Expert's choice: 2025 gold rush

A traditional safe-haven asset is gaining momentum in 2025, attracting investor attention. Discover what's driving gold's rise.

In April, ANZ raised its year-end gold price forecast to US$3,600 per ounce and its six-month forecast to US$3,500 from US$3,200 earlier.

The gold price now sits above US$3,200 per ounce. Twelve months ago, it was hovering around US$2,300, representing an impressive return of over 40% for those who held it. But do not fear if you did not.

As a natural hedge against inflation and geopolitical conflicts, gold has an important role in a diversified portfolio, and we think there could be more upside… if you know where to dig (pun intended).

Gold has been one of the best-performing asset classes so far in 2025. Over the first four months of the year its value has risen by over 20%.

It hit a record high of US$3,433.55 in April.

The problem for many investors is that they didn’t have it in their portfolio when the gold price started to rise.

That does not mean, if you don’t have it, you’ve missed out. Gold’s price has steadily risen over the past century.

A higher gold price correlates with investors’ increasing unease about a weakening global financial system. Currently, investors are worried about geopolitical risks, trade wars and government indebtedness.

This uncertainty continues to fuel investors’ demand for gold as a safe-haven asset. You only need to glance at headlines over the past few months to understand investors' lack of confidence.

Owning gold as an investment is easier said than done. Some people buy gold bars via a broker or specialist seller. They then store and insure it themselves. Others prefer to buy a physical gold bullion ETF, like VanEck’s NUGG, which takes care of those ownership aspects like storage and insurance costs.

Despite the recent rally in the gold price, when considering the rationale to invest in gold, we think it warrants an allocation:

The basis for considering a gold allocation for a portfolio is as valid now as ever.

3 reasons to invest in physical gold:

1. Gold retains its value and act as a hedge against inflation

As a physical commodity, gold has value outside the banking and economic systems. Its value is not impacted adversely by bank failures or economic recessions. Because it is tangible (real), gold is often viewed as a safe haven investment. It is the world’s oldest currency, but unlike fiat currencies, gold cannot default or go bankrupt. As a currency, its price may fluctuate over short periods, but the reality is it has been a store of wealth since the Lydians started minting in 560 B.C., and for thousands of years before that, it was being used to craft jewellery and adornments. These purposes have not gone away because the gold price has risen.

Because gold retains its value, it is considered a hedge against inflation. Inflation erodes the purchasing power of a currency.

According to the World Gold Council (WGC), gold can help investors protect against potentially excessive asset price inflation and currency debasement. For example, according to the ABS’s consumer price index data, prices nowadays are about 103% higher than average prices since 2000.

So, putting this into hypothetical gold terms:

- $100,000 left as cash (put under your bed, earning no interest) in the year 2000 would buy roughly $49,100 worth of goods today.

- $100,000 worth of gold in the year 2000 would have retained its purchasing power. That is, it would still buy, at least, $100,000 worth of goods today. It is important to note, however, that the price of gold does go up and down.

As aggressive tariffs are generally perceived as inflationary, investors' demand for gold is likely to persist.

2. Diversification benefits

Many investors hold gold in their portfolios as it provides diversification from other assets. Diversification is a tenet of modern portfolio theory. The principle is that when you diversify, you improve your risk-return trade-off. A well-diversified portfolio has exposure to asset classes that will move in different ways at different times, i.e. they are uncorrelated.

