Outlook for 2023: Slowing economic growth and three sectors set to benefit

What a year 2022 has been. From skyrocketing inflation and heightened geo-political tensions to global talent shortages and an energy crisis. But as the year draws to a close, and fears of a global recession mount, many are wondering what 2023 might have in store.

What a year 2022 has been. From skyrocketing inflation and heightened geo-political tensions to global talent shortages and an energy crisis. But as the year draws to a close, and fears of a global recession mount, many are wondering what 2023 might have in store.

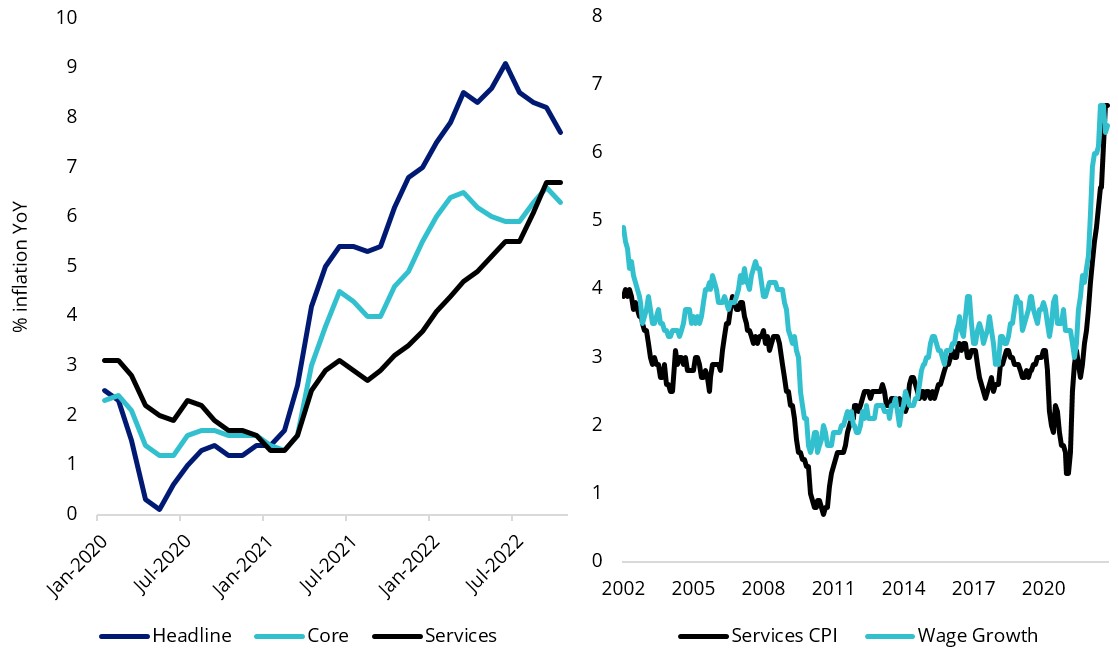

The US Central Bank is sounding alarm bells, Fed Chair Powell has reiterated that there is “more pain to come” despite the US Funds Rate already jumping to 2008 levels with another 1% increase forecast by the futures market in 2023. The Fed is determined to contain inflation quickly, despite the high risk of triggering a US recession in 2023. Of most concern to the Fed is high services inflation. Here is why.

The latest CPI print showed that services inflation remains sticky despite core and headline inflation showing early signs of cooling. Services inflation contributes 60% to total CPI and high accelerating year on year growth is a function of high wage growth and record low unemployment.

| US CPI YoY | US Services CPI versus wage growth |

Source: US CPI YoY - US Bureau of Labor Statistics. US Services CPI vs wage growth - Bloomberg, Federal Reserve Bank of Atlanta.

