Investment strategy: Japanese equities and the case for value

In the land of the rising sun, valuations are looking attractive. Dive into why an international value strategy leaning on Japanese equities could be rewarding for investors.

Japan has been getting a lot of attention from investors lately as its central bank, the Bank of Japan manages the easing of its yield curve control that has been in place since 2016, which in turn was after around 20 years of sub 1% interest rates. While the Bank of Japan did all it could to stimulate the economy, corporate Japan underwent a period change, so instead of focusing on market share as they did in the 1980s, they changed to focus on profitability and the result has been reflected in better metrics such as earnings growth.

On global metrics the Japanese equity market appears cheap.

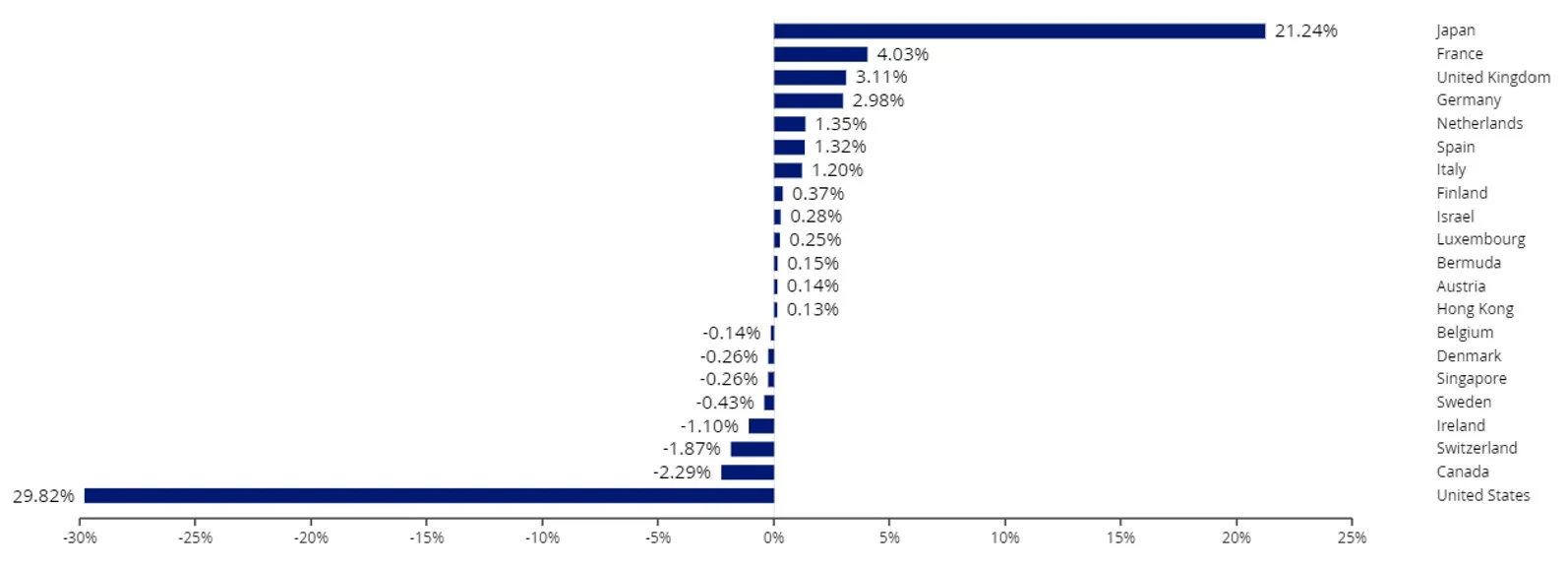

The VanEck MSCI International Value ETF (ASX: VLUE) has a significant overweight position to Japan, relative to the MSCI World ex Australia Index (+21.24% as at 30 September 2023). Investors may be wary of the Bank of Japan’s easing of yield curve control, fearing that higher yields may impact equity prices, but they should consider that the local market is the biggest investor of Japanese Government Bonds. In this scenario, any potential selling of bonds could result in equity buying and could propel prices.

