China: Dragon rising

China A-shares have shot up further in July. Looking ahead, investors expect corporate profits to rebound in the second half of the year driving share prices higher. Additionally, there are also indications that China's New Economy sectors is set to thrive.

China A-shares have shot up further in July. Looking ahead, investors expect corporate profits to rebound in the second half of the year, driving share prices higher. Additionally, the ‘liberalisation’ of Chinese equity markets has seen a sharper focus of valuations and shareholder returns which, coupled with government initiatives, will see technology, healthcare and consumer related stocks thrive.

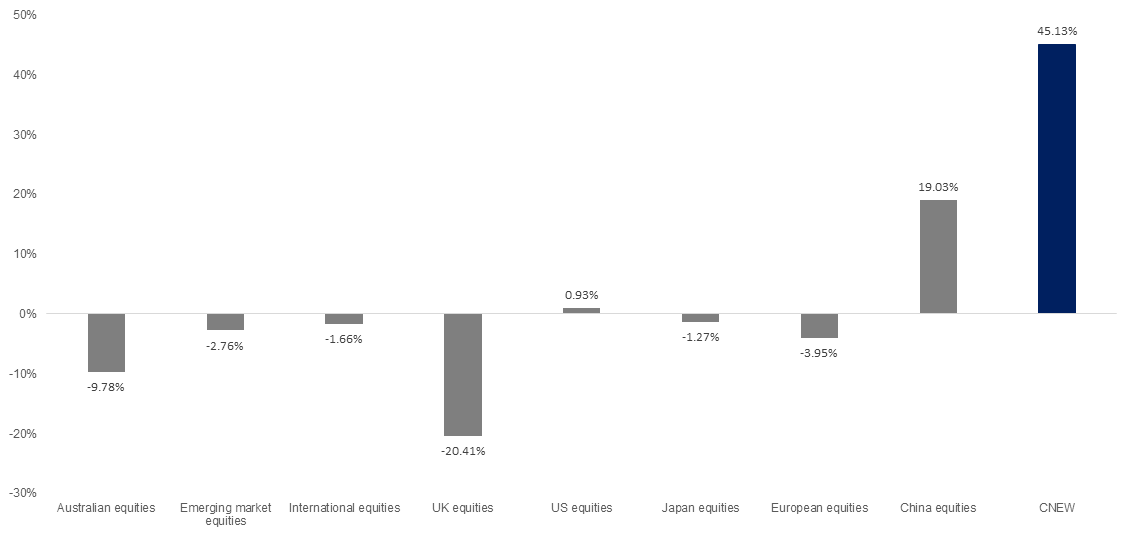

Globally in 2020 there has been no place to hide

It has been a wild ride in equity markets since the beginning of the year. Overall most equity markets across the globe tumbled in the first half of 2020, with the notable exception of China. In the graph below, China’s New Economy, which comprises companies within the technology, health care, consumer staples and consumer discretionary sectors, is represented by CNEW (VanEck Vectors China New Economy ETF).

Calender year to date performance of global equity markets and CNEW

Source: Morningstar Direct. Data as at 14 July 2020. All returns in Australian dollars. You cannot invest in an index. Past performance is not a reliable indicator of future performance. Indices used: Australian Equities – S&P/ASX 200 Accumulation Index; International equities – MSCI World ex Australia Index; Emerging markets equities – MSCI Emerging Markets Index; US equities – S&P 500 Index; UK equities – FTSE 100 Index, Japan equities – Nikkei 225 Index; European equities – MSCI Europe ex UK Index; China equities – CSI 300 Index. CNEW performance includes management fees and other costs incurred in the fund but excludes broker fees and buy/sell spreads associated with investing in CNEW. Past performance is not a reliable indicator of future performance.

The past fortnight’s rise in China A-shares has been well documented and there are a number of reasons for this, primarily liquidity. There is evidence that retail investors are redeeming from low interest rate money market funds, which according to Asset Management Association of China (AMAC) accounted for nearly 50% the total size of China mutual funds, and investing in equities2.In addition to retail liquidity, loose monetary policy is also helping liquidity as the government looks to stimulate the economy. Spending in infrastructure, technology and healthcare will all benefit the New Economy.

