Australian miners three-peat

China’s V-shaped economic recovery, global mining operation suspensions resulting from COVID-19 and gold price surge has benefited Australian resources sector.

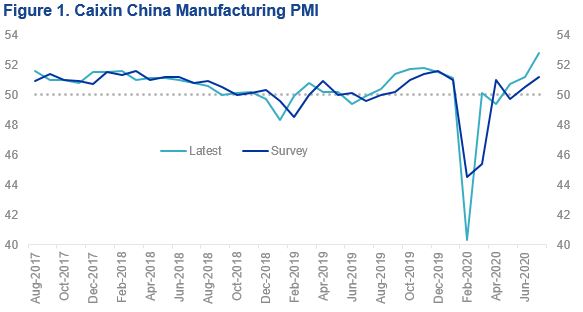

China Demand

Australia’s largest trading partner, China’s V-shaped recovery is in full swing. China reported better than expected production activity for July 2020 as represented by Caixin China Manufacturing PMI index at 52.8 with iron ore imports increasing by 24% YoY, the highest monthly volume since September 2017.

Source: Markit

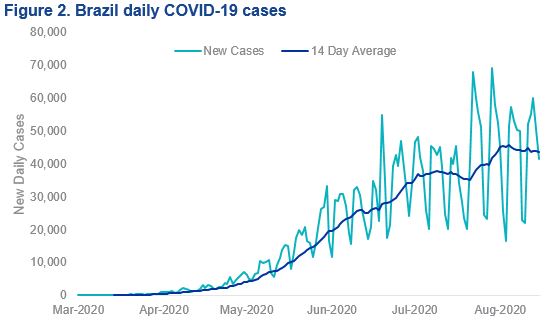

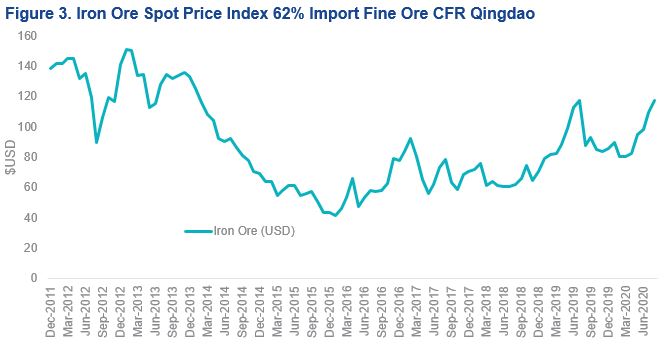

Iron Ore Supply Concerns

The world’s second largest iron ore producer, Brazil, continues to be plagued by supply concerns resulting from the coronavirus outbreak. Vale SA Brazil’s largest iron ore producer suspended mining operations with 188 workers infected. The South American nation has the second highest number of COVID-19 infections in the world with 14 day daily average number of new cases above 40,000.

Source: European Centre for Disease Prevention and Control (ECDC)

Increased iron ore demand from China coupled with Brazil’s supply concerns has driven the price above $110, a level not seen since August 2019.

Source: Bloomberg

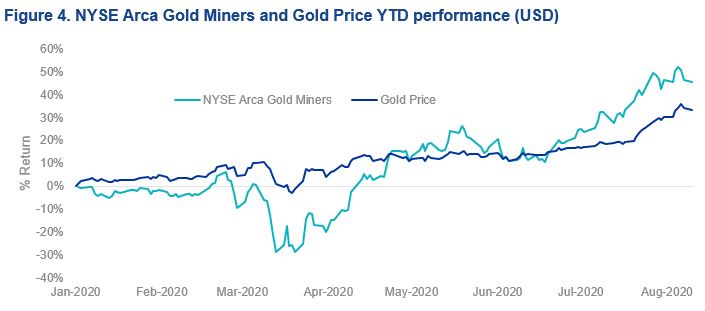

Gold Surge

Gold price has also surged above US$1900 amid negative real interest rates in the US and concerns about the huge size of the US Federal Reserve’s stimulus program, benefiting Australian gold miners.

Source: Bloomberg

One way to access the resources sector is via an ETF. However most ETFs are dominated by one or two big diversified miners, which is why ‘capping’ may provide a better diversified exposure to the sector. The MVIS Australia Resources Index caps stocks at 8%.

VanEck Vectors Australian Resources ETF (MVR) tracks the MVIS Australia Resources Index and is a simple way to gain a diversified exposure to the Australian resources sector.

Related Insights

Published: 24 August 2020

IMPORTANT NOTICE:

This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as responsible entity and issuer of the VanEck Vectors Australian Resources ETF and other VanEck exchanges traded funds on ASX. This information contains general advice only about financial products and is not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision, you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. PDSs are available at www.vaneck.com.au or by calling 1300 68 38 37. The funds are subject to investment risk, including possible loss of capital invested.

The PDS details the key risks. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from any fund.

MVIS Australia Resources Index (‘MVIS Index’) is the exclusive property of MV Index Solutions GmbH based in Frankfurt, Germany (‘MVIS’). MVIS is a related entity of VanEck. MVIS makes no representation regarding the advisability of investing in the Fund. MVIS has contracted with Solactive AG to maintain and calculate the MVIS Index. Solactive uses its best efforts to ensure that the MVIS Index is calculated correctly. Irrespective of its obligations towards MVIS, Solactive has no obligation to point out errors in the MVIS Index to third parties.