Japan is not the only economy dealing with inflation and higher rates.

‘Higher for longer’ has been reflected in the US 10-year yield all year and while the market seems to be betting that the Federal Open Market Committee (FOMC) has done it’s job, Fed Chair Jerome Powell has not ruled out further hikes. In this sort of environment, value companies, which are generally well established and have their valuations more tied to current and near-term expected earnings have historically fared better.

In 2022 ‘value’ emerged as the winning ‘factor’ and should a recession occur, which would be followed by a subsequent recovery, portfolios with exposure to value could again be well placed.

Value in Japan

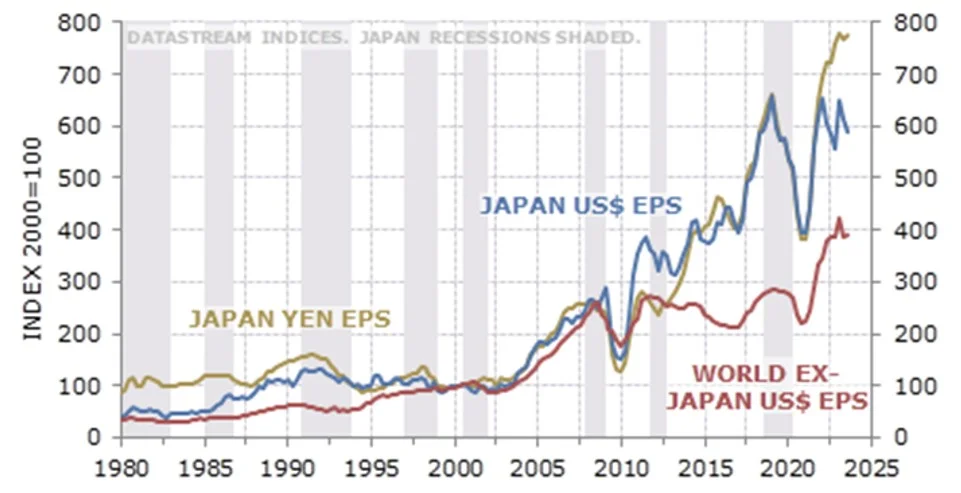

During the 1980s and 1990s, Japanese equities were associated with lazy balance sheets and low earnings growth. For example, non-financial sector earnings per share (EPS) growth lagged the rest of the world into the end of last century but has out-paced global peers since 2000.

Chart 1: Non-financial sector EPS

Source: MSCI, National Bureau of Economic Research

The market has not rewarded Japanese companies for this… yet. Japan’s relative performance, based on MSCI indices, remains near an all-time low. Investors have long memories, and those burned by expensive Japanese equities 20 years ago, have not yet considered cheaper valuations now.

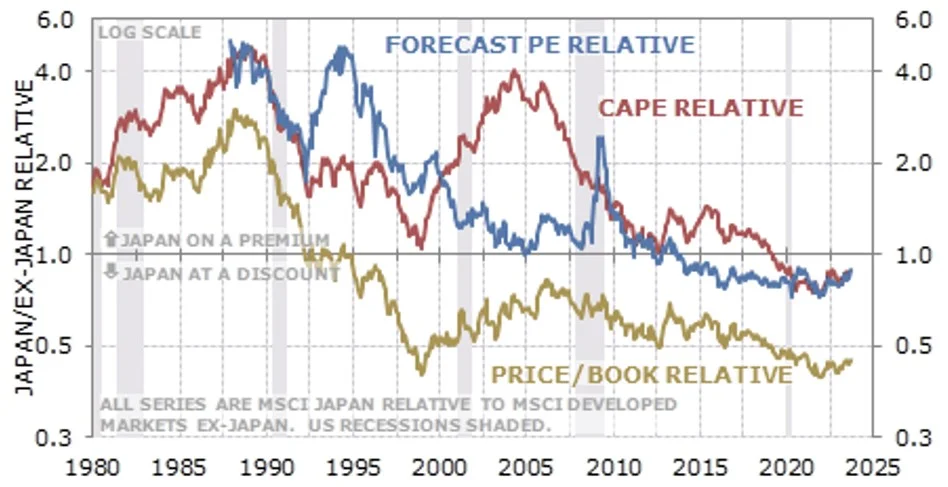

Chart 2: Relative valuation of Japanese equities

Source: MSCI, National Bureau of Economic Research, US Bureau of Labor Statistics, Datastream