Infrastructure expenditure will help technology

The Xinhua news agency reports, “the strategic allocation of the new infrastructure investment this time will be noticeably different from the previous economic crises, as most of it will be channelled towards the high-tech industry.” The overall investment in the approved projects amounts to approximately RMB 982 billion. Among the focus for the technology sector are:

- Electric vehicles and NEV charging

- Hardware and software development as part of Made in China 2025

- 5G infrastructure

- Big data centre as part of the Big Data Industry Development Plan (2016-2020)

- AI as part of the New Generation Artificial Intelligence Plan

- Industrial Internet (cloud computing) as part of the Action Plan for Industrial Internet Development

- UHV – There are 16 UHV lines under construction or approved

In addition, for investors looking to invest in technology CNEW makes a compelling entry point to invest in the opportunities of tomorrow. Compared to the opportunities on US and Australian markets, CNEW is compelling.

|

|

Price/cash flow |

Trailing P/E |

Fwd P/E next year |

P/B |

|

FAANG stocks |

52.43 |

62.4 |

39.9 |

14.9 |

|

WAAAX stocks |

65.10 |

395.8* |

203.3* |

16.6 |

|

CNEW |

17.35 |

25.4 |

26.7 |

5.8 |

|

CNEW tech 30 |

38.66 |

49.2 |

38.4# |

8.5 |

*Altium has a P/E of 1,352.19x

#Coverage 60%

Source: Factset, MarketGrader as at 30 June 2020. CNEW tech 30 is the 30 companies in CNEW from the technology sector.

Boosts to healthcare

Universal access to adequate healthcare is crucial to China’s economic development, as healthy workers drive productivity and economic growth. Comprehensive government reforms, prior to the crisis, have enabled China’s population to achieve significantly improved health outcomes, aided by its centralised health system. However, there are still big gaps in China’s healthcare system and it lags many developed nations3. These gaps, now as a source of national pride, demand continued high levels of investment.

In the aftermath of the COVID-19 outbreak there is likely to be a boost to healthcare investment. While the 2003 Severe Acute Respiratory Syndrome Virus (SARS) outbreak exposed weaknesses in China’s healthcare system and prompted Beijing to initiate much-needed healthcare reforms4 this time the response to the COVID-19 will force the government to do more once the outbreak is fully controlled. Compared to 2003, China is now more urbanised and more service focused. Back in 2003, the Chinese government could stimulate manufacturing in response to the crisis. This time the impact of such a strategy will be diminished, so we expect in addition to a spike in healthcare investment, stimulation will be targeted at the Chinese consumer.

