Finding opportunities off the beaten index

The equity market rally since the US “Liberation Day” has been remarkable. Major benchmarks such as the MSCI World, S&P 500, and S&P/ASX 200 are each up approximately 15% in AUD terms (as at 11 July) and are trading at all-time highs. This exuberance has been supported by several newly announced US trade deals with countries including the UK, China, and Vietnam, and many more reportedly nearing finalisation. Additionally, investors appear to have shrugged off the impact of recent flare-ups in geopolitical tensions and the ever-growing US government debt.

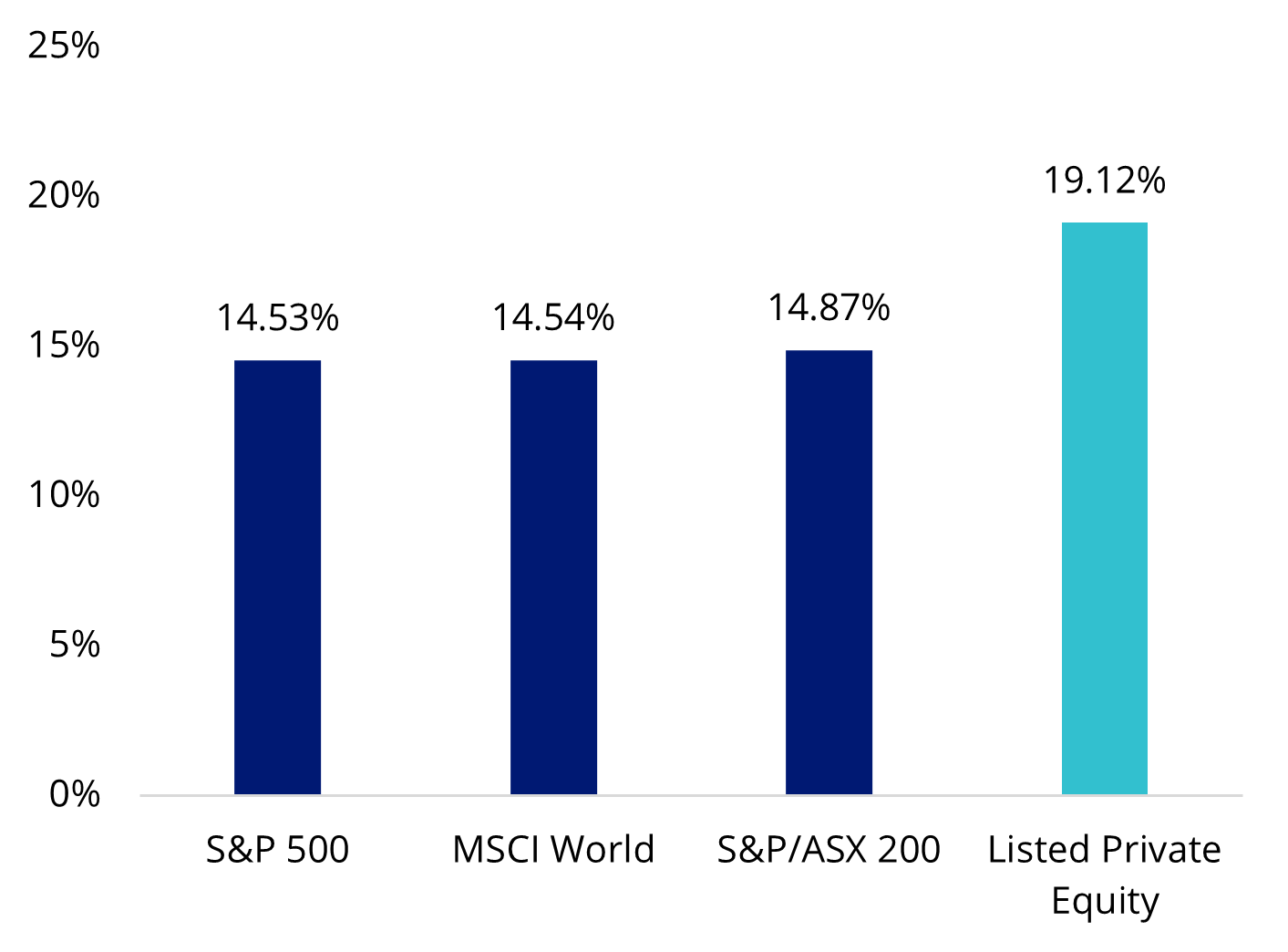

Amid the step-up in risk sentiment, one asset class has outperformed these indices yet continues to fly under the radar: listed global private equity, which has gained 19.12since US Liberation Day (as at 11 July). This segment refers to publicly traded companies that invest in or manage private equity, and there are several reasons we think it has further room to move.

