EPS exceeds 2019 level

February 2022

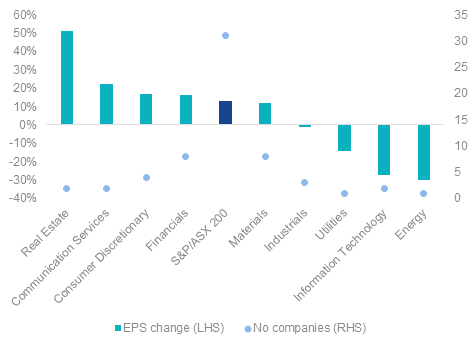

Strong results from BHP highlight that the commodity players have had a solid year. Fortescue, Evolution and Newcrest are all due to report in the next few days and we’re expecting strong results from all of these companies. The Australian market is generally underweight Energy but with the oil price pushing closer to $100 a barrel and tensions still high in Ukraine Woodside and Santos should also post strong results with an impressive forecast.

Financials have also had some significant upside performances with CBA beating expectations by 11.6% and Suncorp by 37.7%. Even with CBA’s surprise upside in earning we are relatively neutral when it comes to banks as their net interest margins continue to be under pressure. We believe that there is better value in the insurance sector which tends to be more resilient in a higher inflation and interest rate market.

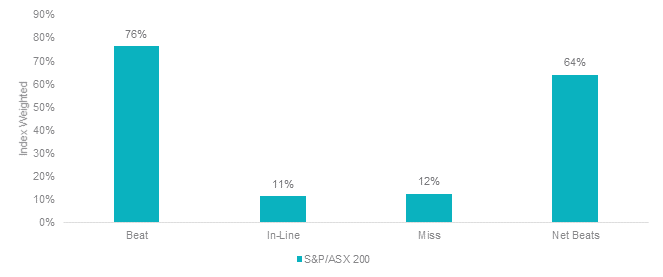

EPS surprise

Source: Bloomberg

Earnings have bounced strongly since the lows in 2020 with the EPS up by 13% since 2019 for those that have already reported. There is a considerable divergence between sectors with materials which include miners and real estate performing the best. Even a period where capital cities have experienced lockdowns and more recently the Omicron variant consumer discretionary stocks have seen increased earning.

2021 versus 2019 earnings per share change by sector

Source: Bloomberg

Even though the sample of companies that have reported so far is relatively small we are of the view we will continue to see more upside surprises. With rising inflation and expected interest rate increases we have seen a swing away from growth stocks to value stocks and expect this trend to continue. Both consumer staples and discretionary retail should do well as many Australian households are holding very high levels of cash and have money to spend in 2022, after staying at home for so long in 2020 and 2021. Insurers too could do well; they have a captive market and pricing power.

There is also a strong case for gold miners. The Gold price is up $80 per ounce in February 2022 to $1871, there is no doubt that the geopolitical tensions in the Ukraine have assisted the increase in the gold price, but inflation and negative real yields are set to push gold higher. We believe that gold miners which are leveraged to the gold prices have the potential to perform strongly. Debt reduction and free cash flow generation has fundamentally transformed how these companies look on both an absolute and relative valuation perspective