China’s peak recovery already behind us

China’s recovery is well underway, but it is not yet fully “balanced”. What are the implications?

China’s peak recovery is already behind us, the annual growth rates are about to start normalizing due to the fading base effect (from sky-high 18.3% year-on-year in Q1-2021 to 8% in Q2, 6.2% in Q3, and mere 5% in Q4, according to Bloomberg LP consensus) and policy normalization is already underway. One area that is not yet back to normal is the structure of China’s growth. You often hear that the recovery is “unbalanced”. What does it mean and what are the implications?

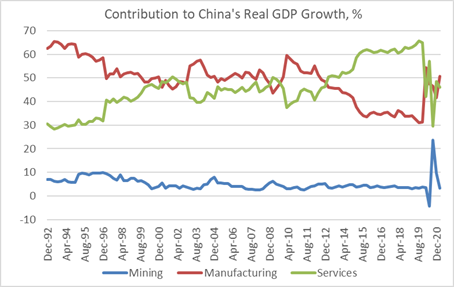

The chart below shows the extent of China’s rebalancing predicament. Estimates suggest that during the pandemic, the contribution of services to real GDP growth collapsed to levels last seen in the early 1990s, and it is still well below the pre-COVID averages. As a result, manufacturing has to pick up the slack, which explains a nervous market reaction when the manufacturing Purchasing Managers’ Index (PMI) surprises to the downside, gets too close to the contraction/expansion border (50.0) or looks okay on the surface (51.0 in May) but has worrying details (May’s drop in new orders and new export orders). Another repercussion is that the services PMI will have to stay well above 50.0—possibly close to May’s 55.2—for an extended period of time to allow the sector fully catch up. This is the reason why we believe the market will remain focused on the weak labor market conditions (the employment PMI remains in contraction zone), partial lockdowns (Guangdong province) and tighter credit availability as potential headwinds (despite rising vaccinations—45.7% of the population).

This is also the reason why “sharp policy turns” are unlikely any time soon, but there will be a lot of policy fine-tuning and on-going targeted support. One area we are watching specifically is government spending. Ministry of Finance’s numbers point to a small fiscal surplus in the first four months of the year. This is fantastic news for government bond holders, but this means more room to extend support for small privately owned enterprises (the small companies PMI was back in contraction zone in May) and potentially public investments if headwinds persist.

Charts at a glance: China growth – services still lagging

Source: VanEck Research; Bloomberg LP

Published: 01 June 2021