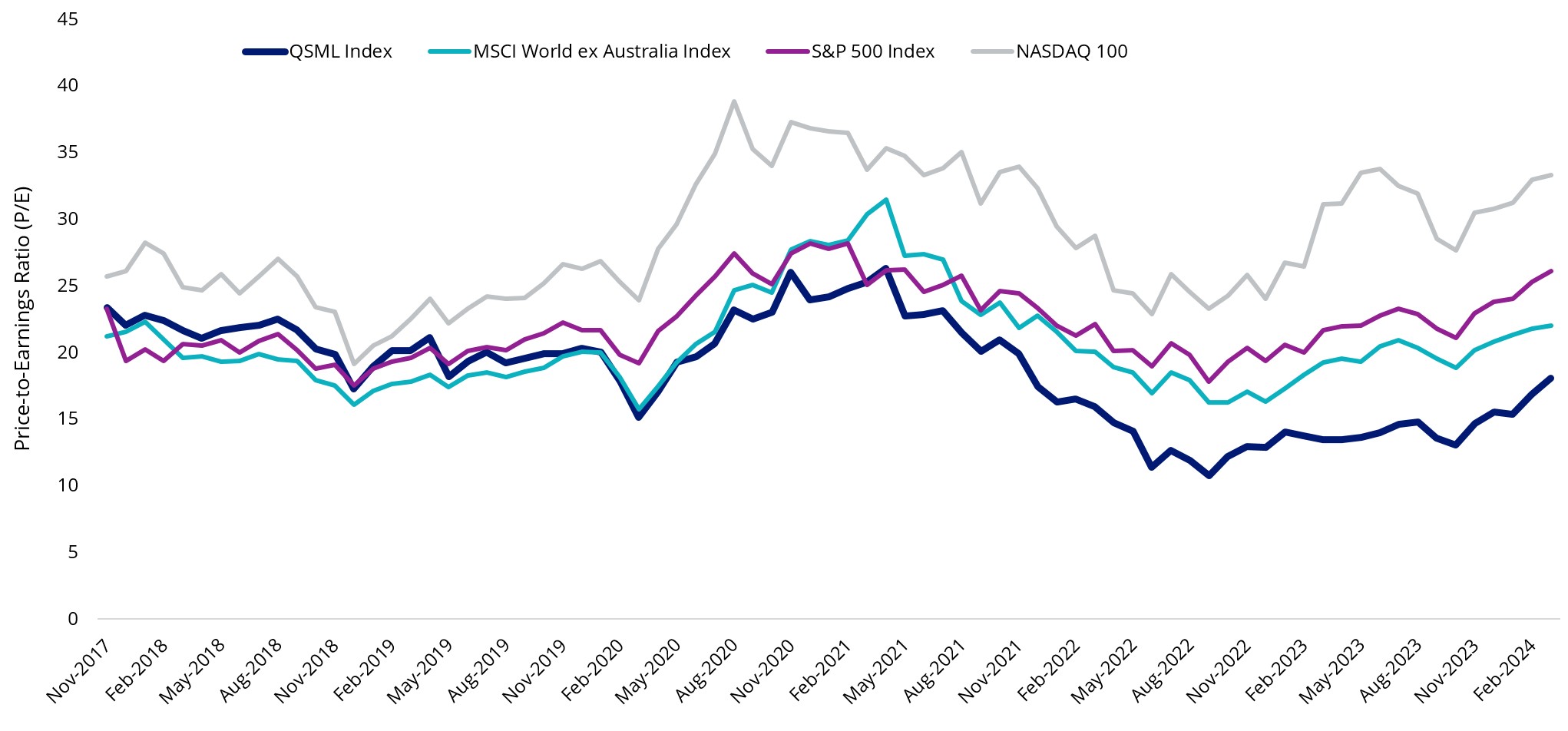

Despite its recent rally, QSML Index is still relatively cheap compared to large caps.

Chart 3: Price to equity (P/E) of QSML Index, MSCI World ex Australia Index and NASDAQ-100

Source: MSCI, FactSet

QSML may be used by investors looking to take advantage of a recovery in a slow growth environment/post-slow-down environment.

It is important to remember too that global small companies are not ‘small’ by Australian standards. Local investors might be surprised to learn that global small-caps, in the context of market size, would be characterised as mid-caps in Australia when measured by market capitalisation. This was a key finding in research we published last year, Global small-caps: An overlooked opportunity, which shows global small-caps, which are typically underrepresented in Australian investment portfolios, have outperformed international large- and mid-caps as well as Australian small-caps over the long term.

Click here to download a copy of Global small-caps: An overlooked opportunity.

Key risks: An investment in the ETF carries risks associated with ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.

Published: 04 April 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

QSML is indexed to an MSCI index. QSML is not sponsored, endorsed or promoted by MSCI, and MSCI bears no liability with respect to QSML, or the MSCI World ex Australia Small Cap Quality 150 Index. The QSML PDS contains a more detailed description of the limited relationship MSCI has with VanEck and QSML.