A-REITs well-positioned for 2022

February 2022

Dexus and Vicinity’s reported earnings both surprising on the upside this week.

Dexus 2H21 Fund from operations beat consensus estimates by 6% and net income grew 82% to $803.2m despite eastern state lockdowns and emergence of Omicron triggering a return to working from home. Vicinity rallied 11.0% yesterday after announcing fund from operations (FFO) improved 7.7% YoY.

Dexus 2H21 Fund from operations beat consensus estimates by 6% and net income grew 82% to $803.2m despite eastern state lockdowns and emergence of Omicron triggering a return to working from home. Vicinity rallied 11.0% yesterday after announcing fund from operations (FFO) improved 7.7% YoY.

VanEck Portfolio Manager, Cameron McCormack, has made the following comments following the reported earnings from major A-REITs:

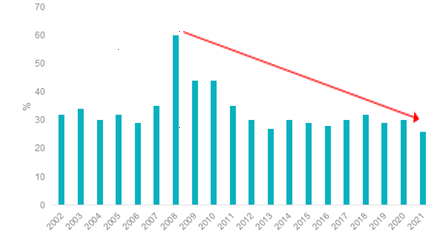

“Overall, funds from operations improved for the 2021 year which bodes well for the broader sector. We believe that A-REITs are attractive for a number of reasons. Firstly, their dividend yield of 4.38% is higher than the 4.16% of the S&P/ASX 200; Secondly, A-REITs progressively reduce their leverage since the GFC, with the average leverage falling from 60% then to 26% now; Lastly, A-REITs could be spurred on further should the trend in the increasing long term interest rates reverse and the 10 Year Australian Government bond is at 2.22%, its highest level since February 2019.

S&P/ASX 200 A-REIT Debt to Enterprise Value (EV)

Source: Bloomberg

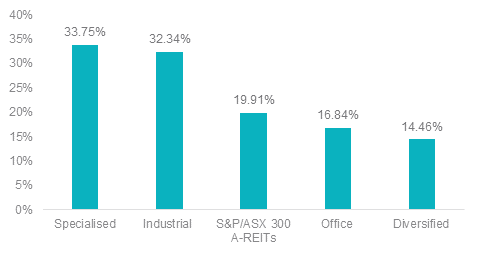

“Over the last year to 31 January 2022 the top performing subsector was Industrials, with Goodman Group being the main contributor achieving a return of 32.3%. The poorest performing sectors since the start of COVID were retail and office. However, with the end of lockdowns and the country re-opening we expect these two sectors to lead returns in 2022.

“Low COVID numbers and speculation that NSW will drop mask mandates in offices starting 1 March plus NSW Transport Minister David Elliott announcing that services will return to normal weekday schedules will likely boost Office REIT sentiment. Also, the opening of Australian borders to visa holders should boost Retail REITs with the return of tourists, international students and also foreign workers.

“Investors navigating A-REITs should consider taking a diversified subsector approach given the improved prospects of office and retail REITs. Australian A-REITs is highly concentrated to Industrial REIT Goodman Group, accounting for 27% of S&P/ASX 300 REITs exposure,” said McCormack.

One year S&P/ASX 300 subsector performance to Jan 2022

Source: Bloomberg, As at 31 Jan 2021. S&P/ASX 300 A-Reit subsector indices.

If you have any questions or would like further commentary, please contact Cameron McCormack, Portfolio Manager, via cmccormack@vaneck.com