The correlation between listed private equity and unlisted private equity

Is listed private equity the fake Prada handbag of the investing world?

Historically, private equity has proven to be an attractive alternative asset class commensurate with risk. Investing in private equity has typically only been accessible to high-net-worth individuals and institutional investors. This is because investing in private equity generally requires:

- Large capital outlays;

- Long lockup periods from 5 to 7 years; and

- A concentrated and illiquid exposure to a small number of private companies – which are often leveraged.

Private equity is investing directly in or with companies that are not publically traded. This can include investing in start-ups, participating in buy-outs and project financing. It’s considered high risk with high reward.

Accessing listed private equity via an ETF removes these barriers and opens up this exciting asset class to all types of investors. The VanEck Global Listed Private Equity ETF (GPEQ) is the first and only private equity ETF in Australia and tracks the LPX50 Index, which includes the largest and most liquid 50 listed global private equity companies. These companies gain exposure to private equity either:

- directly, that is the company invests directly in private equity from its own balance sheet;

- indirectly, by investing into private equity funds; or

- they are the private equity managers themselves.

The natural question arises: is listed private equity the “same stuff” as unlisted private equity, ie the close-ended limited partnership private equity that requires large sums and long lock-up periods?

According to research published by LPX[1], empirical results indicate that listed private equity has a strong correlation of 0.91 with its unlisted counterpart in all periods (a 1.00, would be perfectly correlated). In other words, the two categories generate consistently similar performance in various market cycles.

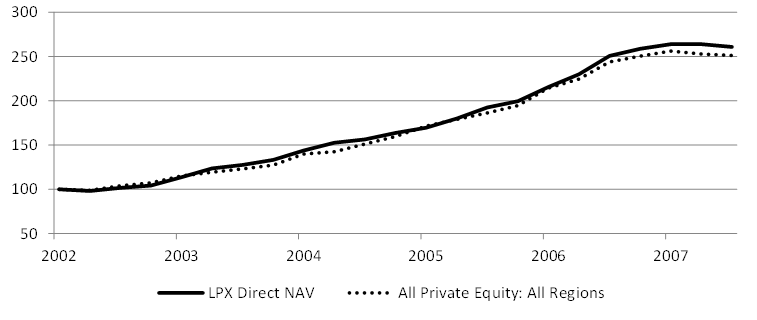

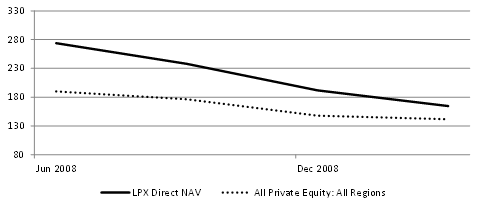

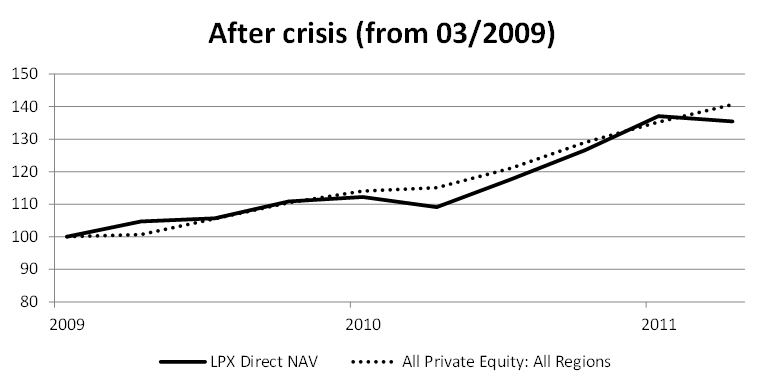

This is evident in the below charts which compare the net asset value (NAV) return of listed private equity to the NAV return of unlisted private equity during the periods before, during and after the Global Financial Crisis.

Chart 1: Pre crisis (until July 2008)

Chart 2: Crisis (July 2008 to March 2009)

Chart 3: After crisis (from March 2009)

Charts 1 to 3L Source: LPX AG; Preqin. LPX Direct NAV: daily Net Asset Value (NAV) history for direct investing LPE stocks; All Private Equity: Preqin Private Equity Quarterly Index; Correlation: Pearson's correlation coefficient based on quarterly log-returns. Past performance is not a reliable indicator of future performance.

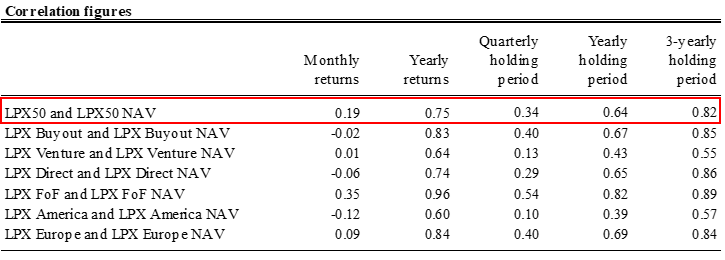

The table below provides the Pearson correlation figures between LPX market price indices (unlisted private equity) and LPX NAV Indices (listed private equity) from 31 December 1993 to 31 December 2020. There is a meaningful correlation between the listed and unlisted class the longer you hold the assets, 3 years in the table. Likewise, the correlation is also higher for yearly returns compared to monthly.

Source: LPX AG. For the market price indices the Total Return (TR) version was used which included dividend payments. The quarterly/yearly/3-yearly holding periods are based on the assumption that an investor invests at t and sells one quarter/one year/3 years later. Past performance is not a reliable indicator of future performance.

Chart 4: Correlation between Market Price and NAV Index

Source: LPX AG. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

The listed private equity vehicle provides better liquidity, diversification across regions and investment categories. VanEck Global Listed Private Equity ETF (ASX ticker: GPEQ) allows Australian investors to include private equity in their alternative allocation of their portfolios via a single trade on ASX. Find more information here.

[1] Michel Degosciu. (2012). Listed vs. Unlisted Private Equity (First Version). Retrieved from https://www.researchgate.net/publication/256021619_Listed_vs_Unlisted_Private_Equity_First_Version

Published: 28 November 2021