The Japanese financial sector also hasn’t done well, facing the dual headwinds of a deleveraging domestic private sector, and a persistent flat yield curve that has pressured net interest margins. Any relaxation of yield curve control or rate rises will benefit local banks. This action also has equity investors worried too, as higher rates are generally negative for equities.

But most Japanese Government Bonds are held locally. Should local investors move out of bonds, fearing poor returns, they could look to equities. This could be beneficial for Japanese equities.

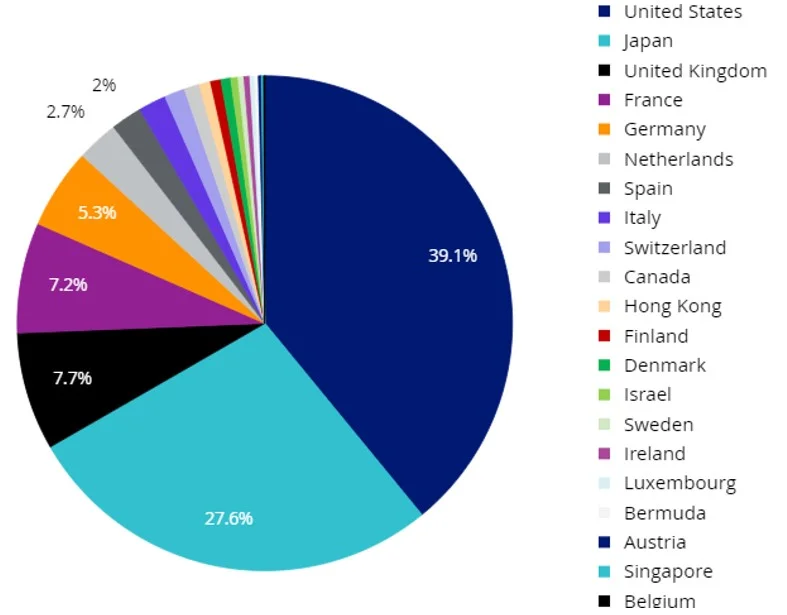

Japan represents the 2nd largest country exposure to VLUE.

Chart 3: VLUE country breakdown

Source: Factset, 30 September 2023

And this is by far the largest overweight position compared to the MSCI world Ex Australia Index.

Chart 4: Country weight differential: VLUE versus MSCI World ex Australia Index

Source: Factset, 30 September 2023

An overweight exposure to Japan is not the only reason we think VLUE could do well into 2024.

Accepting ‘higher for longer’

Now that the market has seemingly moved on from ‘peak rates’ to higher for longer, ‘value’ as a factor has the potential to again come to the fore, as it did in 2022. Value stocks generally have lower ‘duration’ versus growth stocks. While duration is considered a fixed income metric, it can be applied to a company’s cash flows. Long-duration companies realise a higher proportion of their cash flows far into the future. Many technology companies, that are not yet profitable, for example, would be long duration.

