Expert’s choice: You can Invest like the Future Fund - Part 3

Australia’s Future Fund is among the top 20 largest sovereign wealth funds globally. It was established in 2006 in response to our aging population and long-term pressure on the Commonwealth's finances. Like the biggest superannuation funds in Australia, the Future Fund is a large institutional investor, so it often has access to asset classes and investment opportunities beyond the reach of everyday investors. One asset class it invests in is private equity. Until last year, it was difficult for Australian investors to access this opportunity. That changed when we launched the first listed private equity ETF on the ASX, GPEQ.

Put simply, private equity is the ownership or interest in a corporate entity that is not publicly listed. There are different types of private equity investment. It can involve taking a stake in a growing business, making direct loans to business, or it can be taking control of a company either through outright purchase or through obtaining a controlling equity interest (buyout). Private equity provides capital to nurture expansion, new products or restructuring with the goal of unlocking greater value for investors.

Overcoming the difficulty of access

Traditionally, direct investments in private companies and in private equity funds require:

- large capital outlays

- long lockup periods, and

- investors taking a concentrated, illiquid exposure to a small number of private companies – which are often leveraged.

Fees for private equity management fees can be significant.

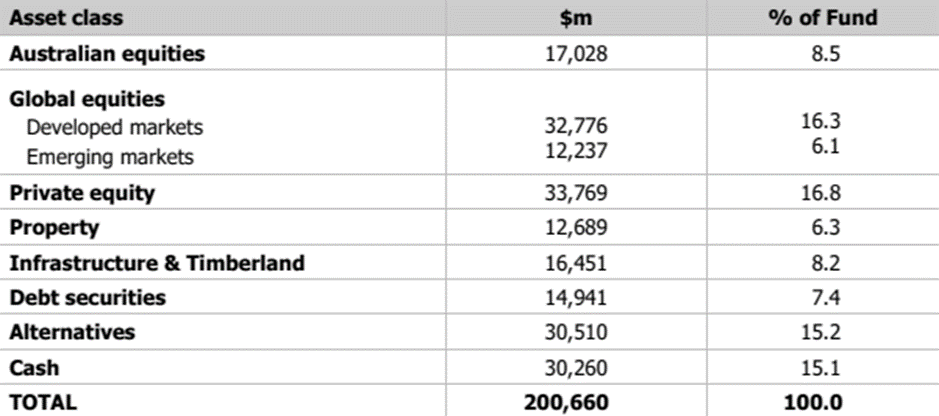

According to the most recent report, at 31 March 2022, Australia’s sovereign wealth fund was valued at $201 billion. It has returned an impressive 10.0% per annum over the last 10 years, against a target annual benchmark return of 6.4%.

Private equity represents around 17% of the Future Funds’ asset allocation.

Table 1: Future Fund Asset allocation as at 31 March 2022

Source: Future Fund, portfolio update to 31 March 2022

Institutional investors, like the Future Fund are attracted to private equity as it provides important diversification benefits. It also has the potential to generate strong returns over the long term.

Private equity has been in the news of late, with discussion about the valuations of Australian start-up Canva. Many large Australian institutions have benefited from the firm’s meteoric rise from a small IT firm in Perth to a multibillion-dollar enterprise. You may be aware of other examples of private equity in practice. We wrote about private equity’s role in the corporate turnaround and eventual listing of Hilton here.

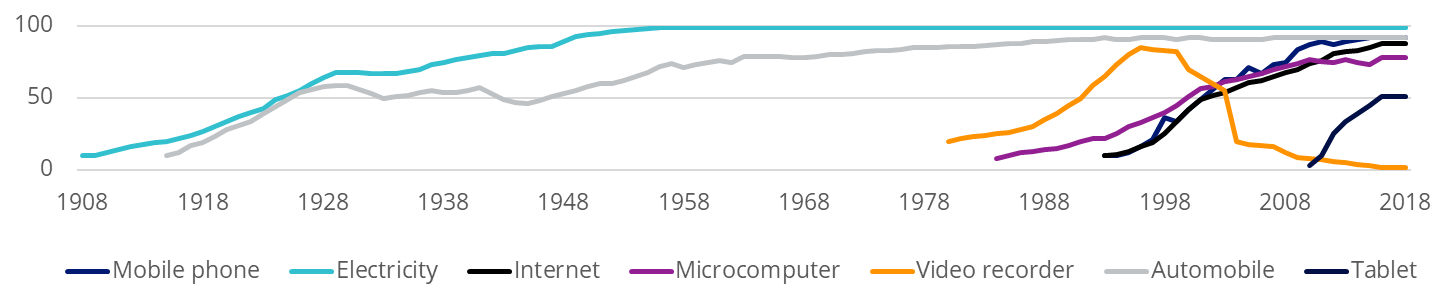

In addition to the buy-outs like Hilton, private equity has played a vital role in the spread and adoption of new technologies. When introducing a new technology, its adoption steadily increases over time. Think of the automobile, while its penetration is still not 100%, it is one of the most important inventions of the 20thcentury and is essential for the economy, establishing itself as ‘basic’. All of today’s basic technologies were at one-point ‘new’ technologies that has become essential for economic functioning.

