Gold price target set at US$2,075 record level

Tail risks have aided gold’s sidewise rise

Gold has been in a bull market for over seven years, rising 87% from its secular low in December 2015. However, unlike the steady and predictable bull market of the 2000s, this bull moves up, down and sideways in fits and turns that make price targeting next to impossible.

Chart 1: Gold’s long and winding path to $2,000

Source: Bloomberg. Data as of June 2023. Past performance is no guarantee of future results.

The main drivers of past gold bull markets are extraordinary tail risks and a falling dollar. We are living in an age of tail risks as the world goes through sickness, war, social disorder and financial stress that most people thought were relegated to the past. The level of tail risks today is at least as significant as in past bull markets.

The key difference in the current bull is the strength of the US dollar. Gold has historically had an inverse correlation with the dollar. The 2000s gold bull market saw the US Dollar Index (DXY) decline 40%, while in the seventies the dollar fell 30%. However, since gold bottomed in 2015, the DXY has risen 6.4%. The gains in gold brought on by increasing risks have been muted by US dollar strength.

Chart 2: Dollar strength hasn’t helped

Source: Bloomberg. Data as of June 2023. Past performance is no guarantee of future results.

Gold keeps testing highs again and again (…and again)

A pattern has emerged in the gold price chart that reflects these opposing drivers. For over three years gold has traded in a range between US$1,700 per ounce and the all-time high of US$2,075 per ounce. Gold has tested the high three times but failed each time. In 2020, the dollar and gold rose and fell in tandem with the COVID outbreak and subsequent massive fiscal and monetary response. Gold retested the high in 2022 during the Russian invasion of Ukraine, but fell back on US dollar strength., The high was tested again in 2023 with the Silicon Valley Bank (SVB) banking crisis but has pulled back recently on US dollar strength. Three failed breakouts have damaged investor sentiment towards gold.

Chart 3: Gold’s already attempted several breakouts

Source: Bloomberg. Data as of June 2023. Past performance is no guarantee of future results.

The gold price is currently testing the base of its recent up-trend at around US$1,950 per ounce. If the near-term base holds, gold will soon have another chance to make new highs. If it fails, gold will retreat once again to its sideways range.

The case for US$2,075

There are a number of reasons we believe gold can again test the highs and in the longer term, maintain a higher floor price.

- More risk events are likely. Geopolitical tensions continue to escalate as countries choose sides between East and West. Meanwhile, financial risks are also high. So far, rising rates have exposed black swans in the UK pension system and among mid-tier US banks. The US Federal Reserve (Fed) has indicated rates could remain elevated for an extended period.

- There is reason to believe the dollar will be less of a headwind to gold. The Fed is probably nearing the top of its rate hiking cycle. Many emerging markets countries are increasing their gold reserves and increasing trade in local currencies in an effort to decrease their exposure to the US dollar. The Fed is in the process of reducing its balance sheet, which holds trillions in treasuries. Central banks globally have also been reducing their US treasury exposure.

- Recession. Lastly, the US entered a manufacturing recession in 2023 and tightening credit markets could push the entire economy into recession.

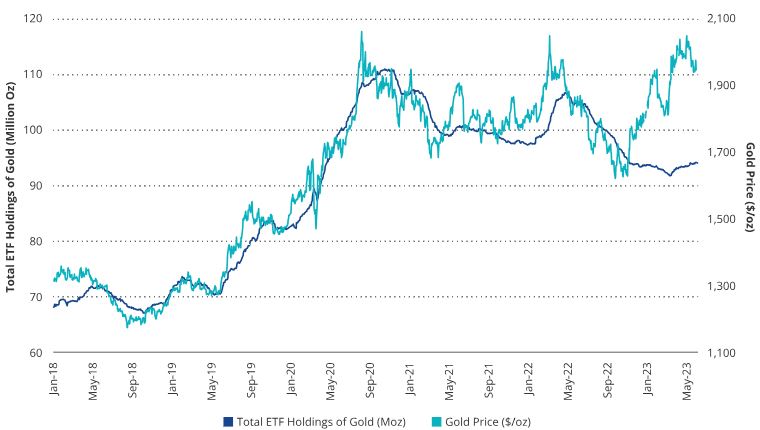

The 2023 banking crisis rally is unique for gold because it occurred without significant inflows to the bullion ETFs. It seems ETF investors remained on the sidelines, fearful of another failed rally, while specs and central banks drove the gold price to its high in May. We believe positive sentiment will return to the gold space once new highs are established and investors regain confidence in the gold market.

What happens if investment demand picks back up?

Source: Bloomberg. Data as of June 2023.

Published: 19 June 2023