China Moment(um)

The Chinese equity market has seen a strong growth coming into July, with CSI 300 Index and FTSE China A50 Index surging by more than 12% in a matter of days, returning to levels last seen in the 2015 bull market.

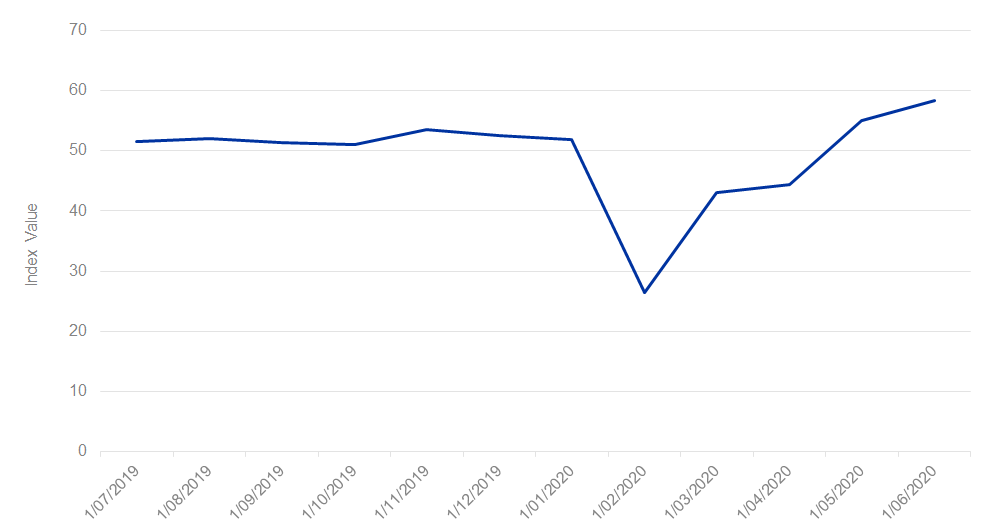

The Chinese equity market has seen a strong growth coming into July, with CSI 300 Index and FTSE China A50 Index surging by more than 12% in a matter of days, returning to levels last seen in the 2015 bull market. Banks and insurers have been the top performers contributing more than 7% month to date. The better-than-expected PMI (Purchasing Managers’ Index) data in June indicates solid recovery of business activities back to the pre-COVID level. The PMI is a measure of economic trends in manufacturing and services. A score above 50 indicates expansionary; below 50 indicates contractionary. At 30 June 2020 China’s services PMI was 58.4, as shown in the graph below.

Caixin China General Services PMI

Source: Bloomberg as at 8 July 2020

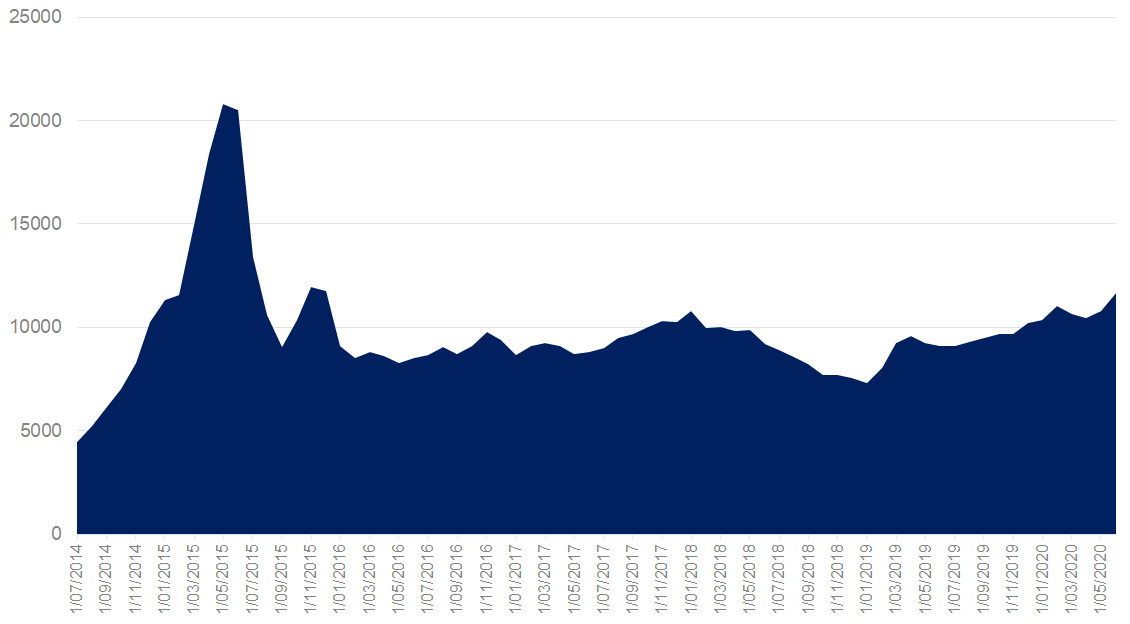

Investors have reacted very positively to the People’s Bank of China (PBOC) rate-cut policy in relending and rediscounting programs; the total margin transactions outstanding rose significantly last week and could be indicative of a forthcoming bull market, especially if levels reach the 2015 peak.

China margin trading – total outstanding balance of margin transactions (in 100 million)

Source: Bloomberg as at 8 July 2020

Over the long run, China A-shares look attractive compared to other emerging markets. China is transitioning from a manufacturing intensive economy towards a new economy focusing on financial services, technology and healthcare. In addition, the reliance on exports is gradually decreasing as a percentage of GDP as a result of resilient domestic demand. As China is gradually coming out of economic shock brought by the pandemic, there are great growth opportunities in Chinese equities.

Investors can access China A-shares by investing in an ETF that track indices like the FTSE China A50 Index or the CSI MarketGrader China New Economy Index.

Trading tip: For best practice ETF execution, use a Limit Order and trade while the China markets are open – which is currently from 12.30pm to 2.30pm (Australian Eastern Daylight Saving time) on ASX.

Published: 08 July 2020

CNEW tracks the CSI MarketGrader China New Economy Index. "MarketGrader" And “CSI MarketGrader China New Economy Index” are trademarks of MarketGrader.com Corporation. MarketGrader does not sponsor, endorse, sell or promote the Fund and makes no representation regarding the advisability of investing in the Fund. The inclusion of a particular security in the Index does not reflect in any way an opinion of MarketGrader or its affiliates with respect to the investment merits of such security.

CETF is not in any way sponsored, endorsed, sold or promoted by FTSE International Limited or the London Stock Exchange Group companies (‘LSEG’) (together the ‘Licensor Parties’) and none of the Licensor Parties make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to (i) the results to be obtained from the use of the FTSE China A50 Index (‘Index’) upon which the VanEck Vectors FTSE China A50 ETF (“the Fund”) is based, (ii) the figure at which the Index is said to stand at any particular time on any particular day or otherwise, or (iii) the suitability of the Index for the purpose to which it is being put in connection with the Fund. None of the Licensor Parties have provided or will provide any financial or investment advice or recommendation in relation to the Index to VanEck or to its clients. The Index is calculated by FTSE or its agent. None of the Licensor Parties shall be (a) liable (whether in negligence or otherwise) to any person for any error in the Index or (b) under any obligation to advise any person of any error therein. All rights in the Index vest in FTSE. “FTSE®” is a trademark of LSEG and is used by FTSE and VanEck under license.