Go with the cash flow

Markets and economic data releases point to an imminent recession, but this recession will be different from the recent past as the Fed grapples with choosing between the fight against high inflation or stimulating growth. It cannot do both and either way gold could possibly win.

By the end of 2022, we expect the Gold price to be on an upwards trajectory. Gold miners stand to benefit, as their balance sheets remain strong and they offer something the market will be looking for in an economic slowdown: cash flow.

Markets and economic data releases point to an imminent recession, but this recession will be different from the recent past as the Fed grapples with choosing between the fight against high inflation or stimulating growth. It cannot do both and either way gold could possibly win.

We expect the gold price to increase by the end of the year and its key driver could be a combination of factors, or a single catalyst, including continuing high inflation, ongoing geopolitical tensions, any weakness in the US dollar, or if the Fed does a policy u–turn.

Gold miners stand to benefit too, as their balance sheets remain strong and they offer something the market will be looking for in an economic slowdown: cash flow. Gold miners have become more profitable as the price of the yellow metal has appreciated and since the GFC, gold companies have been implementing changes to address mistakes of the past, which in our opinion, should lead to outperformance by gold equities relative to bullion in a gold bull market. The additional advantage of gold miners is that many pay dividends.

If inflation remains elevated for several years, the financial system will not be able to return to normal for an extended period. This could create a favourable environment for gold and for gold miners to shine. Investors can gain exposure to global gold miners via the VanEck Gold Miners ETF (GDX).

It’s all pointing to a recession, but so far gold has been on hold

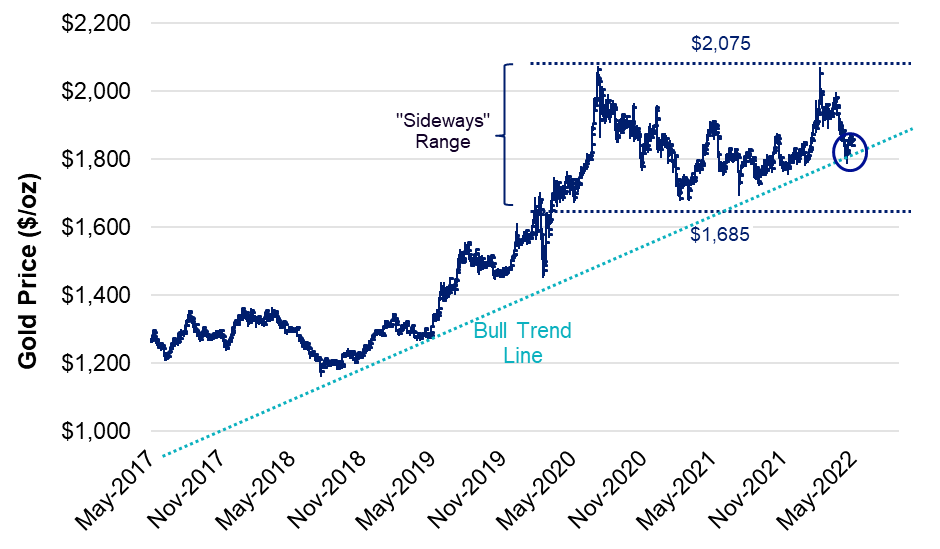

Earlier in the year, driven higher by the Russian invasion of Ukraine, the gold price touched its all-time high price of US$2,075/oz. Since then, it has fallen, now sitting at US$1,841/oz as at 17 June 2022.

The strength of the US dollar has been a headwind affecting the price of gold, rising to a 20-year high in May. The US dollar has benefited from rising interest rates, the Fed’s tough talk on inflation and a favourable economic outlook compared with Europe and China. The chart below shows gold falling below its bull market trend-line that has been in place for three years now and an imminent recession could see the gold price get back on trend.

Source: Bloomberg, VanEck. Data as of 31 May 2022.

During the last four recessions since 1990, the Fed aggressively stimulated the economy. However, those downturns occurred in a secular disinflation environment, where each recession began with an inflation rate that was lower than the last. Today, unless inflation miraculously comes under control, the Fed will have to choose between lower inflation and higher growth. It can’t have both, and it might get neither if stagflation (i.e., high inflation and no growth) sets in. Stratospheric debt levels compound the challenge.

Either way, high inflation may endure and that supports gold

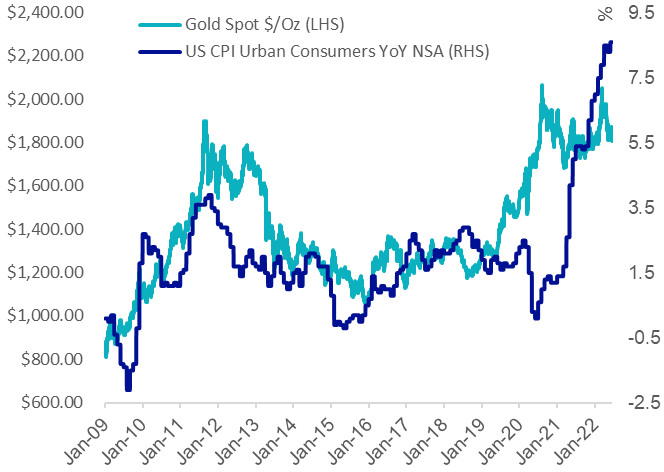

Inflation is likely to persist into the end of the year. Traditionally, to hedge against inflation investors have used gold. In the face of the recent inflation spike, the gold price did not respond as it has in the past.

