Yoda's words of wisdom: Global small companies and the next cycle of growth

During 2022 the US Federal Reserve and other central banks delivered large and rapid increases in policy rates and markets repriced, now as central bankers slow down market participants trying to determine the timing of the ‘pivots’. The problem for equity markets though, is that these pivots - usually in response to economic weakness - are not bullish for equities and historically most of the declines in a US bear market occurred after Fed pivots.

This is where being small and nimble has its advantages.

“Size matters not. Look at me. Judge me by my size, do you?” – Yoda

During 2022 the US Federal Reserve and other central banks delivered large and rapid increases in policy rates and markets repriced, now as central bankers slow down market participants are trying to determine the timing of the ‘pivots’. The problem for equity markets though, is that these pivots - usually in response to economic weakness - are not bullish for equities and historically most of the declines in a US bear market occurred after Fed pivots.

This is where being small and nimble has its advantages. Small companies tend to be domestic rather than internationally focused and they also tend to be more sensitive to the macro environment.

Savvy investors are reassessing portfolios and preparing for the next cycle, which could lead to low growth and a period of recovery. In the past and during this type of cycle, small-caps have offered more upside than large caps because they have fallen further in the market downturn.

However, being selective is important.

The Quality Factor, inspired by investment pioneers such as Benjamin Graham and Warren Buffett, focuses on return on equity and balance sheet strength, so could potentially help investors maneuverer through into the next stage of the cycle.

Navigating the world of investment opportunities through smart beta ETFs has empowered advisers and investors to build robust portfolios and target outcomes.

Australian advisers are no strangers to Australian small companies but the world is far bigger than the ‘Small Ords’. The international small-cap universe presents over 4,000 companies and, as size is a relative term, many of these companies are not that small.

The best January in years

If 2022 was a year to forget for investors, January 2023 was a month to remember. In local currency terms, the US large-cap Russell 1000 gained over 6.6% while the small-cap Russell 2000 returned 9.8%.

For Australian investors, the S&P/ASX 200 was up 6.2% while the S&P/ASX Small Ordinaries enjoyed a 6.6% return. The international benchmark, the MSCI World ex Australia Index returned 3.0%, while the MSCI World ex Australia Small Cap Index returned 5.1%.

Small companies, in the January ‘bounce’, returned more than their large cap counterparts, albeit having experienced larger falls in 2022. While January is just a single month, and we always say past performance should not be relied upon for future performance, it may provide an insight as to how a potential growth/recovery potentially looks over the long term. As last Friday’s jobs numbers illustrated, for markets, there is likely to be setbacks such as a stubborn inflation, COVID clusters and poor economic data.

But one of the beneficiaries of any potential, sustained recovery could be international small companies.

It pays to be selective

As you know, with small companies investing, it pays to be prudent. The international benchmark, as is the case in the S&P/ASX Small Ordinaries, includes companies that are not attractive from an investment point of view. The MSCI World ex Australia Small Cap Index includes in excess of 4,000 companies.

There is a reason many small companies were sold off in 2022. Many were growth companies, highly leveraged, with weak balance sheets. Quality is a factor approach that considers balance sheet strength, so investors may benefit from being selective in global small companies by taking a ‘quality’ approach.

In January, Quality small companies shone, with VanEck MSCI International Small Companies Quality ETF (QSML) returning 5.28%, outperforming the MSCI World ex Australia Small Cap Index. Noting this is not indicative of future performance.

