China: The Way Forward

China’s stated goal and renewed focus is common prosperity – we are going to see social equality, self-sufficiency and security being addressed. Recent announcements such as the edict on education are an example. Although policy risks create short-term ripples in the market, there are sectors in mainland China that remain well positioned to benefit over the long run.

China’s stated goal and renewed focus is common prosperity – we are going to see social equality, self-sufficiency and security being addressed. Recent announcements such as the edict on education are an example. Although policy risks create short-term ripples in the market, New Economy sectors in mainland China remain well positioned to benefit over the long run.

Technology

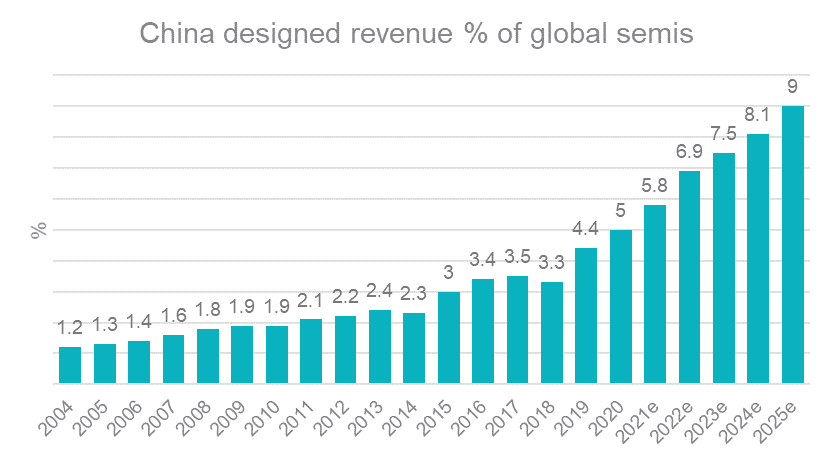

The basis of the recent crackdown on internet platforms is to improve protection of Chinese consumers and employees in these newer industries. However, there are more growth areas beyond internet platforms in the technology sector, for example, semiconductors. Being a crucial component of automation and AI acceleration, chips are likely to enter an expansion phase with strong government support and a large downstream market. Morgan Stanley Research shows that China designed chips are expected to outgrow global semis with a 20% CAGR, reaching US$55bn by 2025.

Source: Gartner, SIA, Morgan Stanley

Consumer staples and discretionary

As the poverty rate drops to zero, wealth distribution inequality is on the rise. The urban disposable income ratio of top to bottom quintile has jumped to 6.2 vs 5.0 in 2012. Narrowing the income gap will help boost spending power of the masses, which in turn would largely benefit domestic brands over global ones. From “Made in China” to “Designed in China”, domestic brands will continue to gain more momentum. They have the competitive advantage of knowing the culture as well as leveraging the well-established e-commerce ecosystem.

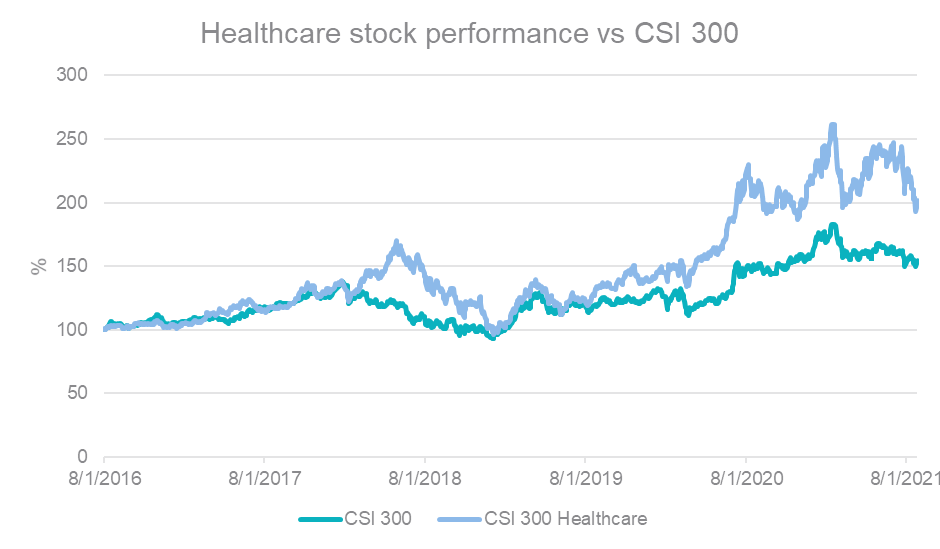

Healthcare

The Chinese government aims for quality, accessibility and affordability in the healthcare space. As China’s population is ageing, healthcare will have a significant supporting role to play. Private hospitals focus on specialists and they complement comprehensive state run hospitals. In addition, China now favours innovation in pharma and biotech, and encourages them to be well differentiated in the market.

Source: Bloomberg as of 25 August 2021

Published: 31 August 2021

VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’) is the responsible entity and issuer of units in the VanEck China New Economy ETF (CNEW). This is general advice only, not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Read the PDS and speak with a financial adviser to determine if the fund is appropriate for your circumstances. The PDS is available here.

An investment in CNEW carries risks associated with: China; financial markets generally, individual company management, industry sectors, ASX trading time differences, foreign currency, sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details. No member of the VanEck group of companies guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from any fund.