Accessing stocks that target the world’s biggest market

The world is changing. The largest market of consumers for the last 30 years is being replaced. Unfortunately many portfolios do not reflect this quantum change.

The world is changing. The largest market of consumers for the last 30 years is being replaced. Unfortunately many portfolios do not reflect this quantum change.

By 2024 China’s GDP will surpass the GDP of the United States, according to the World Bank. This is a quantum change.

In the 1950s, over 90% of the global middle class resided in Europe and North America. Today, over 20% live in China. China is experiencing the fastest expansion of the middle class the world has ever seen. By 2027, it is estimated that 1.2 billion Chinese will be middle class, making up one quarter of the world total.

Unlike aging populations in Europe and Japan, China’s population is young and they are driving the economy. 70% of Chinese Millennials own their own home. In the US, UK and Australia, only around one third of Millennials are homeowners1.

The companies best placed to benefit from this quantum change are those that sell products in China. Most of these are local names you may not have heard of, but these are often large companies, much larger than the companies on local, or even US exchanges. However, until recently it has been difficult for Australian investors to access these companies. Enter VanEck, one of the few Australian fund managers with an RQFII, which allows us to buy companies on the Shanghai and Shenzhen exchanges and offer investors a way to include companies at the forefront of this quantum change as a part of their portfolios.

Below are two companies at the forefront of the China market who are benefiting from this large, wealthy population group.

Wuliangye

Wuliangye is China’s second largest alcohol company and has a market cap of $217 bn., making it bigger than the world’s largest beer company ABinBEv (better known as Anhuser Busch) which has a market cap of $184bn. It is also bigger than all the other well know alcohol companies like Diageo and Pernard Ricard.

The company produces Baijiu which is China’s traditional spirit. Baijiu accounts for 35% of the world’s spirit production and 99% of it is consumed in China

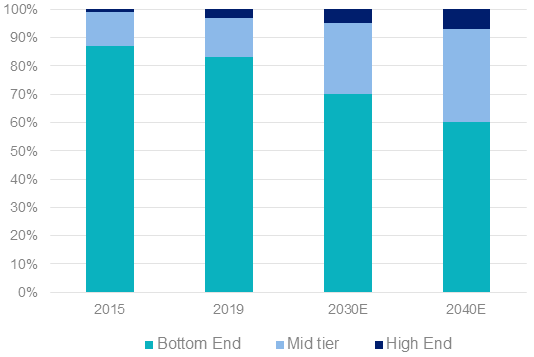

Wuliangye operates mainly at the premium or high end of the market. From 2015 there has been a shift in the Baiju market towards mid and high tier products. UBS predicts that by 2040 40% of consumption will be at the high end.

Chart 1: Transition of Baiju market structure

Source: UBS

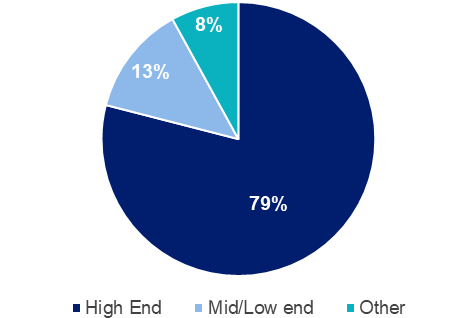

Chart 2: Wuliangye revenue by product tier

Wuliangye has a strong history of increasing sales revenue and managed well to maintain revenue during COVID, considering that business sector consumes a large amount of Baiju. The increase in disposable income and the push for a healthier lifestyle by consumers has made people think more about quality and less about volume. A new culture is developing and the catch phrase “Drink less, drink better” is becoming popular. All this bears well for the future of Wuliangye.

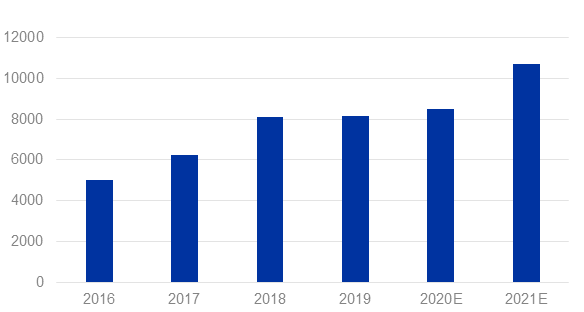

Chart 3: Wuliangye Sales Revenue

Source: UBS

Peacebird

When the global fast fashion brands first came to China a number of years ago they were highly sought after by the newly wealthy generations. But as the market shifted from a Made in China to Designed in China sentiment, which was driven by millennials, local brands have been taking over. Topshop, New Look and Forever 21 have pulled out of China. Chinese brands that started off in the lower tier cities ignored by the global brands are becoming go-to places for their design and lifestyle relevance.

Peacebird is an example of such a company. Peacebird is still small in terms of market capitalisation at $3.5 billion but is one of the fastest growing fast fashion brands in China. The company launched more than 20 years ago selling affordable fashion in lower-tier cities, and has earned a place in the hearts of Gen Z and Millennial trendsetters across China. It has 4000 stores and 8 brands. Peacebird was the first fashion company to list on the A-Share market in 2017. In 2018 it made its debut at New York Fashion Week

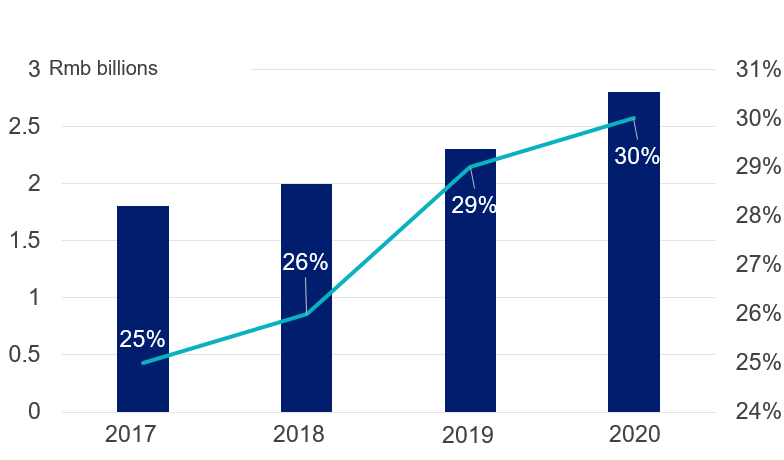

When COVID-19 hit, Peacebird rapidly adapted, inviting superstars, online celebrities, and even corporate CEOs to sell goods in live broadcasts and develop a new virtual connection with their existing customers. It quickly reorganized moving and retraining staff into online marketing teams. Once the economy re-opened Peacebird took the opportunity to open 120 new stores.

Chart 4: Peacebird online sales and percentage of total sales

Both of these companies are included in the VanEck Vectors China New Economy ETF (ASX code: CNEW), which targets China’s growing and affluent population. CNEW includes companies from the Consumer Discretionary, Consumer Staples, Healthcare and Technology sectors.

Published: 19 May 2021

1. HSBC ‘Beyond the Bricks: The Meaning of Home’ Report, 2017, Australian data from Corelogic’s Perceptions of Housing Affordability Report, 2019

IMPORTANT INFORMATION

VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’) is the responsible entity and issuer of units in the VanEck Vectors China New Economy ETF (CNEW). This is general advice only, not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Read the PDS and speak with a financial adviser to determine if the fund is appropriate for your circumstances. The PDS is available here.

An investment in CNEW carries risks associated with: China; financial markets generally, individual company management, industry sectors, ASX trading time differences, foreign currency, sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details. No member of the VanEck group of companies guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from any fund.