Is gold on schedule to catch the inflation train?

Gold shows some resilience

Gold traded in a narrow range in December, finishing at US$1,829.20 per ounce for a US$54.68 (3.08%) gain. The metal posted its low for the month at US$1,753.66 on December 15, following the Federal Open Market Committee (FOMC) meeting in which the Federal Reserve (Fed) set the stage that it would begin increasing rates as early as next spring to combat rising inflation. However, the selling pressure dissipated and gold rallied to the US$1,800 per ounce level the following day. Gold’s resilience suggests the Fed might have a tough time in its battle with inflation.

Lots of action for the miners recently

The larger gold producers gained with the metal as the NYSE Arca Gold Miners Index (GDMNAUDNR) declined slight by 0.35%. However, amid calm gold markets, merger and acquisition (M&A) activity picked up substantially in the fourth quarter.

Three major companies have announced friendly acquisitions of single asset companies, each commanding a premium of 20% to 30%, these include:

- South Africa-based Anglogold is acquiring junior Corvus Gold for its properties in southern Nevada;

- Australian-based Newcrest announced a deal with mid-tier producer Pretium for its mine in British Columbia; and

- Canadian producer Kinross is acquiring junior Great Bear Resources for its development properties in Ontario, Canada.

A smart change for producers

This marks a shift in M&A activity for this gold cycle. Up until now, gold producers have shunned M&A with single-asset juniors, in favour of exploring and developing their existing properties. This has provided organic opportunities that have enabled companies to maintain production and extend mine lives. However, all mineral deposits have their limits, and production would eventually enter a phase of decline. Thus, the majors plan these acquisitions to offset this inevitable decline.

In the last cycle, many companies were caught overpaying for acquisitions that failed to deliver as promised. In addition, companies have historically diluted shareholders by issuing stock to pay for M&A. However, this cycle is different. These three deals have large cash components of 50% to 100%. They are high quality and undervalued at current gold prices. In our view, these are smart acquisitions that will prove to be accretive.

Was 2021 a disappointing year for gold?

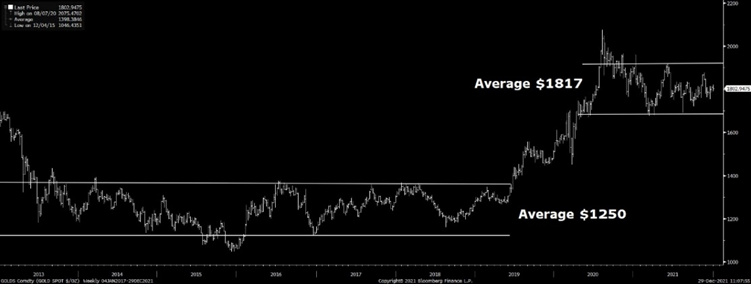

Over the past year, gold established a new higher trading range. The chart shows the old trading range from 2013 to 2019 that averaged US$1,250 per ounce. The uncertainties and risks brought on by the pandemic, along with radical fiscal and monetary policies, have lifted gold to a new high as investors sought safety. Since the pandemic crashed markets in March 2020, gold has averaged US$1,817 per ounce.

Uncertainties have driven gold to a new, higher trading range

Source: Bloomberg. Data as of December 31, 2021. Past performance is not indicative of future results.

While the gold price remains at historically high levels, many gold investors were disappointed by gold’s performance. Gold ended the year with a US$69 loss of -3.6%, at US$1,829.20. We expected strong gains in a year when headline inflation, as measured by the US Headline Consumer Price Index, trended to nearly 8% in November, the highest since 1982. However, focusing solely on inflation ignores other factors that worked against gold. These include:

- Except for some April/May weakness, the dollar trended higher all year, with the US Dollar Index (DXY) gaining 6.4% in 2021;

- Extraordinary fiscal and monetary stimulus following the pandemic outbreak fueled a mania in the markets. In 2021, records were set in options trading, initial public offerings (IPOs), sales of junk bonds and leveraged loans, inflows to equities and exchange traded funds, home prices and valuations of crypto assets. During this period, most investors lacked a sense of risk and saw no reason to invest in safe haven assets; and

- Gold rallied strongly to inflation news in May, October and November. However, in each instance the gold rally was cut short when the Fed discussed or announced changes to its bond purchase plans and rate outlook aimed at fighting inflation. While we believe the belated Fed response to inflation may be too little too late, markets seem to have blind faith in the Fed’s ability to manage the economy.

