Diversification, defence and DFND

Unhappily, the world has changed from countries celebrating the peace dividend, a term used to describe the economic benefits of a decrease in defence spending. Instead, countries are ramping up military expenditure. Europe’s recent urgent push, in particular, to rearm has shone a light on the continent’s defence companies and their shares. This is part of a global trend, and this rebound in defence spending is likely to affect contractors around the globe.

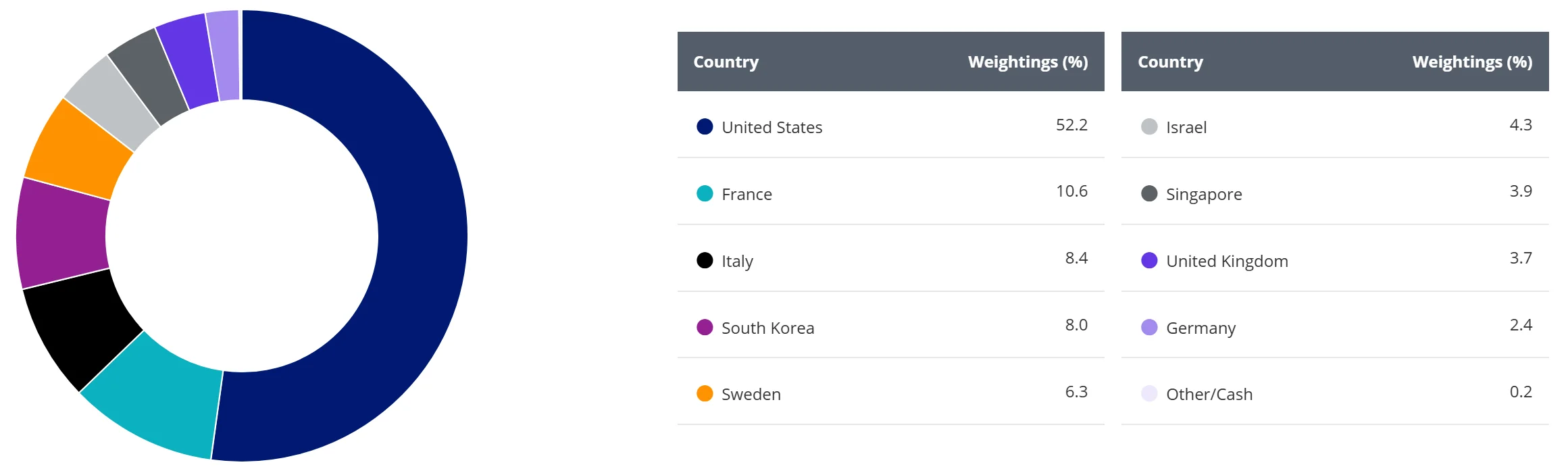

This is why we think diversification within the defence sector is important. Diversification should be by country, sector and names. The VanEck Global Defence ETF (ASX: DFND) includes 29 companies and is diversified by country and sub-sector allocations.

Chart 1: Country weightings of DFND

Source: VanEck, 31 May 2025.