Chart 5: Pointing toward higher for longer, US 10-year yield

Source: Bloomberg, 1 November 2023

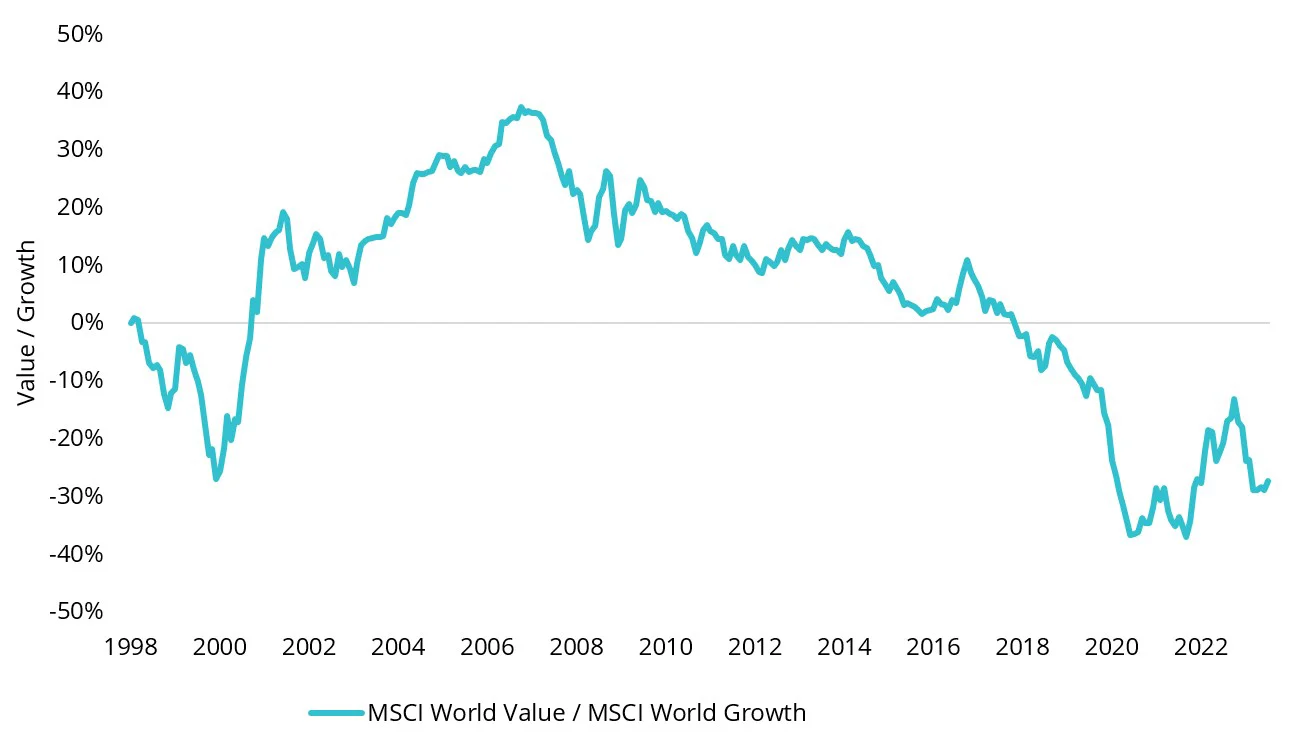

Chart 6: Value starting to fight its way back (again)

Source: MSCI, Bloomberg. Past performance is not indicative of future results.

Many growth stocks experience negative cash-flow, ploughing money back into the business to grow it, with the hope it will turn a profit in the future. While value companies, which are generally well established, pay a higher portion back to shareholders, their valuations are more tied to current and near term expected earnings. This lessens duration risk. So, when stubborn inflation persists, central banks increase policy rates, as we are seeing now and this is adversely impacting the present value of future earnings, therefore it is desirable to hold companies where valuations are tied to the near team earnings. Value companies generally provide this.

Accessing value

Investors seeking to tap the ‘higher for longer trade’ and the current trends in Japan should consider the VanEck MSCI International Value ETF (VLUE). VLUE offers exposure to 250 international large and mid-cap companies with high value scores determined by MSCI.

An AUD hedged version of VLUE, which will have the ASX ticker HVLU, will list shortly.

Key risks

An investment in the ETF carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.

Published: 10 November 2023

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

VLUE is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to VLUE, or respective, or Parent Index. The PDS contains a more detailed description of the limited relationship MSCI has with VanEck and VLUE.