Chart 1: Private equity performance since US Liberation Day

Source: Bloomberg, 8 April 2025 to 11 July 2025. Listed Private Equity as LPX50 Index. . Past performance is not indicative of future performance. You cannot invest in an index.

1. The higher beta play

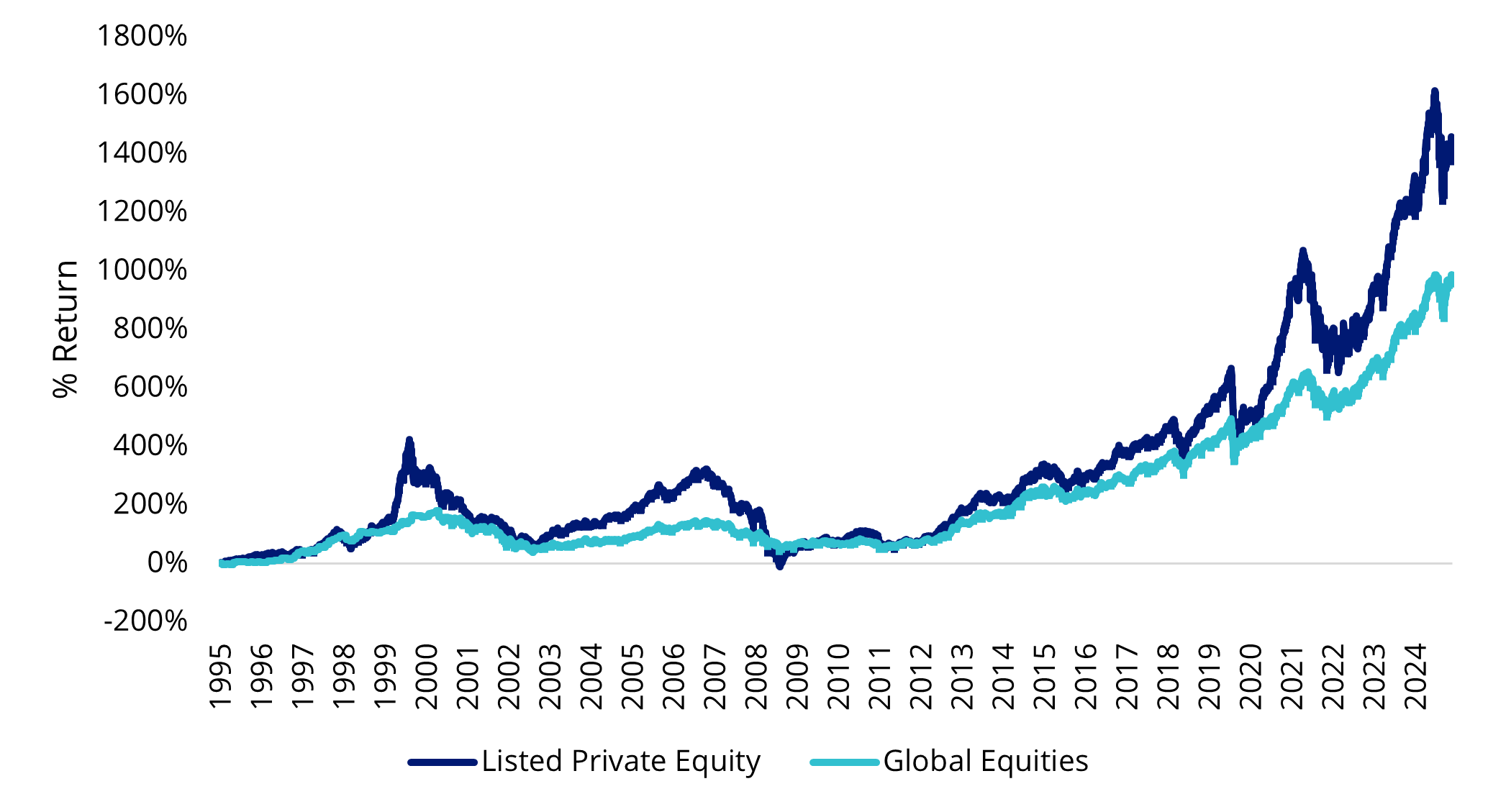

Should economic conditions improve, equity markets could continue to climb. The higher risk profile of private equity means it has tended to outperform broader global equities in up markets. Over the past 30 years, listed global private equity has outperformed broader global equities by 1.25%p.a, with an equity beta of 1.23. This means that for every 1% move in global equities, listed global private equity has historically moved by 1.23%.

Chart 2: Listed private equity has outperformed bull markets for the last 30 years

Source: Bloomberg, 1 July 1995 to 30 June 2025. Listed Private Equity as LPX50 Listed Private Equity Index. Global Equities as MSCI World. . Past performance is not indicative of future performance. You cannot invest in an index.