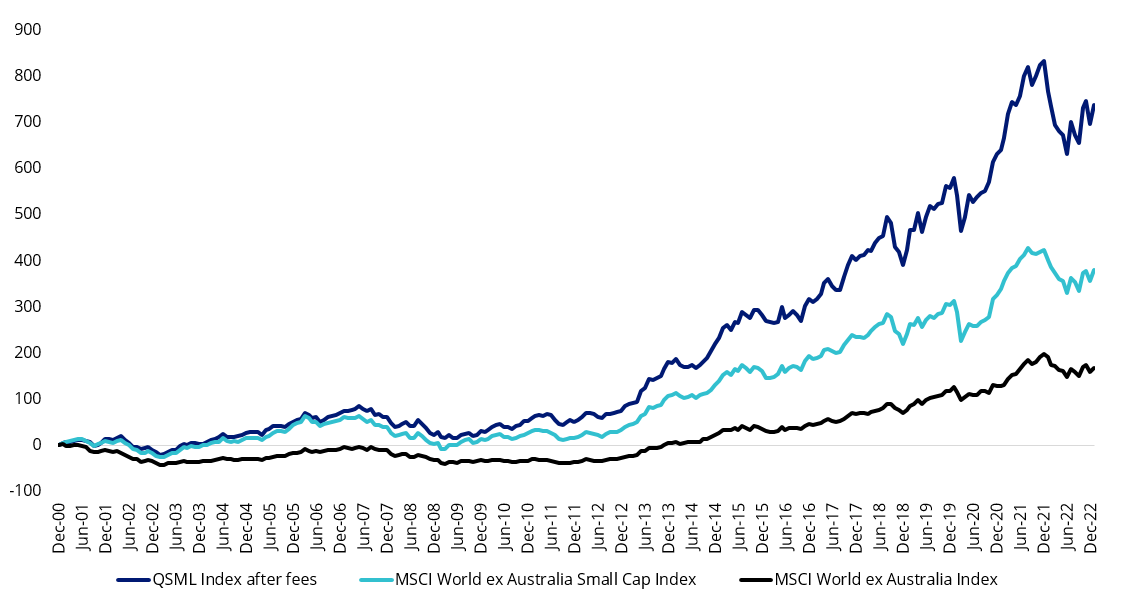

Over the longer term, based on back-testing after fees, QSML’s Index (net of QSML’s 0.59% p.a. management fee) displayed long-term outperformance against the MSCI World ex Australia Small Cap Index, both of which outperformed the large capitalisation equivalent, as highlighted by the chart below.

Chart 1: Cumulative performance: QSML Index after fees1 vs MSCI market capitalisation indices

Figure 1: Trailing returns: QSML, QSML Index after fees1vs MSCI World ex Australia Small Cap Index

Chart 1 and Figure 1 Source: VanEck, Morningstar, Bloomberg as at 22 October 2021. Past performance is not a reliable indicator of future performance. 1QSML Index results are net of QSML’s 0.59% p.a. management fees, calculated daily but do not include brokerage costs or buy/sell spreads of investing in QSML. You cannot invest in an index. QSML’s Index base date is 30 November 1998. QSML Index performance prior to its launch in February 2021 is simulated based on the current index methodology. 2QSML inception date is 8 March 2021 and a copy of the factsheet is here. 3The MSCI World ex Australia Small Cap Index (Parent Index) is shown for comparison purposes as it is the widely recognised benchmark used to measure the performance of developed market small companies, weighted by market cap. QSML Index measures the performance of 150 companies selected from the Parent Index based on MSCI quality scores. Consequently the QSML Index has fewer companies and different country and industry allocations than the Parent Index. Click here for more details.

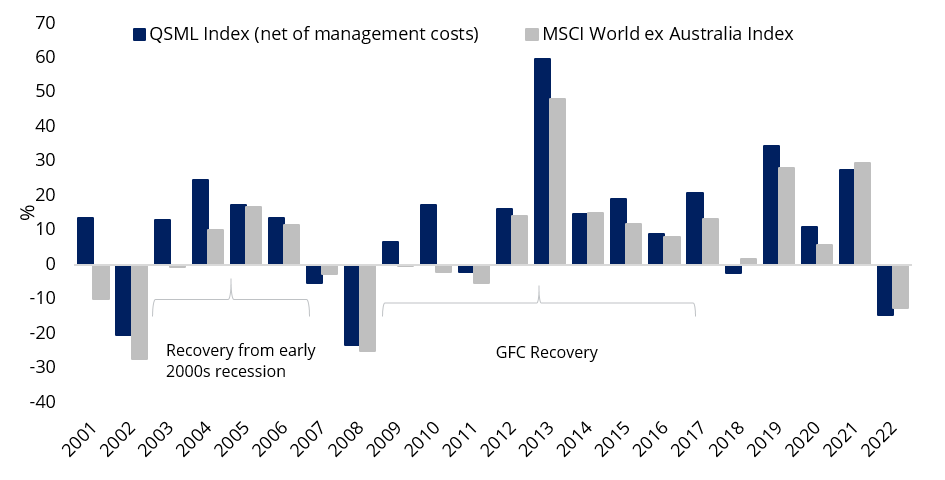

Historically, international quality small-cap companies outperformed larger companies during previous recoveries, namely following: 1) the global slowdown in the early part of the century following the dotcom bubble; and 2) for many of the low-growth years following the GFC.