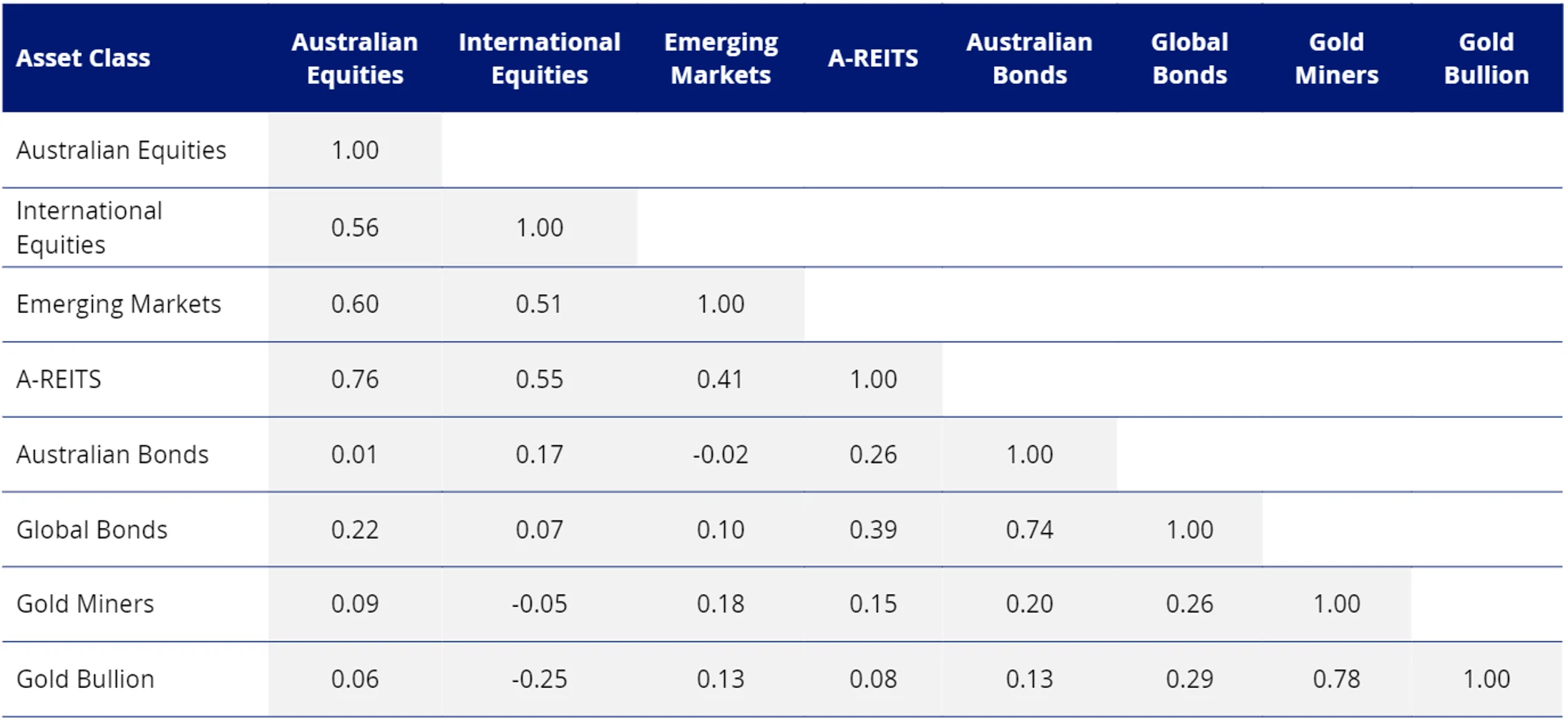

The table below shows the correlation of gold bullion compared to other asset classes. In the table, a 1 is perfectly correlated. The lower the number, the lower the correlation. You can see that over 20-plus years, gold bullion is negatively correlated to Australian equities, international equities, emerging market equities and A-REITs, and it has a low correlation to Australian and global bonds. Gold miners are the only asset class with a high correlation to gold (more on the miners below).

Table 1: Asset class correlations, October 2004 to March 2025

Source: Morningstar Direct, Results are calculated monthly and assume immediate reinvestment of all dividends. You cannot invest in an index. Past performance is not a reliable indicator of future performance. All returns in Australian dollars. Indices used, Australian equities – S&P/ASX 200, International equities – MSCI World ex Australia Index, Emerging markets – MSCI Emerging Markets Index, A-REITS – S&P/ASX 200 A-REIT Index, Global bonds – Barclays Global Aggregate Bond Index A$ Hedged, Australian bonds – Bloomberg AusBond Composite 0+ Yr Index, Gold bullion – LBMA Gold Price PM. Gold Miners is NYSE Arca Gold Miners Index (which launched in October 2004). You cannot invest in an index.

3. Limited supply

Gold is a finite resource. The BBC said, in a recent report, “the below-ground stock of gold reserves is currently estimated to be around 50,000 tonnes according to the US Geological Survey. Based on these figures, there is around 20% still to be mined, although this is a moving target.” Though new gold mines are still being found, discoveries of large deposits are becoming increasingly rare, experts say. The supply of gold remains limited, and this scarcity, as it always has, impacts its value.

As noted above one way to invest in gold is via an ETF, such as VanEck’s Gold Bullion ETF (NUGG).

The gold bullion that physically backs NUGG, is held in a vault by The Perth Mint, and is sourced from Australian gold producers whose operations adhere to the LBMA Responsible Gold Guidance.

In addition to liquidity on the ASX, NUGG gives investors the option of converting their NUGG holdings into physical gold from The Perth Mint.

Digging elsewhere for gold

We mentioned above that the performance of gold is highly correlated to the performance of the gold miners that dig it out of the ground. The relationship is that mining companies typically experience higher operating leverage when gold prices rise and their profit margins expand, potentially leading to outsized earnings growth. The same is true when the price of gold falls.

