ETFs 2.0

The genesis of ETFs stems back to the 1987 stock market crash. Since then, they have evolved and the next generation of ETFs are taking off. In a big way.

Created in the wake of the market crash of 1987, ETFs were initially designed to provide liquidity when investors demand it most. The first ETFs provided investors with a fund, traded on exchange, pricing throughout the day that tracked the market. In the US, the first ETFs tracked the S&P 500 Index.

Soon similar funds started appearing on exchanges around the world. Their initial success led to product issuers expanding the offering beyond benchmark equity exposures. New ETFs tracked benchmarks that measured the returns of sectors such as property and small companies. ETFs also tracked indices for other asset classes such as bonds and infrastructure.

The appeal for investors was low costs. Investors received the market return, minus a fee, and the investment could readily be bought and sold on exchange. These were ETFs 1.0.

However, sophisticated investors started to deliberate about index opportunities beyond ETFs 1.0. They considered alternate index weightings that could give investors different outcomes including higher returns for the same, or even lower levels of risk. In response, ETF providers started working with index companies to create indices that used different construction methods from the standard market benchmarks.

Alternate index construction methods focus on quantifiable metrics in company balance sheets to screen or weight stocks, such as quality measures like return on equity, earnings and debt levels. They also considered and created indices that equally weighted, or capped constituents. Some of these newer indices used a combination of these.

Advances in technology helped index providers analyse and calculate this data.

These innovative index construction techniques became known as “smart beta”.

We think smart beta is the next evolution in ETF investing. And if the most recent VanEck Smart Beta Survey results are anything to go by, they are already well on their way.

Now in its ninth year, the 2024 VanEck's Smart Beta Survey was conducted in August and September among Australian financial professionals.

