New Research – Australian equities in a recovery

Given the effect of the coronavirus on markets, we thought it would be worthwhile to determine if outperformance is evident in periods after a market decline.

An analysis of equal weight performance in Australia after market declines

We previously used mathematics to prove why an equally weighted portfolio in Australia has outperformed the benchmark market capitalisation index here and here.

Given the effect of the coronavirus on markets, we thought it would be worthwhile to determine if outperformance is evident in periods after a market decline.

The results: Equal weighting has outperformed during recoveries and mathematics again proves why this is the case.

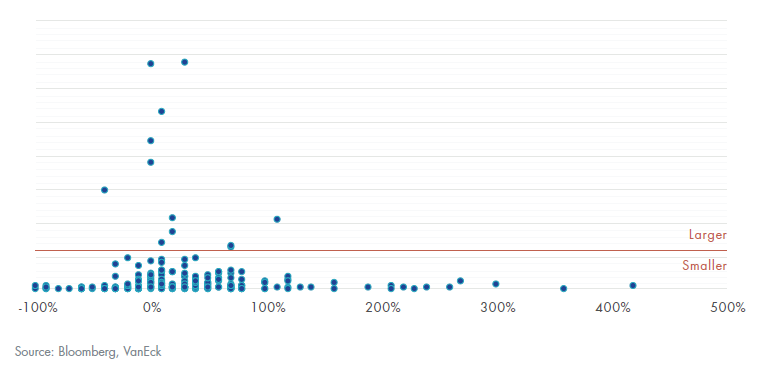

You may recall our previous paper which introduced you to a Mathematical term that you could impress your friends with: ‘ergodicity’. Ergodicity was used to explain the problem with market capitalisation portfolios, that is, they have too much exposure to larger stocks and not enough exposure to smaller stocks. This chart was used to demonstrate the idea:

Returns for the 200 largest Australian stocks versus their market capitalisation

Three years to May 2018

By chance that analysis captured a stock market recovery following a period of market weakness, the Greek debt crisis, which had markets on tenterhooks. It was also a period that corresponded with equal weight outperformance.

Our number-crunchers went back and analysed other past periods of recovery following market weakness.

The results, presented in our new research – here, might not be as big a surprise as last time but they show that for Australian equities, there is a simple reason an Australian equal weight portfolio outperforms the market capitalisation benchmark.

Published: 19 June 2020