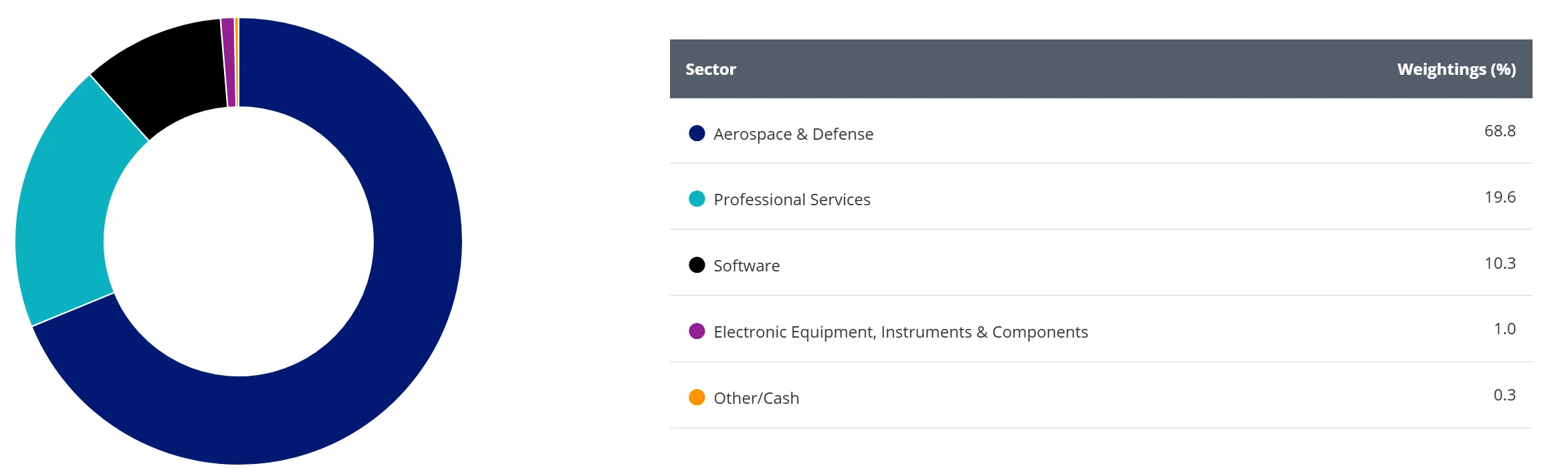

Chart 2: Sub-sector weightings of DFND

Source: VanEck, 31 May 2025.

DFND was the first defence ETF to list on ASX, and it gives investors exposure to a portfolio of the largest global companies involved in aerospace & defence, research & consulting, application software, cyber security and electronic equipment & instruments.

DFND tracks the MarketVector Global Defence Industry (AUD) Index.

The fund’s index methodology is unique from other defence ETFs that have subsequently listed in two ways:

- Investment focus on defence: Constituents must derive 50% of their revenues from military or defence industries. This criterion excludes companies like Boeing Co, which reported only 35% of its revenue from military or defence sectors.

- Controversial weapons screen: Companies that have a verified involvement in controversial weapons are screened for exclusion based on certain criteria. Further details on screening criteria can be found here. There is also a further discussion later in this blog.

This index (the US dollar and defence with an ‘s’ version) is also tracked by VanEck’s Defense UCITS ETF (DFNS)1, which has a 2+ year track record listed in Europe and has generated over US$5.8 billion in assets under management, much of this was raised in the past 12 months.

The interest in defence companies in Europe is understandable.

A focus of Europe’s race to rearm

After languishing at low levels since the end of the Cold War and the collapse of the Soviet Union in 1991, Europe’s defence spending is recovering as the Ukraine war grinds well into its third year. The Pax Americana period of US dominance that kept relative peace is waning, and European governments have little choice but to rearm.

To aid this effort, Europe is buying a significant amount of arms abroad. According to a Stockholm International Peace Research Institute (SIPRI) Fact Sheet, published in March 2025, European arms imports increased by 155% between 2015-2019 and 2020-20242. Unsurprisingly, Ukraine was among the top 10 importers of US arms in the latter period, but so too were the United Kingdom, the Netherlands and Norway.

