China: A digital future

20 years ago the SARS virus was the first epidemic of the 21st Century. In the middle of that outbreak online retail in China boomed, and it hasn’t slowed down since. Today China is home to the most tech savvy consumers on earth.

20 years ago the SARS virus was the first epidemic of the 21st Century. In the middle of that outbreak online retail in China boomed, and it hasn’t slowed down since. Today China is home to the most tech savvy consumers on earth.

China’s digital consumer

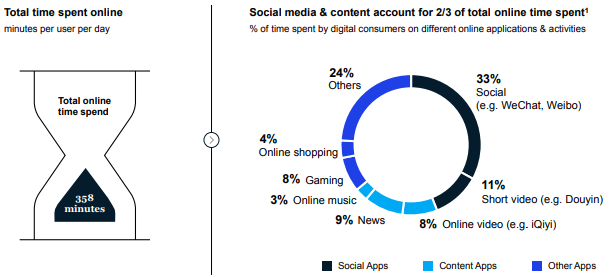

Prior to COVID-19, Chinese consumers were among the most insatiable users of social media. According to a McKinsey survey in 2019, they spent 44 percent of their time on social media apps and another 11 percent watching, sharing and creating short videos on apps such as Douyin (known as Tik Tok in English).

Time spent online by digital consumers

Source: QuestMobile; McKinsey China Digital Consumer Trends 2019

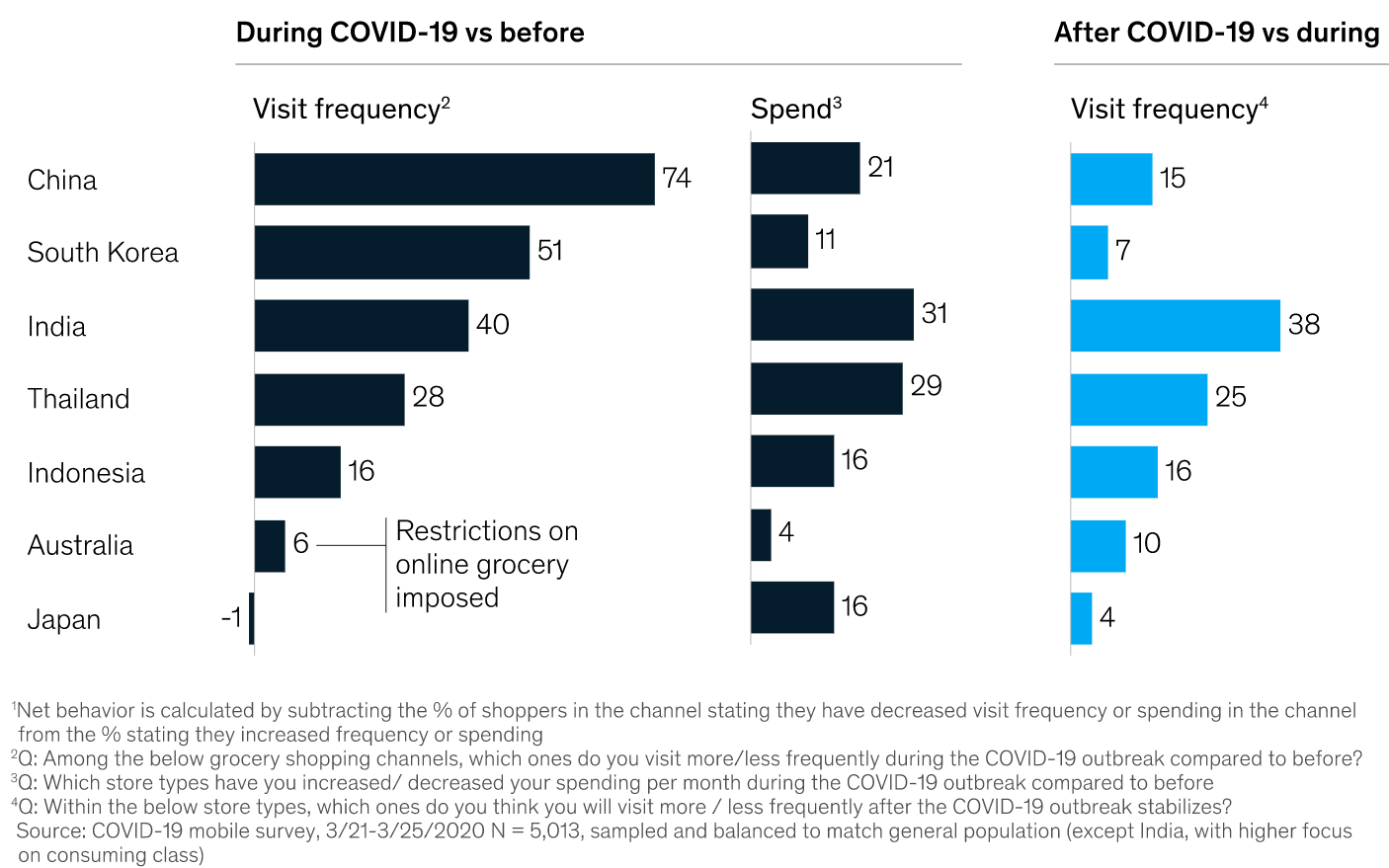

During the pandemic time spent online increased above the already extraordinary 6 hours detailed above in 2019. This created an opportunity for savvy local businesses. During the COVID-19 crisis, online channels became a lifeline for local retailers that wanted to stay connected to their consumers. For example online food purchases spiked more in China than anywhere else in the world.

Online grocery channel survey: net reported behaviour during COVID-19 vs before;

net intent for after COVID-19 vs during (now)1

Source: McKinsey How Chinese consumers are changing shopping habits in response to COVID-19

According to McKinsey, “COVID-19 has emphasized the importance of staying fit and healthy, and changing attitudes are reflected in shopping behaviours.” The demand for fresh food, condiments, and appliances used in food preparation is the reason companies such as Guangdong Xinbao Electrical Appliances, Qianhe Condiment & Food Co. and Chacha Food have all returned over 60% so far this calendar year.

China to lead in 2021

