Duration dilemma

Investors in traditional fixed rate bonds have benefited over the last 10 years from falling interest rates due to the inverse relationship between interest rates and bond prices. With interest rates at historic lows, it’s important to consider the risks of the potential loss of capital on fixed rate bonds in the event of rising interest rates.

Investors in traditional fixed rate bonds have benefited over the last 10 years from falling interest rates due to the inverse relationship between interest rates and bond prices.

With interest rates at historic lows, it’s important to consider the risks of the potential loss of capital on fixed rate bonds in the event of rising interest rates. It is also important to understand how investing in Floating Rate Notes (FRNs) mitigates this risk due to the variable nature of coupon (interest) payments associated with such bonds.

Global interest rates

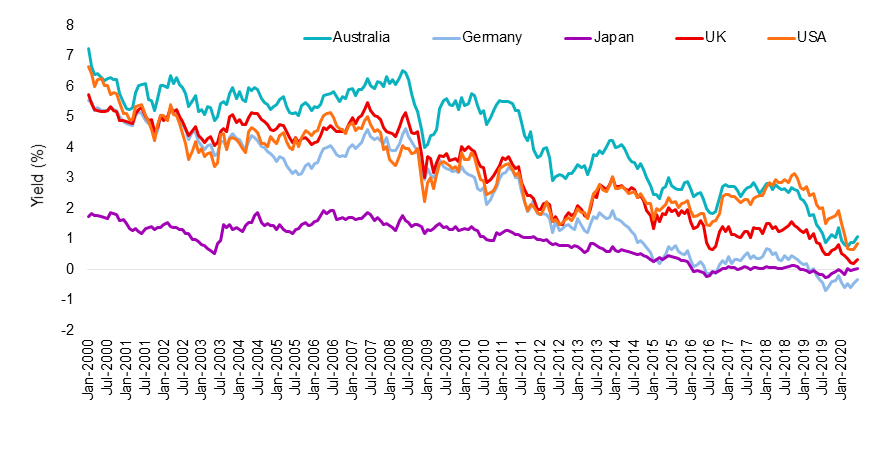

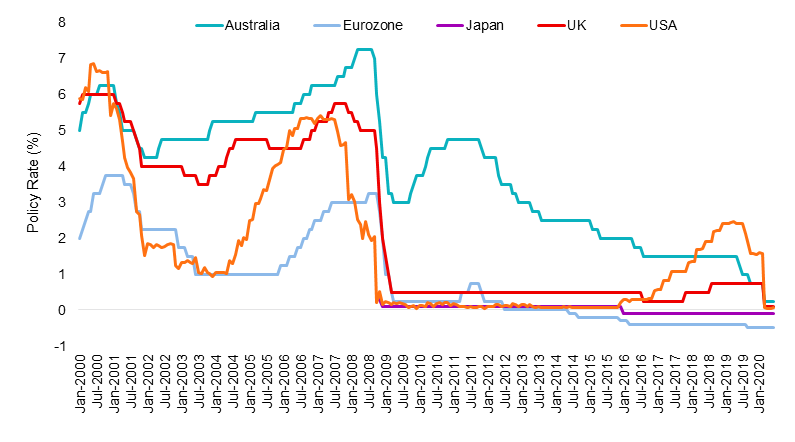

Australian interest rates have now reached historic lows, consistent with the other major developed economies. The RBA cash rate is at 0.25% and the 10 year government bond yield is at 0.90%. The low interest rate environment presents a challenge for investors.

Figure 1. 10 Year Government Bond Yields

Source: Bloomberg. As at 31 May 2020

Figure 2. Global Policy Rates

Source: Bloomberg. As at 31 May 2020

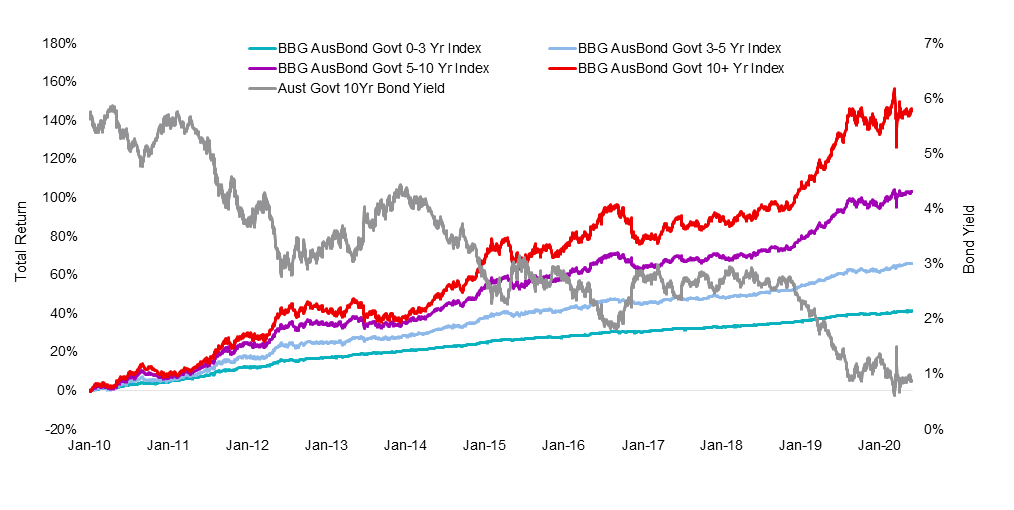

Fixed income performance

The last decade of falling interest rates has benefitted investors in traditional fixed rate bonds due to the inverse relationship between interest rates and bond prices. The longer the duration of a bond, that is, the longer the time to its maturity, the greater the effect of a change in interest rates on the value and therefore price of the bond. As interest rates have come down, investors that held longer-term fixed rate bonds saw greater returns, through either selling the bonds at a higher value than they bought them for, or by receiving ongoing higher yields relative to the lower yielding bonds coming to market.