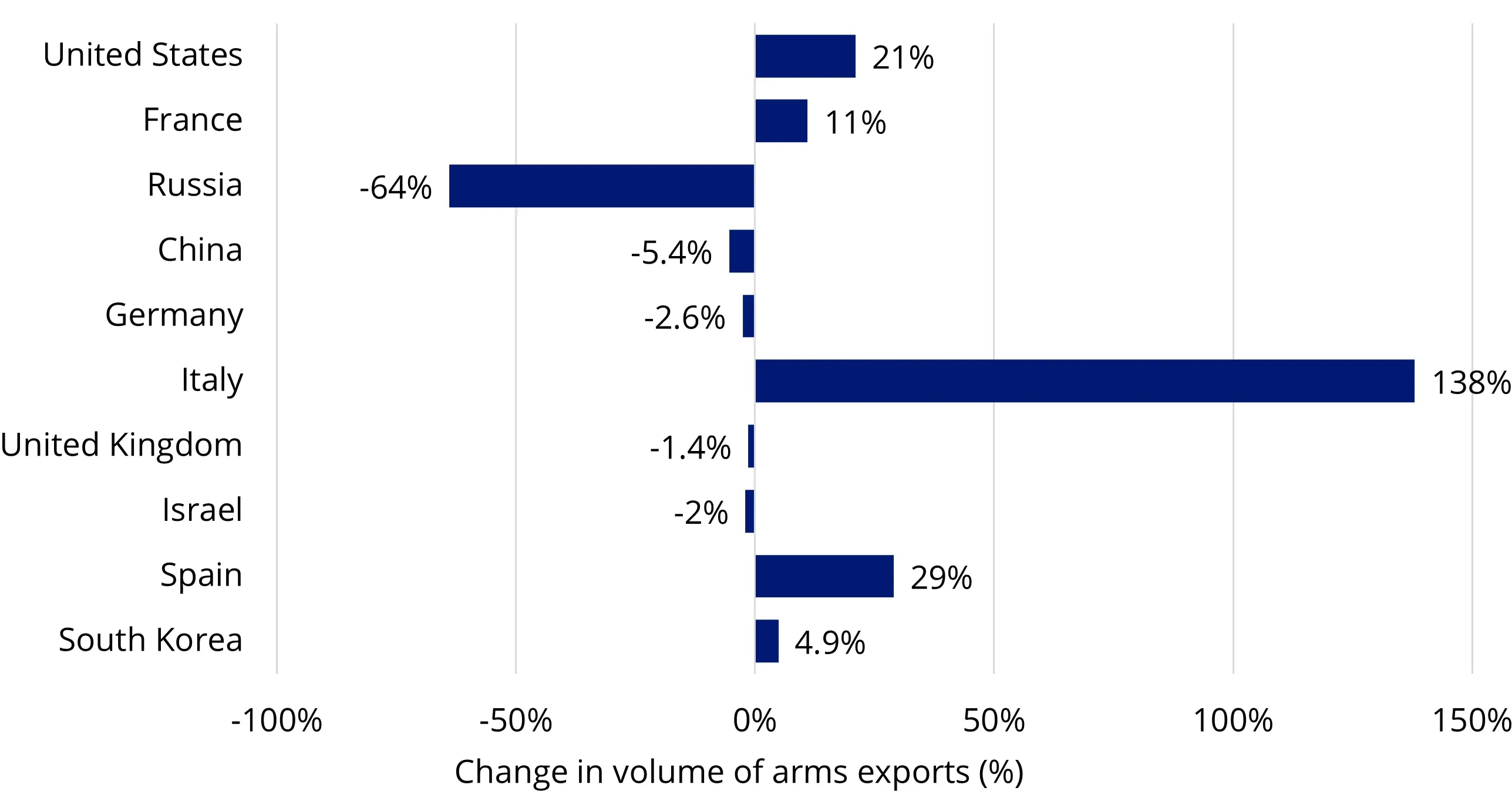

While Europe’s defence industry is now gearing up and its anticipated growth has yet to show up in backward-looking data, the continent’s governments are directing significant spending to the big US contractors that currently have the manufacturing capacity and technology they need. That’s despite the European Union’s stated preference for buying arms within the bloc3.

Chart 3: Changes in volume of exports of major arms since 2015–19 by the 10 largest exporters in 2020–24

Source: SIPRI Arms Transfers Database, March 2025.