2. Acceleration in private equity deals

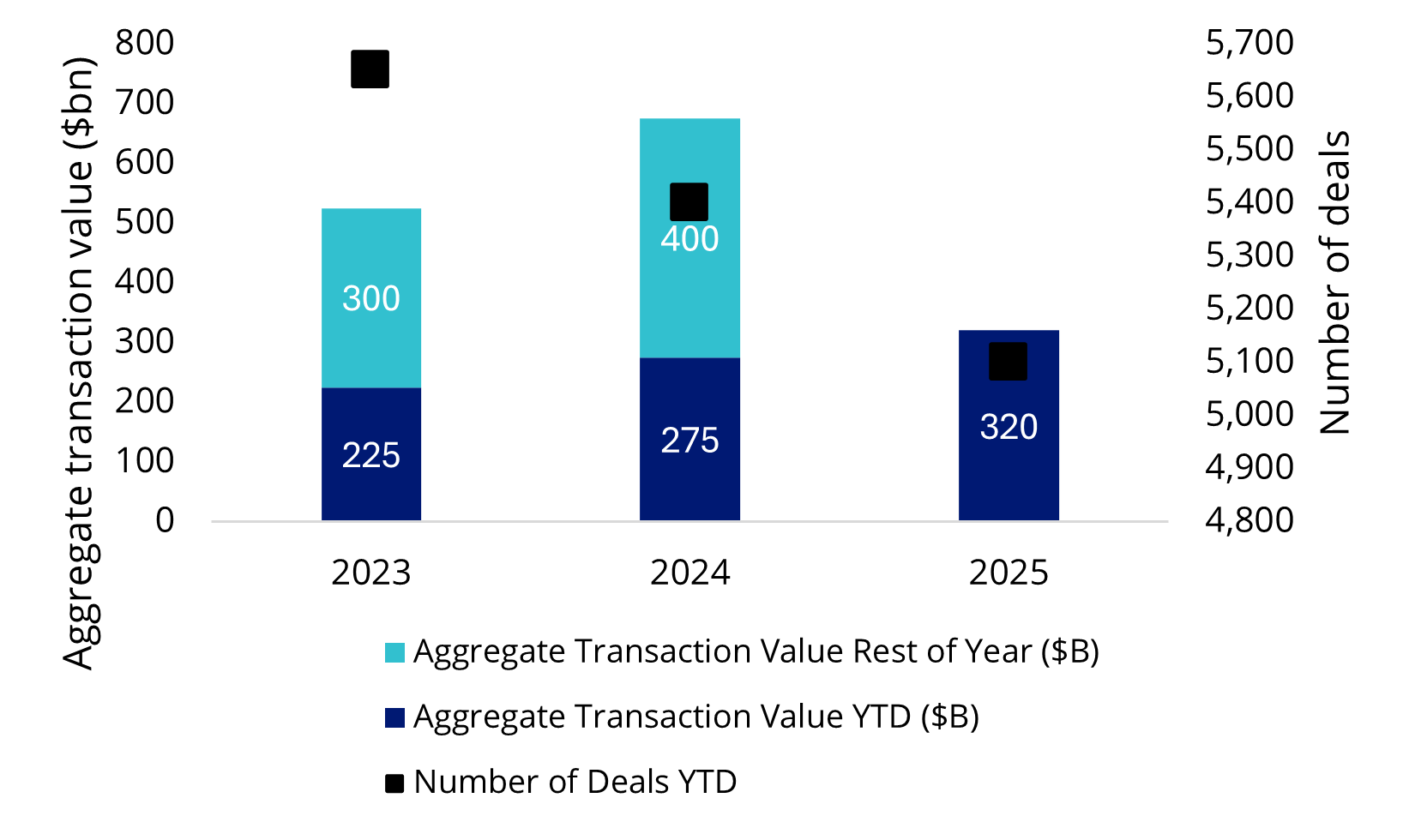

Despite the spike in economic and policy uncertainty following Trump entering office, global private equity transaction deals from 1 January 2025 to 30 May 2025 have outpaced the prior comparative periods in the previous two years. According to S&P, these deals accounted for a total US$320 billion for the first five months of 2025 – a 16% increase on the same period in the year before. While stagflation fears have surfaced following markets assessing the impact of US tariffs, this hasn’t come to fruition yet, and with inflation near 2% and interest rates falling globally, private equity activity has galvanised.

Chart 3: Global private equity and venture capital entries since 2023

Source: S&P, 1 January 2023 to 31 May 2025. Performance in USD.

Megadeals announced in May alone include Blackstone’s acquisition of TXNM Energy Inc and 3G Capital’s acquisition of Skechers USA, each valued at over US$10 billion. clearly signals a healthy backdrop for deal-making and should continue to drive valuations higher, as private equity firms look to unlock synergies.

3. Valuations compelling

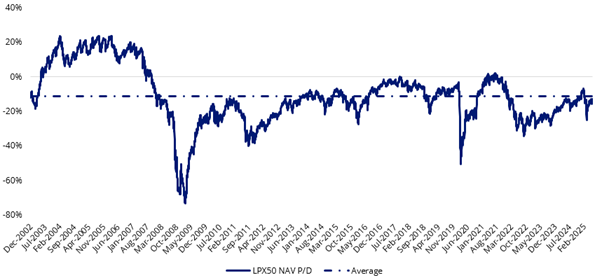

With many asset classes “priced to perfection”, listed private equity is one of a few still trading at a significant discount to the net asset value of its underlying assets. Leading private markets index provider LPX calculates the Net Asset Value (NAV) performance development of the 50 largest listed private equity companies based on the underlying portfolio of private equity investments owned by each listed company comprising the LPX50 Index - this is the LPX50 NAV index. The latest discount is 11.34%.