Chart 1: Adoption rate of selected technologies in the US over the period from 1908 to 2018

Source: Comin and Hobijn (2004) and others, LPX AG

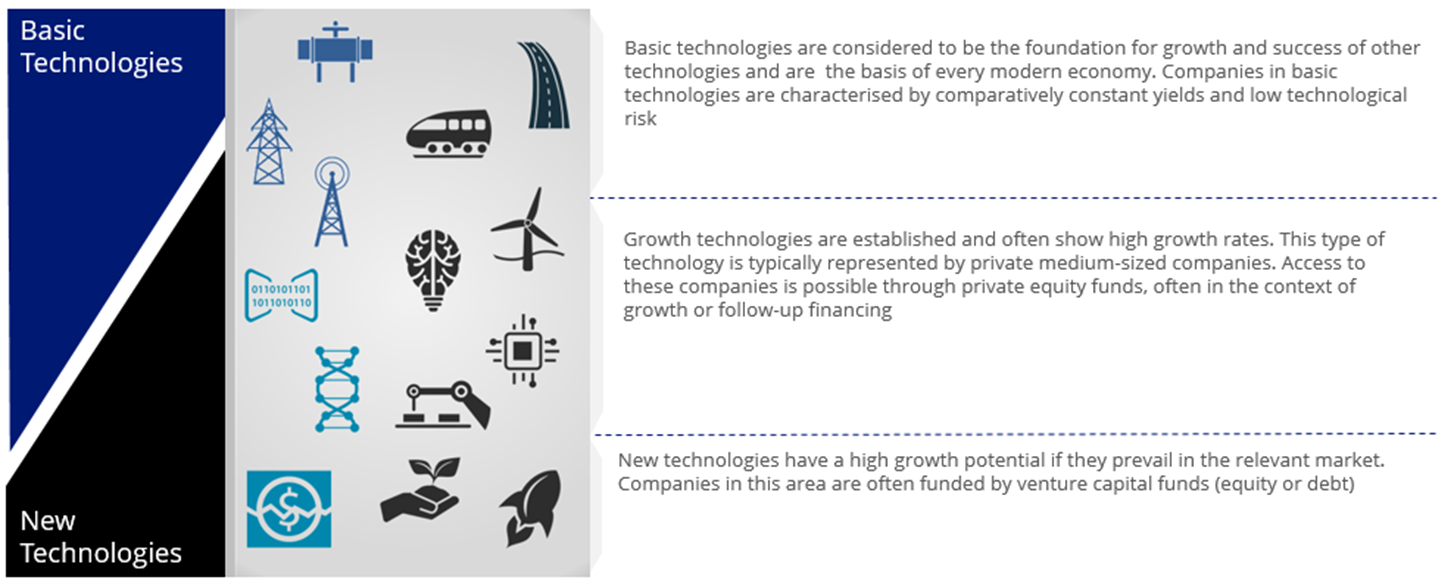

As you can imagine for investors, it is desirable to be able to invest in these technologies as early as possible. This is because the highest growth rate and hence investment return can be achieved for new and growth technologies especially if they achieve a significant market penetration and adoption rate. The private equity asset class plays a vital role in the financing and in the support of new and growth technologies.

Since future technologies are by nature unknown, an investor should diversify. Private equity allows investors to invest across different technology categories. Technology categories can be classified depending on the adoption rate into new, growth and basic technologies. An investor can access a diversified technology portfolio by investing in the private equity asset class.

Chart 2: Private equity strategies and technology categories

Source: LPX

As mentioned above, to date, direct investments or closed end funds that offer private equity investments are typically available only to very large investors who have the financial resources to make long-term commitments. From this background, the private equity asset class can be difficult to access for non-institutional investors.

That changed last year when VanEck Global Listed Private Equity ETF (GPEQ) listed on ASX.

GPEQ tracks the LPX50 Index that includes the largest and most liquid 50 listed private equity companies with exposure to venture, growth and buy-out opportunities. The companies will gain their exposure to private equity either:

- directly, that is the company invests directly in private equity from its own balance sheet;

- indirectly, by investing into private equity funds; or

- they are the private equity managers themselves.

