Cooling late-cycle economy could rekindle interest in gold

Indications of a late-cycle economy are becoming more evident, and rising risk and volatility may lead investors back to gold.

Gold extended its two-year trend of higher lows

Gold's price action in March was considered very positive, even though it only advanced US$6.62 (0.5%). Since the Fed began raising rates in December 2015, the gold market has shown weakness in the weeks ahead of each rate decision. This pattern was repeated once again, as the low for the month was US$1,306 per ounce on 21 March, the day the Fed announced its sixth 0.25% rate increase since it began raising rates. The Fed-induced lows in 2017 were in the US$1,200 to US$1,240 per ounce range, whereas the March 2018 low (US$1,306) was much higher, extending the positive trend of higher lows to over two years. Gold was propelled to its high for the month of US$1,356 per ounce on 27 March following the Trump Administration's announcement of tariffs targeting Chinese goods. China's immediate response was modest in comparison and gold finished the month at US$1,325 per ounce.

Demand from India is weak, but bullion ETF demand solid

Physical demand in India has been weak for a couple of years now due to import restrictions, taxation, and currency changes. We have been expecting demand to return to normal. However, in February, Bloomberg reported weak Indian imports which suggests the gold market in India continues to struggle. While we wait for favourable developments from India, the positive trend in prices has been driven by investment demand for gold bullion exchange traded products (ETPs). Global bullion ETPs have seen steady inflows since early 2017 and holdings have now reached levels last seen in 2013.

Lack of interest, misguided cost concerns fueling gold equity underperformance

Gold equities outperformed gold bullion in March, as the NYSE Arca Gold Miners Index (GDX Index) gained 2.9% in US dollar terms. Perhaps gold stocks have begun to claw back the performance they have lost relative to gold this year. In the first quarter, gold equities underperformed gold by 7.2% in US dollar terms. We normally expect gold equities to advance with gold, which has gained 1.7% in US dollar terms so far this year. There are several reasons for the underperformance:

- A lack of interest in safe-haven investments: While volatility has returned to markets this year, it has yet to reach worrying levels that might motivate investors to hedge their exposure. RBC Capital Markets reports the six-month trailing beta to gold of the VanEck Vectors® Gold Miners ETF has declined to 1.5x, compared to a historical average of 2.0x. General investor apathy towards the miners was also evident at the BMO Global Metals and Mining Conference 2018 in late February. BMO commented anecdotally that institutional investor interest in precious metals was at levels last seen in the early 2000s, before gold's bull market.

- Market worries that a new cycle of mining cost inflation has begun: Several companies have guided to higher all-in mining costs in 2018 and we have seen some press and research that suggests costs are beginning to rise. Since 2012, industry average all-in mining costs have fallen roughly 25% to around the US$900 per ounce level in 2017. Based on company guidance so far, we reckon these costs will likely rise to roughly US$925 in 2018. After talking with many producers about their cost drivers, we believe cost concerns are overblown and that costs will fluctuate around the US$900 level for the foreseeable future. Many companies have long-term contracts for materials and consumables. Some have hedged fuel and currencies at low levels. It seems the labour market has tightened somewhat in Australia, but companies are not reporting any wage pressures globally. In fact, BMO Capital Markets sees the all-in costs of the gold companies in their coverage universe declining 8% in 2019.

- Gold stocks have yet to recover from the early February sell-off: Investors viewed the general market sell-off as an overdue correction, rather than the re-emergence of systemic risks. This interpretation precluded a flight to safe havens, causing gold and especially gold stocks to sell-off with the market in early February. As a result, RBC Capital Markets notes that the gold producers are trading at a roughly 20% discount to their historic valuations. So far, the general sell-off has been too short to benefit safe havens. In a February report, Goldman Sachs finds that it usually takes a month or so of equity drawdown for gold to start to act like a hedge.