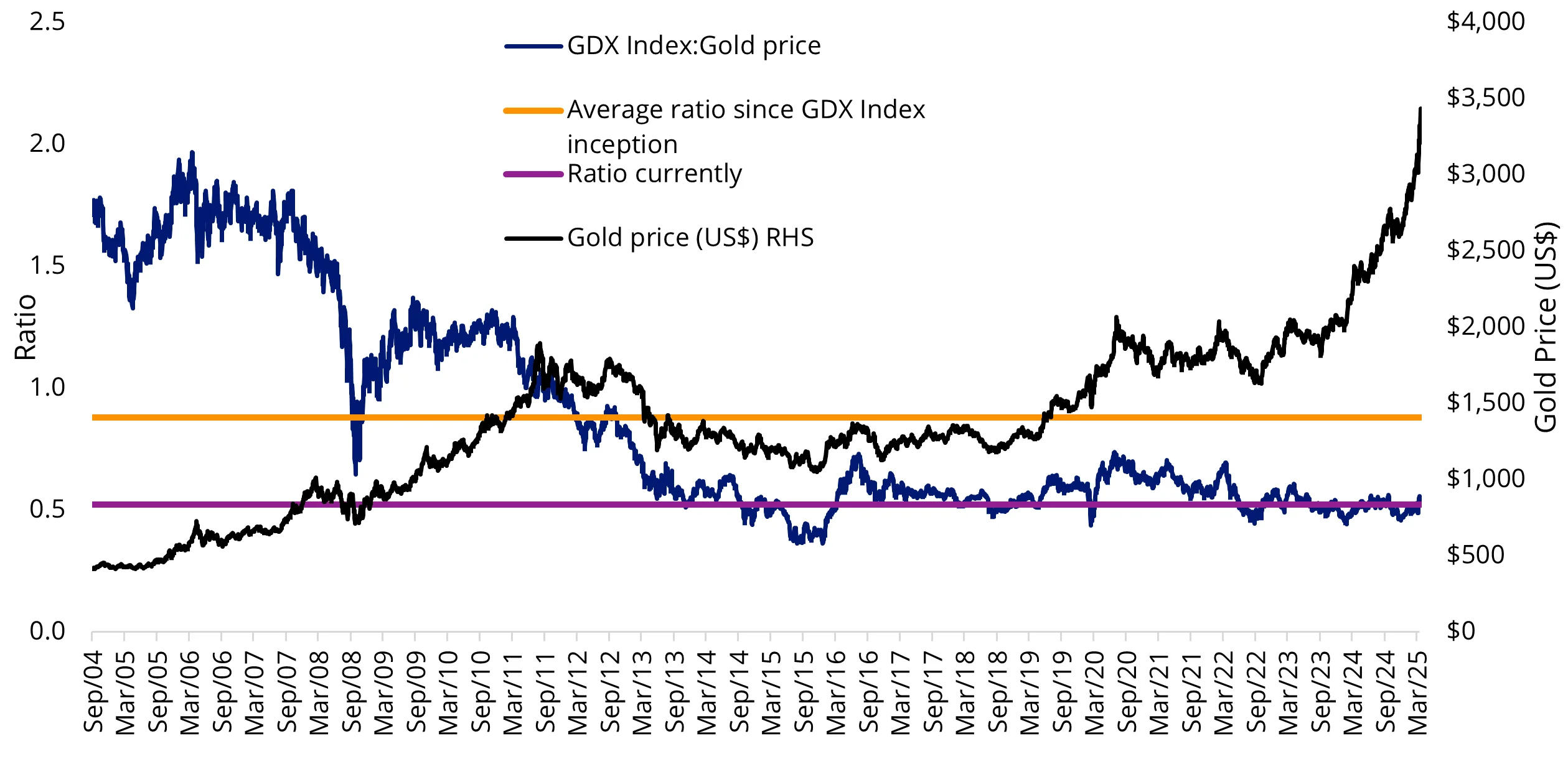

Considering the return of the gold price noted above, miners are, at best, only matching the returns of gold.

Gold miners, we think, remain cheap relative to the price of the metal.

The black line in the chart below shows the price of gold bullion and the blue line shows the ratio of NYSE Arca Gold Miners Index to the price of gold bullion (the index divided by the gold price). When this blue line is falling, gold miners are becoming cheaper, relative to the price of gold and vice versa. The average of this ratio over the 21 years (how long the gold miners index has been around) is approximately 0.8. This average was last achieved when gold was around US$1,900 in 2011. From current levels, a return to the long-term average of 0.80 would need gold miners to rise by approximately 60%.