Despite the contraction in China’s economy during the first quarter of 2020, the IMF still projects the economy to grow by 1.2 percent for the year. For 2021, the IMF predicts China’s economy will grow by 9.2 percent, leading all major economies. This puts the growth rate near the ruling Communist Party’s goal of doubling 2010 GDP and per capita income levels by 2021 in celebration of the Party’s 100thanniversary.

While this year’s growth will be significantly lower than the approximately six percent growth expected before the coronavirus outbreak hit, that China will manage positive growth at all is a testament to its strength. And if the IMF’s projections are correct, China will be making up for lost time in 2021.

In a recent appearance in northwest China’s Shaanxi province, Xi acknowledged the difficulty for government officials to meet this year’s targets but also reaffirmed the need to meet the Party’s centenary goals. While Xi may be seen as laying the groundwork to massage the targets of the goals from “by 2021” to “by the end of 2021” the likely approach to achieve those goals will be to enact a stimulus package to jolt the economy back to life. This could be announced as part of the current Two Sessions meetings which started on May 21.

In line with the Made in China 2025 policy we expect the sizable stimulus to focus on developing “new infrastructure”, such as 5G networks, NEV charging stations, energy efficiency programs, and other initiatives that will help build China’s economy of the future. If China’s stimulus policies are effective, they will not only stabilize the economy in the short-term but help further transition the country towards a high-tech and service-driven economy to set the stage for the coming decade.

See how you can invest in China’s “new economy”.

IMPORTANT NOTICE: This information is prepared in good faith by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as the responsible entity and issuer of VanEck Vectors China New Economy ETF (‘the Fund’).

Published: 25 May 2020