Gold: Hedge or not?

Rising geopolitical tensions and high persistent inflation has generated interest in gold and gold mining company investments. It has also generated questions from Australian investors about how they should access gold and gold miners. Our view is an unhedged exposure is the best way to get access. Here is why.

In March we highlighted the differences between investing in gold miners and bullion (click here). Rising geopolitical tensions and high persistent inflation has continued to generate investor interest in these assets. It has also generated questions from Australian investors about how they should access gold and gold miners. Our view is an unhedged exposure is the best way to get access. Here is why.

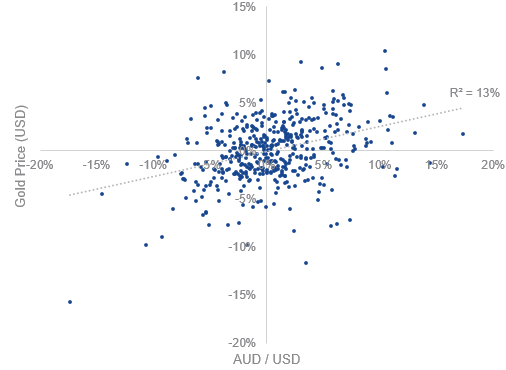

Let’s take a look at the correlation of the gold price in US dollar terms and AUD/USD currency movements since the Australian dollar was floated in December 1983. Correlation measures how strong a relationship is between two variables, in this instance, US dollar gold price movements and changes in the value of the Australian dollar compared to the US dollar.

In the scatter graph (Figure 1) below, you can see there is no specific relationship between the movement in the gold price and changes in the AUD/USD rate because the dots fall in all four quadrants of the graph, they are not skewed to any area. There is no pattern.

One way to express correlation is a statistical measure called R2, pronounced “R squared”. The results of an R2 analysis gives you a score between 0 and 100%. An R2 of 100% would indicate that movements in the gold price can be predicted by movements in AUD/USD. However, as shown below, the R2 is only 13%, therefore there is no evidence to suggest the two variables correlate.

Figure 1: Gold price (USD) versus AUD/USD monthly movements since 1984

Source: Bloomberg. Past performance is not a reliable indicator of future performance.

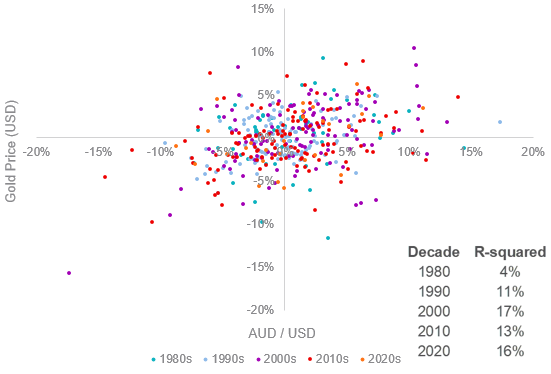

Now, comparing the movements in the two variables over different decades we see each decade produces similar, uncorrelated, results.

Figure 2: Gold price (USD) versus AUD/USD monthly movements since 1984 broken down by decade

Source: Bloomberg. Past performance is not a reliable indicator of future performance.

Because the two are uncorrelated there is no investment rationale to hedge your gold and gold miners exposure back to Australian dollars.

The decision to hedge your exposures is complex. Always speak to a financial adviser to consider your individual financial circumstances, needs and objectives and read the relevant PDS before making a decision to invest. Currency movements are unpredictable and volatile and are just one of the many risks investors have to navigate in these tricky times.

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

Published: 19 May 2022

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.