Value vs growth equities in an era of higher for longer rates

The FOMC’s meeting last week has seemingly caught the market off guard, which up until this point had been waiting for the Fed to come to the market’s rescue by cutting rates before any real economic slowdown.

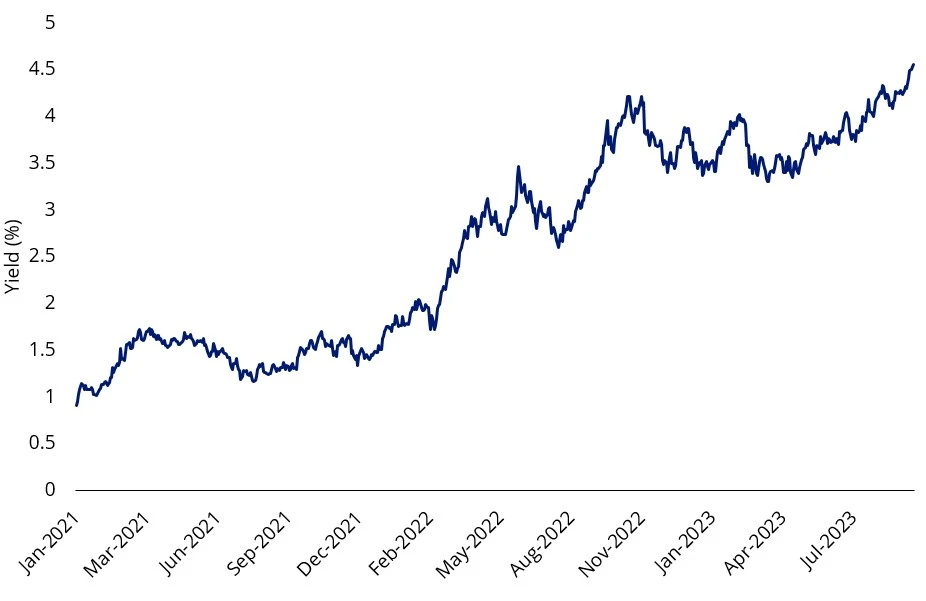

‘Higher for longer’ has been reflected in the US 10-year yield all year and since last week’s meeting that has also ticked higher.

Since the middle of last week those companies more sensitive to interest rates, i.e., those that realise a higher proportion of their cash flows far into the future such as technology companies have been hit the hardest.

Value companies, on the other hand, which are generally well established and have their valuations more tied to current and near-term expected earnings fared better.

Accepting ‘higher for longer’

So far in 2023, equities markets remained strong on the back of the ‘artificial intelligence’ boom and the equity market’s belief that ‘peak rates’ were hit, and that the Fed would start cutting rates and near-zero interest rates would return. The market sought out any positive news stories supporting its narrative.

And there have been many. Inflation numbers continue to encourage investors and the recent earnings season was better than expected.

But the Fed has been unwavering in its commitment to fighting inflation and in hindsight, the market’s expectation that the fastest and highest rate rises in history would instantly bring the economy to a grinding halt, erred. The reality is fiscal policy has been expansionary, consumers still had excess savings from COVID and it was always going to take a while for rate rises to flow through to impact borrowers, many of whom are locked in ultra-low rates.

Now that the market has seemingly moved on from ‘peak rates’ to higher for longer, ‘value’ has come to the fore. Value stocks generally have lower ‘duration’ versus growth stocks. While duration is considered a fixed income metric, it can be applied to a company’s cash flows. Long-duration companies realise a higher proportion of their cash flows far into the future. Many technology companies, that are not yet profitable, for example, would be long duration.