Chart 4: Listed private equity premium/discount to NAV

Source: LPX AG. As at 11 July 2025. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

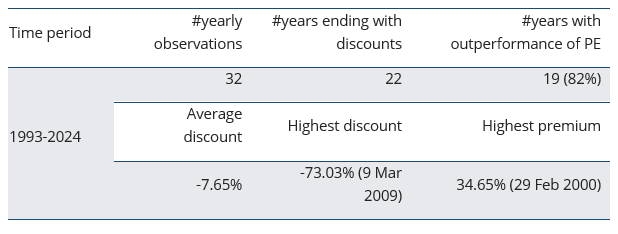

This is important, because historical data since 1993 shows that in 82% of years where listed private equity traded at a discount at year end, it outperformed public markets.

Table 1: Research suggests when discounts are high, consider private equity

Source: LPX AG, 31 December 2024. Noting that past performance is not an indicator of future performance.

Accessing listed private equity

The VanEck Global Listed Private Equity ETF (GPEQ) is the only listed private equity ETF on the ASX, providing convenient access to a highly diversified group of the 50 largest and most liquid listed private equity companies in the world. These companies currently have a collective private equity portfolio of more than 3,300 private equity direct investments and 350 private funds.

Key risks

An investment in our global listed private equity ETF carries risks associated with: listed private equity, ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the VanEck Global Listed Private Equity ETF PDS and TMD for more details.

Published: 22 July 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.