Europe’s surging defence spending

In May, the EU’s announcement of a €150 billion loan-for-arms fund, known as Security Action for Europe (SAFE), highlighted its seriousness about a five-year rearmament plan. At the same time, countries are increasing spending from national budgets to meet and exceed the NATO military alliance’s commitment of spending 2% of gross domestic product on defence, a level that’s expected to rise shortly.

SAFE’s emphasis on European production explains why many European defence contractors’ shares have risen so far in 2025. It allows EU countries to borrow from Brussels and spend on weapons systems and platforms through joint procurement, provided that at least 65% of the value of the components is from arms companies in the EU and specific neighbouring countries. Similarly, the European Defense Industrial Strategy, published in March 2024, proposes EU countries should buy at least 50% of their defence needs from EU contractors by 2030, rising to 60% by 2035.

But that still leaves a lot to be purchased elsewhere. This is why diversification within the sector is key.

US manufacturers are growing fastest

Whether due to US military needs or imports from Europe and elsewhere, US defence manufacturers continue to grow. An analysis of SIPRI data, published in December 20244shows that the 41 US companies among the top 100 arms producers grew their revenues by 2.5%. Yet the 21 European companies in the top 100 increased revenues by just 0.2%, the smallest increase in any world region.

European armed forces may have little choice but to buy US arms if they want the most up-to-date and capable military equipment. That’s because the US has maintained investment in research and development over recent decades, while it has dwindled in Europe.

Budgets outside of Europe

In support of its defence technology, the US budget for so-called research, development, testing and evaluation totalled $118.7 billion in 2022. By contrast, European spending on research and technology fell by €200 million in 2023, according to European Defense Agency data.

The above does not include the rest of the US’s massive defence budget. The US Department of Defense's budget request for fiscal year 2025 was US$849.8 billion.

Closer to home, Australia itself has committed to increasing its defence spending. Budget papers show that by 2033 to 2034 our defence spending will hit $100 billion (or about 2.3% of GDP), an increase from last year’s record $37 billion (2.0% of GDP).

Putting the opportunity into action

Despite these tailwinds, Australian investors are underweight defence stocks because there is scant opportunity on the ASX.

DFND provides investors with diversified access to at least 25 leading defence technology companies, large-scale cyber security firms and defence-relevant service providers based in NATO countries or NATO-friendly countries.

Performance

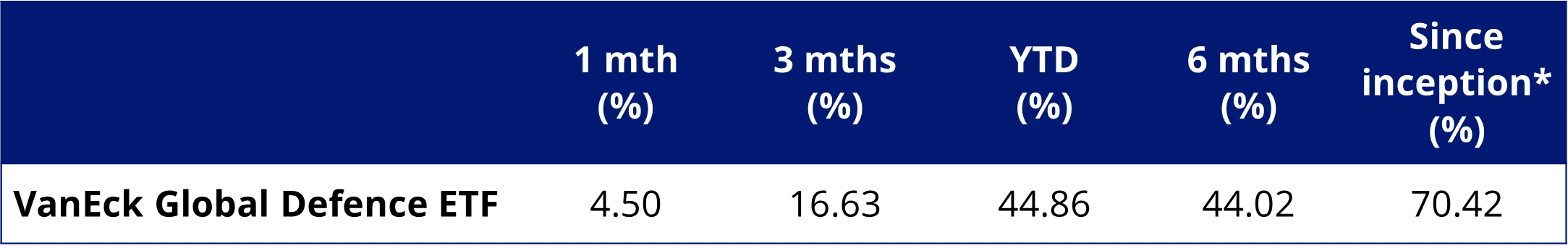

Since its inception, DFND has been one of the best-performing ETFs on ASX. Noting this is a short period, and past performance should not be relied upon for future performance.

Table 1: DFND trailing performance to 26 June 2025

*DFND Inception date is 10 September 2024. A copy of the factsheet is here. DFND is a newly traded fund on ASX with a short performance history and this should not be relied upon for future performance.