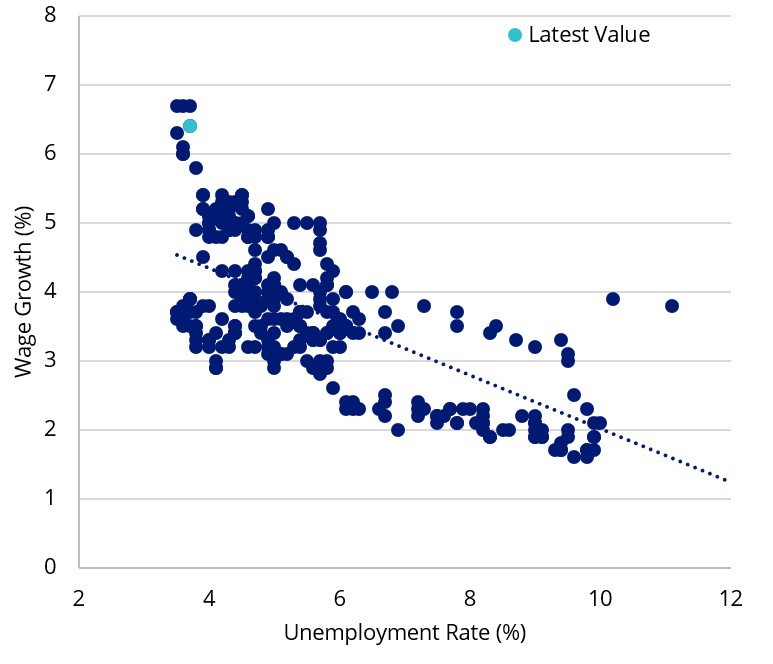

You may have heard of the Phillips curve which describes the negative relationship between inflation and unemployment. Another relationship to observe is the relationship between wage growth and unemployment as shown below. Labor market retrenchment is required (aka increase in the unemployment rate) to slow spending and cost inflationary pressures to lower wage growth. The challenge for the Fed is that every time the US unemployment rate has increased by more than 0.50% it has resulted in a recession.

US wage growth versus unemployment

Source: Bloomberg, Federal Reserve Bank of Atlanta

The rapid succession of central bank policy rate hikes and hawkish tone from the Fed sees several economists predicting a US earnings recession in 2023. Savvy investors are now looking to defensive sector strategies such as infrastructure, health care and Real Estate Investment Trust (REITs) as the global economy slows. There are two reasons we think smart investors are considering these investments; long duration andstable earnings.

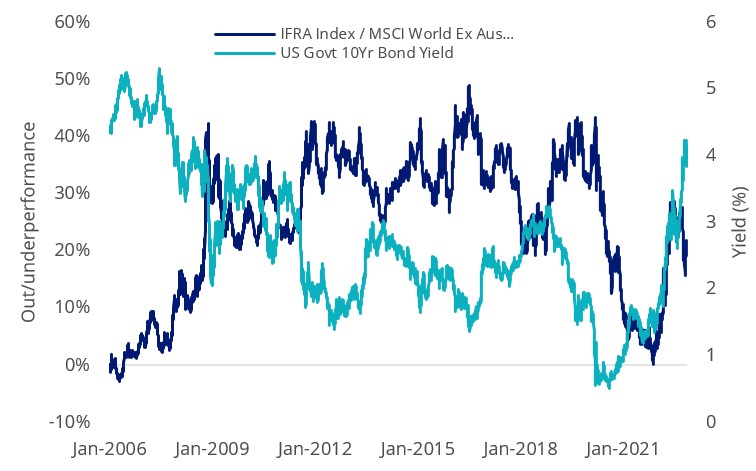

Long duration exposure

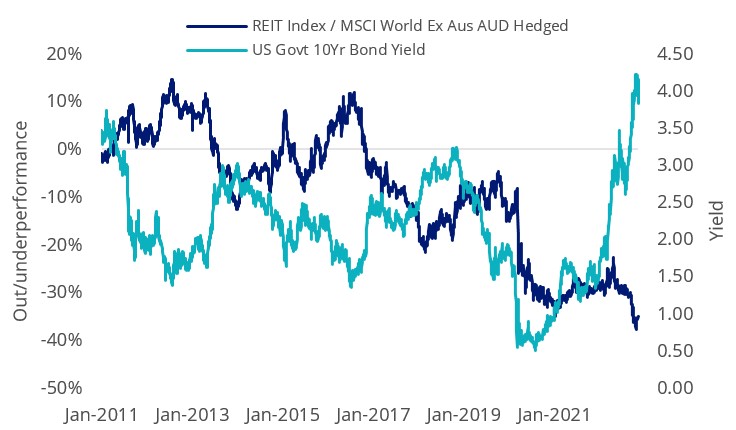

Duration describes the relationship between changes in interest rates and valuations. The longer the duration, the bigger the impact of interest rate changes on valuations. Infrastructure and REITs have assets on their balance sheet with a long shelf lives. Think of toll roads, airports, property and utility pipelines. For health care companies, there is a time lag between research & development, approval and shelf life phase of medicines and medical equipment. Any change in yields have a material impact on valuations and present value of future earnings. Below highlights the historical relative performance of each sector to MSCI World ex Australia AUD Hedged versus US 10-year government bond yield.