Figure 2: Calendar year performance: MSCI World ex Australia Small Cap Quality 150 Index and MSCI World ex Australia Index

Source: VanEck, Morningstar Direct, as at 31 December 2022. You cannot invest directly in an index. Past performance of the index is not a reliable indicator of future performance of QSML. The MSCI World ex Australia Index is shown for comparison purposes as it is the widely recognised international equity benchmark used to measure the performance of developed market large- and mid-cap companies, weighted by market cap. It is used here to represent larger companies. QSML Index measures the performance of 150 companies selected from the MSCI World ex Australia Small Cap Index based on MSCI quality scores. Consequently, the QSML Index includes smaller sized companies, has fewer companies and different country and industry allocations than the MSCI World ex Australia. ‘Click here for more details’.

Both of these periods coincide with periods following a US recession (2001 & 2007 to 2009). And there is a fear that the US is headed for a recession again.

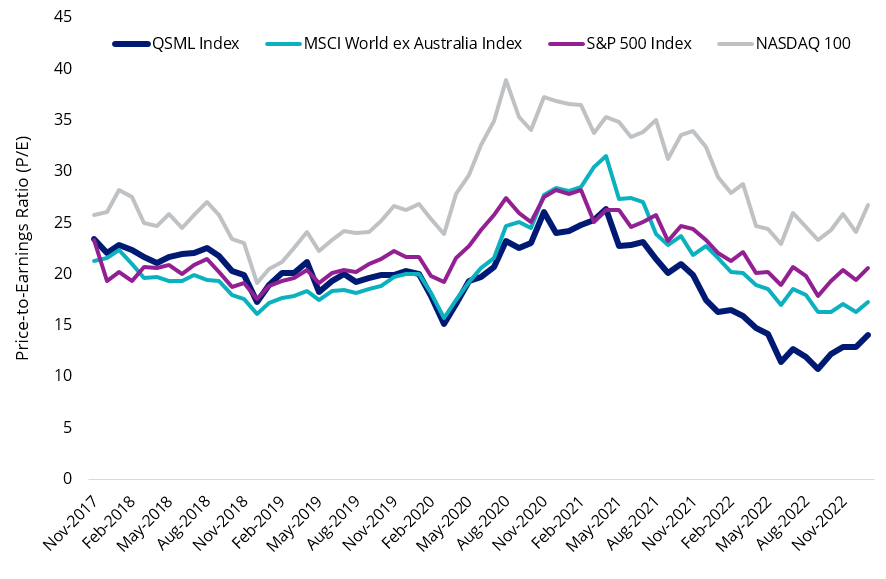

Despite its recent rally, QSML Index is still relatively cheap compared to large caps.

Figure 3: Price to equity (P/E) of QSML Index, MSCI World ex Australia Index and NASDAQ-100

Source: FactSet

QSML may be used by investors looking to take advantage of a global recovery in a slow growth environment/post-recession environment.

Key points of QSML:

150 of the world's highest quality small companiesAccess a diversified portfolio containing some of the world's highest quality small companies based on key fundamentals including (i) high return on equity, (ii) earnings stability and (iii) low financial leverage.

Outperformance potential in growing companiesInvestments focusing on quality small companies that have delivered outperformance over the long term relative to other global small companies benchmarks and also relative to large- and mid-cap benchmarks.

Diversified across countries, sectors and companiesOffering investors a portfolio of 150 companies across a range of geographies, sectors and economies.

Click here to download a copy of Finding the pawns that will become Queens: A guide to international small companies investing. In summary, the paper finds that the Quality Factor is more pronounced in international small companies than international large-and mid-companies.

Key risks: An investment in the ETF carries risks associated with ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.

Published: 23 February 2023

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

QSML is indexed to a MSCI index. QSML is not sponsored, endorsed or promoted by MSCI, and MSCI bears no liability with respect to QSML or the MSCI World ex Australia Small Cap Quality 150 Index. The PDS contains a more detailed description of the limited relationship MSCI has with VanEck and QSML.