A powerful takeover or a political move?

The business world this week was awash with news that NVIDIA is acquiring Arm Holdings (‘Arm’) for US$40 billion from Japan’s Softbank. This is extremely important news for the billions of people who use a smart phone. NVIDIA’s CEO described Arm as “… a company with reach that’s just unlike any company in the history of technology” and said, “We’re uniting NVIDIA’s leading AI computing with Arm’s vast ecosystem.”

Let’s have a look at the players in this acquisition:

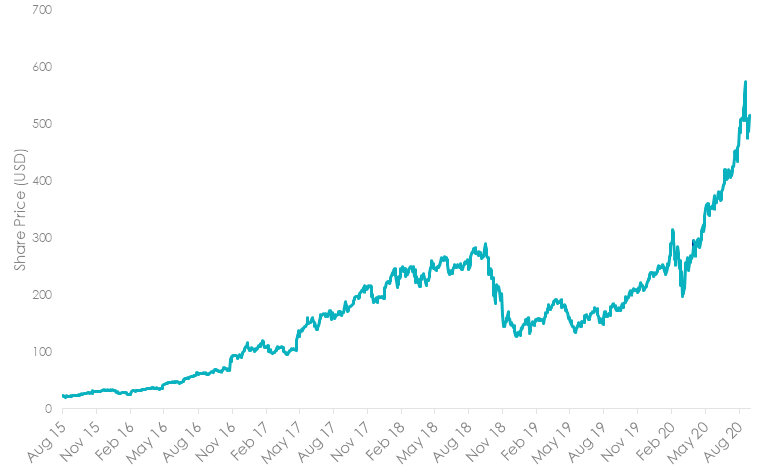

NVIDIA – designs, develops and markets graphic processors and related software. This California based company produces the graphics cards used to generate computer game images in many PC’s and game consoles. The cards also work well in applications for autonomous vehicles, drones and deep learning. NVIDIA outsources manufacturing to Taiwan Semiconductor Manufacturing and Samsung Electronics. Over the past five years, the company’s sales have increased 118% and profit is up 355%.

NVIDIA - Share Price

Source: Bloomberg, 15 September 2020. Past performance is not a reliable indicator of future performance.

Arm – a UK based company that creates semi-conductor circuit designs and owns the intellectual property rights. Its primary earnings come from licensing these IP cores to create microcontrollers, CPU’s and systems on chips. Without getting too technical, its technology is at the heart of more than one billion smart phones sold annually. Chips that use its code and its layouts are in everything from factory equipment to home electronics. It is currently owned by Softbank.

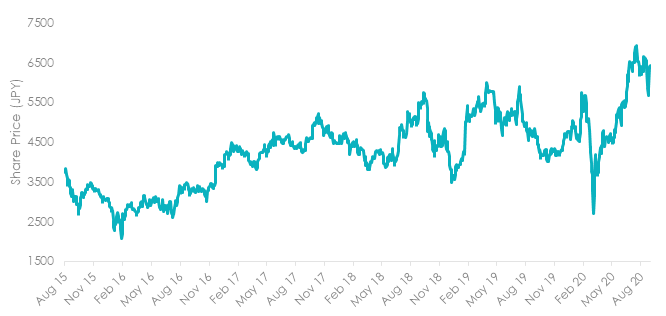

Softbank – a Japanese conglomerate that has a portfolio of holdings from mobile and fixed-line telecommunications to e-commerce, digital content and technology services. Companies include US mobile carrier Sprint Communications, mobile phone distributor Brightstar, British chip designer Arm, and Yahoo Japan, as well as smaller start-up businesses. Just under half of SoftBank's revenue originates from mobile phone services, and Japan accounts for about half of total revenue.

Softbank - Share Price

Source: Bloomberg, 15 September 2020. Past performance is not a reliable indicator of future performance.

This acquisition of Arm can be viewed in two main ways:

- NVIDIA and Arm combined will fuel the drive to bring artificial intelligence to everything that has an “on” switch. It will help spread the technology to everything from a self-driving car to a smart meter; and

- NVIDIA are a US company and are buying a strategically important asset run by the British from the Japanese so that China cannot gain control of the market.

There is no doubt that these two companies’ combined will benefit the broader community in the future, and assuming that the regulatory hurdles are jumped so these two companies do combine, we can expect increased technology innovation and increased profit.

NVIDIA is currently in the VanEck Vectors MSCI World ex Australia Quality ETF (ASX code: QUAL) and the VanEck Vectors Video Gaming and eSports ETF (ASX code: ESPO).

Published: 16 September 2020

An investment in ESPO & QUAL carries risks associated with: financial markets generally, individual company management, industry sectors, ASX trading time differences, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the PDS for details.