Source: Bloomberg, 21 September 2023

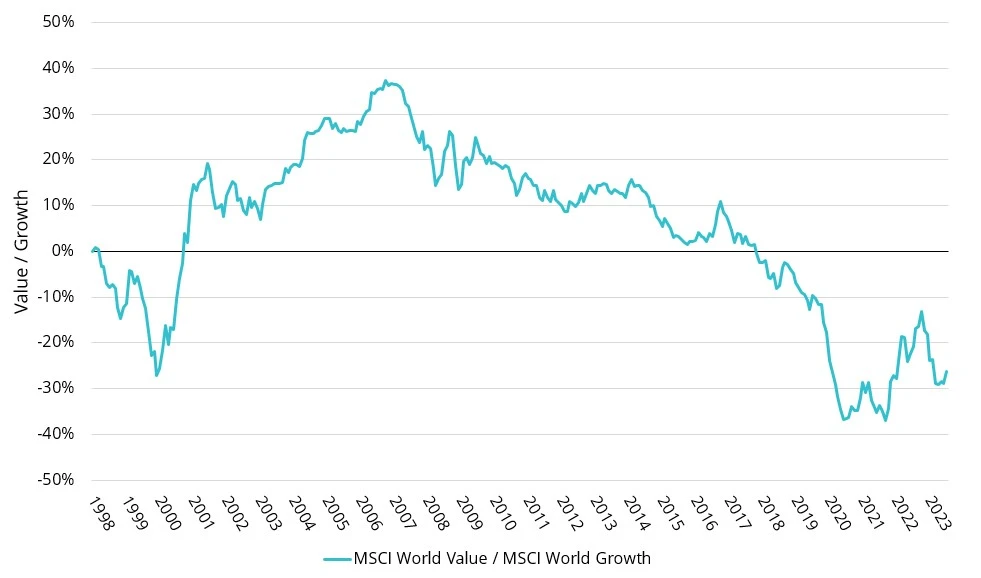

Chart 2: Value starting to come back (again)

Source: MSCI, Bloomberg

Where growth and value stocks differ

Many growth stocks experience negative cash-flow, ploughing money back into the business to grow it, with the hope it will turn a profit in the future. While value companies, which are generally well established, pay a higher portion back to shareholders, their valuations are more tied to current and near term expected earnings. This lessens duration risk. So, when stubborn inflation persists, central banks increase policy rates, as we are seeing now and this is adversely impacting the present value of future earnings therefore it is desirable to hold companies where valuations are tied to the near team earnings. Value companies generally provide this.

Accessing value

In 2022, ‘value’ emerged as the winning ‘factor’ and should a recession occur, which would be followed by a subsequent recovery, portfolios with exposure to value could again be well placed.

One way to play the value resurgence is the VanEck MSCI International Value ETF (ASX: VLUE) which listed on ASX in 2021.

VLUE offers exposure to 250 international large and mid-cap companies with high value scores determined by MSCI. So far this month (as at September 20, 2023), VLUE is one of the few global equity funds to post a positive return though, as always, we caution past performance is not indicative of future performance.

Table 1: Performance as at 20 September 2023

Source: VanEck, Morningstar, Bloomberg as at 30 November 2022. Results assume immediate reinvestment of all dividends and include management fees but exclude brokerage costs and taxes. Past performance is not a reliable indicator of future performance. Active managers selected from Morningstar Category – Australia Fund Equity World Large Value. The comparison period is reflective of the inception date of VLUE which is less than three years.

1VLUE inception date is 8 March 2021 and a copy of the factsheet is here.

2The MSCI World ex Australia Index (“MSCI World ex Aus”) is shown for comparison purposes as it is the widely recognised benchmark used to measure the performance of developed market large- and mid-cap companies, weighted by market capitalisation. VLUE’s index measures the performance of 250 international large- and mid-cap companies selected from the MSCI World ex Australia Index with high value scores relative to their peers at rebalance. Consequently VLUE’s index has fewer companies and different country and industry allocations than MSCI World ex Aus. ‘Click here for more details’.

Key risks

An investment in the ETF carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.

Published: 27 September 2023

IMPORTANT NOTICE

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (‘VanEck’) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

VLUE is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to VLUE, or respective, or Parent Index. The PDS contains a more detailed description of the limited relationship MSCI has with VanEck and VLUE.