Sector cumulative relative performance to benchmark versus US 10-Year Bond Yield

Infrastructure

Source: Bloomberg, Benchmark as MSCI World ex Australia AUD hedged index. Infrastructure as FTSE Developed Core Infrastructure 50/50 AUD hedged Index. Past performance is not a reliable indicator of future performance. You cannot invest in an index.

REITs

Source: Bloomberg, Benchmark as MSCI World ex Australia AUD Hedged index. REITs as FTSE EPRA Nareit Developed ex Australia Rental AUD hedged index. Past performance is not a reliable indicator of future performance. You cannot invest in an index.

Healthcare

Source: Bloomberg, Benchmark as MSCI World ex Australia Index. Healthcare as MarketGrader Developed Markets (ex-Australia) Health Care Index. Past performance is not a reliable indicator of future performance. You cannot invest in an index.

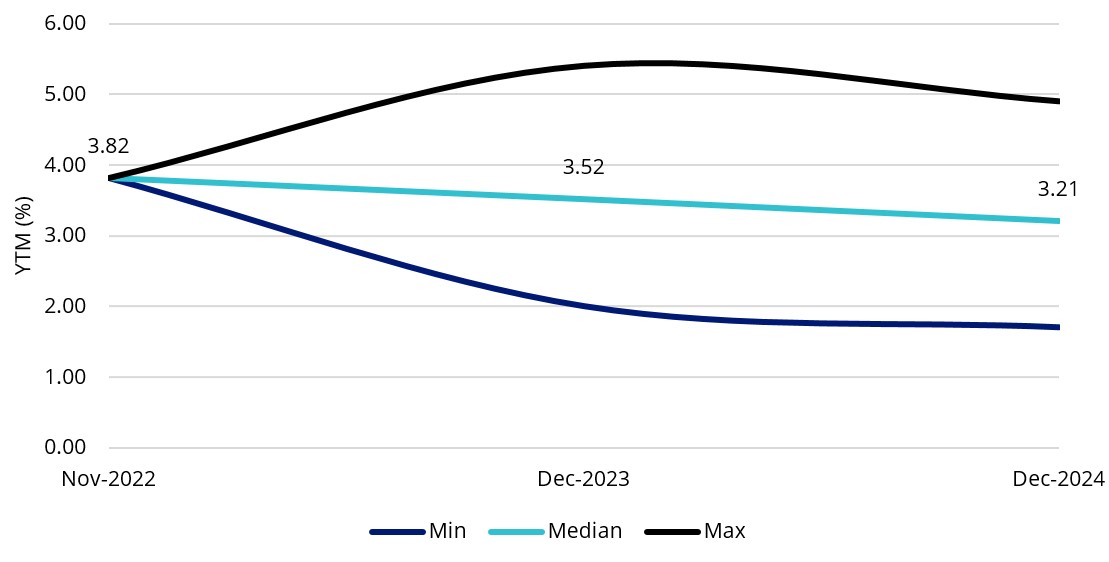

The US treasury 10-year bond yield could be near the peak. Brokers forecast US treasury yields to fall in 2023 and 2024 as the global economy slows in the face of managing higher interest rates. The Futures market also expect the Fed Funds Rate to be cut in H2 2023. Falling yields would be a tailwind for the performance of defensive sectors.

US treasury 10-year bond yield broker forecasts

Source: Bloomberg

Stable earnings throughout the economic cycle

Infrastructure, REITs and healthcare revenue is inelastic. Consumers still need to purchase pharmaceuticals and care for their wellbeing despite economic conditions. Critical infrastructure such as toll roads and utilities are essential for a functioning society. Some contracts also allow revenue increases to be passed through above CPI (i.e greater of CPI or 4%). REIT commercial leases and contracts in office and logistics typically have inflation linked annual increases in rents written into the contract, providing inflation protection on income.

