Bond Market Bets on Wage Rise Despite RBA Rhetoric, Fixed Rates To Climb Further

November 2021

Update from Russel Chesler, Head of Investments and Capital Markets.

Update from Russel Chesler, Head of Investments and Capital Markets

The seasonally adjusted Wage Price Index (WPI) rose 0.6% in September quarter 2021, with annual growth rate of 2.2%%, according to the Australian Bureau of Statistics (ABS).

While wages growth is overall benign, we can expect to see an acceleration of wages growth through 2022. Workers’ bargaining power is rising as labour shortages build around the nation and across sectors and we know that many employers are struggling to fill job vacancies.

The ABS said that pockets of wage pressures continued to build for skilled construction-related, technical and business services roles, leading to larger ad hoc rises as businesses aim to retain experienced staff and attract new staff.

This could ultimately add to pressure on consumer prices. Up until now, many employers have absorbed cost rises; we expect that change in 2022 with global supply bottlenecks and rising energy prices and transport costs inevitably pushing businesses, at some point, to boost their prices to maintain their margins.

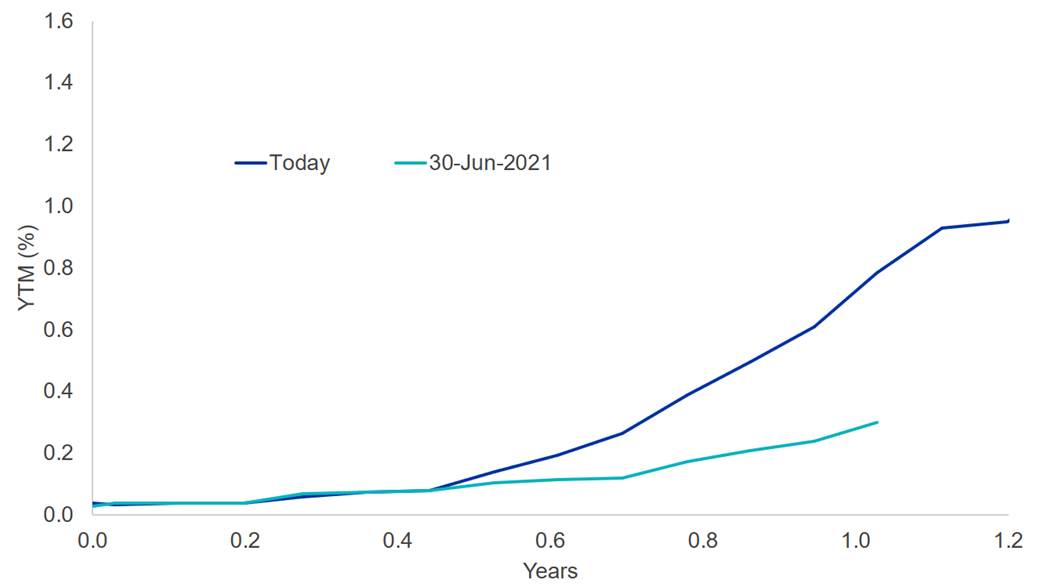

The figure below highlights that bond markets expect that the official cash rate could be as high as 1.0% by December 2022, well up from expectations in June 2021.

Short end bond yields are increasing more than long end, and the yield curve is flattening, which indicates that the bond market does not believe the RBA’s rhetoric that that will hold interest rates next year.

In response to rising bond yields, the big banks are progressively increasing fixed rates across maturities to avoid their margins being squeezed, as highlighted by the CBA profit result today, and we can expect this to continue through the remainder of 2021 and into 2022 as bond yields rise, which will push up home loan rates and could cool the property market.

3M BBSW Futures Curve (RBA Cash rate futures)

Source: VanEck as at 16 November 2021.