China takes the lead

China’s economy grew by 4.9% p.a.in the third quarter compared with a year earlier, accelerating from growth of 3.2% p.a. in the second quarter.

The world’s second-largest economy has recovered strongly after shrinking by 6.8% p.a. in the first three months of the year due to the lockdown efforts aimed at stemming the tide of the coronavirus pandemic.

The International Monetary Fund expects China's economy to expand by 1.9% in 2020. That compares to contractions of 5.8% in the United States and 8.3% in the 19 countries that use the euro. Looking even further ahead, the International Monetary Fund predicts that China's economy will grow by 8.2% in 2021, a much faster pace than advanced economies.

There were plenty of signs of strength in the China economy this quarter, with the services and construction sectors performing especially well.

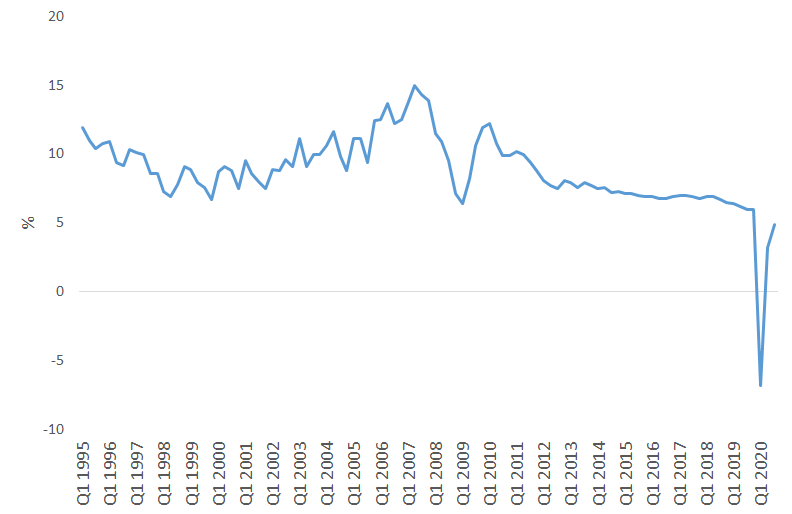

China’s GDP growth, quarterly

Source: National Bureau of Statistics

Industrial production, a gauge of activity in the manufacturing, mining and utilities sectors, grew by 6.9% p.a. in September from a year earlier after a 5.6% p.a. rise in August.

Retail sales, a key measurement of consumer spending in the world’s most populous nation, grew by 3.3% p.a., improving further from the 0.5% p.a. increase in August. August’s growth in retail sales was the first expansion this year, as consumer spending recovered more slowly than other areas of the economy. Now it seems to have momentum, with imports also rising 13.2 % p.a. in September from a year earlier.

Fixed-asset investment, a gauge of spending on infrastructure, property, machinery and equipment, rose by 0.8% p.a.in the first nine months of the year, an increase from the 0.3% p.a. decline in the first eight months. This marks the first month in which the year-to-date growth has turned positive.

The surveyed jobless rate in urban areas stood at 5.4% in September. This was down from 5.6% in August and the peak of 6.2% in February.

To gain a diversified exposure to China A-shares, VanEck offers two ETFs on ASX: the VanEck Vectors FTSE China A50 ETF (CETF) and VanEck Vectors China New Economy ETF (CNEW).

Published: 27 October 2020

Issued by VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’). This is general advice only, not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Read the PDS and speak with a financial adviser to determine if the fund is appropriate for your circumstances. The PDS is available here, and details the key risks. No member of the VanEck group of companies guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from either fund.

An investment in CNEW and/or CETF carries risks associated with: China; financial markets generally, individual company management, industry sectors, ASX trading time differences, foreign currency, sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.