Don’t just do something – sit there

A senior manager at a passive fund management firm noticed a younger colleague doing something he shouldn't have. The senior manager yelled at the junior colleague, "Don't just do something—sit there."...

A senior manager at a passive fund management firm noticed a younger colleague doing something he shouldn't have. The senior manager yelled at the junior colleague, "Don't just do something—sit there!"

This is a joke active fund managers tell about passive fund managers. It isn’t all that funny, but it betrays a common misconception about passive management.

Rather than sitting around idly, passive managers are responsible for much of the innovation within the financial services industry. This innovation provides investors with new choices and opportunities. Investors now have cost effective access to "passive" tools that can outperform the markets, which is something investors have traditionally paid more expensive active managers to do.

The world of passive investing comprises far more than just sitting there.

As you know, an active manager’s job is to beat a fund’s benchmark index. If the index returns 10%, active managers aim to return more than 10%. If the index falls 10%, active managers aim not to fall as low as 10%. Most active managers use a market capitalisation index as the benchmark they attempt to beat. Active managers call their outperformance "alpha." They refer to the performance of the index or the market as "beta."

Beta is also used as a term to measure correlation, i.e., correlation to the market benchmark. The benchmark of international equities, for example, is the MSCI World ex Australia Index and the index has a beta of 1. A fund manager with a beta less than 1 would experience smaller price movements than the MSCI World ex Australia Index. Conversely, a beta higher than 1 would entail bigger price movements than the MSCI World ex Australia Index.

The very first exchange traded funds (ETFs) tracked traditional market capitalisation benchmark indices and were seen as tools for beta exposure. Their portfolios had betas of 1. Investors soon started to question whether these benchmarks made for good investment portfolios. One of the early challenges was related to the use of market capitalisation weights. An ETF that tracks a market capitalisation index allocates more to bigger companies than to smaller companies. When the market overvalues a stock, a fund tracking that index buys too much of the overpriced stock. Conversely, when the market undervalues a stock, the fund sells too much of the underpriced stock. For investors seeking maximum returns, this is not ideal.

Index providers reacted by creating indices that targeted better returns than the traditional benchmark, for example, by capping the weighting for larger companies or even equal weighting the portfolio. These innovative index construction techniques became known as "smart beta." As with most jargon, the definition of smart beta has been hijacked. There is no industry consensus on what smart beta actually means. Some define smart beta as any type of index that is not market capitalisation-weighted. Others define it as investments that apply screening techniques or use company data to narrow the portfolio or adjust weightings in existing indices.

Either way "smart beta" can be thought of as the intersection of active management and passive investing. It has the intention to outperform the market using data techniques in place of active managers’ judgement to select and weight stocks.

Australian institutional investors have been employing smart beta strategies to achieve outperformance, or alpha, relative to market capitalisation benchmark indices for some time. Smart beta strategies have taken off globally with over $US65bn of inflows during 2013 allocated to smart beta ETFs (source: BlackRock).

MSCI, the world’s largest index provider, has been at the forefront of this innovation. MSCI has created a smart beta index that is the basis for the first smart beta international equity ETF on the ASX: the Market Vectors MSCI World ex Australia Quality ETF (ASX code: QUAL).

MSCI analyses the data for the stocks in its MSCI World ex Australia Index and identifies those companies with the strongest investment fundamentals for inclusion in its Market Vectors MSCI World ex Australia Quality Index. MSCI selects the highest scoring companies comprising the top 30% of its MSCI World ex Australia Index. MSCI Quality scores are based on three fundamental factors:

- return on equity;

- earnings variability; and

- debt-to-equity ratio.

There is more to passive investing than just sitting there.

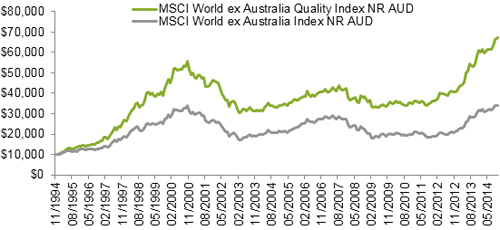

QUAL is the only smart beta international ETF on the ASX. It is an ideal international equity portfolio providing access to 300 of the highest quality international companies in a single trade on the ASX. The MSCI World ex Australia Quality Index can demonstrate historical outperformance against its parent, the standard international, MSCI World ex Australia Index.

Source: Bloomberg, iRate, as at 31 October, 2014

The above graph is a hypothetical comparison of performance of a $10,000 investment in the MSCI World ex Australia Quality Index and the parent index. Results are calculated to the last business day of the month and assume immediate reinvestment of all dividends and exclude costs associated with investing in the ETF. You cannot invest directly in an index. The above performance information is not a reliable indicator of current or future performance of the indices or QUAL, which may be lower or higher.

For more information click here or contact us via this link.

Disclaimer: This information is issued by Market Vectors Investments Limited ABN 22 146 596 116 AFSL 416755 (‘MVI’) as the Responsible Entity and issuer of units in the Market Vectors MSCI World ex Australia Quality ETF (‘the Fund’ or ‘QUAL’). This is general information only and not financial advice. It does not take into account any person’s objectives, financial situation or needs (‘circumstances’). Before making an investment decision in relation to the Fund you should read the current Product Disclosure Statement (‘PDS’) and with the assistance of a financial adviser consider if the decision is appropriate for your circumstances. A copy of the PDS is available at www.marketvectors.com.au or by calling the Registrar on 1300 MV ETFS (1300 68 3837). Investors can buy and sell units in the Fund on the ASX via a stockbroker or financial adviser. ‘Authorised Participants’ can invest in the Fund directly with MVI by completing the application form in the PDS. The Fund is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to the Fund or Reference Index. The PDS contains a more detailed description of the limited relationship MSCI has with MVI and the Fund.

MVI is a wholly owned subsidiary of Van Eck Associates Corporation based in New York (‘Van Eck Global’). The Fund is subject to investment risk, including possible delays in repayment and loss of capital invested. Past performance is not a reliable indicator of future performance.

None of MVI, any other member of the Van Eck Global group or MSCI guarantees the repayment of capital, the performance, or any particular rate of return from the Fund.

© 2014 Market Vectors Australia Pty Ltd. All rights reserved. Market Vectors® and Van Eck® are trademarks of Van Eck Global.

Related Insights

Published: 09 August 2018