Expert’s choice: You can Invest like the Future Fund - Part 2

Australia’s Future Fund is among the top 20 largest sovereign wealth funds globally. It was established in 2006 in response to our aging population and long-term pressure on the Commonwealth's finances. Like the biggest superannuation funds in Australia, the Future Fund is a large institutional investor, so it often has access to asset classes and investment opportunities beyond the reach of everyday investors. One asset class it invests in is global real estate, but this is an asset class that is accessible to Australian investors too.

Most Australian investors’ portfolios include Australian property, Australian equities and international equities. But international property is underrepresented. This observation, however, does not transpose to the portfolios of Australia’s largest institutional investors that include allocation to global property. For most, accessibility is considered the biggest hurdle to owning global property. ETFs assist to help overcome these hurdles.

Australia was one of the pioneers of listed real estate investment trusts (REITs). World leading names including Westfield, General Property Trust and Mutliplex, drove the Australian market in which property once accounted for 25% of the local market index. Due to mergers, restructures and acquisitions – often by overseas pension and sovereign wealth funds - its prominence on the Australian exchange has diminished.

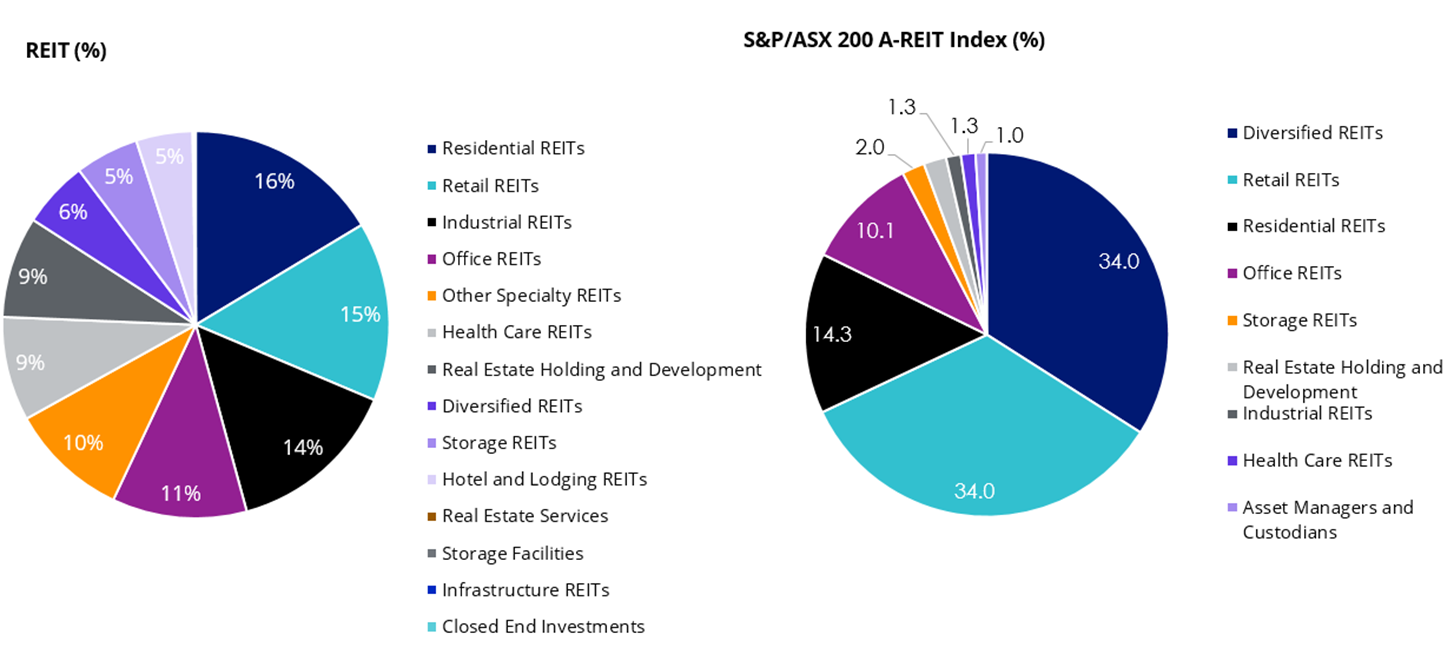

For those investors still holding A-REITs, the Australian market is dominated by a few big trusts, where the top 10 A-REITs accounted for over 75% of the S&P/ASX 200 A-REIT Index as at June 2022. That contrasts with listed property assets offshore which are better diversified and include some sectors that are not readily available in Australia such as healthcare property trusts, hotel and resorts, specialised REITs such as data centres and residential property trusts. Investing offshore can broaden investors’ property opportunities and increase their diversification significantly. This is why Australia’s largest superannuation funds and its sovereign wealth fund, The Future Fund, invest in property assets around the world.

According to the most recent report, at 31 March 2022, Australia’s sovereign wealth fund was valued at $201 billion. It has returned an impressive 10.0% per annum over the last 10 years, against a target annual benchmark return of 6.4%.

