Are you a speculator or an investor?

The current landscape could be considered a speculator's delight as they anticipate and try to profit from the waves of market highs and lows, but with volatility comes risk and big wins that are often surpassed by spectacular losses. Never has it been more important to invest in quality companies.

Benjamin Graham, otherwise known as the father of value investing, believed a successful investor, as opposed to a speculator, is rarely ever forced to sell their shares and is more interested in acquiring and holding securities for a long time and disregarding market volatility.

Today, with easy access to vast amounts of information it is hard for any investor to disregard the noise and their portfolio, particularly during periods of market uncertainty.

But behind Graham's rationale there is good reason. Graham believed an investor should be able to demand from a company a sufficiently strong financial position, satisfactory ratio of earnings to price and the prospect that its earnings will at least be maintained over the years. By investing in a stock with these quality characteristics, Graham believed an investor can take a much more independent and detached view of stock market fluctuations than a speculator who thrives off market fluctuations.

Graham went a step further and classified stocks as either quality or low quality. He observed that the greatest losses result not from buying quality at an excessively high price, but from buying low quality at a price that seems good value. A speculator thrives off buying a low quality stock that has the chance of skyrocketing to record high levels over the short term. It could also fail to provide good returns.

Graham's view of investing gained great credence after major market downturns. Major corporate collapses focused investors awareness on the quality of a company's balance sheet, earnings quality and its corporate governance.

MSCI, one of the world's largest index providers, adopted Graham's approach by capturing quality as a factor and created its MSCI Quality Index series. MSCI identified quality growth companies as those with high return of earnings (ROE), stable earnings that are uncorrelated to the broad business cycle and strong balance sheets with low financial leverage, similar to the characteristics Graham demanded from a company.

Innovation in passive investing has enabled investors to access MSCI's Quality Index using an exchange traded fund (ETF). VanEck Vectors MSCI World ex Australia Quality ETF (ASX code: QUAL) invests in a diversified portfolio of quality international companies including Apple, Microsoft, Google, Cisco and Oracle. The ETF seeks to track the performance of the MSCI World ex Australia Quality Index which tracks companies with high quality scores based on three fundamental factors: high return on equity; stable year-on-year earnings growth; and low financial leverage.

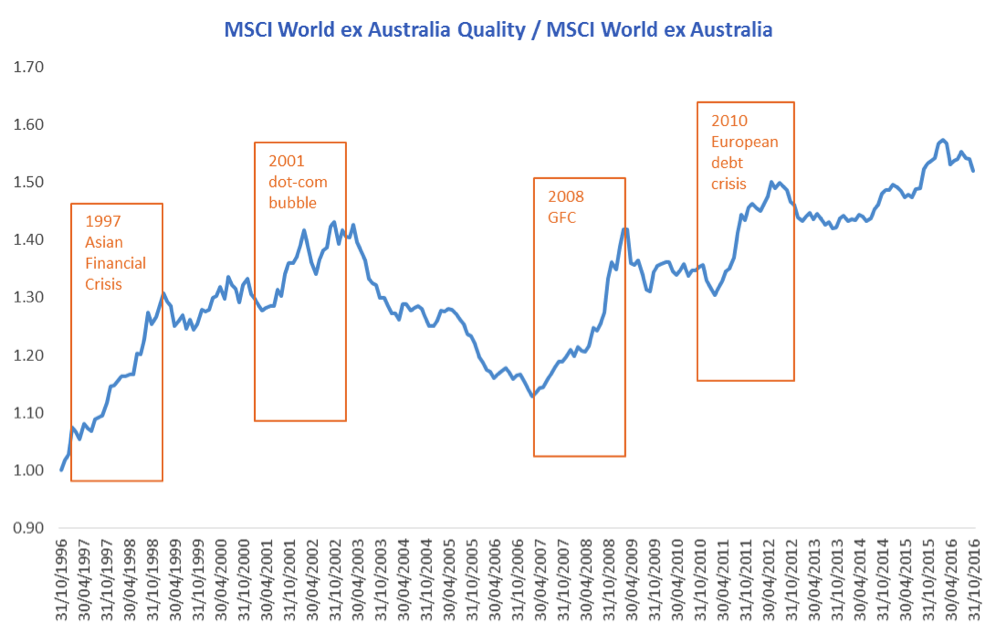

MSCI's Quality approach has demonstrated significant outperformance during market downturns and has outperformed over the long-term with less volatility. The following chart shows the outperformance of the QUAL Index relative to the standard market capitalisation MSCI World ex Australia Index during significant market downturns.

As market volatility becomes a more common feature of the financial landscape, investing in quality companies is becoming paramount. Whether another global recession is on the horizon is uncertain but investing in quality companies has proven to be a successful path for many investor. Graham's approach has demonstrated its benefit throughout many market cycles, but the question remains are you a speculator or an investor?

IMPORTANT NOTICE: This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 ('VanEck') as responsible entity and issuer of the VanEck Vectors MSCI World ex Australia Quality ETF (QUAL) ('Fund'). This is general information only and not financial advice. It does not take into account any person's individual objectives, financial situation or needs. Before making an investment decision in relation to the Fund, you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.vaneck.com.au or by calling 1300 68 38 37. The Fund is subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from the Fund.QUAL invests in international markets. An investment in QUAL has specific and heightened risks that are in addition to the typical risks associated with investing in the Australian market. These include currency risks from foreign exchange fluctuations, ASX trading time differences and changes in foreign laws and regulations including taxation.QUAL is indexed to a MSCI index. QUAL is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to QUAL or the MSCI Index. The PDS contains a more detailed description of the limited relationship MSCI has with VanEck and QUAL.Related Insights

Published: 09 August 2018