Table 1 source: Morningstar Direct. The chart and table above show past performance of DFND. Results are calculated to the last business day of the month and assume immediate reinvestment of distributions. DFND results are net of management fees and other costs incurred in the fund, but before brokerage fees and bid/ask spreads incurred when investors buy/sell on the ASX. Past performance is not a reliable indicator of future performance. Click here for more details.

What makes DFND different

The most important difference that DFND’s index has, relative to peers, is that it excludes companies that violate certain business involvement criteria:

- companies that have a verified involvement in controversial weapons activities are excluded; and

- companies that violate Norms Based Research screening which are aligned with the Principles of the UN Global Compact and the OECD Guidelines for the Multinational Enterprises are excluded.5

No other defence ETF listed on ASX has these exclusionary screens. While DFND does not have an ESG investment objective, nor does the Fund promote ESG outcomes we believe that a suitable investment in defence companies should satisfy certain minimum safeguards. The details of the business involvement screens are available here.

Examples of controversial weapons that are screened for are white phosphorus and depleted uranium. White phosphorus is considered controversial due to its potential use against civilians and its ability to cause severe harm to civilian populations, while depleted uranium is radioactive and poisonous. These are just two filters that establish a baseline for humanitarian considerations alongside the Norms Based screening which aligns with human rights standards.

Let’s have a look at some of the companies that DFND currently excludes:

What’s not in DFND and what is

The following companies have been screened out of DFND’s index due to the following violations and involvements.

Table 2: DFND company exclusions

As a result of its exclusions, DFND’s top 10 may be different to its peers, which could include these holdings.

Table 3: DFND’s Top 10 holdings

Source: FactSet, as at 22 June 2025. Not a recommendation to act. Past performance is not indicative of future performance.

Accessing the growth story of the global defence sector

For investors seeking access to global defence stocks, the VanEck Global Defence ETF (DFND) offers targeted, pure play exposure to the largest global companies in this segment – which are typically under-represented in broad-based benchmarks.

The above is not a recommendation. Please speak to your financial adviser or stockbroker.

For further information you can email us or call on us on +61 2 8038 3300.

Key risks: An investment in the ETF carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the DFND PDS and TMD for more details on risk.

Source:

1 - This is not a recommendation to act or promotion of the product.

2 - SIPRI TRENDS IN INTERNATIONAL ARMS TRANSFERS, 2024, published in March 2025.

3 - Security Action for Europe (SAFE) instrument, published in May 2025. https://www.consilium.europa.eu/en/press/press-releases/2025/05/27/safe-council-adopts-150-billion-boost-for-joint-procurement-on-european-security-and-defence/

4 - THE SIPRI TOP 100 ARMSPRODUCING AND MILITARY SERVICES COMPANIES, 2023, published in December 2024.

5 - Companies are scored 1-10 based on involvement in violations of international standards (e.g. labour rights, corruption, environmental harm, discrimination, human rights).

Scores of 9 or 10 result in exclusion from the DFND Index. A 10 means a verified, unresolved failure to meet norms; a 9 indicates an imminent failure via a binding contract.

Assessments include direct involvement, joint ventures, majority-owned (≥50%) or controlled subsidiaries, or financial services directly linked to the conduct. Please read the full details for the screens here.

Published: 27 June 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au You should consider whether or not any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

The MarketVector Global Defence Industry (AUD) Index (‘MVIS Index’) is the exclusive property of MV Index Solutions GmbH based in Frankfurt, Germany (‘MVIS’). MVIS is a related entity of VanEck. MVIS makes no representation regarding the advisability of investing in the Fund. MVIS has contracted with Solactive AG to maintain and calculate the MVIS Index. Solactive uses its best efforts to ensure that the MVIS Index is calculated correctly. Irrespective of its obligations towards MVIS, Solactive has no obligation to point out errors in the MVIS Index to third parties