Source: VanEck, LBMA. Bloomberg, as at 29 April 2025. All figures in US dollars. Past performance is not a reliable indicator of future performance. There is no guarantee that gold miners, as represented by the GDX Index will return to the long-term average ratio. You cannot invest in an index.

Some ETFs include only gold mining companies, such as VanEck’s GDX. Gold miners could be a potential consideration when contemplating an allocation to gold.

Accessing gold with the specialists

VanEck’s global leadership in gold investing stretches more than 50 years, encompassing gold equities and bullion across ETFs and active funds.

Two ETFs for portfolio considerations:

- NUGG – accessing physical gold, that ‘delivers’

- GDX – investing in a diversified portfolio of gold mining companies

VanEck Gold Bullion ETF (ASX: NUGG)

- Australia’s premium gold bullion ETF.

- NUGG’s gold is only sourced from Australian producers whose operations adhere to the LBMA Responsible Gold Guidance.

- Gold bullion is held by The Perth Mint, with a registered gold bar list published daily.

- In addition to trading on the ASX, investors can convert their ETF holdings into physical gold bullion.

VanEck Gold Miners ETF (ASX: GDX)

- The largest and most liquid gold miners ETF.

- With one trade on the ASX, GDX gives investors instant access to 58 of the largest and most liquid global gold mining companies.

- With over 50 years of experience managing gold equities, VanEck has the longest tenure among global asset managers in the gold sector.

Below we outline the risks of each type of exposure to gold, owning gold bullion and owning gold miners:

Differences between gold miners and bullion

|

|

Gold bullion |

Gold miners |

|

Insurance costs |

Gold must be insured, as it can be stolen. |

None |

|

Storage costs |

Gold bullion should be vaulted in a safe location. |

None |

|

Correlation to currencies |

High - The value of gold is priced in US dollars. This means monetary, fiscal, and, as we are finding out now, trading and defence policies contribute to the fluctuation in currencies and, therefore, the price of gold. |

Low to medium, as gold miners can hedge their cash flows, thus mitigating the risks of currency movements. |

|

Supply constrained / exploration |

Mine output is dropping, and ore grades are getting lower and lower. |

Some miners are mining existing deposits. Some also explore and they may find gold, or there may be no gold. It might also be uneconomical to mine the discovered deposit. This is a risk of owning miners. It is worth noting that the rate of finding new gold deposits has been falling, therefore supply of new gold is finite supporting the share price of miners currently mining high grade gold. |

|

Artificial ownership risks |

High – There is more ‘paper’ gold than physical gold and these artificial securities, owned by banks and hedge funds, can distort the price of physical gold. |

Low |

|

Income |

No |

Miners pay dividends to investors |

|

Management risks |

Not applicable |

Like owning any publicly traded company, the quality of management is a risk of owning gold miners. |

|

Correlation to equity markets |

Low |

Higher than bullion, especially during an equity market downturn. |

|

Regulatory risks |

No |

Miners are subject to the rules and regulations of the country of the location of their mines and of the country they are listed in. |

|

Geopolitical risks |

The price of gold may rise if investors are uncertain about geopolitical issues affecting global markets. |

The price of gold miners may rise if investors are uncertain, however, they may also fall, especially if the geopolitical risk directly affects the gold miner or its mines. |

While each gold strategy has its merit for portfolio inclusion, you should assess all the risks and consider your investment objectives.

Past performance is no guarantee of future performance. The above is not a recommendation. Please speak to your financial adviser or stock broker.

For further information you can contact us via email or on +61 2 8038 3300.

Key risks

An investment in NUGG or GDX carries investment risk. These risks vary depending on the fund and may include gold pricing risk, currency risk, custody risk, Australian sourced gold bullion risk, ASX trading time differences, financial markets generally, individual company management, industry sectors, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the PDSs and TMDs for details on risks.

Published: 02 May 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

NYSE® Arca Gold Miners Index® is a trademark of ICE Data Indices, LLC or its affiliates (“ICE Data”) and has been licensed for use by VanEck in connection with the US Fund. Neither the Trust nor the Fund is sponsored, endorsed, sold or promoted by ICE Data. ICE Data makes no representations or warranties regarding the Trust or the Fund or the ability of the NYSE Arca Gold Miners Index to track general stock market performance.

ICE DATA MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE NYSE ARCA GOLD MINERS INDEX OR ANY DATA INCLUDED THEREIN. IN NO EVENT SHALL ICE DATA HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.