Figure 2: Gold versus inflation

Source: Bloomberg, Jan 2009 to Jun 2022

The gold price may appreciate if the Fed cannot curb inflation, or if it does a policy u-turn to protect markets.

The added appeal of gold companies

The advantage of holding gold miners in such an environment is that their price typically rises more than the gold price itself, as gold miners will add their own margins to gold production. Many miners pay dividends too, adding to the potential return.

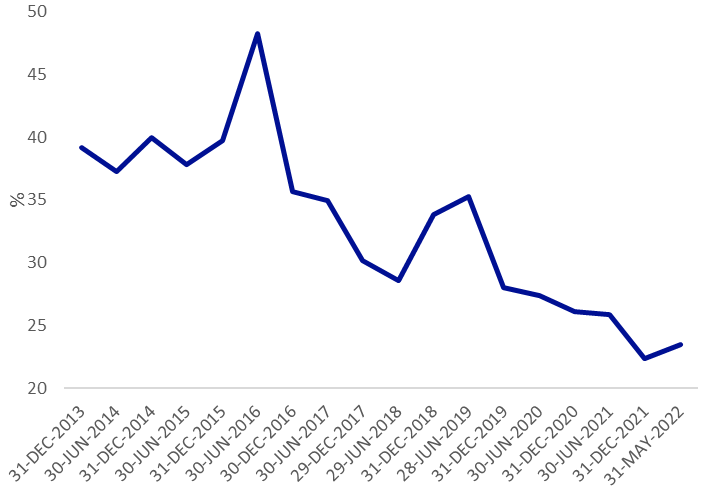

Gold companies have been becoming more profitable as the yellow metal has risen in value since the GFC. Since that time gold companies have been implementing changes to address mistakes of the past that, in our opinion, should lead to outperformance by gold equities relative to bullion in a gold bull market. Gold miners’ balance sheets are strong.

Figure 3: Debt to equity of NYSE Arca Gold Miners Index

Source: Factset, Dec 2013 to May 2022, calculated monthly. GDX tracks the NYSE Arca Gold Miners Index

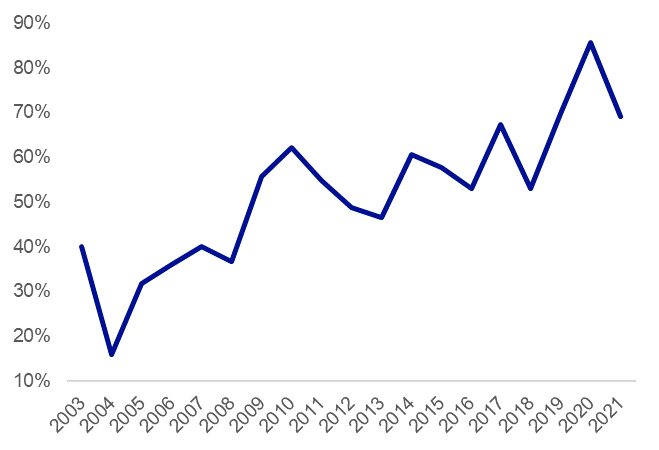

In addition to debt reduction, a focus on cash flow has transformed the valuation of gold miners. More miners have positive free cash flow than ever before and this is leading to more businesses that are profitable with the ability to reward shareholders.

Figure 4: Percentage of gold miners with positive free cash flow

Source: Bloomberg. Gold miners are the constituents of NYSE Arca Gold Miners Index

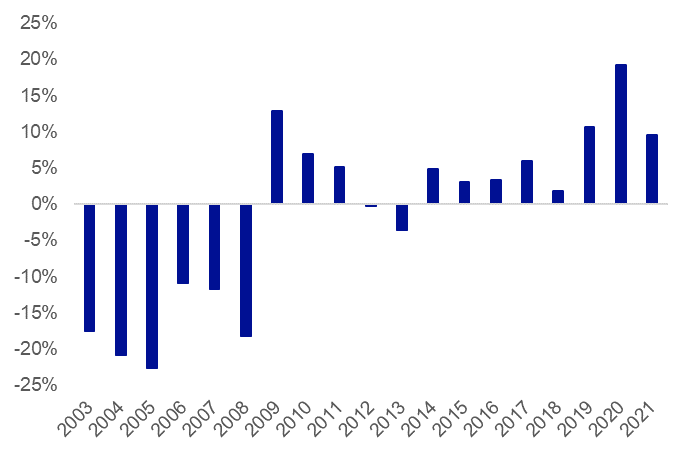

Figure 5: Median free cash flow of gold miners

Source: Bloomberg. Gold miners are the constituents of NYSE Arca Gold Miners Index

Many gold mining companies are holding their costs below US$1,000 an ounce, and are returning the cash to shareholders via increased dividends and share buybacks.

Investors can access the opportunity to invest in gold miners on ASX with GDX. With over 50 years of experience managing gold equities, VanEck has the longest tenure among global asset managers in the gold sector.

Key Risks

An investment in the ETF carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the PDS for details.

Published: 21 June 2022

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

NYSE® Arca Gold Miners Index®

NYSE® Arca Gold Miners Index® is a trademark of ICE Data Indices, LLC or its affiliates (“ICE Data”) and has been licensed for use by VanEck in connection with the US Fund. Neither the Trust nor the Fund is sponsored, endorsed, sold or promoted by ICE Data. ICE Data makes no representations or warranties regarding the Trust or the Fund or the ability of the NYSE Arca Gold Miners Index to track general stock market performance.

ICE DATA MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE NYSE ARCA GOLD MINERS INDEX OR ANY DATA INCLUDED THEREIN. IN NO EVENT SHALL ICE DATA HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE