Despite headwinds, gold's base remains solid

The gold price held its ground during October and ended the month with a small loss. Although some headwinds are likely to occur the reminder of the year, the base that has formed over the last couple of years is expected hold firm in the US$1,200 to US$1,350 per ounce range.

Gold price held firm in October as US Dollar gained strength

The gold price held its ground during October with a small loss of US$9.08 (-0.7%), ending the month at US$1,271.07 per ounce. Most of the macroeconomic news was negative for the gold price except in the US where economic releases in October were favourable and third quarter GDP growth beat expectations. The market gained conviction for a December Federal Reserve (Fed) rate increase and there was activity in the Senate that might enable tax reform later this year. Also, the European Central Bank (ECB) announced much anticipated plans to taper its bond purchases that was not as aggressive as expected. All of this caused both the US dollar and interest rates to trend higher, keeping a lid on the gold price.

Gold stocks rose

marginally. The NYSE Arca Gold Miners Index (GDX Index) rose 0.21% as many

of the large companies reported third quarter results that matched

expectations.

Looming headwinds to gold may also add global economic risks

Gold may face several headwinds in the remainder of the fourth quarter that could lend strength to the US dollar:

- The economic strength reported in October (for September), along with two consecutive quarters of 3% GDP growth, may indicate the economy is gaining momentum. If this continues, gold will likely remain under pressure. However since the financial crisis, economic growth has been inconsistent and below historic norms. This, along with our belief that this is a late-cycle economy, suggests we are due for some disappointments in the economy.

- Gold may be negatively impacted if expected tax reforms accomplish their stated goals, namely lower taxes for the general public, elimination of provisions for special interests, and overall simplification of the tax system. Given past performance from Washington, infighting among Republicans could result in limited reforms. Also, tax reform is likely to substantially increase fiscal deficits that harm the economy in the longer term and some provisions could hamper the housing market.

- The Fed is widely expected to raise rates at the December Federal Open Market Committee (FOMC) meeting. This is the third year in which the markets are anticipating a December increase. We have noticed a pattern where gold becomes oversold leading into the rate increase and rallies in the following months. During the last two months of 2015 and 2016, gold declined 7.1% and 9.8%, respectively. This was followed by gains of 16.7% and 8.3% in the first two months of 2016 and 2017, respectively.

While these headwinds may weigh on gold in the near term, they also carry broader economic and financial risks. We expect the base that has formed over the last couple of years to hold firm in the US$1,200 to US$1,350 per ounce range.

Lack of production growth should support gold prices

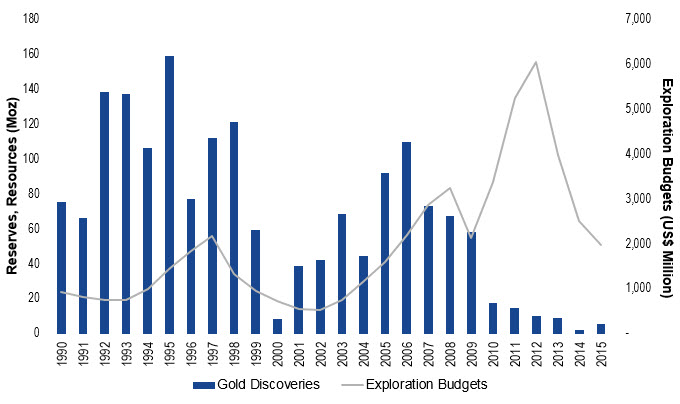

In a July issue of The Northern Miner, David Garofalo, President and CEO of senior gold producer Goldcorp (2.7% of net assets*), said “If you look at the production perspective, by our own admission, the industry will shrink production by 15% to 20% in the ensuing five years”. According to Metals Focus, gold production from China, the world’s largest gold producer, is “plateauing” as production has fallen 8% in the first half of 2017. Most industry analysts have gold production peaking in the 2017–2020 period with no increase likely in the foreseeable future. This spells an end to the roughly 2.5% average annual production growth that has gone on for decades. The reason for the lack of growth is that most of the relatively easy to locate, near-surface gold deposits have been found and the industry has been unable to find any new prolific districts, akin to those of South Africa, Nevada, or Western Australia. The lack of discoveries has not been due to a lack of trying. The chart below shows the dramatic rise in exploration spending in the last decade, while discoveries trended lower.

Gold Discoveries Declined as Exploration Spending Grew

Source: BofA Merrill Lynch Global Research; SNL Financial. Data as of December 31, 2015. Historical performance is not indicative of future results.

This lack of production growth should be supportive of gold prices.

IMPORTANT DISCLOSURE

Issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’). VanEck is a wholly owned subsidiary of Van Eck Associates Corporation based in New York, United States. VanEck Vectors ETF Trust ARBN 604 339 808 (the ‘Trust’) is the issuer of shares in the VanEck Vectors Gold Miners ETF (‘US Fund’). The Trust and the US Fund are regulated by US laws which differ from Australian laws. Trading in the US Fund’s shares on ASX will be settled by CHESS Depositary Interests (‘CDIs’) which are also issued by the Trust. The Trust is organised in the State of Delaware, US. Liability of investors is limited. VanEck Associates serves as the investment adviser to the US Fund. VanEck, on behalf of the Trust, is the authorised intermediary for the offering of CDIs over the US Fund’s shares and issuer in respect of the CDIs and corresponding Fund’s shares traded on ASX.

This is general information only and not financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Investing in international markets has specific risks that are in addition to the typical risks associated with investing in the Australian market. These include currency/foreign exchange fluctuations, ASX trading time differences and changes in foreign regulatory and tax regulations. Before making an investment decision in relation to the US Fund you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.vaneck.com.au or by calling 1300 68 38 37.

Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies or the Trust gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance or any particular rate of return from the US Fund.

An investment in the US Fund may be subject to risks that include, among others, competitive pressures, dependency on the price of gold and silver bullion that may fluctuate substantially over short periods of time, periods of outperformance and underperformance of traditional investments such as bonds and stocks, and natural disasters, all of which may adversely affect the US Fund. Foreign investments are subject to risks, which include changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations, and changes in currency exchange rates that may negatively impact the US Fund’s return. Small- and medium- capitalisation companies may be subject to elevated risks. The US Fund’s assets may be concentrated in a particular sector and may be subject to more risk than investments in a diverse group of sectors.

NYSE Arca Gold Miners Index is a trademark of ICE Data Indices, LLC or its affiliates (“ICE Data”) and has been licensed for use by VanEck in connection with the US Fund. Neither the Trust nor the Fund is sponsored, endorsed, sold or promoted by ICE Data. ICE Data makes no representations or warranties regarding the Trust or the Fund or the ability of the NYSE Arca Gold Miners Index to track general stock market performance.

ICE DATA MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE NYSE ARCA GOLD MINERS INDEX OR ANY DATA INCLUDED THEREIN. IN NO EVENT SHALL ICE DATA HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

Published: 09 August 2018