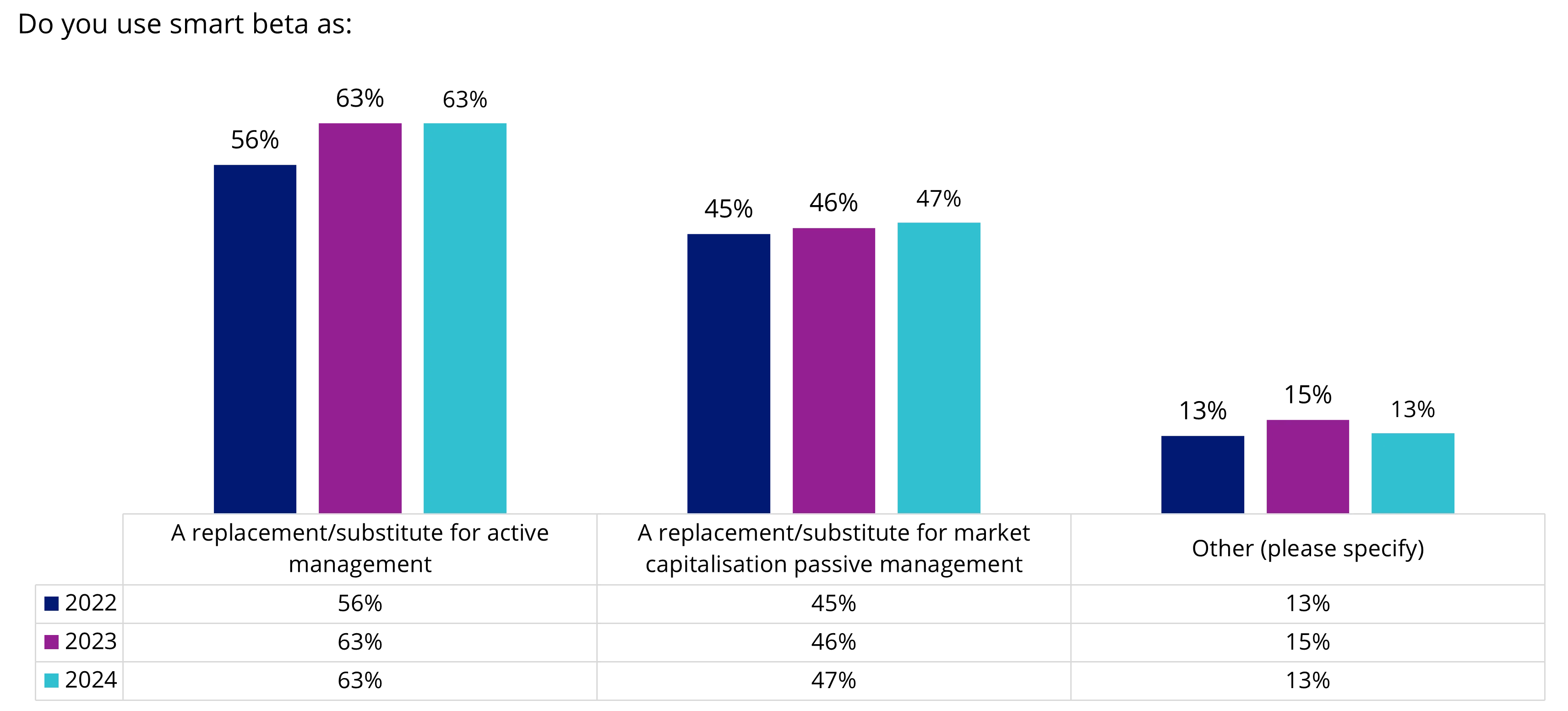

We believe the survey is the largest of its kind worldwide. This year, 946 financial professionals working in an advisory capacity in Australia responded. One result was clear, financial advisers are increasingly turning away from active management and using smart beta as an alternative. The survey also uncovered why this is.