Figure 3. Australia Government Bond Indices at different terms versus 10 year bond yield

Source: VanEck, Bloomberg. As at 31 May 2020

However, with interest rates now near zero and the RBA declaring the cash rate has reached the “effective lower bound”, it’s important for investors to consider how an increase in interest rates from here will impact bond valuations, particularly in relation to recently issued bonds with low coupon rates. For fixed rate bonds, an increase in rates means a decrease in the bond price. The longer the duration, the bigger the decrease in value.

Enter FRNs

A Floating Rate Note (FRN) is a type of bond that pays a coupon based on a variable or ‘floating’ rate of interest. FRNs mitigate duration risk as their coupon (interest) payments are variable as opposed to fixed which offsets the effect of rising interest rates on valuations. To illustrate this, we compare a selection of fixed income indices with two of our ETFs which invest in FRNs.

Table 1. Modified duration comparison by index/fund

|

Bond Type |

Index / Fund |

Modified Duration |

|

Fixed |

Bloomberg Ausbond Govt 10+ Yr Index |

11.93 |

|

Fixed |

Bloomberg AusBond Composite 0+Yr Index |

5.67 |

|

Fixed |

Bloomberg AusBond Corporate 0+Yr Index |

3.72 |

|

FRN |

VanEck Vectors Australian Floating Rate ETF (ASX: FLOT) |

0.14 |

|

FRN |

VanEck Vectors Australian Subordinated Debt ETF (ASX: SUBD) |

0.14 |

Source: VanEck, Bloomberg. As at 31 May 2020

Modified duration is the percentage decrease in the value of a bond that would result from a 1% increase in interest rates. So the table above shows that a 1% increase in interest rates would decrease the value of Bloomberg AusBond Govt 10+ Yr Index by 11.93%. In contrast, the value of FLOT’s and SUBD’s FRNs would fall by only 0.14%.

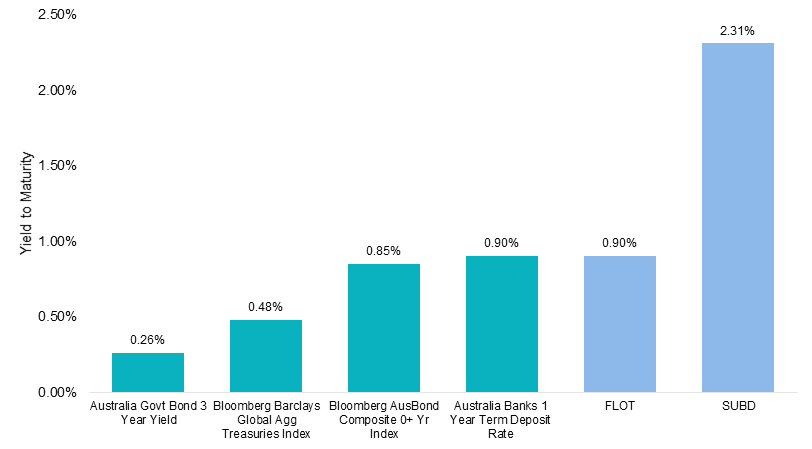

For investors seeking income, who are willing to take on greater levels of risk than holding cash, traditional fixed rate bonds and term deposits, floating rate notes including subordinated bonds can enhance yield, but with increased levels of credit risk.

Figure 4. Yield to Maturity Comparison

Source: VanEck, Bloomberg. As at 31 May 2020. Yield to Maturity (YTM) is the estimated annual rate of return that would be received if the fund’s current securities were all held to their maturity and all coupons and principal were made as contracted. YTM does not account for fees or taxes. YTM is not a forecast, and is not a guarantee of, the future return of the fund which will vary from time to time.

Learn more about the different types of bonds and how you can include these in your investment portfolio here.

Always read the relevant PDS and speak to a financial adviser to consider your individual financial circumstances, need and objectives, before making a decision to invest.

Published: 25 June 2020

FLOT is based on the Bloomberg AusBond Credit FRN 0+ Yr Index (‘FLOT Index’). The FLOT Index is the property of Bloomberg Finance L.P. and its affiliates (collectively, “Bloomberg”). Bloomberg are not affiliated with VanEck and do not approve, endorse, review, or recommend FLOT. BLOOMBERG and the Bloomberg AusBond Credit FRN 0+ Yr Index are trademarks or service marks of Bloomberg licensed to VanEck. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to FLOT.

SUBD is based on the iBoxx AUD Investment Grade Subordinated Debt Index (‘SUBD Index’). The SUBD Index is the property of Markit Indices Limited (‘Markit’) and iBoxx® and Markit® are trademarks of Markit or its affiliates. The SUBD Index and trademarks have been licensed for use by VanEck. SUBD is not sponsored, endorsed, or promoted by Markit.