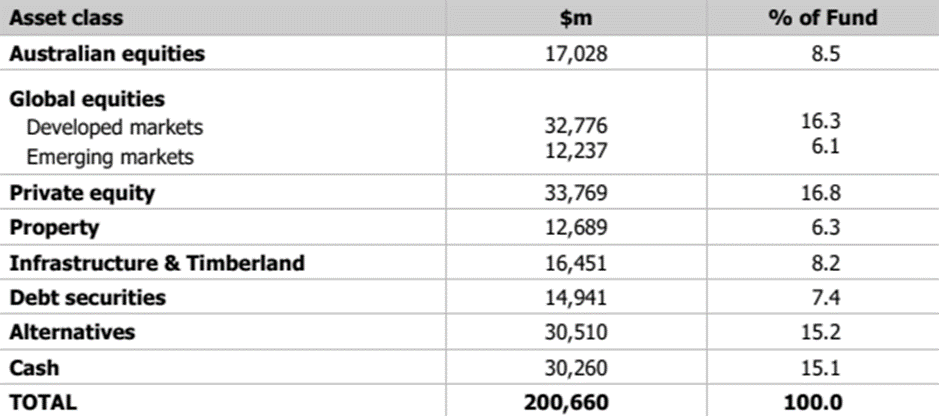

Property is around 6% of the Future Funds’ asset allocation.

Table 1: Future Fund Asset allocation as at 31 March 2022

Source: Future Fund, portfolio update to 31 March 2022

Institutional investors like the future fund are attracted to global property as it provides important diversification benefits. The table below shows the correlation of global property compared to other asset classes. In the table, a 1 is perfectly correlated. The lower the number, the lower the correlation to international property.

Table 2 – Correlation of international property to other asset classes

|

Asset class |

Australian |

Global |

Australian |

Australian |

Global |

International Property (hedged) |

|

Australian Equities |

1.00 |

|||||

|

International Equities |

0.56 |

1.00 |

||||

|

Australian Property |

0.81 |

0.49 |

1.00 |

|||

|

Australian Bonds |

0.09 |

0.22 |

0.32 |

1.00 |

||

|

Global Bonds |

0.24 |

0.14 |

0.46 |

0.74 |

1.00 |

|

|

International Property (hedged) |

0.71 |

0.45 |

0.77 |

0.17 |

0.47 |

1.00 |

Source Morningstar Direct, Ten year correlation 1 July 2012 – 30 June 2022. Results are calculated monthly and assume immediate reinvestment of all dividends. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

Indices used Global Bonds – Barclays Global Aggregate Bond Index A$ Hedged, Australian Bonds - Bloomberg AusBond Composite 0+ years, International property – FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged, International Equities – MSCI World ex Australia Index , Australian Equities – S&P/ASX 200 Accumulation Index; Australian property – S&P/ASX 200 A-REIT Index.

What many investors do not realise is that ASX investors can invest like the Future Fund and also access a diversified global property portfolio via an ETF. The VanEck FTSE International Property (Hedged) ETF (ASX: REIT) gives investors access to a portfolio of approximately 300 international REITs diversified by country and sector. REIT provides exposure to commercial, healthcare, retail, office, industrial and other sectors not available in Australia.

Figure 1: More sectors and better diversification globally

International REITs generally pay more dependable and higher dividends than other companies listed overseas and an additional benefit of REIT is how it utilises tax rules to smooth income, with income being one of the reasons many investors consider global listed infrastructure. Not many fund managers utilise this strategy and are unable to pay income every period, consistently. We discuss this here. REIT has maintained a steady quarterly income since inception.

REIT tracks the FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged, the widely regarded market benchmark for the sector. This the international property index used by APRA to calculate its My Super Product Heatmap.

Key risks

REIT invests in international markets. An investment in REIT has specific and heightened risks that are in addition to the typical risks associated with investing in the Australian market. These include currency risks from foreign exchange fluctuations, ASX trading time differences and changes in foreign laws and regulations including taxation.

As always, if you are considering an investment in global property, we recommend that you speak to your financial adviser or stock broker.

For further information you can contact us at +61 2 8038 3300.

Related Insights

Published: 29 July 2022

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

The Fund is not in any way sponsored, endorsed, sold or promoted by FTSE International Limited or the London Stock Exchange Group companies (‘LSEG’) (together the ‘Licensor Parties’) and none of the Licensor Parties make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to (i) the results to be obtained from the use of the FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged (with net dividends reinvested) (‘Index’) upon which the Fund is based, (ii) the figure at which the Index is said to stand at any particular time on any particular day or otherwise, or (iii) the suitability of the Index for the purpose to which it is being put in connection with the Fund. None of the Licensor Parties have provided or will provide any financial or investment advice or recommendation in relation to the Reference Index to VanEck or to its clients. The Reference Index is calculated by FTSE or its agent. None of the Licensor Parties shall be (a) liable (whether in negligence or otherwise) to any person for any error in the Reference Index or (b) under any obligation to advise any person of any error therein. All rights in the Reference Index vest in FTSE. “FTSE®” is a trade mark of LSEG and is used by FTSE and VanEck under licence.