Exhibit 1: Smart beta is being used more as a substitute for active management

Source: VanEck Ninth Annual Smart Beta Survey

Performance and diversification: the key drawcards

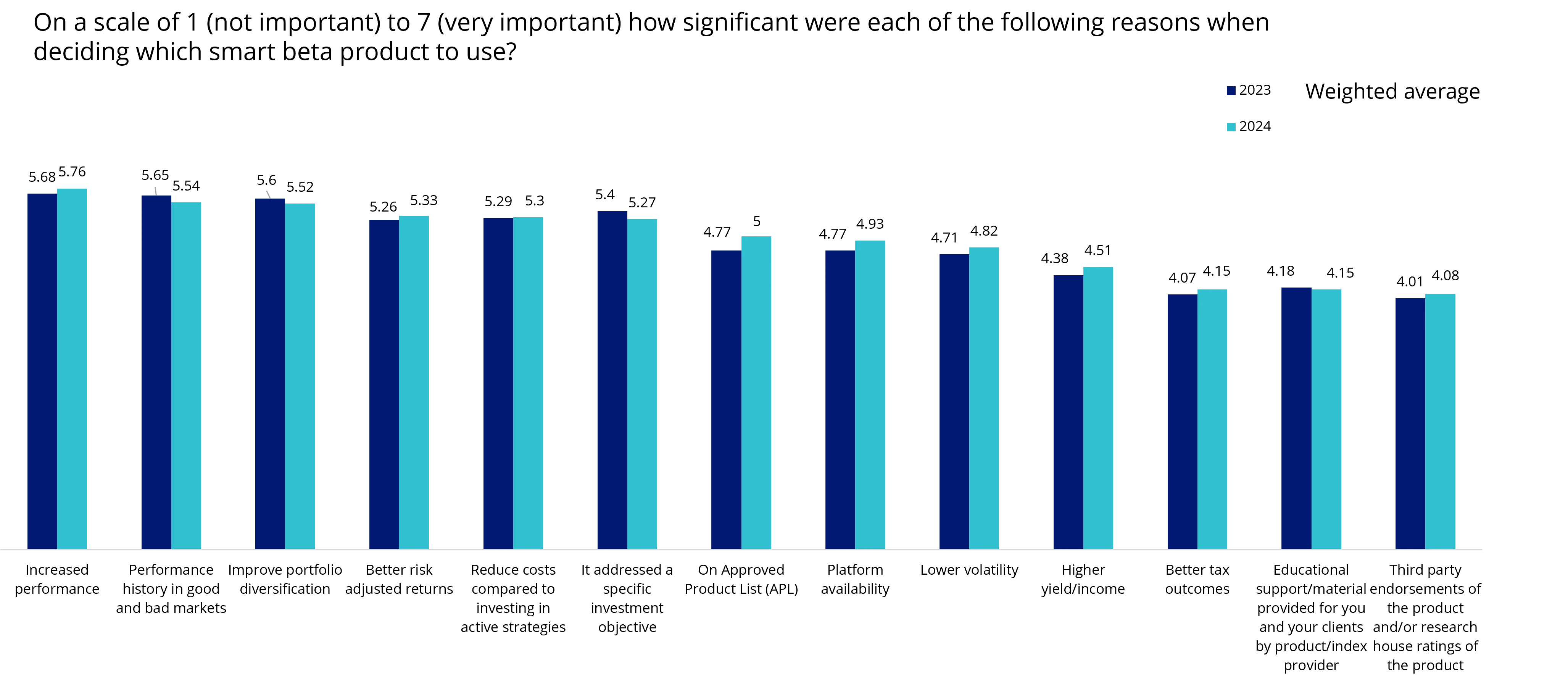

Diversification and strong performance are the major motivating factors for financial professionals when selecting smart beta strategies to use in portfolio construction. It seems investors and their advisers have realised that many actively managed funds underperform their benchmarks while continuing to charge higher fees. Savvy investors are shifting to smart beta to seek potential targeted performance outcomes, for lower fees and with full transparency. VanEck’s smart beta survey indicates that among the motivating reasons for using smart beta are improved performance (and risk-adjusted performance), portfolio diversification and lower costs.