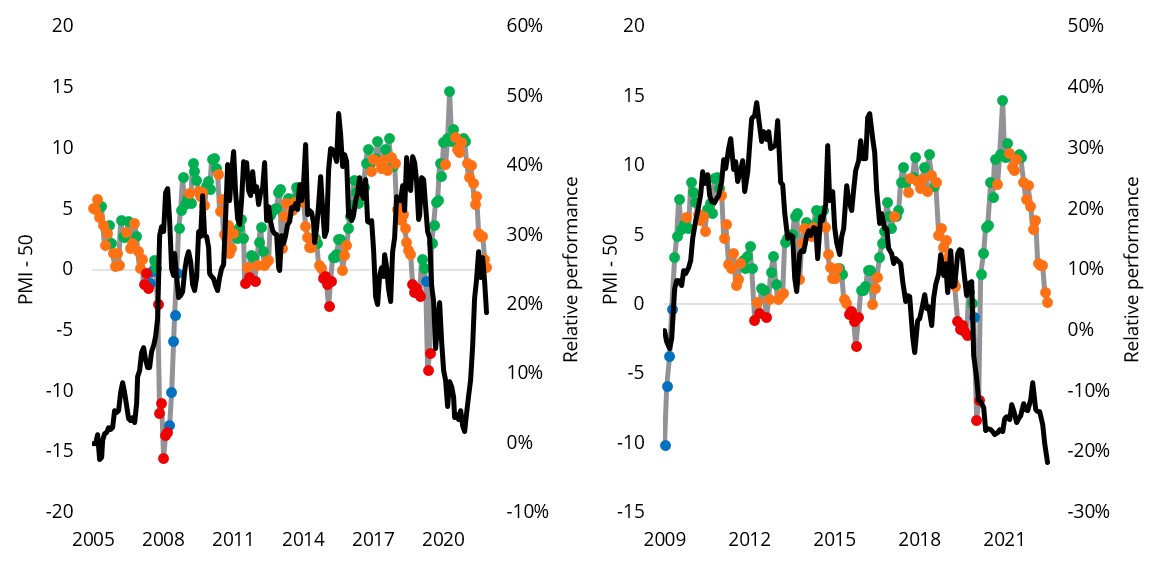

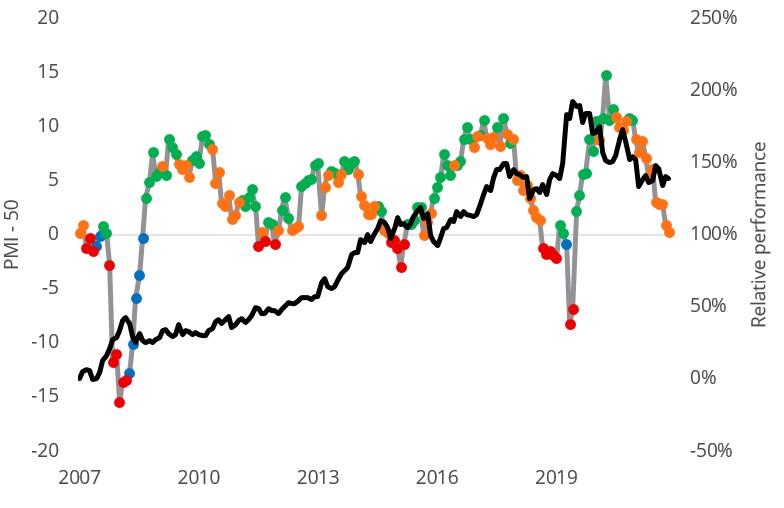

These sectors typically outperform when economic growth slows as these companies are rewarded for their ability to generate sustainable earnings.

The graphs below highlight that these sectors historically outperform when manufacturing activity (proxy for economic activity) slows or contracts (orange or red).

Sector cumulative relative performance to benchmark versus US ISM Manufacturing Index

| Infrastructure | REITs |

Source: LHS - Bloomberg, Benchmark as MSCI World ex Australia AUD hedged index. Infrastructure as FTSE Developed Core Infrastructure 50/50 AUD hedged Index. RHS - Bloomberg, Benchmark as MSCI World ex Australia AUD Hedged index. REITs as FTSE EPRA Nareit Developed ex Australia Rental AUD hedged index.

Healthcare

Source: Bloomberg, Benchmark as MSCI World ex Australia Index. Healthcare as MarketGrader Developed Markets (ex-Australia) Health Care Index.

Access to Global Real Estate

VanEck FTSE International Property (Hedged) ETF (ASX: REIT) gives investors access to a diversified portfolio of international property securities from developed markets (ex Australia) with returns hedged into Australian dollars.

Access to Global Infrastructure

VanEck FTSE Global Infrastructure (Hedged) ETF (ASX: IFRA) gives investors exposure to a diversified portfolio of infrastructure securities listed on exchanges in developed markets around the world.

Access to Global Health Care

VanEck Global Healthcare Leaders ETF (ASX: HLTH) invests in 50 fundamentally sound companies with the best growth at a reasonable price (GARP) attributes in the healthcare sector from developed markets excluding Australia.

Key Risks

All investments carry risk. An investment in any of these ETFs carry risks associated with ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, currency hedging (REIT and IFRA), country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.

Published: 28 November 2022

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.