A “glass half full” approach

While investment demand for gold was weak, physical demand has helped support gold prices in its new higher trading range. Central bank demand has returned to pre-pandemic levels, as a range of countries that include Kazakhstan, Uzbekistan, Hungary, Thailand, Singapore and Brazil are seeing a need to diversify their forex reserves with gold. Jewelry demand in India has returned to pre-pandemic levels. In a report by UBS, Indian imports of gold are running 30% above 2019 levels. Chinese demand has also been improving, with October gold imports at their highest in nearly two years.

High gold prices in a weak gold market proved to be a boon for the gold companies and a bust for investors. The industry is financially healthy and able to return capital to shareholders in the form of dividends and stock buybacks. However, gold is the primary driver of gold stocks and when sentiment towards gold is low, there is little interest in gold stocks. As a result, the GDMNAUDNR declined 3.81% on the year. The underperformance has driven valuations to historic lows, so any pickup in the gold price should bode well for gold stocks.

Also, it may not be over…

There have only been two other inflationary periods in the last 50 years. The first was in the seventies, the second from 2003 to 2008. In each of these inflationary periods, gold underperformed commodities in the first half and outperformed in the second half. Markets do not take inflation or gold seriously until it proves to be intractable.

There are reasons to believe 2022 will see the beginning of a wage/price spiral, which include:

- The S&P CoreLogic Case-Shiller National Home Price Index rose 19.1% in October from a year earlier. This is not yet reflected in the US Headline Consumer Price Index, which lags due to its method of measuring housing costs, as owner’s equivalent rents5(OER) are up just 3% this year;

- The priciest housing market in history is forcing many potential buyers to keep renting. According to Realtor.com, asking rents are up 20% for the year ending in November and it expects increases of 7% in 2022;

- Record job openings outnumber unemployed workers by about four million and people are quitting jobs in record numbers. In October, there were 67 unemployed for every 100 open positions;

- Wages for all private sector workers grew at an annual pace of 4.6% in the third quarter, yet average hourly earnings after inflation declined 2.7% so far this year. The conference board finds that companies are setting aside an average of 3.9% of payroll for wage increases for 2022;

- An inflation psychology is beginning to take hold, as unions are beginning to get cost-of-living adjustments6(COLAs) written into their wage contracts;

- Americans have lots of money to spend. A New York Times article published on November 7 estimates that Americans have US$2.3 trillion more in savings than would have been expected in the pre-pandemic path;

- Many food manufacturers say they plan to raise prices further in 2022. General Mills increased its cost inflation estimate for 2022 to between 7% and 8%; and

- The seismic shifts in consumption patterns, manufacturing logistics and green economy needs may continue to bring shortages in the longer term.

Policy remains a key risk

In addition to inflation, the shift in Fed policies to tightening in 2022 brings a new set of risks that could drive gold. The Fed has a history of remaining too easy for too long, which has impacted the economy negatively in the past. Currently, the Fed is set to end the tapering of its bond purchases by March, clearing the way for rate increases. Meanwhile, it appears that President Joe Biden’s plans to spend trillions to “build back better” are failing. Without all the stimulus, markets are at risk, the economy might falter and debt service costs could escalate.

Rate increases could be favourable for gold, according to a report by UBS. In this report, gold’s performance was analysed in the period six months before and after each of the past three initial rate hikes of each cycle, in 1999, 2004 and 2015. Gold was found to decline between 5% and 10% in the six months before each initial hike. In contrast, for the six months following each initial hike, gold gained between 10% and 20%. From this analysis, perhaps gold’s weak performance in 2021 was a normal pre-rate hike behavior and that 2022 could be an interesting year for gold to gain.

Published: 12 January 2022

Important Disclosures

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (‘VanEck’) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed. Past performance is not a reliable indicator of future performance.

NYSE® Arca Gold Miners Index® is a trademark of ICE Data Indices, LLC or its affiliates (“ICE Data”) and has been licensed for use by VanEck in connection with the US Fund. Neither the Trust nor the Fund is sponsored, endorsed, sold or promoted by ICE Data. ICE Data makes no representations or warranties regarding the Trust or the Fund or the ability of the NYSE Arca Gold Miners Index to track general stock market performance.

ICE DATA MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE NYSE ARCA GOLD MINERS INDEX OR ANY DATA INCLUDED THEREIN. IN NO EVENT SHALL ICE DATA HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.