Exhibit 2: Performance and diversifications driving decisions, above costs

Source: VanEck Ninth Annual Smart Beta Survey

International and Australian equities

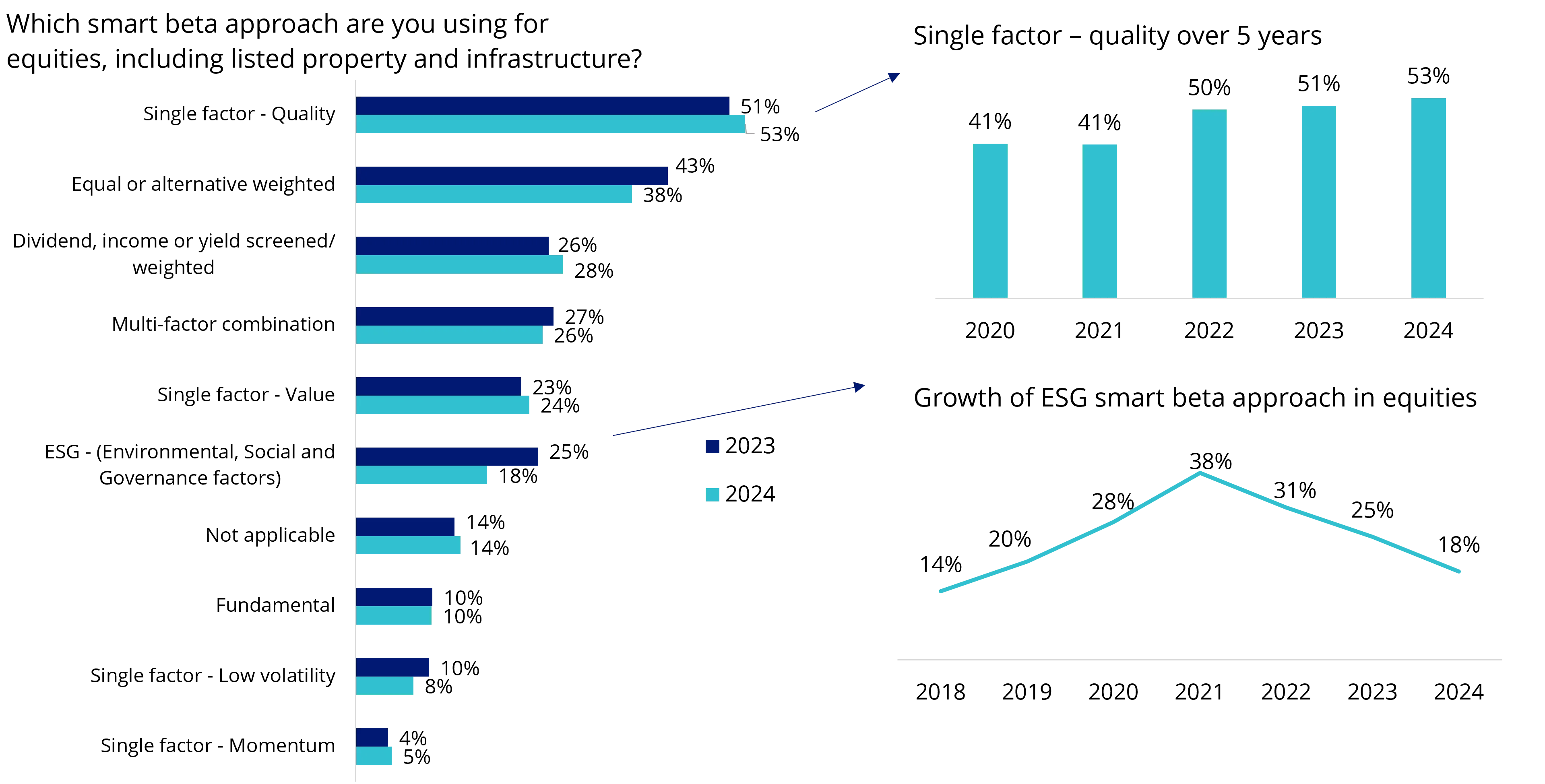

According to the survey results, most financial professionals use smart beta ETFs for international equities (65 per cent) and Australian equities (80 per cent) exposure. 53 per cent of advisers said they are currently using a single factor quality smart beta ETF approach. The second most popular approach was equal weighting and dividend/income-focused came in third.

We have also observed that the popularity of ESG (Environmental, Social and Governance) approaches has fallen over the last few years. This could be due to increased regulatory oversight of so-called ‘greenwashing’ by Australia’s regulators, leading to a lack of promotion and new products by ETF issuers.

Exhibit 3: Single factor smart beta approaches lead in equities

Source: VanEck Ninth Annual Smart Beta Survey

High levels of satisfaction

The survey also reveals very high levels of satisfaction among smart beta users, with almost 99 per cent of advisers using smart beta strategies indicating they are satisfied with their smart beta investments, with an increase in those indicating they are extremely satisfied and very satisfied compared to the 2023 and 2022 surveys.

Smart beta taking over from active management share

The survey, we think, provides further evidence that active management is being disrupted.

This is also why so many active fund managers, lured by the rise of ETFs, have been listing their strategies on the Australian exchange. Since 2015, the number of active ETFs on ASX has grown from just 6 to 119.

