You see it but you don’t believe it

It would be naïve to think that ‘confirmation bias’ doesn’t exist in financial markets. It goes a long way to explain the failings of most Australian equity portfolios.

Most Australian equity portfolios use market capitalisation as a basis for weighting their investments. The S&P/ASX 200 Index (S&P/ASX 200) is a market capitalisation index. A market capitalisation weighted index (or portfolio), weights stocks according to their size, the larger stocks making up a larger portion of the allocation. This assumes that the biggest companies are the most important in the market and in a portfolio context, the best to invest in. But as the recent blip in the share market has illustrated, investing the most in the biggest companies is not always the best strategy.

There is mounting evidence that market capitalisation is not the best foundation for a portfolio. They see it, yet many professional investors still choose to ignore this evidence.

These investors are subject to what is called 'confirmation bias'. Confirmation bias is a term used in psychology which is defined as "our all-to-natural ability to convince ourselves of whatever it is we want to believe. We attach undue emphasis to events that corroborate the outcomes we desire and downplay whatever contrary evidence arises." (Michael Pompian, Behavioural Finance and Wealth Management, 2006).

Confirmation bias experiment: Confirmation bias is demonstrated by the classic experiment known as the Wason Card Task. Participants are presented with four cards on a table and are told that each card has a letter on one side and a number on the other. Participants can see one vowel, one consonant, one odd number and one even number facing up (eg, A, B, 1, and 2). Participants are asked to test the hypothesis: "If a card has a vowel on one side, it has an even number on the other." They are to turn over only two cards to determine whether the hypothesis is true. The correct answer is to turn over the vowel (which must reveal an even number, for the rule to be valid), and the odd number (which must NOT reveal a vowel, in order for the rule to be valid). Most people turn over the vowel but then turn over the even number even though both actions will prove the hypothesis, not disprove it. People only seek evidence to confirm the theory in question, at the expense of evidence that could prove it to be false. This is confirmation bias. |

Prior to last month, the rise of the big four banks had been unprecedented. As at 30 June 2005 the big four constituted 16.7% of the S&P/ASX 200. As at 30 June 2015 the big four had risen to 29.9% of the S&P/ASX 200. Investors know the danger of sector concentration risk but choose to ignore it because it doesn't confirm their bias to market capitalisation. Many professional investors have seen the research that shows equal weighting performs better than market capitalisation, but ignored it because it doesn't confirm their bias.

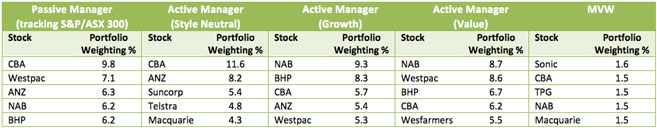

A review of the holdings of a sample of the largest fund managers shows that they are exposed to the concentration risk inherent in the Australian market.

Top 5 holdings of Passive Manager and select Active Managers

Source: Market Vectors, Morningstar Direct, as at 30 June 2015

Much of the commentary surrounding the rise of the banks and their performance is the yields they pay. As investors clamoured for yield, the price of the banks soared. Kenneth Fisher and Meir Statman in their 2000 paper, Cognitive Biases in Market Forecasts: The Frailty of Forecasting found that there is no relationship between dividend yields and the performance of stocks in the following periods. Of the 64 data points they used, forecasters could point to 33 instances in which higher dividend yields produced above median returns for stocks. But the evidence contrary to this is just as strong, there are 31 instances in which a higher dividend yield produced below median returns. Dividend yields are unreliable forecasters of future returns, because they provide as many bad forecasts as good ones. The Fisher and Statman paper finds similar results for P/Es.

Australian Banks performed well after the GFC being among some of the only banksglobally that retained their strong credit ratings. However, despite contrary evidence in the past few years, investors continue to drive up the price of banks. Increased capital requirements, a low growth economic environment (which usually negatively impacts cyclical stocks such as financials) and poor investments have largely been ignored by investors. When the price of banks has corrected the market response has been a predictable, "the yield of banks are attractive again." The market is subject to confirmation bias.

An equal weight index, as the name implies, weights all of its constituents equally. It does not consider the economic conditions nor does it consider the size of the stock, its dividend yield or its P/E.

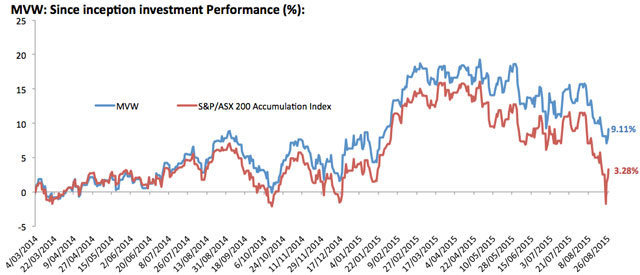

Market Vectors Australian Equal Weight ETF (ASX code: MVW) is the first and only equal weight Australian equity ETF available on ASX. MVW equally weights the largest and most liquid ASX-listed companies and has delivered superior returns compared to the S&P/ASX 200 Accumulation Index.

We are convinced of the evidence supporting equal weight, though it may be through our own confirmation bias. Let's check the performance:

Source: Morningstar Direct, 4 March 2014 to 27 August Results are calculated daily and assume immediate reinvestment of all dividends. The above performance information is not a reliable indicator of current or future performance of MVW which may be lower or higher.

IMPORTANT NOTICE: This information is issued by Market Vectors Investments Limited ABN 22 146 596 116 AFSL 416755 as responsible entity ('MVIL') of the Market Vectors Australian Equal Weight ETF ('Fund'). MVIL is a wholly owned subsidiary of Van Eck Associates Corporation based in New York, United States ('Van Eck Global').

This is general information only and not financial advice. It does not take into account any person's individual objectives, financial situation nor needs. Before making an investment decision in relation to the Fund, you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.marketvectors.com.au or by calling 1300 MV ETFs (1300 68 3837).

The Fund is subject to investment risk, including possible delays in repayment and loss of capital invested. Past performance is not a reliable indicator of current or future performance. No member of the Van Eck Global group of companies guarantees the repayment of capital, the performance, or any particular rate of return from the Fund.

Market Vectors® and Van Eck® are registered trademarks of Van Eck Global.

© 2015 Van Eck Global. All rights reserved.

Published: 09 August 2018