Consumer sectors

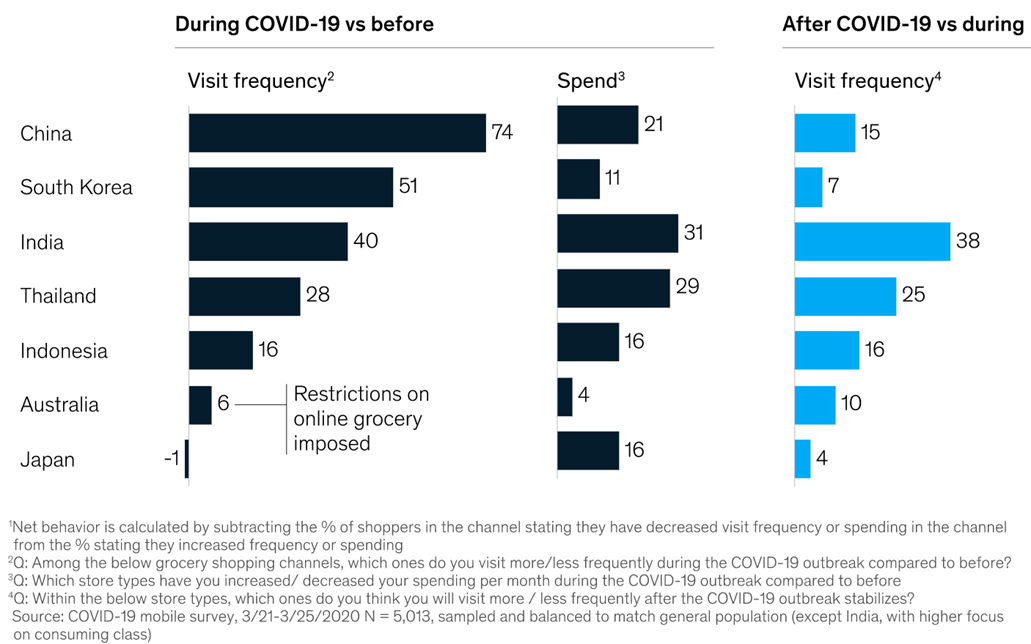

Despite COVID-19 China continues to move towards the post-industrialization and information era, in which the pillar industries will be service-oriented industries represented by technology and consumption. Prior to COVID-19, Chinese consumers were among the most insatiable users of ecommerce. During the pandemic time spent online increased. This created an opportunity for savvy local businesses. During the COVID-19 crisis, online channels became a lifeline for local retailers that wanted to stay connected to their consumers. For example online food purchases spiked more in China than anywhere else in the world.

Online grocery channel survey: net reported behaviour during COVID-19 vs before; net intent for after COVID-19 vs during (now)1

Source: McKinsey How Chinese consumers are changing shopping habits in response to COVID-19

According to McKinsey, “COVID-19 has emphasized the importance of staying fit and healthy, and changing attitudes are reflected in shopping behaviours.” The demand for fresh food, condiments, and beverages is the reason companies such as Angel Yeast, Sichuan Swellfun and Jiugui Liquor have all returned over 60% so far this calendar year and we expect demand to continue. All three are among the holdings in CNEW.

CNEW, which has returned over 40% so far this year, has been a beneficiary of this. CNEW is a portfolio of 120 of the most fundamentally sound companies with the best growth prospects from the sectors at the forefront of China’s transforming new economy, namely: technology; healthcare; consumer staples; and consumer discretionary. It is these sectors that have done relatively well during the coronavirus pandemic and as China emerges from the COVID-19 crisis, and we think these sectors will continue to thrive in the medium to long term.

Being selective in China is important and recently MarketGrader wrote about the best way to invest in China.

Increasing index inclusion and opening of markets

Most major global indices now include China A-shares. This was lengthy process as index providers and market participants worked with Chinese authorities to make its onshore markets more accessible, and therefore eligible for index inclusion. In March, China officially scrapped quota restrictions on two major inbound investment systems and simplified procedures for outbound payments. This relaxation of regulations is a game changer for China equities in two ways:

- With investment by institutional clients and foreign investors, over the medium to long term, there is likely to be increased stability, liquidity and sophistication in China’s markets. This will also bring increased focus on fundamentals and good management which will in turn drive market performance as these investors seek long term success; and

- Increased index inclusion adds up to a lot of extra demand for A-shares and a likely uplift in valuations.

Investors wanting access to China’s booming healthcare sector and its “new economy” can do so via an ETF that tracks the CSI MarketGrader China New Economy Index.

2. Investors Pull Cash From China’s Money-Market Behemoth as Yields Tumble – Wall Street Journal, June 18 2020

3. Source: http://www.healthdata.org/node/6446, Measuring performance on the Healthcare Access and Quality Index for 195 countries and territories and selected subnational locations: a systematic analysis from the Global Burden of Disease Study 2016, March 2018.

4. https://chinapower.csis.org/china-health-care-quality/

Published: 20 July 2020

This information is general advice about a financial product and not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision investors should read the product disclosure statement and with the assistance of a financial adviser consider if it is appropriate for their circumstances. A copy of the PDS is available at www.vaneck.com.au or by calling 1300 68 38 37.

An investment in Chinese securities has heightened risks compared to investing in the Australian market. See the PDS for details of the key risks. No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from the Fund.

The Fund tracks the CSI MarketGrader China New Economy Index. "MarketGrader" And “CSI MarketGrader China New Economy Index” are trademarks of MarketGrader.com Corporation. MarketGrader does not sponsor, endorse, sell or promote the Fund and makes no representation regarding the advisability of investing in the Fund. The inclusion of a particular security in the Index does not reflect in any way an opinion of MarketGrader or its affiliates with respect to the investment merits of such security.

© 2020 VanEck Australia Pty Ltd