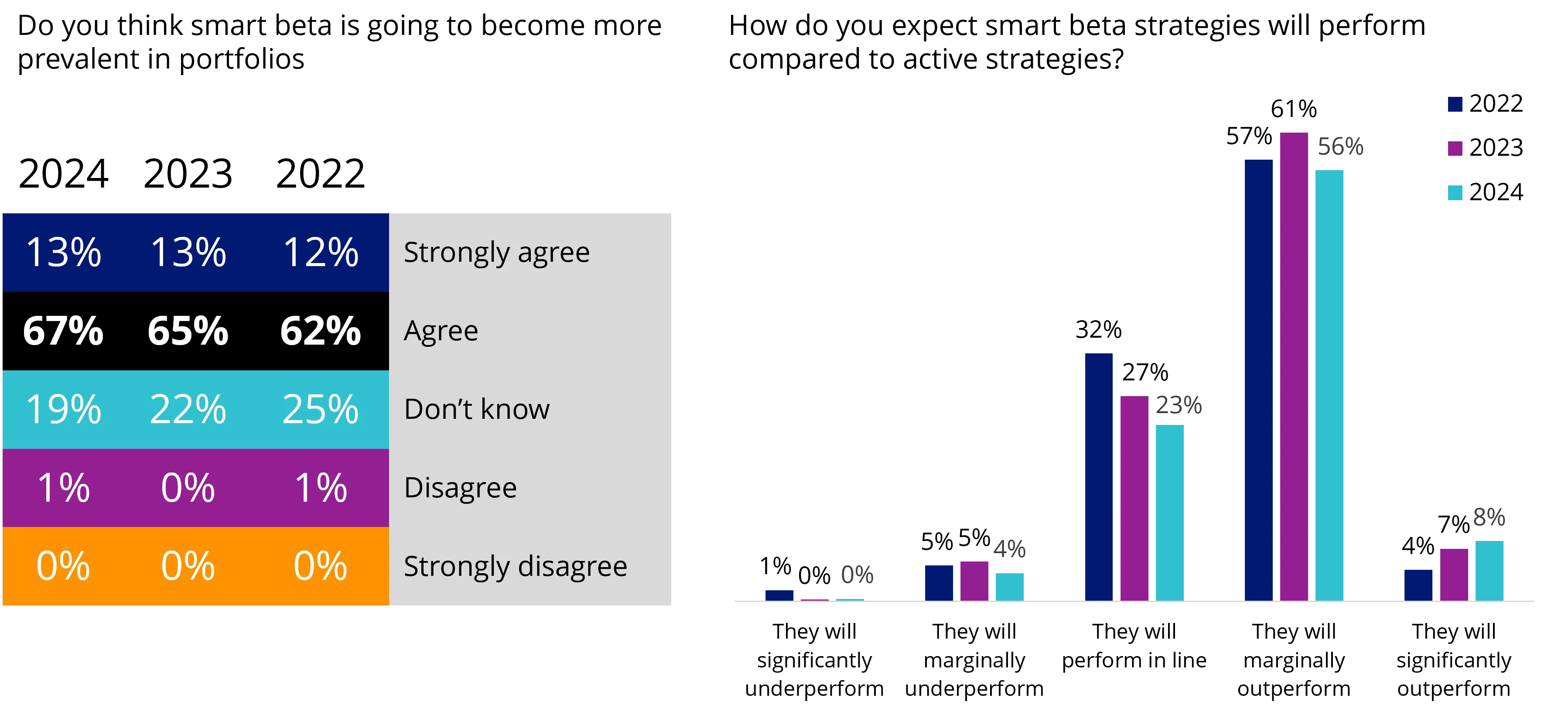

Not only are smart beta ETFs getting more flows than active ETFs, but more and more investors believe that they will outperform active strategies.

Exhibit 4: Smart beta outlook

Source: VanEck Ninth Annual Smart Beta Survey

Smart beta ETFs truly are ETFs 2.0.

ETFs 2.0 help investors to seek outcomes beyond 1.0. These outcomes include outperformance, better risk-adjusted returns, higher income and better diversification. These are outcomes typically associated with active management.

There is no reason, we think the trends identified in the survey will not continue, especially as markets navigate uncertain times ahead and smart beta ETFs gain longer track records.

Related Insights

Published: 04 October 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.