Cracks appear in market and investor psychology

It appears that the confidence and complacency that has dominated the US stock market for several years is now beginning to dissipate. Investor psychology is changing, the market is no longer bulletproof, and many of the high flying stocks are coming down to earth. Social media is facing a reckoning, as Facebook has become embroiled in a widening scandal over user data. Unfortunate mishaps for Tesla and Uber suggest autonomous driving may be much more difficult to achieve than expected. Regulators and tax authorities are targeting cryptocurrencies, while hackers target their exchanges.

Indications of late-cycle economy and rising inflation more evident

The US Commerce Department reported retail sales fell in February for the third month in a row, while the University of Michigan Consumer Sentiment Index jumped to a 14-year high and the Conference Board Consumer Confidence Index hovers near 17-year highs. This suggests that while times are good for most people, they have little desire to spend more in an economic expansion that is one of the longest on record. Households may save their gains from the Trump tax cuts, rather than spend in the economy, as the Commerce Department reports the savings rate ticked higher in February.

We believe these are signs that the post-crisis economic and stock market cycle is approaching its end. There are also many signs indicating core inflation could move beyond the Fed's 2% target. The S&P CoreLogic Case-Shiller Index is 6.3% higher than its 2006 peak. A shortage has led lumber to record highs. Freight costs are near 20-year highs. General Mills CEO Jeff Harmening was quoted in The Wall Street Journal, "we are seeing an unprecedented rise in logistics costs". In the 12 state Midwestern region, job openings outnumber out-of-work job seekers. Idaho workers led the nation with a 5.3% increase in earnings in 2017 thanks to labour shortages. The Fed's February Beige Book saw employers raise wages and expand benefit packages in response to tight labour market conditions in most districts. Layered on all this are new tariffs that could raise the costs of a wide range of goods.

Historically, tightening does not end well

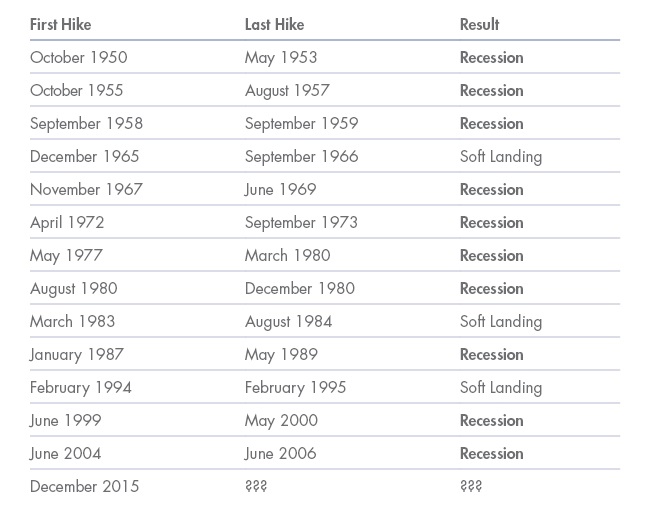

With core inflation at 1.8%, it is likely that inflation achieves a "two-handle" (2%) soon, and rather than risk falling behind the curve, the Fed might tighten more aggressively. This would also be classic late-cycle behaviour. The track record of the 13 hiking cycles since 1950 compiled by Gluskin Sheff leaves little room for optimism:

Fed hiking cycles, 10 landed in recession

Source: Haver Analytics, Gluskin Sheff.

In addition, many other countries are enjoying growing economies. A February report by HSBC economist Stephen King identified all periods since 1990 in which the world economy has delivered synchronised growth. Mr. King finds that each was followed by some kind of economic or financial shock, attributed to excessive optimism and unanticipated shifts in monetary policy.

Increased risk and volatility should lead investors back to gold stocks

If we are right in our late-cycle assessment, gold and gold stocks stand to benefit if the current market, characterised by confidence and complacency, transitions to one filled with risks and volatility. We believe that once generalist investors take the time to assess gold stocks, they will like what they see — companies with strong balance sheets, cost containment, and good cash flow run by managements incentivised by profitability and shareholder returns. Under the right conditions, it probably won't take long for the global gold mining sector with a market capitalization of just $250 billion to fill the valuation gap and regain its historic beta to gold.

Published: 09 August 2018