Reflect and Move Forward

2018 proved to be a stellar year for the Morningstar® Wide Moat Focus IndexTM, as Morningstar’s research process helped position the strategy away from what turned out to be trouble spots in Q4. The index’s December review resulted in new positioning for 2019.

For the Month Ending 31 December, 2018

2018 was a stellar year for MOAT, despite a drawback in December.

In December, the Morningstar® Wide Moat Focus IndexTM (MOAT Index) fell 5.83% versus the loss of 5.71% experienced by the broad US equity market benchmark, the S&P 500 Index. For the year the MOAT index returned 10.28%, outperforming the S&P 500 by 4.36%.

Strong performance for the year was driven in large part by the Index’s overweight to healthcare stocks, such as Eli Lilly and Co (LLY), Merck & Co., Inc. (MRK), and Express Scripts Holding Co. (ESRX). The communication services sector also saw success in 2018, driven largely by Twenty-First Century Fox Inc. (FOXA), which was also among the index’s top performers.

Not all positions benefited the U.S. Moat Index in 2018. L Brands, Inc. (LB) and General Electric (GE) were the most high profile performance detractors for the year as both saw their Economic Moat Ratings downgraded from wide to narrow by Morningstar’s equity analysts.

New year, new positioning

The Moat Index is reviewed quarterly to ensure the Index is allocated to companies that Morningstar believes possess a sustainable competitive advantage and, just as importantly, are among the most attractively priced of those companies. Following the market sell-off in the fourth quarter, the Moat Index’s December review resulted in its most dramatic sector allocation shifts of the year.

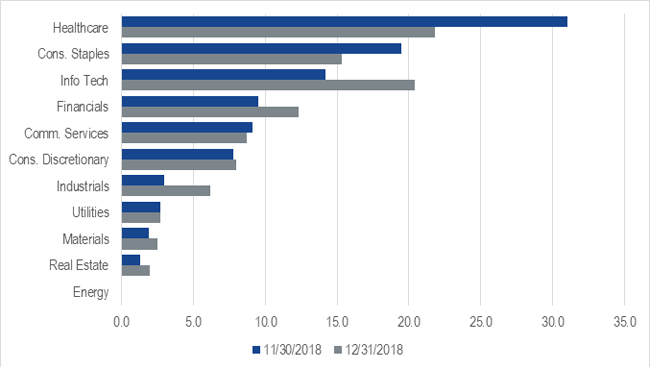

Moat Index December re-positioning

Source: Morningstar. Index positioning not representative of fund positioning.

The Index pared its exposure to healthcare and consumer staples companies while adding to its information technology, financials, and industrials exposure.

Healthcare was the top sector contributor to returns of the Moat Index for the year and saw its weighting adjusted in December accordingly as several companies no longer represented a valuation opportunity. Interestingly, communications services and consumer discretionary companies were the second and third best contributors, respectively, in 2018 but both maintained similar exposure in the Index.

The most notable shift in the portfolio was the increase in information technology exposure. The Moat Index weighting of roughly 20% to information technology is now back to market weight relative to the S&P 500. Information technology was a significant underweight for most of 2018, a position which benefited the portfolio on a relative basis.

Clearly, valuation opportunities among wide moat companies changed as the year came to an end. The strategy locked in gains in several positions, exited some laggards, and allocated to several new companies with potential upside in the eyes of Morningstar equity analysts.

Source: VanEck, Morningstar. Stock returns in US dollars all other returns in Australian dollars. Index returns are calculated to the last business day of the month and assume immediate reinvestment of all dividends and exclude costs associated with investing in MOAT. You cannot invest directly in an index. Past performance is not a reliable indicator of future performance of the indices or MOAT.

Published: 23 January 2019