Vaccine resets Australian equity market direction

We are seeing a number of different themes develop:

- Many of the worst performers in terms of sectors and individual stocks have risen the most

- Large caps are now outperforming midcaps

- Value stocks which have had a long run of underperforming growth stocks have now come into their own

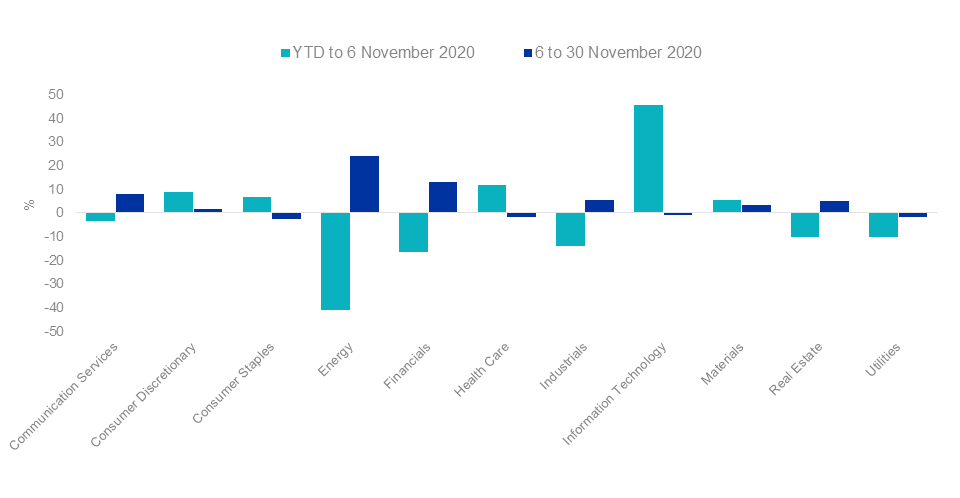

The graph below shows how energy and financials, which were the worst performing sectors this year, have fared the best since the announcement of the vaccine.

Figure 1. Australian Equity Sector performance comparison: Before and after vaccine announcement

Source: Factset, as at 30 November 2020. Past performance is not a reliable indicator of future performance.

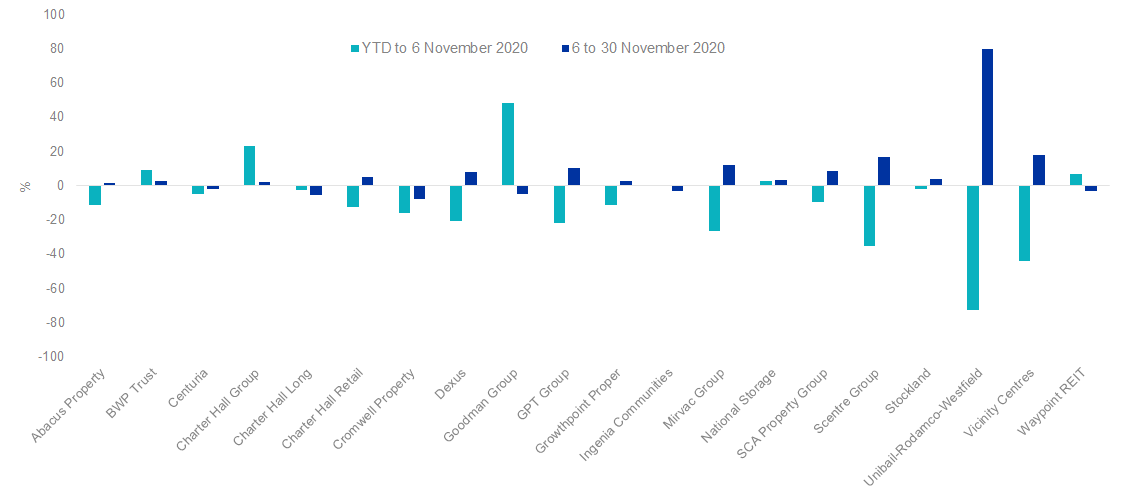

There has been a wide divergence of performance within the A-REITs sector. Retail REITs literally jumped on the day the vaccine was announced, with the likes of Vicinity Centres and Scentre Group up by 17.86% and 16.67% respectively since 6 November 2020. Industrial stocks like Goodman Group, which were up around 48.51% prior to 6 November 2020 on the back of increased demand for warehouses by online retail companies, fell by 4.98% as at 30 November, following news of the vaccine.

Figure 2. A-REITs performance comparison: Before and after vaccine announcement

Source: Factset, as at 30 November 2020. Past performance is not a reliable indicator of future performance.

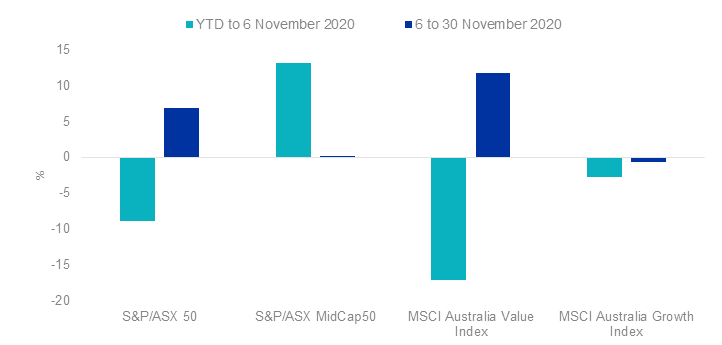

With large and mid-caps there has also been a turnaround in fortunes with the S&P/ASX 50 outperforming the S&P/ASX Midcap 50 by almost 7% over the three weeks from 6 November to 30 November. The outperformance of value stocks has been more extreme with value stocks beating growth stocks by 12% over the same period.

Figure 3. Large versus mid-caps comparison, and value vs growth comparison: Before and after vaccine announcement

Source: Factset, as at 30 November 2020.

Diversifying your investment portfolio has always had strong benefits, but over the last year it has been essential, choosing the wrong stocks could result in a very poor outcome.

Published: 04 December 2020

Issued by VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’). This is general advice only, not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Read the PDS and speak with a financial adviser to determine if a fund is appropriate for your circumstances. PDSs are available at www.vaneck.com.au. No member of the VanEck group of companies guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from any fund