GPEQ provides immediate access to a highly diversified private equity portfolio of more than 3,300 private equity direct investments and 350 private funds.

GPEQ provides investors with private equity returns, but with share market liquidity.

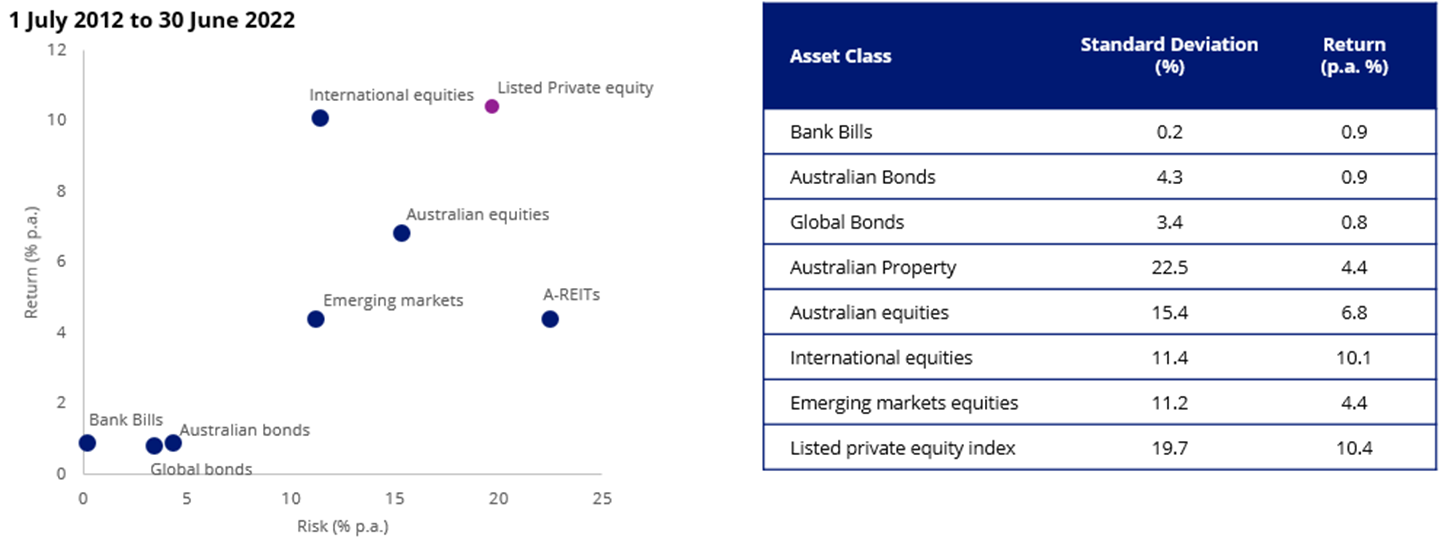

You can see in the chart below, compared to other indices the LPX50 index has provided the highest return, albeit at higher risk, as measured by standard deviation of returns. Though we would always caution that past performance is not a reliable indicator of future performance.

Chart 3: Illustrative risk and return of major asset classes

Source: Morningstar Direct, Ten year risk-reward. Results are calculated monthly and assume immediate reinvestment of all dividends. You cannot invest in an index. Past performance is not a reliable indicator of future performance. Indices used Bank Bills – Bloomberg AusBond Bank Bill Index, Global Bonds – Barclays Global Aggregate Bond Index A$ Hedged , Australian Bonds – Bloomberg AusBond Composite 0+ years, Australian Property – S&P/ASX 200 A-REITs Index, International Equities – MSCI World ex Australia Index , Australian Equities – S&P/ASX 200 Accumulation Index, Emerging markets equities – MSCI Emerging Markets Index, Listed private equity – LPX50 Index.

Key risks

An investment in the ETF carries risks associated with: listed private equity, ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for more details on risk.

As always, if you are considering an investment in listed private equity, we recommend that you speak to your financial adviser or stock broker.

For further information you can contact us via [email protected] or +61 2 8038 3300.

Published: 11 August 2022

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

LPX and LPX50 are registered trademarks of LPX AG, Zurich, Switzerland. The LPX50 Index is owned and published by LPX AG. Any commercial use of the LPX trademarks and/or LPX indices without a valid license agreement is not permitted. Financial instruments based on the index are in no way sponsored, endorsed, sold or promoted by LPX AG and/or its licensors and neither LPX AG nor its licensors shall have any liability with respect thereto.